INCOME TAX

All about Advance Tax Under the Income-tax Act, 2025

RJA 05 Mar, 2026

All about Advance Tax Under the Income Tax Act, 2025 Advance tax refers to income tax paid in installments during the financial year on estimated income rather than paying it in a lump sum at year-end. Advance tax follows the self-assessment principle. The taxpayer himself must estimate income and pay advance ...

INCOME TAX

Overview CBDT Issues Draft Income Tax Rules 2026 & Forms

RJA 01 Mar, 2026

CBDT Releases Draft Income Tax Rules, 2026 & Forms Key Changes with Mapping The Central Board of Direct Taxes has placed the Draft Income‑tax Rules, 2026, along with the draft forms, in the public domain, inviting comments from stakeholders and the general public. This step has been taken ahead of their ...

INCOME TAX

All about Crypto Tax Implications in India (As of 2026)

RJA 26 Feb, 2026

Overview Crypto Tax Implications in India (As of 2026) The blog explicitly notes that the 30% flat tax on crypto gains remains unchanged. And the 1% tax deducted at the source on crypto transactions also continues as it is. This means the framework introduced in Budget 2022 continues without relaxation. So, from a taxation ...

INCOME TAX

ESOP Taxation in India (2026 Guide)

RJA 26 Feb, 2026

What Are ESOPs (Employee Stock Option Plans)? ESOPs are equity compensation plans where employers grant employees the right to buy company shares at a predetermined exercise (strike) price after a vesting period. Employees typically benefit when the FMV (Fair Market Value) of shares rises above the exercise price. Employee Stock ...

INCOME TAX

Foreign Assets of Small Taxpayers (Disclosure Scheme 2026)

RJA 21 Feb, 2026

FAST DS, 2026 : Foreign Assets of Small Taxpayers (Disclosure Scheme 2026) A one time compliance window under the Finance Bill, 2026. FAST DS (Foreign Assets of Small Taxpayers Disclosure Scheme), 2026, is a one‑time, six‑month voluntary disclosure window announced in the Union Budget 2026 and introduced through the Finance Bill, 2026. ...

INCOME TAX

Tax Snapshot of Union Budget 2026

RJA 19 Feb, 2026

Ease of Doing Business & Ease of Living through Union Budget 2026 1. Reliefs & Rationalisation Income tax Insurance compensation received by a natural person from a motor accident tribunal is fully exempt from income tax, and no TDS will apply. Due date for filing revised returns shifted from 31 December to 31 March (...

INCOME TAX

New Draft Income Tax Rules, 2026 – Objective, Areas, Highlights,

RJA 16 Feb, 2026

New Draft Income Tax Rules, 2026 – Objective, Areas, Highlights, The Central Board of Direct Taxes has proposed significant reforms under the Draft Income Tax Rules, 2026, to simplify compliance, enhance transparency, and modernize tax administration. Objective of the New Draft Income Tax Rules, 2026 : The proposed changes aim to simplify complex tax ...

INCOME TAX

New Income Tax Slab Rate for FY 2026‑27 & AY 2027‑28 (Budget 2026)

RJA 01 Feb, 2026

New Income Tax Slab Rate for FY 2026 2027 & AY 2027 2028 (Budget 2026) The Finance Minister’s announcement marks one of the biggest overhauls of India’s tax framework in decades. Following are some of the key highlights from the budget speech Income Tax Slab Rates (Default New Regime – FY 2026 2027) ...

INCOME TAX

Comparative Summary on 44AD / 44ADA / 44AE vs. Section 58 (Income-tax Act, 2025)

RJA 28 Jan, 2026

Comparative Chart: 44AD / 44ADA / 44AE vs. Section 58 (Income Tax Act, 2025) Conceptual Understanding “Presumptive “Taxation Reimagined” Presumptive Taxation Reimagined Section 58—Income Tax Act, 2025 Section 58 of the Income Tax Act, 2025, marks a structural shift—not merely a rate revision—in the presumptive taxation framework. Under the ...

INCOME TAX

Best Judgment Assessment under Income-tax Act 1961 & Income-tax Act, 2025

RJA 27 Jan, 2026

Summary of Changes in Best Judgment Assessment from Income Tax Act, 1961 to Income Tax Act, 2025 Applicability of Best Judgment Assessment under Section 144 Section 144 of the Income-tax Act, 1961, deals with what is commonly known as a best judgment assessment. This provision is invoked when a taxpayer fails to ...

INCOME TAX

CBDT issued FAQs on Income Tax Bill 2025 with Key Highlights & Change

RJA 25 Dec, 2025

CBDT issued FAQs on the Income Tax Bill, 2025, & key highlights and major changes: The CBDT FAQs are designed to explain and interpret provisions of the Income Tax Bill, 2025, especially where language/definitions are simplified, changes affect recurring compliance, procedural aspects are clarified, and ambiguities that historically caused disputes are ...

INCOME TAX

Top Personal Income Tax Rates Around the World (2025)

RJA 25 Dec, 2025

Top Personal Income Tax Rates Around the World (2025) India at 39% falls in the mid-range category, similar to New Zealand and Colombia. Nordic countries dominate the highest tax bracket (Finland, Denmark, Sweden). Tax havens and Gulf countries have zero personal income tax. & Global trend is Developed nations generally have higher ...

INCOME TAX

CBDT Launches NUDGE 2.0 for Voluntary Compliance in respect of FA’s

RJA 02 Dec, 2025

Foreign Income Not in Your ITR? Expect a Sharp NUDGE Before December 31 What Is NUDGE 2.0? The Income Tax Department has launched the enhanced NUDGE 2.0 campaign, aimed at identifying taxpayers who may have undisclosed foreign assets or overseas income in their AY 2025–26 ITRs. NUDGE (Non-intrusive Usage of Data to Guide ...

INCOME TAX

Key Provisions Tax on Winnings of online Gaming in India

RJA 27 Nov, 2025

CBDT issues guidelines for TDS and notifies manner of computing ‘net winnings Online gaming: CBDT issues guidelines for TDS and notifies manner of computing ‘net winnings. Here are the key highlights Finance Act 2023 introduced in two section mention here under : Section 115BBJ: Tax on income from online gaming. ...

INCOME TAX

Overview Guide on Long-Term Capital Gains tax in India

RJA 24 Jul, 2025

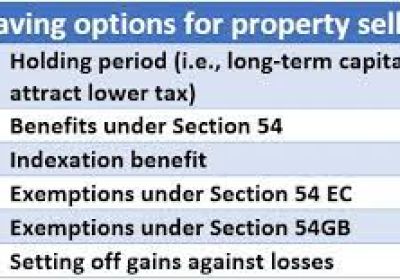

Tax Planning Guide for Zero Tax on Capital Gains (Post 23rd July Changes) The new rules change how capital gains from property sales are taxed. Depending on when you purchased the property (before or after 23rd July 2024), your tax treatment will differ, especially in terms of Shared provides a tax ...

INCOME TAX

AIS Woes: How Taxpayers Are Struggling with Inaccurate Reporting

RJA 20 Jul, 2025

AIS Woes: How Taxpayers Are Struggling with Inaccurate Reporting This blog highlights common issues taxpayers face with the Annual Information Statement & provides practical steps and expert recommendations. What is an Annual Information Statement AIS introduced by the Income Tax Dept in 2021 to enhance financial transparency, has unexpectedly become ...

INCOME TAX

New additional disclosures required for AY 2025-26 : Old Tax Regime

RJA 04 Jun, 2025

New additional disclosures required for AY 2025-26 : Old Tax Regime New additional disclosure requirements for claiming deductions in ITR-1 and ITR-4 for Assessment Year (AY) 2025-26 under the Old Tax Regime. These disclosures are aimed at increasing transparency and reducing incorrect deduction claims. Ensure all supporting documents are readily ...

INCOME TAX

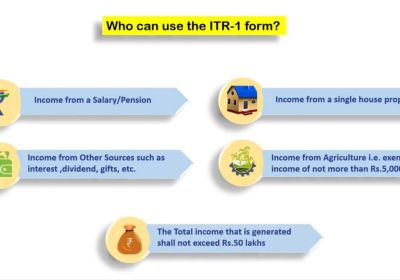

Summary of Income Tax Return (ITR) Forms – AY 2025–26

RJA 04 Jun, 2025

Summary of Income Tax Return (ITR) Forms – AY 2025–26 ITR-1 (SAHAJ) For: Resident Individuals (Ordinary) with income up to INR 1 crore from: Salary/Pension One house property Other sources (excluding lottery, racehorses) Agricultural income up to INR 5,000 LTCG u/s 112A up to INR 1.25 lakh Cannot ...

INCOME TAX

Legitimate political donations are not wrongly denied tax benefits u/s 80GGC

RJA 24 Mar, 2025

Legitimate political donations are not wrongly denied tax benefits u/s 80GGC Background of the Case Armee Infotech donated ₹55 lakhs to Rashtriya Komi Ekta Party (a Registered Unrecognized Political Party – RUPP) in AY 2012-13 and ₹3 crore in AY 2014-15. The AO added the ₹55 lakh donation to Armee Infotech's ...

INCOME TAX

Amended Section 115BBE for Unaccounted Income

RJA 04 Mar, 2025

Amended Section 115BBE for Unaccounted Income Introduction: Section 115BBE was introduced to curb tax evasion by imposing a higher tax rate on unexplained income covered under Sections 68, 69, 69A, 69B, 69C, and 69D. This provision gained significant relevance post-demonetization(2016), as the government intensified its crackdown on black money and unaccounted transactions. ...

