Chartered Accountants

ICAI: Norms for Audit Firms to Join Global Network

RJA 26 Feb, 2026

ICAI Brings New Norms for Audit Firms to Join Global Network The Institute of Chartered Accountants of India (ICAI) has introduced new global networking guidelines for Indian chartered accountancy (CA) firms. These norms were announced by ICAI’s newly elected president, Prasanna Kumar D. Purpose of the ICAI Guidelines&...

Chartered Accountants

ICAI UDIN Directorate – New Validation & Audit Ceiling

RJA 17 Feb, 2026

UDIN Directorate Update: Field-Level Validation & 60 Tax Audit Ceiling (Effective 1 April 2026) The Unique Document Identification Number Directorate of the Institute of Chartered Accountants of India has announced important changes relating to UDIN generation under the “GST and Tax Audit” category. At its 442nd Council Meeting (May 2025), the the ...

Chartered Accountants

ICAI NOW ALLOWS ADVERTISING: BIG UPDATE FOR CA FIRMS

RJA 26 Jan, 2026

ICAI NOW ALLOWS ADVERTISING: BIG UPDATE FOR CA FIRMS In a landmark reform, the Institute of Chartered Accountants of India has issued a press release dated 12 December 2025, announcing a major relaxation in the Code of Ethics. The Institute of Chartered Accountants of India has issued a press release dated 12 December 2025, ...

Chartered Accountants

Overview on AI (Artificial Intelligence) and Tax Compliance in India

RJA 19 Jan, 2026

Transforming Enforcement, Compliance, and Taxpayer Services India’s tax administration is undergoing a structural transformation, driven by Artificial Intelligence (AI), Big Data, and advanced analytics. The article explores the evolution of India’s digital tax ecosystem, current AI implementations by CBDT and CBIC, global benchmarks, and future policy ...

Chartered Accountants

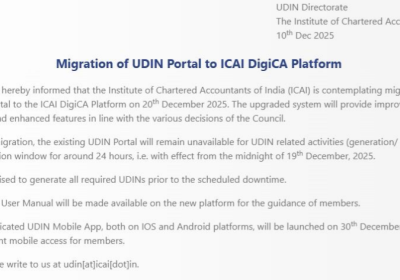

ICAI Announcement on Migration of UDIN Portal to ICAI DigiCA Platform

RJA 15 Dec, 2025

ICAI Announcement on Migration of UDIN Portal to ICAI DigiCA Platform This notice is crucial for chartered accountants to plan their UDIN generation before the migration and be ready for the new platform and mobile app. Members are hereby informed that the Institute of Chartered Accountants of India (ICAI) is ...

Chartered Accountants

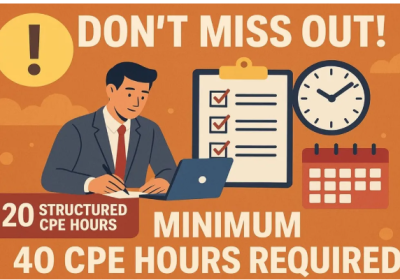

Practicing CA Complete a minimum of 20 CPE hours before calendar year

RJA 15 Dec, 2025

Practicing chartered accountants must complete a minimum of 20 structured CPE hours before the calendar year ends to meet ICAI requirements. CPE Requirements: ICAI mandates these hours for members holding a Certificate of Practice (COP), typically as part of the annual total (e.g., 40 hours for those under 60, split between structured ...

Chartered Accountants

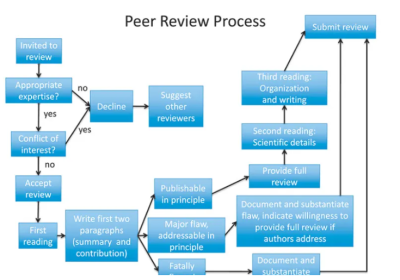

ICAI Peer Review Objectives, Eligibility, Process, Phases, Cost

RJA 13 Dec, 2025

ICAI Peer Review Objectives, Eligibility, Process, Phases, Cost Peer Review of Chartered Accountant Firms – Overview Peer Review for Chartered Accountant firms, overseen by the Institute of Chartered Accountants of India, functions as an independent evaluation mechanism to ensure that firms engaged in assurance services adhere to the prescribed technical, ...

