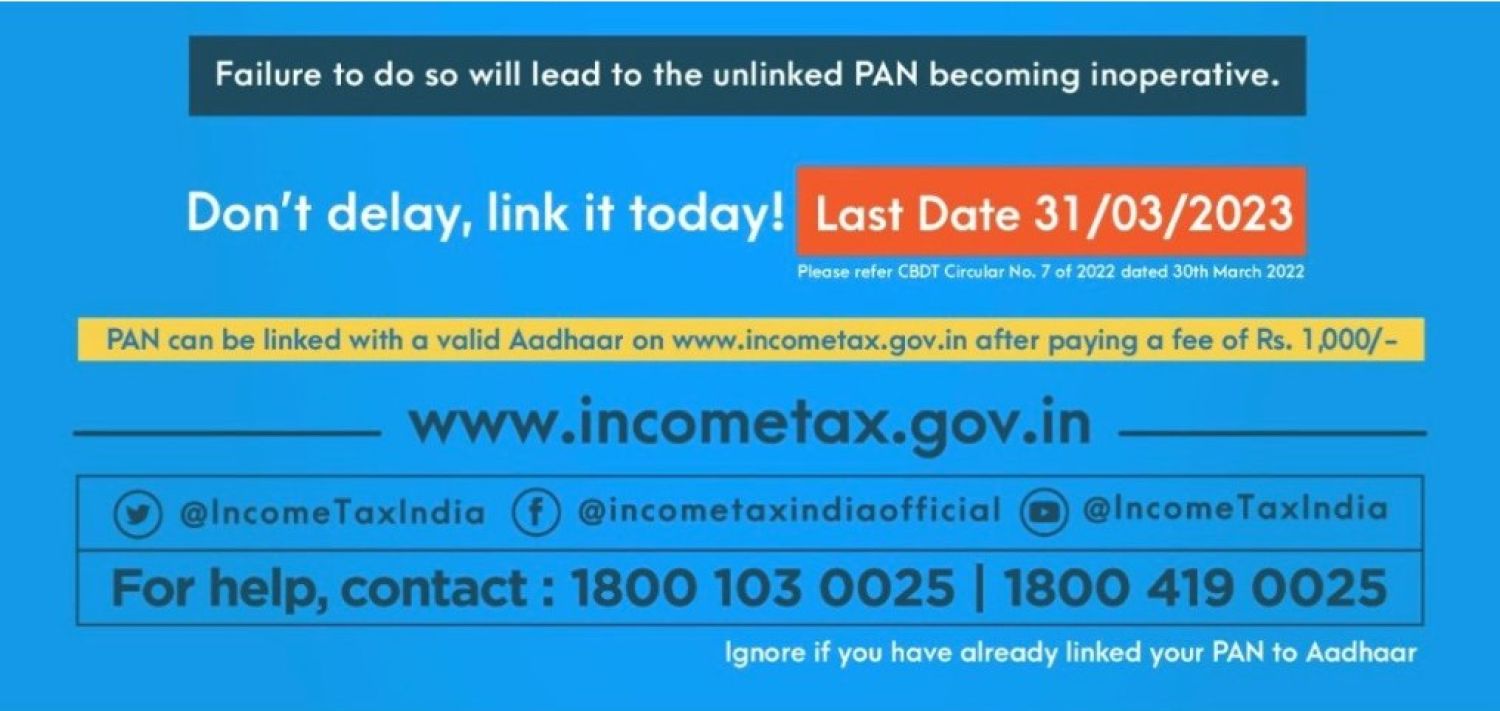

PAN become inactive if it is not connected Aadhaar till 31.03.2023

According to the income tax dept. The Income Tax Dept does not deactivate Assessees' PAN cards unnecessarily. But, they can avoid having his PAN deactivated by mistake. Assessees can prevent his permanent account number from getting deactivated by keeping a few points in mind: Submit his ITR’s every year.

PAN would become inactive if it is not connected to your Aadhaar as of April 1, 2023. According to the Income Tax Act of 1961, all PAN holders who are not exempt are required to link their permanent account number with Aadhaar before 31.3.2023,

After timeline is over, the permanent account number holders will not be able to use his 10 digit unique alphanumeric No & financial transactions linked to PAN will be stopped.

In case permanent account number holders wish to surrender or cancel his permanent account number (which you are currently using), then you need to visit your local Tax Assessing Officer with a apply by letter to surrender or cancel his permanent account number.

Conclusion

If PAN is not linked to Aadhaar by 1 April 2023, it would cease to function. Aadhaar and PAN can no longer be linked after March 31, 2023.