INCOME TAX

What happen if Taxpayer falsely claimed deductions u/s 80GGC & 80GGB

RJA 13 Feb, 2025

What happens if Taxpayer falsely claims deductions u/s 80GGC & 80GGB This move by the Income Tax Department is part of its intensified scrutiny of political donations claimed under Section 80GGC (for individuals) and Section 80GGB (for companies). If a taxpayer falsely claimed deductions under these sections, they are ...

INCOME TAX

Budget Finance Bill, 2025 (Union Budget 2025-26) Proposals By

RJA 01 Feb, 2025

Budget Finance Bill, 2025 (Union Budget 2025-26) Proposals on Indirect & Direct Taxes By FM The Finance Bill 2025, presented by Finance Minister Nirmala Sitharaman on February 1, 2025, is available for download on the official Union Budget website. You can access the PDF directly using the following link: Finance Bill 2025 ...

INCOME TAX

Reassessment proceedings u/s 148- Validity of notices issued u/s 148A(b) & 148A(d)

RJA 14 Jan, 2025

Reassessment proceedings u/s 148- Validity of notices issued u/s 148A(b) & 148A(d) – In the Amalgamation. Sonansh Creations Pvt Ltd. v. Assistant Commissioner of Income Tax and Anr. Case No.: W.P.(C) 12316/202 Background: A notice u/s 148A(b) of the Income ...

INCOME TAX

Highlights on Extended deadline for declaring foreign assets & ITRs

RJA 14 Jan, 2025

Highlights on Extended deadline for declaring foreign assets & ITRs Tax Dept. has officially extended the deadline for filing belated and revised Income Tax Returns (ITRs) for the fiscal year 2023-24 (AY 2024-25) from Dec 31, 2024, to Jan 15, 2025. This provides an additional window for taxpayers, particularly those with foreign assets or ...

INCOME TAX

CBDT: Completing Schedule FA & Schedule FSI in their ITR

RJA 19 Nov, 2024

CBDT: Completing Schedule FA & Schedule FSI in their ITR The CBDT has launched a Compliance-Cum-Awareness Campaign for AY 2024-25 to assist taxpayers in accurately completing Schedule Foreign Assets and Schedule Foreign Source Income in their Income Tax Returns. Here's an overview of Completing Schedule Foreign Assets & Schedule ...

INCOME TAX

Tax Dept Sets Systematic approach to verify 'high-risk' refund claims

RJA 18 Oct, 2024

CBDT: Sets Systematic approach to verify 'high-risk' refund claims AY 2024-25 The Income Tax Department has introduced a systematic approach to verify 'high-risk' refund claims for the AY 2024-25 (Financial Year 2023-24) based on a Standard Operating Procedure (SOP) issued by the Income Tax Systems Directorate under the Ministry of ...

INCOME TAX

Overview on bonds under Section 54EC & Taxation aspects

RJA 26 Sep, 2024

Overview on bonds under Section 54EC & Taxation aspects Section 54EC bonds, commonly known as capital gain bonds, are an effective way for investors to save on long-term capital gains (LTCG) tax. If you sell a capital asset like real estate, shares, or other qualifying assets and make a long-term ...

INCOME TAX

FAQ on payments made to MSE’s & section 43B(h) applicability

RJA 19 Sep, 2024

FAQ on Impact on payments made to MSE’s & section 43B(h) applicability Following questions & Answers elated to specific tax & payment scenarios U/s 43B of the Income Tax Act, particularly related to payments made to Micro and Small Enterprises (MSEs) under the Micro, ...

INCOME TAX

Overview on Sec 80GGC - Deduction for Political Contributions

RJA 21 Aug, 2024

Overview on Sec 80GGC - Deduction for Political Contributions Section 80GGC of the Income Tax Act, 1961, provides a deduction to individual taxpayers for contributions made to political parties. This deduction is aimed at promoting transparency in political funding and encouraging voluntary contributions. Basic Key Features of Section 80GGC are mentioned ...

INCOME TAX

Penalty U/s 270A& 270AA related to income under-reporting/misreporting

RJA 20 Aug, 2024

Penalty U/s 270A& 270AA related to income under-reporting & misreporting Penalty U/s 270A& 270AA provisions & case laws illustrate the strict penalties for misreporting, the potential relief available under Section 270AA, and the importance of precise and justified assessment orders. Section 270A plays a significant role ...

INCOME TAX

Restoration of Indexation Benefit for LTCG - Budget - 2024

RJA 10 Aug, 2024

Restoration of Indexation Benefit for Long-Term Capital Gains- Budget - 2024 Govt of India has proposed that indexation benefit under Long-Term Capital Gains will be restored for immovable property bought before July 23, 2024. As per the provisions, the Long-Term Capital Gains tax would be calculated at the rate of 12.5 % without indexation, ...

INCOME TAX

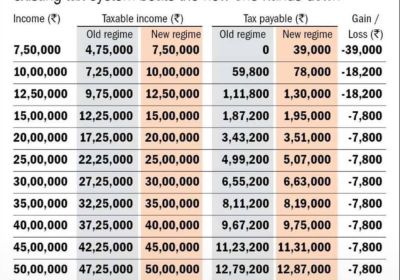

Understanding the Differences between Old vs. New Tax Regime

RJA 04 Jul, 2024

Old vs. New Tax Regime: Understanding the Differences For the assessment year 2024-25, individuals and Hindu Undivided Families (HUFs) have to pay taxes under the new tax regime unless they opt for the old regime while filing their return of income before the due date. The new tax regime requires ...

INCOME TAX

Futures and Options transactions may attract higher tax rate

RJA 20 Jun, 2024

Tax Implications on Reclassification of Futures & Options The reclassification of Futures & Options profits as speculative income would introduce a higher tax rate, restrict loss offset capabilities, and potentially deter retail participation in the Futures & Options segment. Traders and investors would need to adjust their strategies accordingly, and ...

INCOME TAX

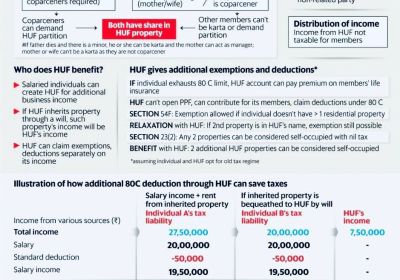

Taxation Aspect of a Hindu Undivided Family (HUF)

RJA 09 Jun, 2024

Taxation Aspect of a Hindu Undivided Family (HUF) A.Introduction: Hindu Undivided Family stands for Hindu Undivided Family. It is a legal entity created by a Hindu family, which can also be formed by Buddhists, Jains, and Sikhs. HUF is recognized as a separate tax entity, allowing families to pool ...

INCOME TAX

Is Linking Aadhaar with PAN for NRI's?

RJA 09 Jun, 2024

Is Linking Aadhaar with PAN for NRI's? NRIs without Aadhaar: NRIs who do not possess an Aadhaar card are exempt from the requirement to link PAN with Aadhaar, provided they update their residential status as Non-Resident on the income tax portal. Exempt from linking PAN with Aadhaar, provided they ...

INCOME TAX

Documents Required to Apply for NRI PAN Card

RJA 09 Jun, 2024

Documents Required to Apply for NRI Permanent Account Number (PAN) Card When Non-Resident Indian (NRI) applicants apply for a Permanent Account Number card, they need to submit the following documents: Documents Required to Apply for NRI Permanent Account Number (PAN) Card : NRI applicants are required to file below documents when ...

INCOME TAX

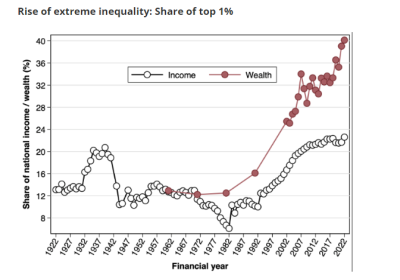

India Should Implement 2% Wealth Tax & 33% Inheritance Tax to Tackle Rising Inequality

RJA 09 Jun, 2024

India should implement a wealth tax & inheritance tax to address inequalities & fund social sector investments Introduction A recent paper by the World Inequality Lab, authored by economists Thomas Piketty, Nitin Kumar Bharti, Lucas Chancel, and Anmol Somanchi, suggests that India should implement a wealth tax and inheritance ...

INCOME TAX

Complete Guide on freelancers Taxation in India

RJA 03 Jun, 2024

Complete Guide on freelancers Taxation in India Taxation for freelancers can be a bit complex, but understanding the rules and available deductions can significantly ease the process and ensure compliance. Filing income tax returns as a freelancer is crucial for compliance, financial health, and availing benefits. By understanding the applicable ...

INCOME TAX

Modified Return (Form ITR-A) in Case of Business Reorganisation

RJA 02 Jun, 2024

All about the Modified Return (Form ITR-A) in Case of Business Reorganisation: Section 170A and the associated provisions offer a structured approach to filing modified returns in the case of business reorganization. The modified return of income is to be furnished by a successor entity to a business reorganisation as ...

INCOME TAX

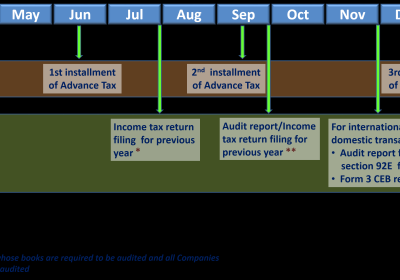

Complete Income Tax Calendar 2024

RJA 31 May, 2024

Income Tax Calendar 2024 January 2024: 7th: Deposit Tax Deducted at Source and Tax Collected at Source for Dec 2023. 14th: Issue Tax Deducted at Source certificates (Section 194-IA, 194-IB, 194M). 15th: Submit quarterly Tax Collected at Source statement (Dec 31, 2023). 30th: Issue Tax Collected at Source certificate (quarter ending Dec 31, 2023). 31st: Submit quarterly ...

