ROC Compliance

E-Form MGT-7 Signing Limits - for Company Secretaries in Practice

RJA 21 Oct, 2024

E-Form MGT-7 Signing Limits - for Company Secretaries in Practice The ICSI has introduced limits on the number of E-form MGT-7 filings a Company Secretary in Practice can sign per financial year, effective from April 1, 2025. Here's a quick recap of the new restrictions and guidelines: E-Form MGT-7 Signing Limits:&...

ROC Compliance

Key changes in Schedule-III of the Companies Act wef FY 2021-22

RJA 30 Sep, 2022

Key changes in Schedule-III of the Companies Act which is applicable from 1-april- 2021 the MCA revised Schedule III of the Companies Act 2013 with the goal of increasing openness and giving users of financial statements more disclosures with effect from On March 24, 2021. These changes will be in effect as ...

ROC Compliance

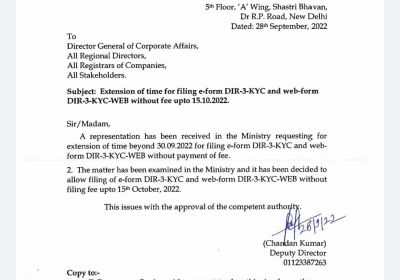

Is Dir 3 KYC date extended for FY 2022?

RJA 28 Sep, 2022

Is Dir 3 KYC date extended for FY 2022? For FY 2022-23 - all the individual who has been allotted “DPIN/DIN” on or before 31.03.2022 & status of such Director Identification Numbers is 'Approved', needs to file form DIR-3 KYC to update KYC details in the MCA system on ...

ROC Compliance

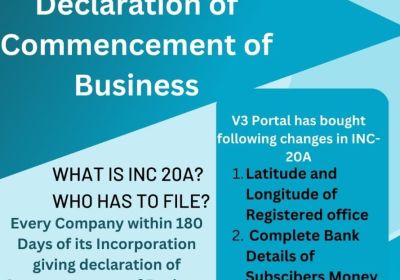

Non-Filing of E-Form INC-20A- Consequences

RJA 15 Oct, 2021

Commencement of Business E-Form INC-20A Filing Brief Introduction Form INC-20A is basically a declaration form that's to be filed by the directors of the corporate at the time of commencement of business. The declaration form should be verified by ...

ROC Compliance

All About Form MGT-9 & its Filling requirement

RJA 14 Oct, 2021

All About Form MGT-9 & its filling requirement Brief Introduction At the end of each financial year, companies in India should file an annual return. There are numerous amendments associated with the filing of annual returns. There has also been lots ...

ROC Compliance

How to apply DIN before Company formation

RJA 14 Oct, 2021

DIN Allotment Prior to Incorporation of Company Brief Introduction DIN or the Director Identification Number is basically a unique identification number, that is compulsorily be obtained by all the directors. It's similar to an identity proof of a director. DIN is allotted by&...

ROC Compliance

FAQS ON INSPECTION, SEARCH AND SEIZURE UNDER GST

RJA 09 Jun, 2021

FAQS ON INSPECTION, SEARCH AND SEIZURE UNDER GST Q.: What does search mean under GST? Under the law, search has been defined as an action undertaken by government machinery involving visiting, inspection and examination of the place, area, person, object etc., where there is an instinct to find something concealed ...

ROC Compliance

E-KYC, Aadhaar, Linking required for Existing GST Taxpayers

RJA 15 Mar, 2021

GST Portal allowed e-KYC/ Aadhaar/Linking for Present GST Taxpayers The GST Portal has allowed Aadhaar Authentication/E-KYC on the GST Portal for Existing Taxpayers. Performance for Aadhaar Authentication and e-KYC where Aadhaar is not accessible has been dispatched to GST Common Portal w.e.f. 6 January 2021 for existing taxpayers. ...

ROC Compliance

TimeLine dates Extension for Key Compliance by CBIC, MCA, and ICAI

RJA 30 Sep, 2020

TimeLine dates Extension for Key Compliance by CBIC, MCA, and ICAI Ministry of Corporate Affairs extended the deadlines until 31 December 2020 with regard to the various compliances listed below in view of the continued disruption caused by COVID 19 and to provide greater ease of business: 1. Relief for filing forms relating to ...

ROC Compliance

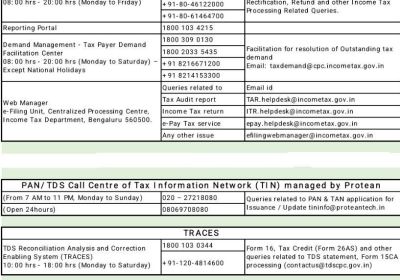

ROC open new corporate help desk operational number

RJA 30 Jul, 2020

Corporate Affairs Ministry (ROC) Open New Operational Number of Corporate Helpdesk New Helpdesk Number has been made successful by Corporate Ministry Seva Kendra and CRC Helpdesk to answer stakeholder queries on Company Name Availability and Company Incorporation, accessible July 17, 2020 (8:00 a.m.) A new contact number for the CRC Helpdesk and ...

ROC Compliance

GST applicability on Bitcoin in India

RJA 31 Mar, 2020

GST applicability on Bitcoin in India GST on Bitcoin – Is Bitcoin trading taxable? There are a lot of situations in which GST tax could be levied on Bitcoin trading and other cryptocurrencies. Let's find out if there's a GST on bitcoin. Authorized Person of India’...

ROC Compliance

Due Date for Filling Annual Return

RJA 18 May, 2018

Due Date for Filing Annual Return All companies registered in India must file annual returns each year, irrespective of business turnover or activity. The annual return must be filed in Form MGT-7 and Form AOC-4 is also filed along with the annual return. In this article, we look at the ...

ROC Compliance

Shifting of Registered Office from One State to Another

RJA 11 May, 2018

Shifting of Registered Office(RO) of the Company from One State to the Another which has more compliance than shifting the Registered Office within the State. Detailed Procedure According to Section 13 read with Rule 30 of Companies (Incorporation) Rules, 2014:- Prepare Draft Memorandum and Articles of Association of the Company. Call ...

ROC Compliance

MCA has notified amendment to various rules under Companies Act, 2013

RJA 11 May, 2018

MCA has notified amendment to various rules under the Companies Act, 2013. w.ef. 07 May, 2018 MCA has notified amendment to various rules under the Companies Act, 2013. The amendments are effective from May 07, 2018. The amended provisions have been discussed as under: MCA has amended the Companies (Meetings of the ...

ROC Compliance

MCA proposes change in process of obtaining fresh Director Identification Number

RJA 05 Jan, 2018

MCA proposes change in process of obtaining fresh Director Identification Number MCA has proposed to re-engineer the process of allotment of Director Identification Number (DIN) by allotting DIN to individuals only at the time of their appointment as Directors (If they do NOT possess a DIN) in companies. DIR-3 (Application ...

ROC Compliance

Common mandatorily annual compliance of Private Limited company

RJA 11 Sep, 2017

COMPLETE FILING OF YOUR COMPANY ROC ANNUAL COMPLIANCE- COMMON COMPLIANCE’S WHICH A PRIVATE LIMITED COMPANY HAS TO MANDATORILY ENSURE- TIME IS RUNNING OUT-: - While you are busy planning the business strategies, there are various compliance’s which are required to be followed ...