Chartered Accountants

CPE Hours Applicability 4 level: CPE Non-Compliance Consequence Level

RJA 20 Jun, 2025

CPE Hours Applicability is applied on the following four levels: CPE Non-Compliance Consequence Levels (to be operational w.e.f. 1/1/2025 for non-compliances arising from the calendar year 2024) Level I: (1st Jan to 30th June – Immediate Next Year) : CA Members not completing CPE by 31st Dec are given an extended ...

Chartered Accountants

ICAI Caps Tax Audits at 60 Per Partner Annually from FY 2026–27

RJA 19 Jun, 2025

ICAI to Cap Tax Audits at 60 Per Partner Annually from FY 2026-27 In a landmark move aimed at improving audit quality, reducing audit concentration, and promoting equitable work distribution, the ICAI has imposed a hard cap of 60 tax audits per partner per year, effective from FY 2026–27. Effective FY 2026-27, ...

Chartered Accountants

CA Members' Completion ICAI compliance of CPE hours Year ended 2024

RJA 04 Jun, 2025

Mandatory Compliance of CPE Hours for the Calendar Year 2024—ICAI Circular Key Highlights. The last date to complete and claim CPE hours (structured/unstructured) for the calendar year 2024 is 31st December 2024. Non-compliance will trigger consequential provisions starting 1st January 2025, including public display of default status, disclosure in MEF, ...

Chartered Accountants

How to Online Download ICAI firm Constitution Certificate?

RJA 19 Mar, 2025

Online Steps to Download ICAI Firm Constitution Certificate from ICAI SSP Portal It looks like you're referring to an older process for downloading the ICAI Firm Constitution Certificate. ICAI has now shifted most of its services to the Self Service Portal (SSP) for members' convenience. Updated Process to Download ...

Chartered Accountants

ICAI Announces May 2025 Exam Dates & Centers schedule:

RJA 17 Jan, 2025

ICAI Announces Exam Dates & Centers for CA Foundation, Intermediate & Finals The Institute of Chartered Accountants of India has officially announced the schedule for the May 2025 Chartered Accountants examinations. The schedule covers the CA Foundation, CA Intermediate, and CA Final courses, as well as the CA Post Qualification Course ...

Chartered Accountants

Overview on Peer Review Reporting including AQMM Reporting

RJA 17 Sep, 2024

Overview on Peer Review Reporting including AQMM Reporting Peer Review is a critical part of ensuring audit quality and adherence to professional standards in the audit profession. In India, the Institute of Chartered Accountants of India (ICAI) oversees peer reviews to assess the quality of services ...

Chartered Accountants

Audit Partner Rotation for Engagements Exceeding 7 Years with Same Client

RJA 17 Sep, 2024

Explanation of SQC-1 on Audit Partner Rotation for Engagements Exceeding 7 Years with the Same Client The Standard on Quality Control (SQC) 1, issued by the Institute of Chartered Accountants of India (ICAI), outlines a robust framework for ensuring audit quality and independence. One of its key provisions is the rotation of ...

Chartered Accountants

Role of the Engagement Quality Control Reviewer

RJA 17 Sep, 2024

Role of the Engagement Quality Control Reviewer The Role of the Engagement Quality Control Reviewer (EQCR) is critical in ensuring audit quality and compliance with standards. Appointing an EQCR is a mandatory requirement for firms conducting Statutory Audits under the Standard on Quality Control (SQC) 1, SA 220 (Quality Control for an ...

Chartered Accountants

Documentation for Peer Review- Audit work For CA in Practices.

RJA 04 Jul, 2024

Documentation for Peer Review- Audit work For CA in Practices. Peer review is a process where the audit work and practices of a Chartered Accountant (CA) or a CA firm are reviewed by another CA or CA firm to ensure adherence to professional standards and regulatory requirements. Proper documentation is ...

Chartered Accountants

Myths about Chartered Accountants Examination Preparation

RJA 16 Jun, 2024

Myths about Chartered Accountants Examination Preparation Part I : Keeping Impossible Targets A common mistake is assuming you can watch 7-10 classes per week, which is unrealistic due to other commitments like extra work, office celebrations, or family dinners. Setting a more realistic target, like 5 classes per week, helps manage ...

