Selling House within 5 years of taking possession will Reverse Tax advantage on Home Loan

- As per Sec 80C of income tax act 1961, In case we sell house within 5 years from the end of the FY in which property possession was taken, all the income tax advantage availed U/s 80C of Income tax Act 1961, in respect of repayment of the home loan will be needed to be reversed & it is required to be treated as taxable income for the FY in which Property was sale off.

- It is to be keep in our mind that We have not observed any such kind of provisions of reversal of the income tax advantage availed with respect of interest u/s 24(b) of Income tax Act 1961. Consequently, all income tax benefits that you have claimed earlier in relation to repayment of principal amount will be considered part of your income for the current year if you sell the residential property in March 2023.

- In order to prevent the effects of the reversal of the tax benefits you previously received, I would recommend that you make sure that you complete the full 5 FY's starting from the end of the year in which possession was taken.

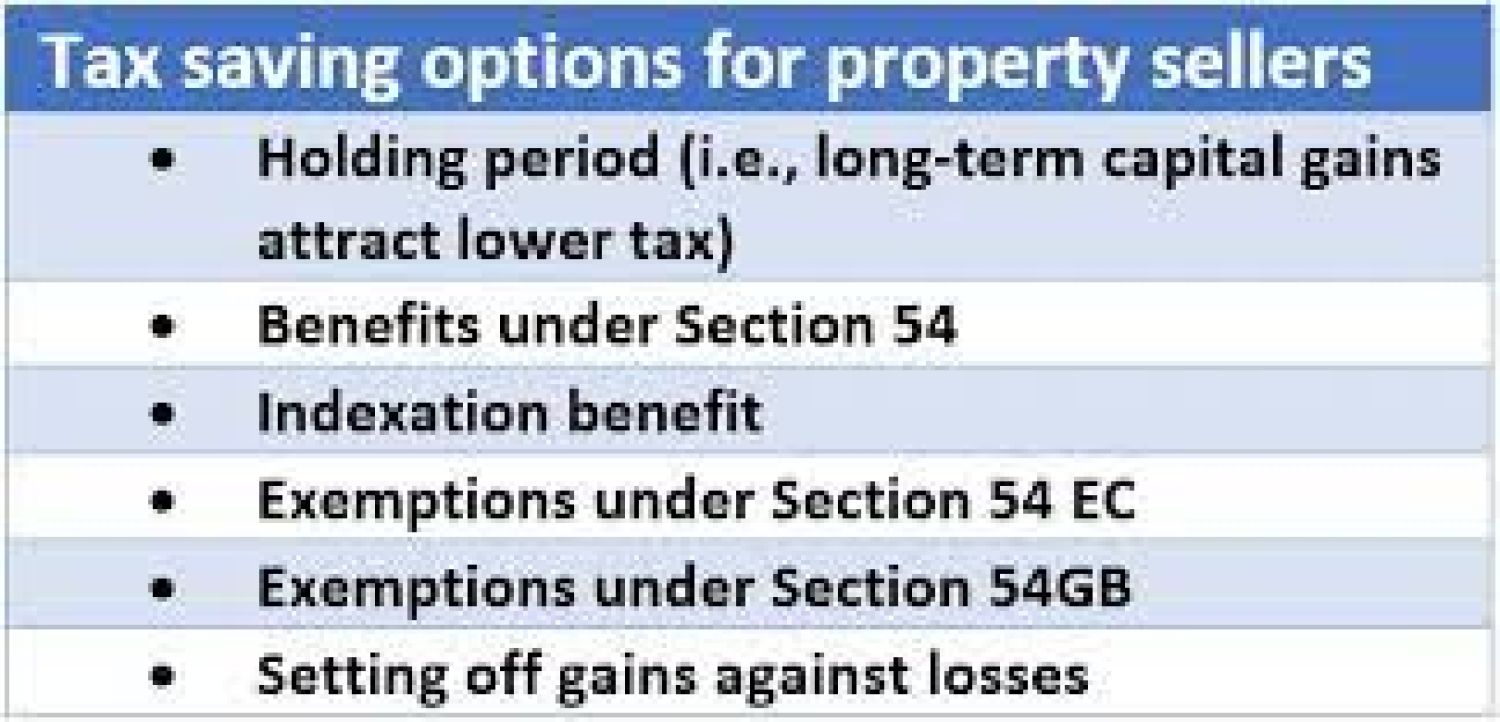

- Since you've owned the home longer than 24 months, any profits you make from selling it will be considered long-term capital gains (LTCG), and you might be required to pay taxes on the difference between the home's indexed cost and its sale price. Please note that There is no effect on your tax liability if you prepay your home loan; however, you may be able to claim same u/s 80C up to INR 150,000/- along with other eligible items.

- What you are doing is the application of income earned by you & not expenditure incurred to earn this taxable income. There are no tax advantage available for such an application of income. It should be Noted that as gift to your family members. If family members are among specified relatives as defined u/s 56(2), there will not be any income tax implication for them, otherwise, amount will be treated as their income, if total of all gifts received by them individually more than INR 50k in a year.