INCOME TAX

Overview of Section 119(2)(b) Application for Condonation of Delay

RJA 29 May, 2024

Overview of Section 119(2)(b) Application for Condonation of Delay Section 119 of the Income Tax Act empowers the Central Board of Direct Taxes (CBDT) to issue instructions to lower levels of tax authorities for the proper administration of the tax laws. This section provides the CBDT with the authority to ensure ...

INCOME TAX

Do legal representatives Required to intimate about the death of taxpayer?

RJA 25 May, 2024

Do legal representatives need to intimate about the death of the taxpayer to the IT Department? Legal representatives of a deceased taxpayer are not legally mandated to notify the Income-Tax (IT) Department about the death of the taxpayer. This position was confirmed by the Delhi High Court in the case ...

INCOME TAX

Taxability of Reimbursement of Medical Treatment by the Employer

RJA 24 May, 2024

Taxability of Reimbursement of Medical Treatment by the Employer With Reference to Section 17(2) of the Income-tax Act, 1961, the reimbursement of medical expenses by an employer to an employee can, under certain conditions, be excluded from being considered a taxable perquisite. Here’s a detailed explanation based on the provided ...

INCOME TAX

CBDT Guidelines compulsory selection of ITR for Scrutiny for the FY 2024-25

RJA 07 May, 2024

CBDT Guidelines compulsory selection of ITR for Scrutiny for the FY 2024-25 The Government of India has been given the Guidelines via CBDT for mandatory selection of Income tax returns for complete scrutiny during FY 2024-25. These Guidelines via CBDT guidelines, outlined in a document dated May 3, 2024, are designed to ...

INCOME TAX

Ten transactions that may trigger tax authorities' income tax scrutiny

RJA 03 Apr, 2024

Ten transactions that may trigger tax authorities' income tax scrutiny In today’s world, taxpayers should ensure that the money they declare accurately reflects their actual financial activity. Transparency regarding finances is important. The Income Tax Department is employing increasingly sophisticated techniques to investigate potential discrepancies between taxpayers' reported ...

INCOME TAX

All about the Equity Linked Savings Scheme & its Returns

RJA 20 Mar, 2024

5 Golden Tips to Maximise ELSS Fund Returns ELSS or Equity Linked Savings Scheme is a type of diversified equity-oriented scheme which comes with a lock-in period of 3 years. By investing in this type of scheme, one will get tax exemptions u/s 80C of the IT Act 1961. A key interesting ...

INCOME TAX

How to respond notices for AIS (Annual Information Statement) mismatch?

RJA 09 Mar, 2024

How to respond notices for AIS (Annual Information Statement) mismatch? AIS (Annual Information Statement) mismatch means there is a discrepancy between the information provided in your tax return and the information reported by third parties, such as banks, financial institutions, or employers, to the tax authorities through the Annual ...

INCOME TAX

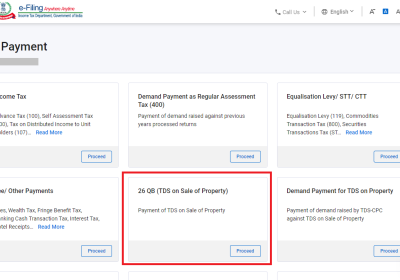

Payment of TDS via using Form 26QB on sale of property

RJA 03 Mar, 2024

Payment of TDS via using Form 26QB on sale of property transaction The following are some essential key points about Form 26QB: 1. Objective of Form 26QB : It assures that income tax is withheld at the moment of the property transaction and is specifically designed for Tax Deducted at Source on ...

INCOME TAX

NITI Aayog suggest for mandatory savings plans for elderly & tax reforms

RJA 23 Feb, 2024

NITI Aayog recommends for mandatory savings plans for elderly & tax reforms The apex public policy think tank of the Government of India NITI Aayog has pitched for Income tax & GST tax reforms, mandatory saving plan, & housing plan for elderly in India, as the recent data shows that ...

INCOME TAX

Outstanding Small Income Tax Demands Not required pay off: Budget 2024

RJA 05 Feb, 2024

Outstanding Small Income Tax Demands Not required pay off : Budget 2024 The Indian Government has extended an olive branch to Income tax taxpayer those who are still handling with Petty small Income tax Demands related to previous year. Tax Dept to waive off small Income tax demands autonomously clear pending petty ...

INCOME TAX

Income Tax refund claimed in ITR for AY 2018-19 to 2020-21 to Jan 31, 2024

RJA 13 Dec, 2023

Income Tax refund claimed in ITR for AY 2018-19 to 2020-21 to Jan 31, 2024 Central Board of Direct Taxes via Order F. No. 225/132/2023-ITA-II, issued on October 16, 2023 extends Timeline for process income Tax refund claimed Income Tax return for Assessment Year 2018-19 to Assessment Year 2020-21 to January 31, 2024 The Central Board ...

INCOME TAX

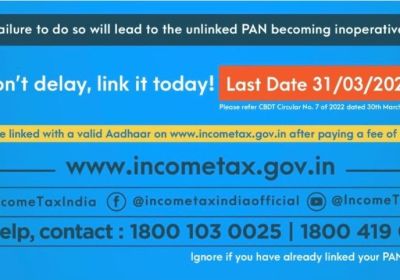

CBDT: 11.5 Cr PAN cards were deactivated for failing to be linked with Aadhaar cards

RJA 21 Nov, 2023

CBDT: 11.5 Cr PAN cards were deactivated for failing to be linked with Aadhaar cards Link PAN and Aadhaar card: Failure to link PAN and Aadhaar card by 30 June will result in a fine of Rs. 1,000 and PAN deactivation. PAN will become inoprative from 1 July 2023, therafter you needed Reactivating the ...

INCOME TAX

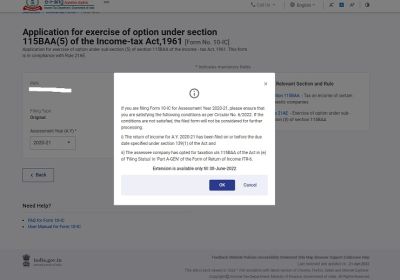

Basic Conditions of Condonation in filing of Income Tax Form 10-IC

RJA 24 Oct, 2023

Conditions of Condonation in filing of Income Tax Form 10-IC 1. Representations had been received by The Central Board of Direct Taxes stating that Income Tax Form No. 10-IC could not be submitted for A.Y. 2021-22 within the Timeline date or extended Timeline date, as the case may be. ...

INCOME TAX

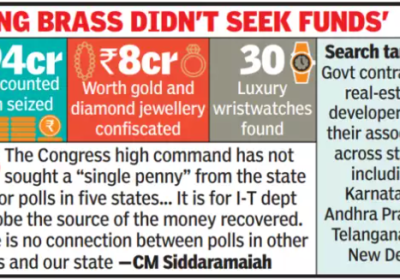

IT Dept. : More than INR 102 Cr value of jewellery & cash seized in searches on contractors

RJA 18 Oct, 2023

More than INR 102 Cr value of jewellery & cash seized in searches on contractors: the Income Tax Department has disclosed. The Income Tax Department has revealed that searches conducted between October 12 and 15 at 55 locations in Karnataka, Telangana, Andhra Pradesh, and Delhi in connection with alleged illicit earnings generated by civil ...

INCOME TAX

Mode of operation in financial fraud & tax avoidance made by contractor

RJA 18 Oct, 2023

Mode of operation in financial fraud & tax avoidance made by contractor The basic method of operation outlined points to a typical scheme for financial fraud and tax avoidance. To decrease their tax liability and produce unaccounted cash and hidden assets, contractors engaging in such activities overstate their expenses and ...

INCOME TAX

Timeline Date for Payment of Second Instalment of Income Tax Advance Tax

RJA 12 Sep, 2023

Timeline Date for Payment of Second Instalment of Income Tax Advance Tax Tax Dept. has notifies that Second Instalment of Advance Tax Payment is approaching soon. Timeline Date of payment of second instalment of Advance Tax is 15th Sep, 2023. Pay your Second Instalment of Income Tax Advance Tax by 15th ...

INCOME TAX

CBDT issue Circular for Income Tax Section 80P

RJA 28 Jul, 2023

Cooperative Societies may submit requests to Chief Commissioners of Income· tax (CCsIT) / Directors General of lncome·tax (DGsIT) for condonation of delay in filing of Income tax return : CBDT 1. CBDT authorises Chief Commissioners of Income· tax (CCsIT) / Directors General of lncome·tax (DGsIT) to condone delay ...

INCOME TAX

Beware about the Fake income tax refund email

RJA 21 Jul, 2023

Beware about the Fake income tax refund email Please refrain from clicking on any phone links that offer refunds. The Income Tax Department did not send these phishing emails, the I-T department stated in a tweet. For its part, the agency has begun contacting income tax taxpayers through email ...

INCOME TAX

Guidelines Compulsory Scrutiny of ITR Returns for FY 2023-24

RJA 14 Jul, 2023

Guidelines Compulsory Selection of Income Tax Returns for Complete Scrutiny during FY 2023-24 Central Board of Direct Taxes issues guidelines for compulsory selection of ITR Returns for Complete Scrutiny during the FY2023-24 along with the compulsory selection of Scrutiny procedure, Compulsory selection Parameters of returns for Complete Scrutiny as ...

