GST Registration

Automated scrutiny of GST Returns set to roll out under GST law

RJA 16 May, 2023

GST Returns scrutiny via using Advanced Analytics in Indirect Taxation system Company owners will need to be extra cautious while filing GST returns because the automated GST scrutiny system is going to use advanced artificial intelligence and data analytics to check discrepancy. The new system, which is due to be ...

GST Registration

OIDAR Service Providers GST Registration in India

RJA 21 Oct, 2022

OIDAR Service Providers GST Registration: What is an OIDAR service as per GST Act? Any company or originations giving online information & database retrieval services (OIDAR services) is needed to compulsory take GST registration in India, irrespective of the threshold for aggregate turnover, online information & database retrieval services providers ...

GST Registration

key changes in new gst amendment w.e.f. 1st Jan 2022

RJA 01 Oct, 2021

Important Change in Compliances for New GST Registrants From 1st Jan 2022 From 1st January your GSTR-1 filing could be blocked As per CBIC's newest advisory, GSTR-1 filing will be blocked as of January 1, 2022, if a monthly GSTR-3B return filer has not submitted GSTR-3B for the previous month. ...

GST Registration

Complete Overview of GST Registration

RJA 25 Apr, 2021

PERSON LIABLE FOR GST REGISTRATION OR NOT Provisions on persons responsible for registering for GST are provided for. Under Section 22 & Section 24 the Central Goods and Service Tax Act (CGST) 2017, are provide and made the provision for GST registration explained by this article. Personal persons registered under Pre-GST law ...

GST Registration

GSTN notify SOPs for verification of Taxpayers who have granted Deemed Registration

RJA 29 Nov, 2020

GSTN notify SOPs for verification of Taxpayers who have granted Deemed Registration A Standard Operating Procedure (SOP) has been introduced by the CBIC for the verification of taxpayers deemed to be registered. As of August 21, 2020, rule 9 of the 2017 CGST Rules provides that in cases where the applicant has either not ...

GST Registration

Is GST registration necessary for a charitable-based pharmacy store operated by NGO?

RJA 22 Jun, 2020

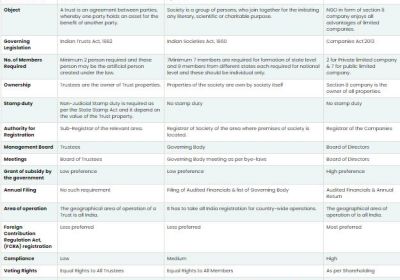

Conditions for exempting a charitable trust from GST A charitable trust or non-profit organisation must satisfy specific criteria to be exempt from the Goods and Services Tax. The charitable trust or NGO must be registered under Section 12AA of the income tax Tax and the services it ...

GST Registration

REQUIREMENT OF GST REGISTRATION

RJA 04 Sep, 2018

Registration is required in case of liability under RCM, even if no taxable supplies are effected In the case of the Joint Plant Committee [2018], the Authority of Advance Ruling held that if Assessee is engaged in providing exempt goods or services only then they not liable to apply for registration ...

GST Registration

How to do GST registration for the branches and business verticals?

RJA 28 Aug, 2018

According to the CGST Act, registration is important for suppliers of the taxable goods and services under the GST in the union territory, from the payable supply of the services and goods, is created. In addition, provisions have been given in the GST Registration Rules for getting GST registration ...

GST Registration

Cancellation and revocation of Registration under GST

RJA 03 Aug, 2018

Cancellation and revocation of Registration under GST You want to cancel your GST (Goods and Services Tax) registration because GST does not apply to you or because you are closing your business or profession. Or there is some other valid reason due to which you want to cancel your GST ...

GST Registration

How GST registration works for service providers

RJA 10 Jan, 2018

Registration of GST has been made easier for service providers by implementing modified rules in the 23rd GST Council Meeting. Turn Over limit remains the same for service providers as well Service providers to register for GST must have a turnover of Rs.20 lakhs or more per annum in all ...

GST Registration

REGISTRATION OF GST MADE EASIER FOR SERVICE PROVIDERS

RJA 01 Jan, 2018

GST Registration for Service Providers Registration of GST has been made easier for service providers by implementing modified rules in the 23rd GST Council Meeting. Turn Over limit remains the same for service providers as well Service providers to register for GST must have a turnover of Rs.20 lakhs ...