Income tax return

Comprehensive Guide on filing ITR Returns for the FY 2023-2024

RJA 31 May, 2024

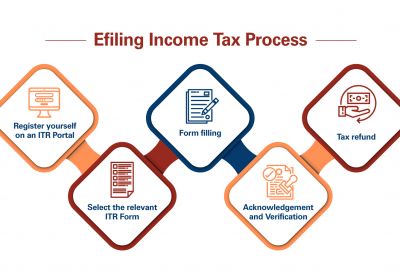

Comprehensive Guide on filing Income Tax Returns for the FY 2023-2024 For the fiscal year 2023-2024, salaried individuals can start the process of filing their Income Tax Returns (ITR) in June 2024, after receiving Form 16 from their employers. Filing on or before 31st July 2024 helps avoid interest and penalties. Timely ...

Income tax return

The CBDT has notified Format & Particulars ITR Forms for AY 2023-24

RJA 01 Mar, 2023

The CBDT has notified Format & Particulars ITR Forms for AY 2023-24 The Central Board of Direct Taxes notified Particulars as well as Format of Income tax return Forms along with ITR Acknowledgement (ITR-V) for AY 2023-24 has been officially notified, Basically Central Board of Direct Taxes is a ...

Income tax return

Impact of Delay in filing Income tax returns

RJA 08 Oct, 2021

Impact of Delay in Filing Income Tax Returns The most important obligation for any tax payer is to file their income tax on time, on or before the due date. Whenever income tax returns are submitted late, the taxpayer misses a lot of benefits. Apart from the smaller exemptions, the ...

Income tax return

FREQUENTLY ASKED QUESTION ON INCOME TAX RETURN:

RJA 03 Oct, 2021

FREQUENTLY ASKED QUESTION ON INCOME TAX RETURN: Q.: What Are the Benefits of Filing Income Taxes? In recent years, the Government of India has taken restrictive action in enforcing the Income Tax Law by linking various benefits for prompt tax filers, which has resulted in low Income Tax filing Compliance ...

