KEY FEATURES OF TCS ON GOODS SALE (SECTION 206C(1H) APPLICABLE FROM 1 OCTOBER 2020

The Finance Act, 2020 has been amended by adding section 206C(1H) of the Income Tax Act, 1961 (hereinafter referred to as the "Act"), which is effective from 01.10.2020. As a consequence of the said amendment, a seller collects any sum as payment for the selling of any products of value or gross value exceeding Rs. 50 Lakh in any previous year shall, at the time of receipt of that sum, recover from the purchaser an amount equal to 0.10 percent of the sale consideration in excess of Rs. 50 Lakhs as income tax.

Section 206C of the Act provides for the collection of source tax (TCS) on trade in alcohol, liquor, forest products, scrap, etc. Subsection ( 1) of that section, inter alia, provides that every person, being a seller, shall, at the time of debiting the amount payable by the purchaser on the account of the purchaser or at the time of receipt of that amount from the purchaser in cash or by issuing a check or draught or by any other means, whichever is earlier, collect from the purchaser a sum equal to the specified amount from the purchaser.

The Central Board of Direct Taxes has implemented amendments to the TCS regulations with effect from 1 October 2020 through the budget 2020, i.e. The Finance Act of 2020. Such developments would impact a wide number of sectors across different industries. The article describes the reach, the eligibility, and the exemptions. CBDT issues Recommendations for new TDS & TCS requirements as of 1 October 2020

Important points that should be noted in TCS New section 206C(1H)

