FEMA

Legitimate Foreign Currency while Person Travelling Foreign

RJA 14 May, 2022

What is legitimate Foreign Currency while person travelling foreign. Manny countries have slowly & steadily opened their doors to foreign tourists after a long period of closure. The last two years have been particular worst for domestic and international travel, whether for education or business. But now that restriction is ...

FEMA

Complete Coverage about FEMA Returns with RBI Forms

RJA 07 Oct, 2021

FEMA Returns with RBI, Forms for Foreign Company, Forms for Import Export Business FEMA Returns with RBI Forms for Foreign Company S. No. Particulars of Form Purpose of Form Periodicity Letter of Comfort Format for Letter of Comfort for LO/BO Before establishing LO/BO Report to ...

FEMA

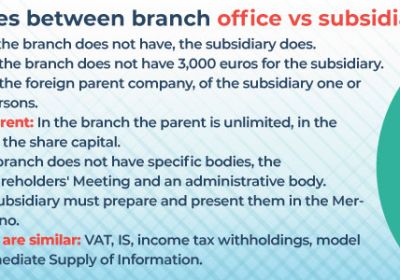

COMPARISON BETWEEN BRANCH OFFICE & COMPANY

RJA 26 Sep, 2021

COMPARISON BETWEEN BRANCH OFFICE & COMPANY Branch Office: It implies an institution founded by parent company to perform the similar business operations at different locations. one in every of the common strategies of the businesses to expand their business at the national ...

FEMA

Compounding of Contraventions under FEMA

RJA 10 Jul, 2021

What does it mean to FEMA compound? In some nations, it's also known as the Composition of Offense. Compounding an offence is a method of settling a case in which the offender is given the option of paying money instead of facing prosecution, so avoiding a lengthy legal battle. &...

FEMA

RBI reporting under Single Master Form

RJA 30 Jun, 2021

RBI reporting under Single Master Form BRIEF INTRODUCTION The reserve bank of India has announced the new reporting structure for FDI related transactions during which they need combined different reporting into one combined form i.e., the only Master Form (‘...

FEMA

Increasing Foreign Direct Investment Opportunities in India

RJA 17 Jan, 2021

Continuously Increasing FDI in India As the country has one of the most facilitative policies to draw overseas investors. In the midst of the Covid-19 pandemic, Commerce and Industry Minister Piyush Goyal said India is experiencing a fast and sustained recovery in economic performance measures. In the first nine ...

FEMA

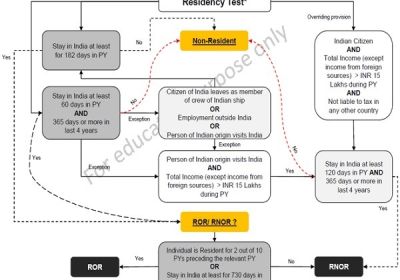

RESIDENTIAL STATUS UNDER INCOME TAX and FEMA

RJA 09 Apr, 2018

Tax incidence on an assessee depends on his residential status. For instance, whether an income, accrued to an individual outside India, is taxable in India depends upon the residential status of the individual in India. Similarly, whether an income earned by a foreign national in India (or outside India) is ...

FEMA

Reporting of Form FC-TRS to RBI,

RJA 30 Jan, 2018

RBI Circular No. 40 dated 1st February, 2016; RBI has made it mandatory to report any transactions and filing of forms online in respect of issue and transfer of shares from an Indian Entity to outside India. FORM-FC-TRS Foreign investors can invest in Indian companies by purchasing / acquiring existing shares from ...

FEMA

Reporting of Form FC-GPR to RBI

RJA 16 Jan, 2018

The Form FC-GPR comes into use whenever there is new issue of shares. The onus to submit the form or comply with the laws is on the resident entity. Any Company or Organization receiving foreign investment must report the transaction to the RBI within a stipulated timeline. Similar to the ...