Chartered Accountants

ICAI Council: Restricting revocation of UDINs within 48 hours

RJA 25 Jun, 2023

ICAI: Restricting revocation of UDINs within 48 hours ICAI Important New Announcement on Restricting revocation of Unique Document Identification Number (UDINs) within 48 hours– The Institute of Chartered Accountants of India -Council, in its 420th meeting held on 23rd-24th March, 2023, decided that revocation of Unique Document Identification Number (UDINs) would ...

Chartered Accountants

Applicability of laws of the PMLA on CA's, CS’s & CWAs

RJA 11 May, 2023

One Significant Development - PMLA will now apply to CAs CSs, & CWAs The laws of the PMLA will now apply to CAs, CSs, and CWAs, forcing them to comply with several obligations such as keeping financial transaction records, identifying and authenticating clients, and reporting suspicious transactions to ...

Chartered Accountants

ICAI : CA can be Director Simpliciter or Professional Director

RJA 21 Mar, 2023

ICAI Decision: CA can be Director Simpliciter/Professional Director According to a recent ruling by the Institute of Chartered Accountants of India (ICAI) Board of Discipline, a Chartered Accountant in practise is not guilty of professional misconduct if they serve as a Director Simpliciter or Professional Director. A Member of ...

Chartered Accountants

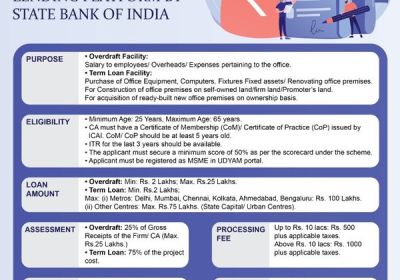

Beneficiary Schemes for the Chartered Accountants : ICAI

RJA 13 Mar, 2023

Beneficiary Schemes for the Chartered Accountants Members of ICAI: The chartered accountancy profession is regulated in India by the Institute of Chartered Accountants of India (ICAI), which also establishes accounting standards and provides professional development courses. he Institute of Chartered Accountants of India have come up with new mediclaim ...

Chartered Accountants

Implications on statutory Auditor if mistake in Schedule III Format

RJA 25 Sep, 2022

What are the implications for statutory auditors in case a mistake happens Schedule III Format? No reporting or qualification in his statutory Audit Reporting with respect to mistakes or omissions in the audited financial statements vis-à-vis format specified by Schedule III of Companies Act, 2013 is being taken as ...

Chartered Accountants

ICAI issue Notice to CA Firms on violate Company Law Via Chinese Co.

RJA 11 Aug, 2022

ICAI issue Notice to CA Firms on violate Company Law Via Indian subsidiaries Chinese Co. About 200 CA firms have received Disciplinary Notices from the ICAI for allegedly engaging in or assisting Chinese firms that were violating the law through Indian subsidiaries and shell entities. Considering the extensive alleged/complained by ...

Chartered Accountants

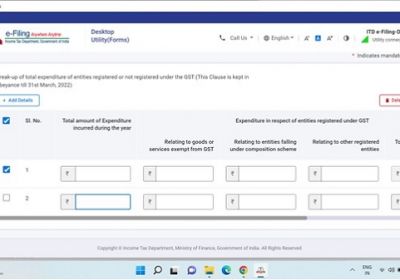

Required to fill Clause 44 of Form 3CD under Tax audit

RJA 11 Aug, 2022

Needed to fill Clause 44 of Form 3CD under Tax audit If you are subjected to an Income Tax audit provision, you must shall adhere by Clause 44 of Form 3CD. Tax Auditor Reporting under the Tax Audit Report clause No 44 under the Form 3CD of Tax Audit Report Under Income ...

Chartered Accountants

Chartered to keep our Business Guide and Protector role

RJA 01 Jul, 2022

What is Chartered accountants? An internationally recognised financial expert who manages client budgets, audits, taxes, and business plans is a chartered accountant. You can work for organisations, the government, and people as a CA. Your role is to assist clients with money management and offer knowledgeable financial advise. A person ...