Income tax return

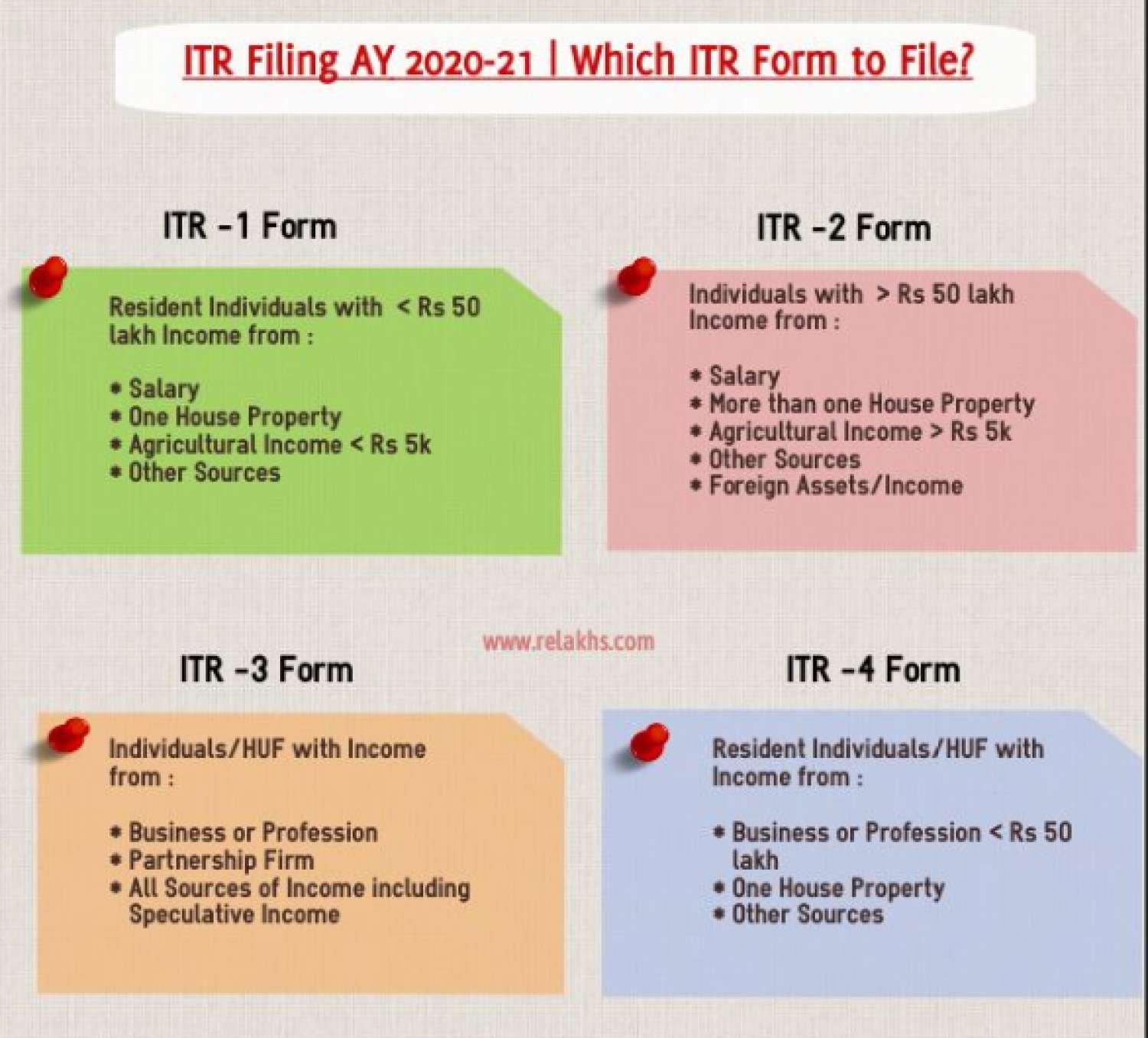

LATEST UPDATE ON INCOME TAX RETURN FORMS FOR FY 2020-21: NEW ITR FORM

RJA 22 Jun, 2021

ITR Forms- LATEST UPDATE ON INCOME TAX RETURN FORMS FOR FY 2020-21 Identifying the ITR form for the specific income of the taxpayer was a very important and technical task when all ITRs were filed in physical mode. However, in today's technological age, this task is done by ...

Income tax return

FAQS RELATED TO INCOME TAX RETURN FILLING IN INDIA

RJA 21 Jun, 2021

Frequently Asked Question on Income Tax return filling in India Q.: What is the difference between an ITR-V form and an ITR-Acknowledgement? Form ITR-V contains information from income tax returns filed in Forms ITR-1, ITR-2, ITR-3, ITR-4, ITR-5, and ITR-7 but not e-verified. Form ITR-Acknowledgement shows and verifies data ...

Income tax return

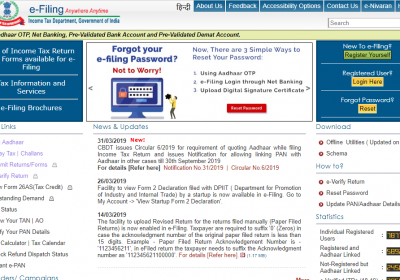

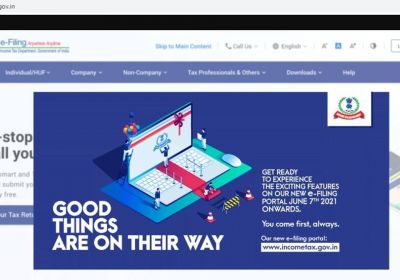

Latest Features of the new e-filing income tax Launched portal 2.0

RJA 07 Jun, 2021

The income tax Dept introduced a new e-filing portal on June 7, 2021. The Tax Dept of India has updated the official tax filing system in India with a new design and interface. The rebuilt website, dubbed ITR e-filing portal 2.0, aims to improve user experience with a new dashboard that houses all ...