INCOME TAX

Central Board of Direct Taxes Amends Rule 11AA of Income Tax Rules

RJA 01 Jun, 2023

Central Board of Direct Taxes Amends Rule 11AA of Income Tax Rules Central Board of Direct Taxes has issued a notification proposing change to Rule 11UA to implement the changes brought by the Finance Act 2023, The change expand scope of section 56(2)(viib) to include share application premium/money from ...

INCOME TAX

Statement of Financial Transactions to be filed by 31.05.2023.

RJA 31 May, 2023

Statement of Financial Transactions to be filed by 31.05.2023. SFT is a report of specified financial transactions by specified persons including specified reporting specified financial transactions. The income tax authority or another specified authority or agency must provide Statement of Financial Transactions from such specified persons who register, retain, or ...

INCOME TAX

Income Tax Liability on Re-Development Carried from 31st March 2023

RJA 28 May, 2023

Income Tax Liability on Re-Development Carried out in Societies from 31st March 2023 Normally, housing societies Re-development are being carried out through some Developer. A Development Agreement has to be executed between the Developer and Hosing Society. By virtue of this agreement, the Housing Society transfers development rights [Floor Space Index ...

INCOME TAX

Tax exemption limit of Leave Encashment increased to INR 25 Lakhs

RJA 28 May, 2023

Central Board of Direct Taxes increased limit of Leave Encashment exemption u/s 10(10AA) to Rs. 25 Lakhs for Non- Government Employees Central Board of Direct Taxes through Income tax Notification No. 31/2023 dated 24th May 2023 has notified INR 25,00,000/- as exemption limit U/s 10(10AA) with regard to Leave Encashment ...

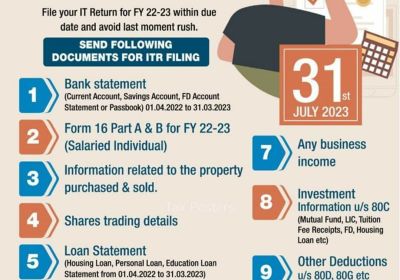

INCOME TAX

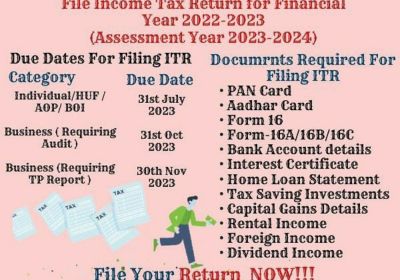

Avoid Mistakes While submitting ITR’s For AY24

RJA 27 May, 2023

Avoid Mistakes While submitting ITR’s For AY24 Despite the fact that ITR e-filing has been enabled, Income tax taxpayers are able to start filing their income tax returns for FY 2022-23 (or AY 2023-24). If you are doing the ITR on your own, there are a few pitfalls ...

INCOME TAX

Compulsory Selection of ITR’s for Complete Scrutiny during FY 2023-24

RJA 26 May, 2023

CBDT Directions on Compulsory Selection of ITR’s for Complete Scrutiny during FY 2023-24 The Central Board of Direct Taxes releases directions for the mandatory selection of Income Tax returns for Complete Scrutiny during the Fiscal Year 2023-24, as well as the method for the mandatory selection of Scrutiny. ...

INCOME TAX

How to compute ‘Net Winnings’ from online games u/s 115BBJ & 194BA

RJA 22 May, 2023

How to compute ‘Net Winnings’ from online games u/s 115BBJ & 194BA: CBDT Central Board of Direct Taxes published Notification No. 28/2023 on May 22, 2023, announcing the new Rule 133 under the Income-tax (Fifth Amendment) Rules, 2023. Above new income tax rule prescribed, How to calculate 'Net Winnings' from online games ...

INCOME TAX

Is Provision for warranty allowed/ disallowed as an expense?

RJA 07 May, 2023

Is warranty expenses provision allowed/disallowed as an expense? A warranty is an official assurance provided by the manufacturer to the purchaser of a product, committing to repair or replace it if necessary within a set time frame. As a consequence, it is a future expense that a manufacturer may ...

INCOME TAX

PAN become inactive if it is not connected Aadhaar till 31.03.2023

RJA 19 Mar, 2023

PAN become inactive if it is not connected Aadhaar till 31.03.2023 According to the income tax dept. The Income Tax Dept does not deactivate Assessees' PAN cards unnecessarily. But, they can avoid having his PAN deactivated by mistake. Assessees can prevent his permanent account number from getting deactivated by keeping ...

INCOME TAX

Tax Collections grown up to INR 13.73 lakh Cr till 10.03.2023

RJA 13 Mar, 2023

Tax Collections (Income Tax) grown up from 16.8% to INR 13.73 lakh Cr till 10.03.2023 Indian Income tax Collections up to 10.03.2023 continue to register increase growth. Income Tax collections up to 10.03.2023 disclose that Gross India collections are at INR 16.68 lakh Cr (Provisional figures) which is INR 22.58 Percentage higher than Gross collections for the ...

INCOME TAX

Shift between old and new tax regime, Cant come back to old tax regime

RJA 07 Feb, 2023

The new income tax regime is now the default choice for income taxpayers under budget 2023. Therefore, the updated new income-tax system will apply unless a person declares that they are choosing the old income tax regime. Many taxpayers may now question if the advantage of switching between the old and ...

INCOME TAX

Reverse Tax benefit on Home Loan if Selling House in 5 years of possession

RJA 25 Dec, 2022

Selling House within 5 years of taking possession will Reverse Tax advantage on Home Loan As per Sec 80C of income tax act 1961, In case we sell house within 5 years from the end of the FY in which property possession was taken, all the income tax advantage availed U/s 80C&...

INCOME TAX

Consequences of ignorance & Non-Filling of Tax Return

RJA 17 Dec, 2022

What are the consequences of ignorance & Non-Filling of Tax Return? Income Tax Return as it is generally referred to, is a formal document that you are mandated by law to submit annually. ITR filing is required if you want to avoid certain serious consequences, even though it may seem ...

INCOME TAX

LTC is only allowed for travel with in India - SC

RJA 26 Nov, 2022

What is Leave Travel Concession? Leave Travel Concession is an exemption for assistance/ allowance received by the employee from his employer for travelling on leave, related provision is stated in the section 10(5) of the Income Tax Act 1961. Value of travel assistance or concession received by or due to the ...

INCOME TAX

Easy way of checking status of your Income tax refund

RJA 22 Oct, 2022

Checking status of your Income tax refund The Income Tax Department gives taxpayers the option to track the progress of their ITR refund after 10 days from the day the ITR was filed. Income Tax e-filing platform now allows taxpayers who filed their ITR more than 10 days ago to monitor the ...

INCOME TAX

Verification of Undisclosed income under 'Operation Clean Money'

RJA 21 Oct, 2022

Verification of cash deposits & other Undisclosed income under 'Operation Clean Money' On January 31, 2017 the Income Tax Department initiated Operation Clean Money to investigate the sizable cash deposits made between November 9 and December 30, 2016. This operation was started with the intention of checking the taxpayer's cash transaction history, namely if ...

INCOME TAX

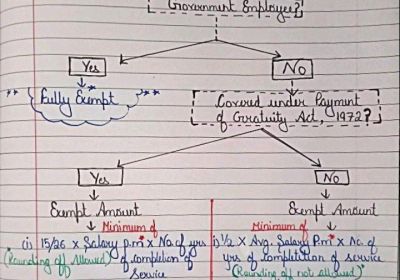

How to calculation of the gratuity amount exempted from income tax ?

RJA 20 Sep, 2022

How to calculation of the gratuity amount exempted from income tax ? When a monetary reward provided by the employer but not included in the employee's regular monthly salary is known as a gratuity. The Payment of Gratuity Act, 1972 regulates the gratuity provisions, and it is paid upon the occurrence ...

INCOME TAX

Timeline For Filling Form 67 under Income tax

RJA 15 Sep, 2022

What is Timeline For Filling Form 67 under Income tax act ? FTC would be claimed only if income tax Form-67, along with the required documents, was filling within timeline date for filing original Income-tax return in India, As per Latest amendment Income tax taxpayer restricting ability of claiming Foreign ...

INCOME TAX

Extension of tax returns filing deadline for AY 2022–23 till 31st Aug 2022

RJA 08 Aug, 2022

Extension of the Due date of filing ITR for AY 2022–23 till 31st August 2022 A Representation from the Gujarat Federation of Tax Consultants and the Income Tax Bar Association have been submitted to the Indian Minister of Finance and the Chairman of the CBDT to extend the date for submitting ...

INCOME TAX

New Income tax Rules for verification of Income tax return Filling

RJA 01 Aug, 2022

New Income tax Rules for verification of Income tax return Filling If ITR for Assessment year 2022-23 filed today or in months to come upto 31.12.2022 and not verified within 30 days Date of verification will be taken as date of filing. So interest and late fees will be levied accordingly Where ...

INCOME TAX

New Rule on e-Verification of income tax return Return

RJA 01 Aug, 2022

Overview of New E-Verification of income tax return Rule If the filed return is not verified within the provided timeline, the return filing procedure is not complete. If an Income tax return’s is filed but not verified, the ITR is deemed to be invalid and is subject to ...

INCOME TAX

Online ITR submitting Due Dates for AY 2023-24

RJA 01 Aug, 2022

Online ITR Filing Amendment – FY 2022-23 (AY 2023-24) What is the Income Tax? · There are two Kind of tax levy one is a an indirect tax & second is direct tax. Income tax is a kind of direct tax that is mainly directly attributable to the ...