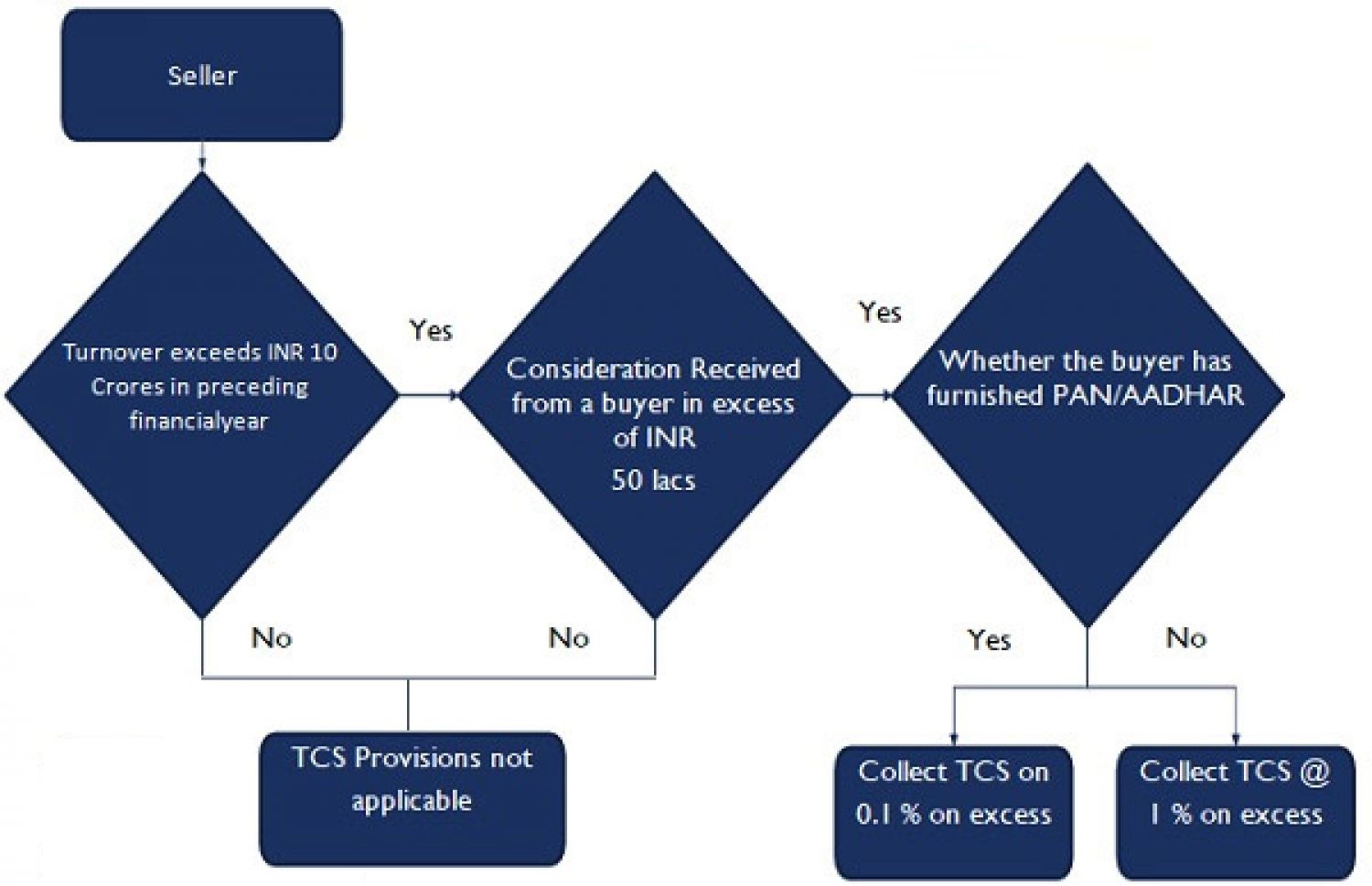

1. The seller of products is liable to earn TCS at a rate of 0.1% on consideration received from the purchaser in the preceding year in excess of 50 lakh rupees. In non-PAN / Aadhaar cases, the average is only one percent.

2. Just those sellers whose overall revenue, gross receipts or sales from the company taken on by them surpass 10 crore ropes during the financial year period prior to the financial year shall be liable for the collection of such TCS. The 2020 budget, that is. The Finance Act, 2020 requires any seller of products (other than Alcohol, Tendu Leaves, Timber, Forest Processing, Scrap, Coal, Lignite, Iron or Motor Vehicle) with a turnover of more than INR 10 crores in the preceding financial year to collect TCS at a rate of 0.1% (0.075 percent for FY 2020-21) from customers to whom sales after 30 September 2020 surpass INR 50. The new clause shall operate from 1 October 2020.

3. The government may, subject to the terms set out in that notification, notify an entity that is not liable to collect such TCS.

4. No TCS shall be obtained from the central govt, the Government of the State and the Embassy, the High Council, the Legation, the Council, the Consulate, the Trade Representative of a Foreign State, the Local Authority as described in the Explanation of Section 10 (20) or any other individual as may be stated by the Central Government by notification in the gazette notification for this reason, subject to such conditions set out in the Description of Section 10.

5. No TCS shall be received from the importer of any products to India.

6. These TCS shall not be collected if the seller is liable to collect TCS pursuant to any other provision of section 206C or the purchaser is liable to deduct TDS pursuant to any provisions of this act and has deducted such Amount.

7. Is this relevant to the Service Provider: Latest TCS provision is not applicable to service providers since it applies only to the seller of certain kinds of products.

8. Scope of TCS in section 206C(1H) - Eligibility

- Sale of any products above Rs. 50 lakhs;

- Revenue of Rs . 10 Crores and above during FY 2019-20 and after 1 October 2020

9. Exceptions to this TCS in section 206C(1H)

- If the purchaser is liable to deduct TDS or collect TCS under some other clause of the Act and has deducted/collected the amount from the seller of the goods purchased by the purchaser;

- If the purchaser is a central / state government, an embassy, a high commission, a legation, a consulate, a foreign state trade agent, a local authority; or

- Any person goods imported to India or any class of person notification to the central govt in the Official Gazette for that reason, subject to the condition stated in that notifications.

10. Important CBDT clarifications for applicability of Latest TDS/TCS provision applicable 1 October 2020:

- The tax agency also explained that payments made for e-commerce purchases require two transactions-one when the customer makes the payment through the payment gateway and one after the e-commerce platform collects the money through the payment gateway. With payment gateway also eligible for the e-commerce platform, the Government makes it clear that either the payment gateway or the e-commerce platform will subtract the TDS.

- An e-commerce operator shall deduct income tax at a rate of one percent of the gross sum of sales of products or services, or both, made simpler by means of its electronic or digital service or portal.

- On selling of motor vehicles above Rs 10 lakh, which already attracts TCS of 1%, the tax agency has clarified that because TCS of 1% on the sale of motor vehicles costing more than Rs 10 lakh is sold by B2C, sales to dealers will be regarded as triggering the new TCS. Even so, sales of Rs 10 lakh or fewer motor vehicles, which do not already attract a TCS of 1%, will be included in the estimate of sales of 0.1% TCS.

- The Guidelines have explained that any trades in shares, goods through registered exchanges or electricity transactions, energy savings certificates, etc. would be held outside the scope of these new TCS and TDS requirements.

- Adjustment for revenue return, discount, or indirect taxes: It is requested to explain whether changes are necessary for sales returns, discounts or indirect taxes, including GST, for the purposes of tax collection under subsection (1H) of section 206C of the Act. It is hereby explained that no change to the sale return or discount or indirect taxes, including GST, is needed for the collection of tax under section 206C(1H) of the income tax Act because the collection is made with regard to the receipt of the value of the sale consideration.

- Applicability of insurance provider or insurance aggregator: In certain situations, insurance brokers or insurance aggregators have not been involved in transactions between the insurance provider and the purchaser for the following years. It has been argued that, in subsequent years, the obligation to deduct tax can arise from insurance brokers or insurance aggregators, even though the transactions have been done directly with the insurance provider. This can result in difficulties for insurance agents/aggregators.

Regards

Rajput Jain and Associates