Table of Contents

Q1.: Is there any advantage to submitting a income tax return if one's income is less than Rs 2,50,000 / Rs 3,00,000 / Rs 5,00,000?

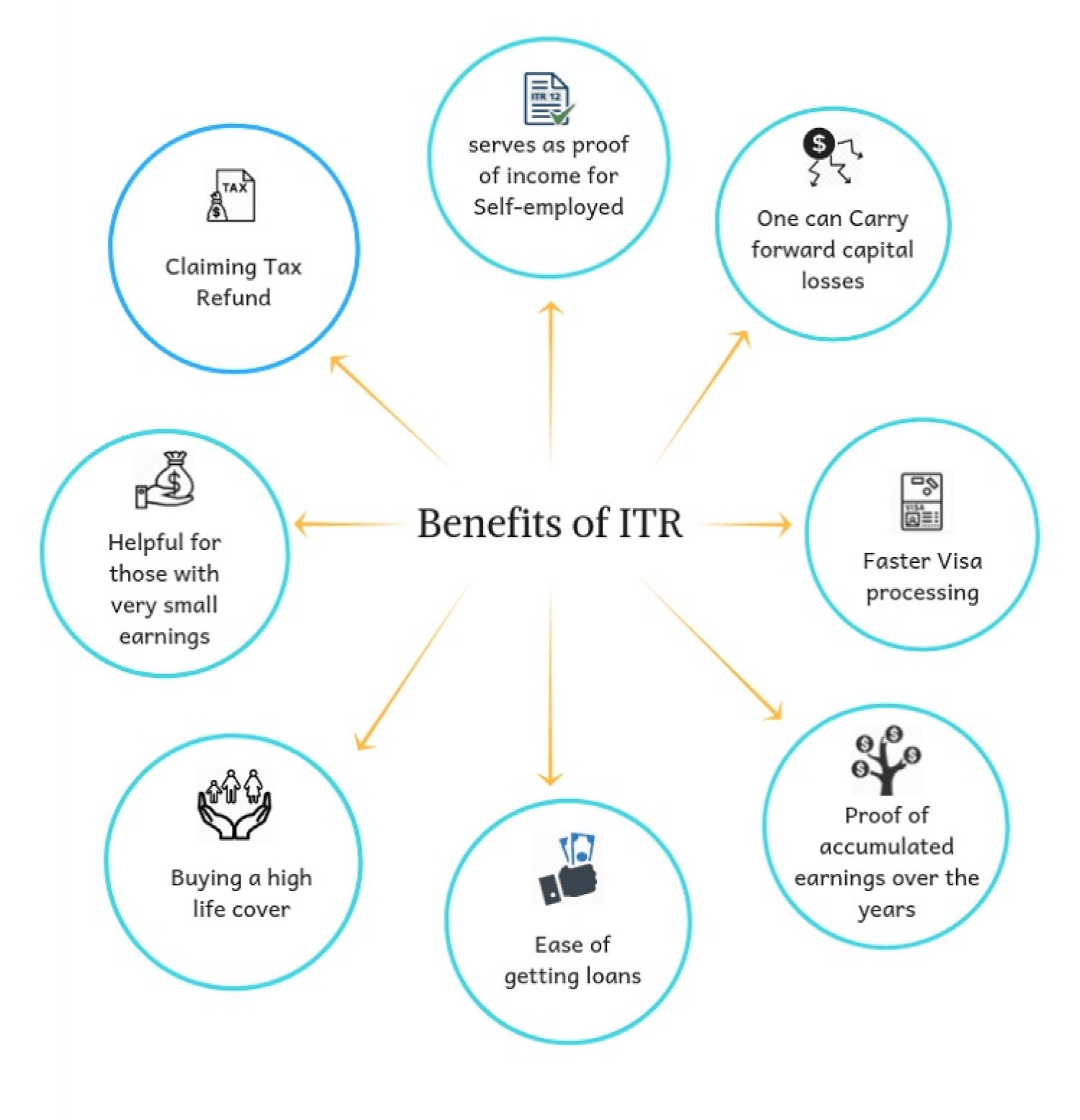

Ans: If Our annual income does not exceed INR 2,50,000/-, Then we do not needed to file a income tax Return. However, as a Tax consultants in India we still suggested that you should file your tax return & take the benefit of filling of an Tax Return(ITR),:

Details are mention below :

- Can Carry forward capital losses: IN case in FY you have incurred capital losses, then you can carry forward it & settle in future.

- Buying insurance Policy with high life cover: Few insurance companies are adamant for ITRs while providing high life cover to verify Annual income.

- Help in Obtaining Government Tender Normally furnishing your ITR is a must to apply for govt tenders especially when tender of hug value are being awarded.

- Proof of Net worth/ Proof of Income: What’s the best document for your Income Proof? No brownies for guessing this 1. Yes, we all know it’s your ITR.

- IT is Avoid penalty Non-filing of ITR can lead you in trouble with the tax dept. You carry the risk of not only paying a penalty but interest on i

- Income Tax Refund You can claim a refund of the amount that you have paid in excess or deducted excessively in the form of TDS. There is no bigger joy than getting back your money from the Tax Dept.

- It will Protection against Black Money If you diligently file your ITR every year, then your savings will never be at risk of being termed as black money by the AO’s as any income not reported to the Tax Dept comes under the radar of black money.

- Help in Accidental Claims This is one of the benefits that comes to picture when you meet with an accident and want accidental claim from the insurance companies. If you have your ITR’s with you then court applies a simple formula to arrive at the claim amount.

- Can Carry forward of losses Want to claim last year’s business loss? File your ITR & you’re all set for it.

- Person will be Eligibility in Loan Application ITR’s of the last 3 years is one of the basic documents required for loans. This helps banks in judging your pay back capacity.

- Required for Startup Funding Looking to raise funds from VC’s, angel? You need to have ITR’s filed till date ready. Many investors study your business scalability, profitability and other cost parameters from your business ITR.

- Help in Obtaining Visa For travelling abroad, foreign consulates of many countries ask you to furnish last three years’ ITRs or current year’s ITR. Absence of any return can reduce the chances of you getting a visa specially under the visitor, investor and work permit category.

Advantages can be take only to Individuals & HUFs*

Income Tax Rates & Relief

|

S.N. |

Particulars |

Benefits |

Available to |

|

1. |

Concessional tax regime U/s 115BAC |

Choose for payment of taxes at reduced rates (subject to certain conditions) |

Individuals & Hindu Undivided Family. |

|

2. |

Hindu Undivided Family. is assessed to tax as a separate entity |

HUF is treated as a person distinct from Individual members or Karta. |

Hindu Undivided Family. |

|

3. |

Maximum amt of income which is not chargeable to Income-tax in the hands of a resident senior citizen, who is at least Six Years of age at any time during the PY but less than 80 Years of age on the last day of the PY |

INR 3,00,000 |

Resident Senior Citizen |

|

4. |

Maximum amount of income which is not chargeable to Income-tax |

INR 2,50,000 |

Individual/ Hindu Undivided Family. |

|

5. |

Rebate u/s Section 87A to resident individual whose total income does not exceed Rs. 5,00,000 |

Tax payable but subject to maximum of INR 12,500 |

Resident Individual |

|

6.

|

Maximum amount of income which is not chargeable to Income-tax in the hands of a resident super senior citizen who is at least 80 Years of age at any time during the PY |

INR 5,00,000 |

Resident Super Senior Citizen |