INCOME TAX

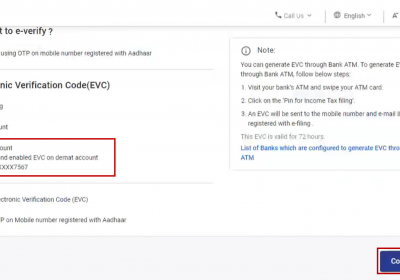

Step for Verify your Income tax return via Using your Demat Account

RJA 15 Jul, 2022

How to verify your ITR via Using your Demat Account : ITR 2021-22 Every taxpayer must verify their income tax return at income tax portal within 120 days after filing the ITR 2021-22, otherwise it would be ruled or deemed invalid. The Deadline for submitting an income tax return for the Financial ...

INCOME TAX

Last date approaching; How to file ITR For AY 2023-24

RJA 26 Jun, 2022

Last date approaching; How to file ITR For AY 2023-24 Income tax Taxpayers can e-verify his Income tax return immediately or within one hundred and twenty days of filing using the techniques outlined on the website. The ITR e-verification can be completed via pre-validated demat account, or Aadhaar OTP, pre-validated ...

INCOME TAX

CBDT: Issues Clarification on income tax Form 10CCB

RJA 25 Jun, 2022

The Income tax Dept. has issued the Clarification on income tax Form 10CCB to prevent errors in form filing and verification, clarification provides as mentioned below : After Chartered Accountants assign the appropriate Chartered Accountant complete filing of form income tax portal. Income Tax Taxpayer can reject/ accept the income tax ...

INCOME TAX

CBDT issue guidelines for removal of difficulties U/s 194R of I. Tax Act.

RJA 17 Jun, 2022

CBDT issue guidelines for removal of difficulties U/s 194R(2) of I. Tax Act. Guidelines for removal of difficulties U/s 194R(2) of the Income-tax Act w. e. f. July 1, 2022, The Finance Act 2022, New section 194R of the Income-tax Act was inserted under the Income-tax Act. Before providing any benefit ...

INCOME TAX

TAXABILITY OF VIRTUAL DIGITAL ASSETS U/S 115 BBH

RJA 01 Jun, 2022

TAXABILITY OF VIRTUAL DIGITAL ASSETS/ CRYPTOCURRENCY U/S 115 BBH Applicability of TDS & Tax Rate on Virtual Digital assets/ cryptocurrency Any Kind of Income received from the transfer of any Virtual Digital Assets/ cryptocurrency will be taxed @ 30%. Slab rate 1% tax deducted at source will be deducted on such transfers of ...

INCOME TAX

Benefits & Drawbacks of Tax saving by Formation of HUF

RJA 16 May, 2022

Benefits & Drawbacks of Tax saving by Formation of HUF. What is a Hindu Undivided Family (HUF)? HUF stands for Hindu Undivided Family. This is a legal practice of reduction of taxes and assets pooling by forming HUF which comes under the Hindu Undivided Family Act. All the members of ...

INCOME TAX

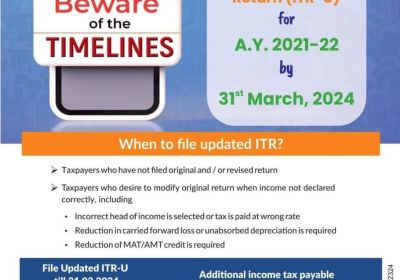

CBDT Notifies Manner & Form for filing Updated ITR Returns U/s 139(8A)

RJA 30 Apr, 2022

CBDT through Notification No. 48/2022 Dated 29th April 2022 notifies Form and Manner for filing Updated ITR Returns under section 139(8A). On April 29, 2022, the CBDT has issued the New income tax rules i.e Income-tax (Eleventh Amendment) Rules, 2022 to amend the OLD income rule i.e Income-tax Rules, 1962 & introduces manner for ...

INCOME TAX

ICAI issue FAQs.: CAs are not allowed to certify an ITR as a true copy

RJA 28 Apr, 2022

CAs are not allowed to certify an ITR as a true copy: ICAI provides Frequently Asked Questions. In a set of FAQs about issuing the UDIN, the ICAI said that "Chartered Accountants have no authority to qualify an Income Tax Return as a valid document." Chartered ...

INCOME TAX

CBDT has notified additional conditions u/s 139(1) for compulsory return filing

RJA 23 Apr, 2022

CBDT inserts Rule 12AB to provide further conditions, where filing of ITR is mandatory as per clause (iv) of 7th Proviso to section 139(1) CBDT via Notification No. 37/2022 dated 21.04.2022 via Income-tax (Ninth Amendment) Rules, 2022 notified conditions for furnishing a ITR n terms of clause (iv) of the seventh proviso section 139(1) ...

INCOME TAX

How to Check your PAN card status in minutes

RJA 07 Apr, 2022

How to Check your PAN card status in minutes by your self PAN cards are used to file Income Tax Returns (ITRs) and perform transactions. This is the reason why so many people pay such close attention to this document. PAN Card fraud has been all too common in recent ...

INCOME TAX

Top Unconventional Tax Planning ways Save Income Tax

RJA 01 Mar, 2022

Top Unconventional Tax Planning ways Save Income Tax Paying income tax at the conclusion of a financial year is a time-consuming process for most people. The majority of the strain is spent figuring out how to submit insurance, rent, and other expenses in such a way that the tax burden ...

INCOME TAX

CBDT Guidance on uploading of Manually filling 15CA & 15CB

RJA 28 Feb, 2022

CBDT Guidance on uploading of Manually filling 15CA & 15CB CBDT has provided instructions on how to upload manually filed Income Tax Forms 15CA and 15CB with Authorized Dealers between June 7, 2021, and August 15, 2021. In accordance with the Income Tax Department Press Release dated July 20, 2021, The www.incometax.gov.in e-filing ...

INCOME TAX

Crypto is taxed does not mean that it will not be prohibited in India

RJA 12 Feb, 2022

Taxation on Crypto does not mean that it shall not be banned future in India Indian finance minister N. Sitharaman, said on Friday that the government has the sovereign right to tax money earned from cryptocurrency transactions, but that the govt has yet to decide whether to legalise or ban ...

INCOME TAX

New Tax Regime Vs Old Tax Regime

RJA 07 Feb, 2022

Old Tax Regime vs New Tax Regime The Finance Act 2020 made a number of amendments to our direct tax structure. The implementation of the New Tax Regime U/S 115BAC of the Income Tax Act of 1961 was the most significant change. On the one hand, the new regime offers lower ...

INCOME TAX

Quick Steps to ensure processing time income tax refund

RJA 23 Jan, 2022

What is Eligibility Conditions of Income Tax Refund The Income Tax taxpayer’s applying for the income tax refund required to make sure that Dept have updated at tax return & validated their bank accounts with the Tax Dept where they would like to obtain their tax refund ...

INCOME TAX

How can we save Income Tax in India?

RJA 23 Jan, 2022

How can we reduce income tax in india You can Reduce your Tax Liability by save money/investment for your future 1. Deductions Upto 80C We can use up to deduction under chapter VI Rs 1.5 lakh ceiling u/s 80C. Income Tax Deductions or investments are all this subjected to ...

INCOME TAX

Industry wants clarity on Crypto Tax Laws in the Union Budget

RJA 11 Jan, 2022

Industry wants clarity on Crypto Tax Laws in the Union Budget The Indian industry association Indiatech has written to the country's finance minister Mrs. N Sitharaman about Crpto Taxation. Coinswitch Kuber, Wazirx, and Coindcx are among the major cryptocurrency exchanges represented by the group. Business group requested clarification on ...

INCOME TAX

Chartered Accountant�s Role in Tax Planning in India

RJA 07 Jan, 2022

What is a Chartered Accountants: CHARTERED ACCOUNTANT: A Internationally Recognized Profession. Chartered Accountants normally called as CA is a Internationally recognized profession related to finance and it’s management. Key roles that a chartered accountant plays is to manage budgets, auditing, formulating taxes and business strategies for clients ...

INCOME TAX

Overview of Deductions under Chapter VI A of Income Tax Act

RJA 31 Dec, 2021

Q.1 What are the different deductions under Schedule VI of Income tax Act ? The following deductions have been provided under Schedule VI of Income Tax Act, 1961 – SECTIONS PARTICULARS ELIGIBLE PERSONS PRESCRIBED LIMIT OF DEDUCTION SECTION 80C INVESTMENT IN LIC, PPF, SUKANYA SAMRIDDHI ACCOUNT, MUTUAL FUNDS, FD ETC INDIVIDUAL AND ...

INCOME TAX

FAQ on the filing of an Income Tax return

RJA 25 Dec, 2021

FAQ on the filing of an Income Tax return Q.1: Would the Dept of Income Tax provide an e-filing utility? Yes, the e-filing service has been offered by the Tax Department. E-filed returns can be generated and provided by electronic means. Q.2: What's the distinction between e-payment ...

INCOME TAX

Rental income income under the head business income or house property where to disclose

RJA 19 Dec, 2021

Rental income income under the head house property or business income where to disclose The treatment of revenue from the rental of immovable properties for tax reasons has been a point of conflict between the Income Tax Department and taxpayers. Depending on whether the rental income is considered as house ...

INCOME TAX

Income tax Exemption on Electric Vehicle (U/s 80EEB)

RJA 14 Dec, 2021

Income tax Exemption on Electric Vehicle (U/s 80EEB) The central government has announced an incentive for purchasing an electric vehicle in the 2019 Union Budget. The Finance Minister has announced that Registered Electric Vehicle and Advance battery come under this Scheme. Section 80EEB is introduced for deduction for INTEREST ...

