Table of Contents

Mode of operation in financial fraud & tax avoidance made by contractor

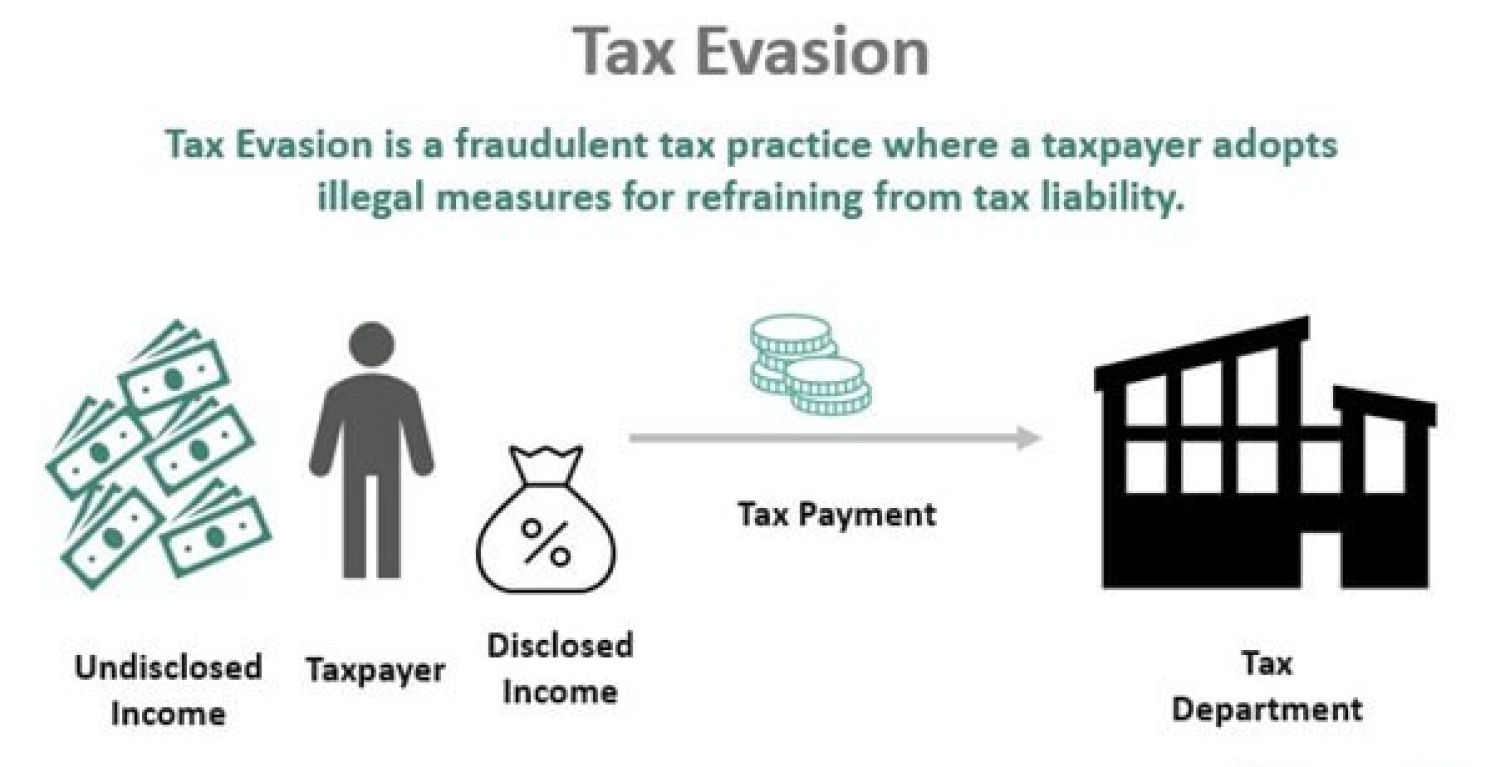

The basic method of operation outlined points to a typical scheme for financial fraud and tax avoidance. To decrease their tax liability and produce unaccounted cash and hidden assets, contractors engaging in such activities overstate their expenses and engage in a number of fraudulent practises. The main ideas are breakdown of the key points as follows:

- Non-Genuine Claims: Contractors could inflate costs they didn't actually incur. This can involve making claims for deductions for costs they didn't really incur while conducting their business.

- Creation of Undisclosed Assets: Contractors could purchase investments or properties that aren't disclosed to tax authorities using the unexplained cash. As a result, a concealed, parallel financial portfolio is created.

- Bogus Purchases: It's possible for contractors to generate bogus invoices for purchases that didn't happen. These fictitious purchases are made to increase expenses even more and lower their taxable income.

- Sub-contractor Fraud: Certain vendors could work together with subcontractors to fabricate transactions and submit fraudulent expense claims. This may entail working together to fool the tax authorities.

- Ineligible Expenses: Contractors may deduct costs that aren't actually allowed by tax regulations. Another approach to lessen their tax obligation is by doing this.

- Inflating Expenses: In order to lower their taxable revenue, contractors overestimate their business expenses. This could entail inflating the price of supplies, labour, or other business-related charges.

- Unaccounted Cash: Their financial practises are irregular, and as a result, "black" or unreported money is created that is not disclosed to tax authorities. You can use this unexplained money for secret objectives.

One essential component of ensuring tax compliance and preserving the integrity of the tax system is the Income Tax department's identification of such inconsistencies and tax evasion practices. This encourages tax compliance and discourages fraud by ensuring that people and corporations pay their fair share of taxes.