Income tax return

Must Know Significant changes in ITR Form for FY 2020-21

RJA 07 May, 2021

Must Know Significant changes in ITR Form for FY 2020-21 Income tax return Form ITR-1 cannot be filed in cases where TDS has been deducted under section 194N: If the amount of cash withdrawn during the year from a co-operative bank, a banking company or post-office from 1 or more bank ...

Income tax return

Can HRA & Home Loan Benefits be claimed when ITR is filing?

RJA 22 Apr, 2021

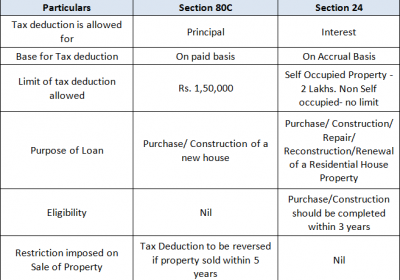

Can HRA & Home Loan Benefits be claimed when ITR is filing? Manny Employees earning a monthly income for both the House Rent Allocation (HRA) and home loans are often confused that they claim the income tax benefit on ITR furnishings. Based on rent, but payment for the domestic loan. ...

Income tax return

Tax filing: changes are taken into account when making the ITR

RJA 27 Nov, 2020

Document Checklist for ITR Filing Documents ITR 1 ITR 2 ITR 3 ITR 4 Basic Information (PAN, Aadhaar, bank details, Form 26AS, AIS/TIS, etc.) YES YES Salary (Form 16, salary slips, proof of deductions under 80C, 80D, 80E, 80TTA) YES YES YES NO House Property (Rent receipts, home loan ...

Income tax return

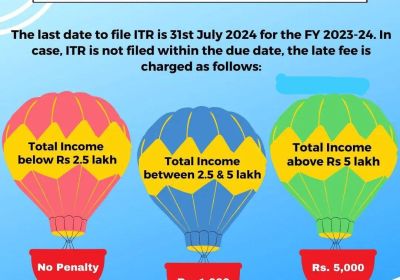

Get aware for penalty of section 234F for late filing of ITR

RJA 13 Jul, 2018

In Budget 2017 our honourable Finance Minister, Mr Arun Jaitley introduced a new section 234F to ensure timely filing of returns of income. As per section 234F of the Income Tax Act, if a person is required to file Income Tax Return (ITR forms) as per the provisions of Income ...

Income tax return

Change in law of belated return in income tax from A.Y. belated return u/s 139(4)

RJA 03 Jul, 2018

Old provision up to the Assessment year:- Any person who has not filed his return within the time allowed us 139(1) he can file his return at any time before the expiry of one year from the end of the relevant assessment year or completion of the assessment whichever is ...

Income tax return

Common Mistakes in Income Tax Return Filling

RJA 17 Jun, 2018

Common Mistakes in Income Tax Return Filling Mistakes that are commonly done by taxpayers in filing ITR are listed below. These mistakes may create some problems or may bring tax notice for the taxpayers. So it is beneficial to avoid such mistakes that are given below:- Filing ITR using ...

Income tax return

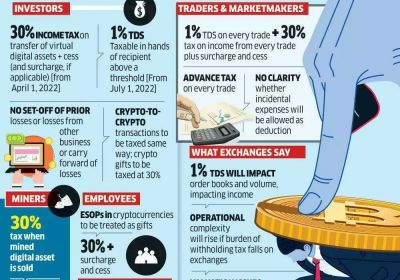

Needed to file income tax returns for your bitcoin profits earn

RJA 17 Mar, 2018

Needed to file income tax returns for your bitcoin profits earn Profited from Bitcoins or other Cryptocurrencies and not sure how to file your income tax returns? Did you know gains from bitcoin is treated as capital gains and hence taxed? We are India’s leading tax ...