INCOME TAX

How to submit Online Income tax Return

RJA 14 Dec, 2021

How you can file your Income Tax Return without help of Professional/Chartered Accountants. Individuals generally regard filing income taxes as a hardship; yet, due to the lack of accurate data, the advice of a Chartered Accountants or other professional is required. Allow us to inform you that the ...

INCOME TAX

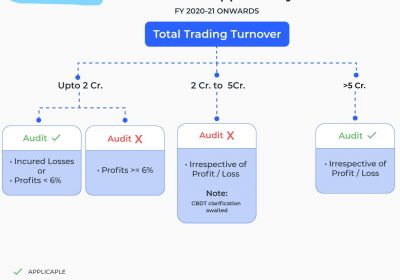

Frequently Asked Questions related to Tax Audit

RJA 07 Dec, 2021

Frequently Asked Questions related to Tax Audit Q1.: What is the purpose of section 44AB? Ans. According to this provision, taxpayers must perform an audit of their company or profession in order to provide an audit report for taxes purposes. Q2.: Who is in charge of conducting a tax ...

INCOME TAX

Income Tax Treatment on Listing Gains IPO

RJA 07 Dec, 2021

Income Tax Treatment on Listing Gains IPO Many IPOs are priced at a premium, many investors consider recording gains on the first day of trading. This is a good opportunity to achieve significant returns in a short amount of time. Are you aware that there are tax issues that you ...

INCOME TAX

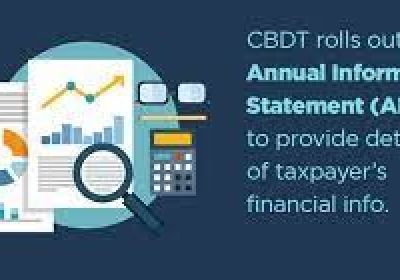

What is Annual information statement?

RJA 07 Dec, 2021

What is Annual information statement? Annual Information Statement is a record of all financial transactions done by you during the FY. AIS is an extensive view of information for a taxpayer available or visible in Form 26AS. AIS is a lot of detailed of financial statement. ...

INCOME TAX

Benefit of Filling of Income tax return if income is less than INR 2,50,000 etc

RJA 21 Nov, 2021

Q1.: Is there any advantage to submitting a income tax return if one's income is less than Rs 2,50,000 / Rs 3,00,000 / Rs 5,00,000? Ans: If Our annual income does not exceed INR 2,50,000/-, Then we do not needed to file a income tax Return. However, as a Tax consultants ...

INCOME TAX

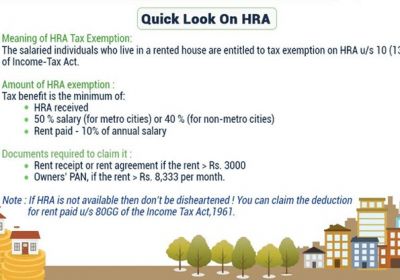

How to claim HRA allowance while Filing Income tax return?

RJA 11 Nov, 2021

How to claim HRA allowance, while Filing Income tax return? HRA is one of the most significant benefits accessible to salaried workers (House Rent Allowance). You can utilise the HRA to partially or totally lower your tax liability if you are a salaried individual who lives in a leased home. ...

INCOME TAX

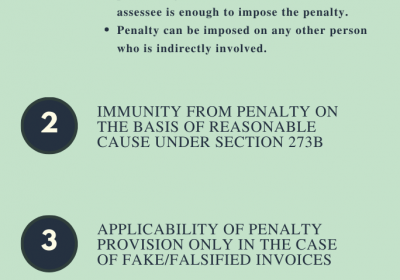

Penalty for false entry or fake invoices -New Section 271AAD

RJA 06 Nov, 2021

Penalty for false entry or fake invoices -New Section 271AAD The Finance Bill 2020 added New section 271AAD under Penalties Imposable - Chapter XXI With effect from 1-04-2020. Section 271AAD "During any proceeding under income tax Act, Without prejudice to any other provisions of income tax Act. &...

INCOME TAX

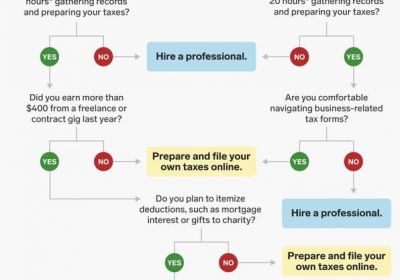

Why should you hire a CA as tax consultant?

RJA 05 Nov, 2021

Why should you hire a Chartered Accountants as tax consultant? To be honest, the necessity is mostly determined by the needs of your company. In today's world, every dollar you save can be reinvested. Accurate accounting guidance will certainly assist you in properly planning your business capital. When it ...

INCOME TAX

What is AIS (Annual Information Statement)?

RJA 05 Nov, 2021

What is AIS (Annual Information Statement)? Annual Information Statement (AIS) is a comprehensive view of information for a taxpayer displayed in Form 26AS of income tax portal. Taxpayer Information Summary (TIS) is an details category wise information summary for a income tax taxpayer. Income tax taxpayers can access the “...

INCOME TAX

Consequences if you do not verify your ITR?

RJA 01 Nov, 2021

Consequences if you do not verify your ITR? What will Consequences if you do not verify your Income tax Return with 120-day deadlines; it could happen that you forgot to do so. The final phase in the tax return process of filing is verification (ITR). The ITR should ...

INCOME TAX

CBDT Notifies E-settlement scheme 2021 for pending applications with settlement commission

RJA 01 Nov, 2021

CBDT notifies E-settlement scheme 2021 for pending applications with settlement commission CBDT of Direct Taxes by exercise power u/s 245D (11) and 245D (12) of Income-tax Act has issued a Scheme may be called E-Settlement Scheme 2021 to settle pending income-tax settlement applications transferred to a settlement commission. (Notification No. 129/2021/ F.No. 370142/52/2021...

INCOME TAX

Validity of Partnership remuneration disallowed U/s 40A(2)(a)

RJA 16 Oct, 2021

Validity of Partnership remuneration disallowed U/s 40A(2)(a) Problem based on provisions of Sections 40(b)(v) & 40A(2)(a) of the Income Tax Act, 1961. LETS see the applicability of provision of applicable of section. SECTION 40(b)(v) of income tax provides that: Remuneration to Partners exceeding the limit prescribed ...

INCOME TAX

COMPLIANCE REQUIREMENTS UNDER INCOME TAX ACT FY 20-21

RJA 14 Sep, 2021

REQUIREMENTS FOR COMPLIANCE WITH THE INCOME TAX ACT OF 1961 Sl. Compliance Particulars Due Dates 1 TDS/TCS obligations for the previous month are due on this day. 07.09.2021 2. Deposit of equalization levy 07.09.2021 3 Due date for issue of TDS Certificate for tax deducted under section 194-IA, section 194-IB ...

INCOME TAX

Income Tax Due dates extended again

RJA 10 Sep, 2021

CBDT extends due dates for filing of Income Tax Returns and various reports of audit for Assessment Year 2021-22 Saummary on Income Tax Due dates extended again Following due dates have been extended which I believe in wake of the challenges put forward by the ...

INCOME TAX

Taxation of Inter-Corporate Dividends U/S Section 80M

RJA 09 Sep, 2021

Taxation of Inter-Corporate Dividends under section 80M of Income Tax Act 1961 BRIEF INTRODUCTION The Finance Act 2020 has brought with it a slew of measures and reforms to boost the expansion of the economy and improve tax administration. In order to reduce tax and compliance burden ...

INCOME TAX

Housewives savings deposited in bank A/c up to 2.5 lakh in demonetization cannot be consider income

RJA 21 Jun, 2021

Housewives savings deposited in bank A/c up to Rs. 2.5 lakh in demonetization cannot be income: ITAT Agra Brief Summary of the Case: During the demonetization phase, the assessee, a housewife, deposited cash in her bank account totalling Rs. 2,11,500/-. She was asked to explain the source of the deposit ...

INCOME TAX

Income Tax Notices in India - Meaning & Types

RJA 03 Jun, 2021

Income Tax Notices in India - Meaning & Types An income tax notice is a written letter from the Income Tax Department to a taxpayer informing him of a problem with his tax account. The notification might be given for a variety of reasons, including filing or not submitting ...

INCOME TAX

FAQS ON PRESUMPTIVE TAXATION IN INDIA

RJA 01 Jun, 2021

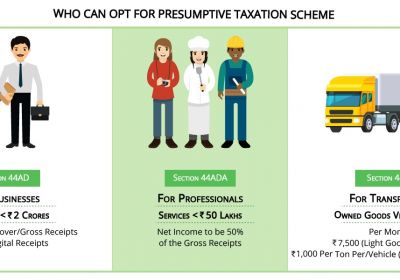

FAQS ON PRESUMPTIVE TAXATION IN INDIA Q.: What does a presumptive taxation scheme mean? Presumptive taxation scheme related to providing relief to small taxpayers. Any small taxpayer whose turnover is less than Rs 2 crores shall be eligible for such a scheme. To facilitate the running of businesses without any burden ...

INCOME TAX

EQUALISATION LEVY ON E-COMMERCE OPERATORS

RJA 01 Jun, 2021

BRIEF INTRODUCTION ON EQUALISATION LEVY ON E-COMMERCE OPERATORS Equilisation levy was introduced in India in 2016 and the same was substantially implemented in the 2020 Budget. Apart from taxing the online advertisement services, the equalization levy shall also be applicable on the consideration, being received by an e-commerce operator, having turnover ...

