Table of Contents

Payment of TDS via using Form 26QB on sale of property transaction

The following are some essential key points about Form 26QB:

1. Objective of Form 26QB : It assures that income tax is withheld at the moment of the property transaction and is specifically designed for Tax Deducted at Source on the sale of property.

2. Applicability of Form 26QB: It is required for both the seller and the buyer to adhere to Income Tax Form 26QB. The seller can examine the information online once the buyer completes the form and deducts Tax Deducted at Source.

3. TimeLine Date for TDS Payment: After the completion of the month in which Tax Deducted at Source is deducted, the money must be deposited within 30 days. For instance, Tax Deducted at Source should be deposited by the end of April if it is withheld in March.

4. Permanent account number Details: It is crucial to supply precise Permanent account number information for both the vendor and the customer. Accurate Permanent Account Number data guarantee the seller proper credit and make it easier for the tax authorities to track Tax Deducted at Source.

5. Online Submission: The official website for Tax Deducted at Source-related procedures is TRACES (Tax Deducted at Source Reconciliation Analysis and Correction Enabling System), where Income Tax Form 26QB is submitted online.

6. TDS Challan Generation: Purchaser required to generate a TDS challan online for the Tax Deducted at Source payment. The TDS challan includes details such as Permanent account number, amount, address etc.

7. Tax Deducted at Source Certificate (Income Tax Form 16B): After successful submission of Income Tax Form 26QB and payment of Tax Deducted at Source, the buyer should download the Tax Deducted at Source certificate in Income Tax Form 16B from the TRACES (Tax Deducted at Source Reconciliation Analysis and Correction Enabling System) website. This Tax Deducted at Source certificate is then provided to Property seller.

Ensuring accurate and prompt adherence to Income Tax Form 26QB is vital in order to evade any penalties or complications associated with Tax Deducted at Source for property transactions. For specific question related to TDS challan details, it's recommended to speak with a tax expert or tax professional.

How to Generate Challan Form User Manual

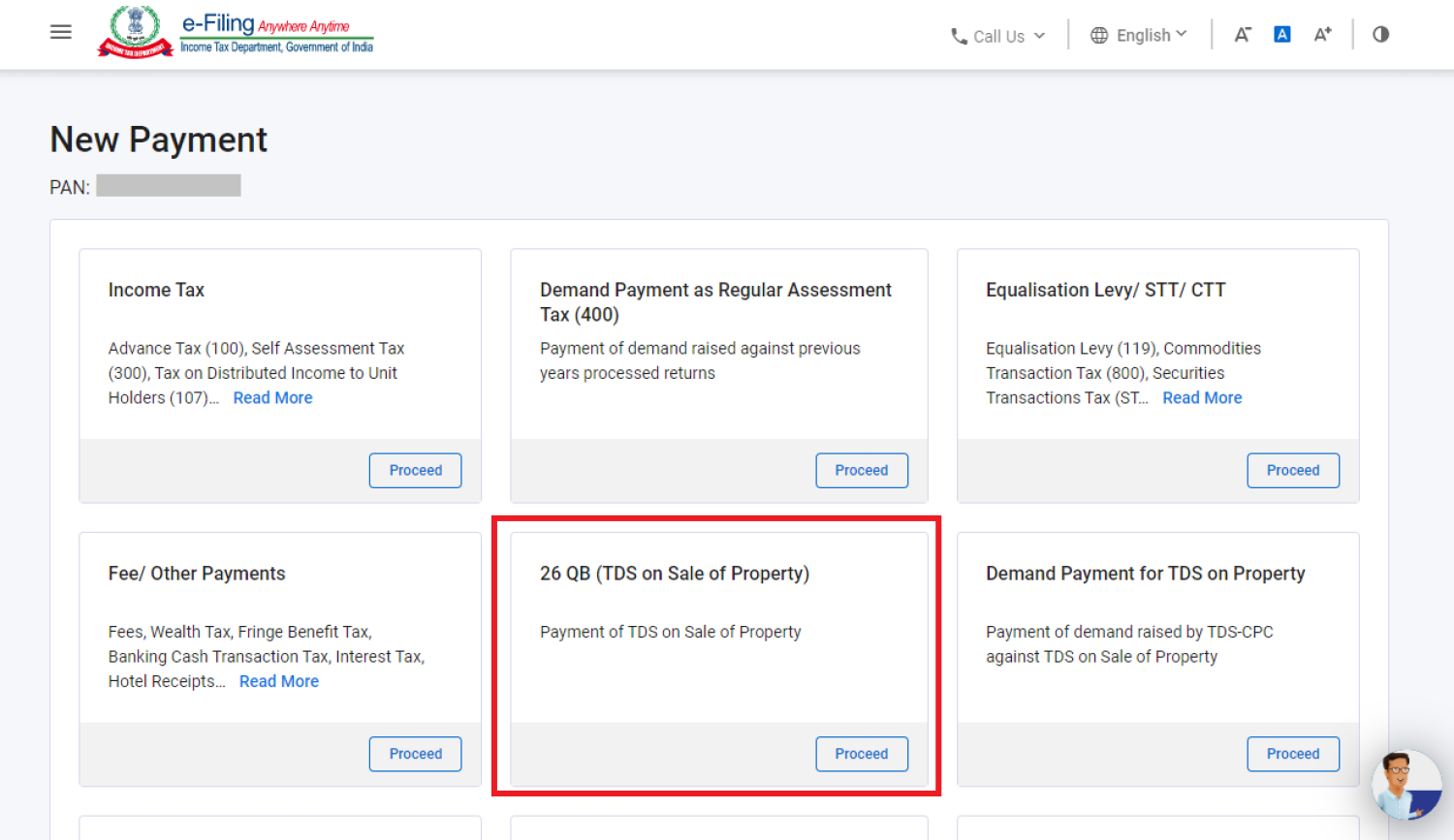

Here's a step-by-step guide on how to make TDS payment using Form 26QB for the sale of property:

-

Go to the TIN NSDL website: Visit the official website of the Tax Information Network (TIN) managed by the National Securities Depository Limited (NSDL) at https://www.tin-nsdl.com/.

-

Navigate to Form 26QB: Look for the option to fill Form 26QB. It's usually available under the "TDS on Sale of Property" section.

-

Fill out the form: Enter all the required details accurately. This includes details such as Buyer/Seller's name, PAN, property details, sale consideration, etc.

-

Calculate TDS: The TDS amount will be calculated automatically based on the sale consideration mentioned in the form. Ensure that the correct TDS amount is calculated as per the prevailing tax rates.

-

Select the mode of payment: Choose the mode of payment through which you want to make the TDS payment. You can pay via net banking or directly at authorized bank branches.

-

Generate and Download Form 26QB: After filling out the form and verifying the details, generate and download Form 26QB.

-

Make the payment: Use the Challan 26QB to make the TDS payment. If you choose to pay online, you'll be redirected to the bank's payment gateway. Follow the instructions provided by your bank to complete the payment.

-

Receive the acknowledgment: After successful payment, you'll receive a Challan Identification Number (CIN) or Transaction ID as acknowledgment.

-

Submit Form 26QB: After making the payment, you need to submit Form 26QB along with the required documents to the relevant authority within the specified time frame.

-

Generate and issue Form 16B: Within 15 days from the due date of filing Form 26QB, the buyer should download Form 16B from the TRACES website and issue it to the seller as proof of TDS payment.