INCOME TAX

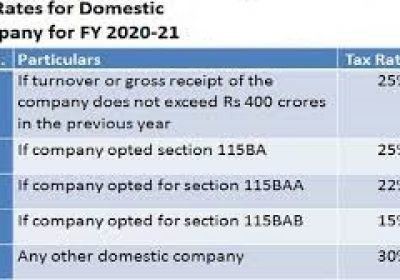

TAXATION UNDER SEC-115BAA & 115BAB

RJA 21 May, 2021

SECTION 115BAA Under this section, newly set up manufacturing companies are provided with a concessional rate of tax. The tax rate is as follows – The annual income is subject to a tax @ 22%. In Addition to this, a surcharge of 10 % and cess of 4 % is also levied, thus making the effective ...

INCOME TAX

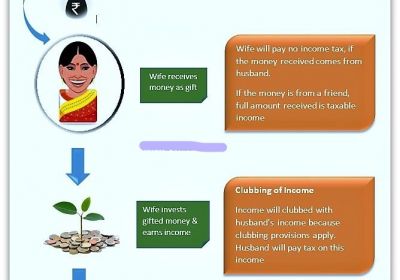

Income/Assets Transferred to Spouse Taxable In the Hands of Transferor Spouse

RJA 19 May, 2021

Income/Assets Transferred to Spouse Taxable In the Hands of Transferor Spouse In India there is normal practice to buy/transfer properties under the name of a woman, for example, acquisition of real estate under the name of a wife, buying jewelry or stock under the name of a wife, ...

INCOME TAX

GUIDELINES TO BANKS TO REPORT TAXPAYERS INTEREST INCOME: CBDT

RJA 28 Apr, 2021

GUIDELINES TO BANKS TO REPORT TAXPAYERS INTEREST INCOME: CBDT Exempted Income tax income under the Income Tax Act 1961 like interest on PPF account etc need not be reported. The CBDT published detailed guidelines for reporting information on taxpayers' interest & dividend income from banks and companies. The “specified reporting ...

INCOME TAX

Highlights of Faceless Penalty Scheme, 2021.- E-penalty or faceless penalty Scheme, 2021

RJA 22 Apr, 2021

Highlights of Faceless Penalty Scheme, 2021.- E-penalty or faceless penalty Scheme, 2021 CBDT Through Notification No. 03/2021 dated 12.01.2021 - has notified Faceless Penalty Scheme, 2021. to provide for the online imposition of e-penalty or faceless penalty by the Tax Authorities. This scheme shall become effective with effect from 13.01.2021. Salient features Faceless Penalty Scheme, 2021 ...

INCOME TAX

Document Required For Permanent Account Number (PAN) application

RJA 21 Apr, 2021

Document Required For Permanent Account Number (PAN) application Proof of Identity- Copy of following : Ration card having a photograph of the applicant; or Aadhaar Card issued by the Unique Identification Authority of India; or Elector’s photo identity card; or Pensioner card having a photograph of the applicant; or ...

INCOME TAX

All about tax benefit enjoy by Resident Senior Citizens

RJA 26 Jan, 2021

Overview on Tax Concessions/ benefit for Resident Senior Citizens So After a lifetime of working, raising families, and making a contribution to the success of this Nation other ways senior citizens deserve a dignified retirement.- Charlie Gonzalez Every Nation Govt provides special specific relief to senior citizens in a ...

INCOME TAX

No Notional Taxation! If gap in value of stamp duty is no more than 20% of actual transaction,

RJA 18 Jan, 2021

No Notional Taxation! If the gap in the value of the stamp duty is no more than 20% of the actual value of the transaction, Valuing the stamp duty is a benchmark tax price and plays an important role in the tax obligation evaluation of the property's value. Now ...

INCOME TAX

Frequently asked questions (FAQ) on UDIN issued by the income tax department

RJA 10 Dec, 2020

Frequently asked questions (FAQ) on UDIN issued by the income tax department The Institute of Chartered Accountants of India has been pioneering in the construct of a unique idea called 'Unique Document Identification Number (UDIN)' after finding false certifications by Non - Chartered Accountants’ that have been misrepresented as ...

INCOME TAX

Income Tax dept. permit the revision of declarations filed under Direct Tax Vivad se Vishwas scheme

RJA 09 Dec, 2020

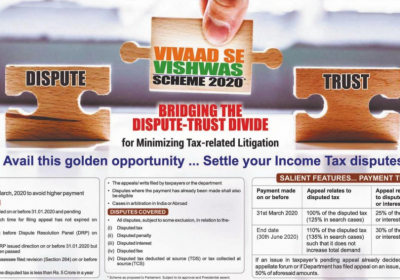

Income Tax dept. permit the revision of declarations filed under the “Direct Tax Vivad se Vishwas Act scheme” The CBDT has explained in FAQ’s that the 'Vivad Se Vishwas' scheme should not be used in a situation where proceedings are pending before the Income Tax Settlement ...

INCOME TAX

CBDT Given Explanation on DIRECT TAX VIVAD SE VISHWAS SCHEME

RJA 01 Dec, 2020

CBDT: ISSUE AN EXPLANATION IN RESPECT OF DIRECT TAX VIVAD SE VISHWAS ACT, 2020. Central Board of Direct Taxation through the Circular at the end of October 2020 issued an Explanation in respect of DIRECT TAX VIVAD SE VISHWAS ACT, 2020. Under the current section 5(2) of the Vivad se Vishwas Act, the ...

INCOME TAX

Ministry of Finance discloses the new GST UPI Payment Guidance

RJA 01 Dec, 2020

Ministry of Finance discloses the new GST UPI Payment Guidance The Indian Govt issued the exemption in the fine to those pursuing companies to consume Business to Business transactions for a term of four months from 01 Dec 2020 to 31 Dec 2021 in order to issue invoices except dynamic QR code through ...

INCOME TAX

CBDT: Tax Department hopes to finalize all faceless e-Assessments by mid-September.

RJA 30 Nov, 2020

Income Tax Department hopes to finalize all faceless e-Assessments by mid-September. 3.130 tax officers, including 600 Income Tax officers, are engaged in the operation of the Faceless Income Tax Assessment Scheme. Of the 58,319 cases selected for faceless assessment, 8,700 cases have already been disposed of. The system, 1st announced by FM Minister Nirmala ...

INCOME TAX

Faceless Assessment: Step by step Procedure & Reasons for the implementation in India

RJA 30 Nov, 2020

E-Assessment Process: The E-filing portal is built as a forum for the conduct of various tax procedures online and electronically. E-Assessment under Income Tax Appeal is a mechanism in which tax officers interact via e-mail and to the taxpayer's account on the e-filing site. On further receipt of the ...

INCOME TAX

AMT : Essential of Alternate Minimum Tax(AMT) & Difference with MAT

RJA 29 Nov, 2020

Essential of Alternate Minimum Tax(AMT) & Difference with MAT Alternative Minimum Tax – Essential The aim of the Finance Act 2011 is to tax such LLP differently. A new Chapter XII-BA titled "Special Provisions relating to certain LLP" was adopted on 01 April 2012. Under this chapter, LLPs are now ...

INCOME TAX

How to get Tax Relief Through TRC under DTAA

RJA 04 Nov, 2020

How to obtain a Tax Resident Certificate for tax relief under a double tax evasion deal Tax Residency Certificate (TRC) The Government of India has modified the Section 90 & 90A of the I T Act, 1961 appears with finance Bill, 2012 to make the provisions provide the submission of the Tax Residency ...

INCOME TAX

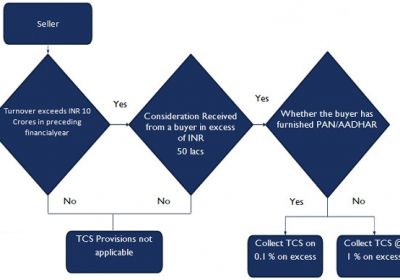

KEY FEATURES OF TCS ON GOODS SALE (SECTION 206C(1H) APPLICABLE FROM 1 OCTOBER 2020

RJA 01 Oct, 2020

KEY FEATURES OF TCS ON GOODS SALE (SECTION 206C(1H) APPLICABLE FROM 1 OCTOBER 2020 The Finance Act, 2020 has been amended by adding section 206C(1H) of the Income Tax Act, 1961 (hereinafter referred to as the "Act"), which is effective from 01.10.2020. As a consequence of the said amendment, a seller ...

INCOME TAX

Income Tax consultancy Service in India

RJA 25 Sep, 2020

Income Tax Services Income tax accounts for the tax which is imposed on individuals by the government whereby an individual is required to file income tax every year to determine their tax obligations. It reduces the amount that business owners and individuals are allowed to keep. Income Tax Services in ...

INCOME TAX

Tax and Regulatory Services and their Compliance in India

RJA 17 Sep, 2020

Tax and Regulatory Services With the major shift in multinationals for investing and transacting in India, it is important to have a deep insight into tax and regulatory policies for multiplying growth and grabbing opportunities. The major tax consultants and advisors in India conduct tax and regulatory procedures for dealing ...

INCOME TAX

CBDT implements functionality for banks to verify the ITR filing status.

RJA 03 Sep, 2020

CBDT implements functionality for banks to verify the ITR filing status. Wednesday, the IT Dept said it introduced a service for financial institutions to verify the status of tax filings submitted by entities based on their PAN. On Wednesday, the IT Dept said it introduced a service for banks to ...

INCOME TAX

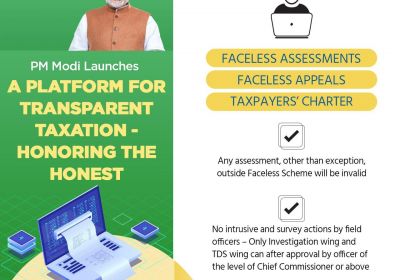

Key highlights of PM Modi's speech on Transparent Taxation: Seamless, painless, Faceless Assessment

RJA 13 Aug, 2020

Key highlights of PM Modi’s speech on Transparent Taxation: Seamless, painless, Faceless Assessment On 13 August PM Modi will launch the platform 'Transparent Taxation – Honoring the Honest', The upcoming platform would help CBDT's reform agenda to make the tax filing process clearer and simpler, the Ministry ...

INCOME TAX

FAQ�s on Deduction under section 80C, 80CCC, 80CCD & 80D

RJA 08 Jul, 2020

FAQ’s on Deduction under section 80C, 80CCC, 80CCD & 80D Q.: Can taxpayers claim the deduction of 80C while submitting the return on income tax? Claims for 80C deductions are allowed before the end of the assessment year while filing the return on income. Q.: What ...

INCOME TAX

Latest revised Form 26AS with effective from 1 June 2020 : CBDT

RJA 04 Jun, 2020

Govt Notified: Latest revised Form 26AS with effective from 1 June 2020 Latest Form 26AS with effect from 1 June 2020: With effect from 1 June 2020, all data of the taxpayer will be available in the new Form 26AS: Tax withheld at source and tax assessed at source Details of financial transactions listed Income tax ...

INCOME TAX

Basic understanding of Rebate U/s 87A of I. Tax Act

RJA 02 Jun, 2020

Basic understanding of Rebate U/s 87A of I. Tax Act The main obligation of any Govt of India should protect the citizens of its nation, and the Govt of India is constantly working towards that goal. To order to help the government achieve this vision efficiently, the people ...

INCOME TAX

CBDT CLARIFYING Compiling the new Section 115BAC tax legislation implemented in the Budget 2020

RJA 18 May, 2020

AMOUNT IS DEDUCTED OF TDS ON SALARY-DEDUCTION OF TDS ON SALARY-CBDT CIRCULAR CBDT CIRCULAR CLARIFYING THE PROCESS FOR DEDUCTION CLARIFYING THE METHOD FOR DEDUCTION IN THE EXISTING AND CURRENT SCHEMES OF TAXATION: Income tax Amendment 2020 adopted a revised income tax system for individual taxpayers. The new tax scheme is offered ...

INCOME TAX

REBATE U/S 87A OF INCOME TAX ACT , 1961

RJA 31 Jul, 2018

Rebate u/s 87A of the Income Tax Act was introduced in the year of 2013 with the objective of reducing the tax liability of the assessee whose income is not more than Rs 3,50,000 You can claim the rebate u/s 87A if you fulfil the following conditions: You are an ...

INCOME TAX

Penalty U/S 234F (Fees) For Late Filling of ITR

RJA 22 Jul, 2018

PENALTY U/S 234F (FEES) FOR LATE FILING OF ITR Under this section, the fee (penalty) is levied if the Income-tax return is not filed within the due date. It is likely to be increased from 1st April 2018 onward as per Section 234F of the Income Tax Act. Provisions ...

INCOME TAX

ALL ABOUT EQUALISATION LEVY/GOOGLE TAX

RJA 21 Jul, 2018

Taxation Indian digital Economy: Equalisation Levy Over the last decade, Information Technology has gone through an expansion phase in India and globally. Consequently, this has given rise to various new business models, where there is a heavy reliance on digital and telecommunication networks. As a result, the ...

INCOME TAX

HOW TO RESPONSE INCOME TAX DEMAND NOTICE

RJA 11 Jul, 2018

IF a taxpayer income tax return differs from the assessment made by the INCOME TAX OFFICER then taxpayer issued income tax demand notice. This notice is issued when the taxpayer has deposit less Tax for which he is liable to pay. IF You received demand notice then here are ...

INCOME TAX

LIMIT APPLICABLE FOR INCOME TAX AUDIT (U/S 44AB) IN INDIA

RJA 09 Jul, 2018

Objective if Tax Audit:- The objective of the tax audit is to report the requirements of Form Nos. 3CA/3CB and 3CD. Other than the reporting requirements of Form Nos. 3CA/3CB and 3CD a proper tax audit will ensure that the books of account and other records ...

INCOME TAX

QUICK REVIEW ON INCOME COMPUTATION AND DISCLOSURE STANDARDS (ICDS)

RJA 30 Jun, 2018

CBDT issued 12 drafts of Income Computation and Disclosure Standards (ICDS) after taking suggestions from stakeholders and the draft ICDS was open for comments and suggestions till 8 February 2015. After taking suggestion 10 ICDS is finalized by CBDT on 31st March 2015. It will applicable from AY 2017-18. APPLICABILITY RULES OF ICDS:- ...

INCOME TAX

Common mistakes in ITR have been done by you ?

RJA 17 Jun, 2018

Mistakes that are commonly done by taxpayers in filing ITR We appreciate that filing IT returns may be time consuming, especially if you are young and have just filed a few. However, the advantages outweigh the time and effort required to file it. It is also the responsibility of ...

INCOME TAX

National Committee on Deduction benefit under section 35AC

RJA 02 Jun, 2018

This is to update about Deduction benefit under section 35AC, the Government today said the benefit of deduction under section 35AC of the IT Act will only be available till March 31, with respect to the payments made to associations or institutions approved by the National Committee for carrying-out any ...

INCOME TAX

IMPORTANT ANALYSIS OF ALL MAJOR AMENDMENTS IN INCOME TAX APPLICABLE FOR A.Y. 2018-19

RJA 02 Apr, 2018

Maintenance of Books of Accounts Change in limits for Maintenance of Books of Accounts (Section 44AA): If your net income* from Business or Profession in the financial year 2017-18 is more than Rs 2,50,000 OR if your total sales from Business or Profession in the financial year is more than 25,00,000, then ...

INCOME TAX

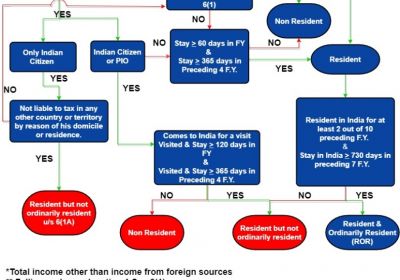

RESIDENTIAL STATUS UNDER INCOME TAX

RJA 14 Mar, 2018

Residential Status of Individual- Section 6 Tax incidence on an assessee depends on his residential status. For instance, whether an income, accrued to an individual outside India, is taxable in India depends upon the residential status of the individual in India. Similarly, whether an income earned by a foreign national in ...

INCOME TAX

DEDUCTIONS UNDER SECTION 80CCD OF INCOME TAX ACT

RJA 17 Feb, 2018

DEDUCTIONS UNDER SECTION 80CCD OF INCOME TAX ACT Income Tax Act, 1961 provides various tax deductions under Chapter VI-A for contribution to pension plans. Such deductions are available u/s 80C, 80CCC, and 80CCD. This guide talks about section 80CCD. This section provides tax deductions for contribution to the pension schemes ...

INCOME TAX

A QUICK GLANCE ON IMPACTED THE ECONOMY & TAXATION ON BUDGET 2018

RJA 01 Feb, 2018

Arun Jaitley recalls the measures — like GST, FDI, demonetisation, etc. — taken by the NDA government in the past four years that have impacted the economy of the country. The government estimates 7.2-7.5% GDP growth in the second half of the current FY18. Fiscal deficit for 2017-18 at 3.5% ...

INCOME TAX

Massive Increment in Prosecution on Tax Evaders

RJA 29 Jan, 2018

The Income Tax Department has accorded the highest priority to tackle the menace of black money. With this objective in mind, the Department has initiated criminal prosecution proceedings in a large number of cases of tax offenders and evaders. Prosecutions have been initiated for various offences including ...

INCOME TAX

Few ways Via � Income Dept. is monitoring your high-value transactions

RJA 28 Jan, 2018

Few ways through – Dept is monitoring your high-value transactions check tax evasion, the Income Tax Department has stepped up its vigilance against undeclared income. Now, you have to report PAN on all your high-value transactions. Property registrars and financial institutions with which you deal with like your bank, insurer, ...

INCOME TAX

VALUATION OF UNQUOTED SHARES AN ANALYSIS

RJA 11 Jan, 2018

VALUATION OF UNQUOTED SHARES –AN ANALYSIS OF SECTION 56 ALONG WITH RULE 11UA Finance Act, 2017 inserted two new provisions under the Act- clause (x) under Section 56(2) and section 50CA. The said sections were inserted to deal with a situation where the property, including unquoted shares, is being transacted ...

INCOME TAX

ELECTORAL BOND SCHEME 2018 UNDER INCOME TAX

RJA 09 Jan, 2018

ELECTORAL BOND SCHEME 2018 UNDER INCOME TAX Electoral Bond is a financial instrument for making donations to political parties. These are issued by Scheduled Commercial banks upon authorization from the Central Government to intending donors, but only against cheque and digital payments (it cannot be purchased by paying cash). These bonds ...

INCOME TAX

LEGAL STATUS OF BITCOINS IN INDIA

RJA 12 Dec, 2017

What's Cryptocurrencies-Bitcoin? Bitcoin is a cryptocurrency invented by a few unknown groups of people. You can buy or sell bitcoins on a bitcoin exchange. The currency is not controlled by any bank or government. Blockchain is the leading technique behind bitcoin and other cryptocurrencies. It's a public ...