Table of Contents

FAQS ON PRESUMPTIVE TAXATION IN INDIA

Q.: What does a presumptive taxation scheme mean?

Presumptive taxation scheme related to providing relief to small taxpayers. Any small taxpayer whose turnover is less than Rs 2 crores shall be eligible for such a scheme. To facilitate the running of businesses without any burden due to excessive compliance-related requirements, Section 44AD was introduced in the Income Tax Act. Under this section, the assesses can declare their income at the prescribed rate and be relieved from the requirement of maintaining books of account.

This relaxation would also involve non-requirement of getting the accounts auditing, thus saving their cost and time. Businesses that enrol for taxation under the presumptive taxation scheme shall compute their income on an estimated basis, as provided under Section 44AD.

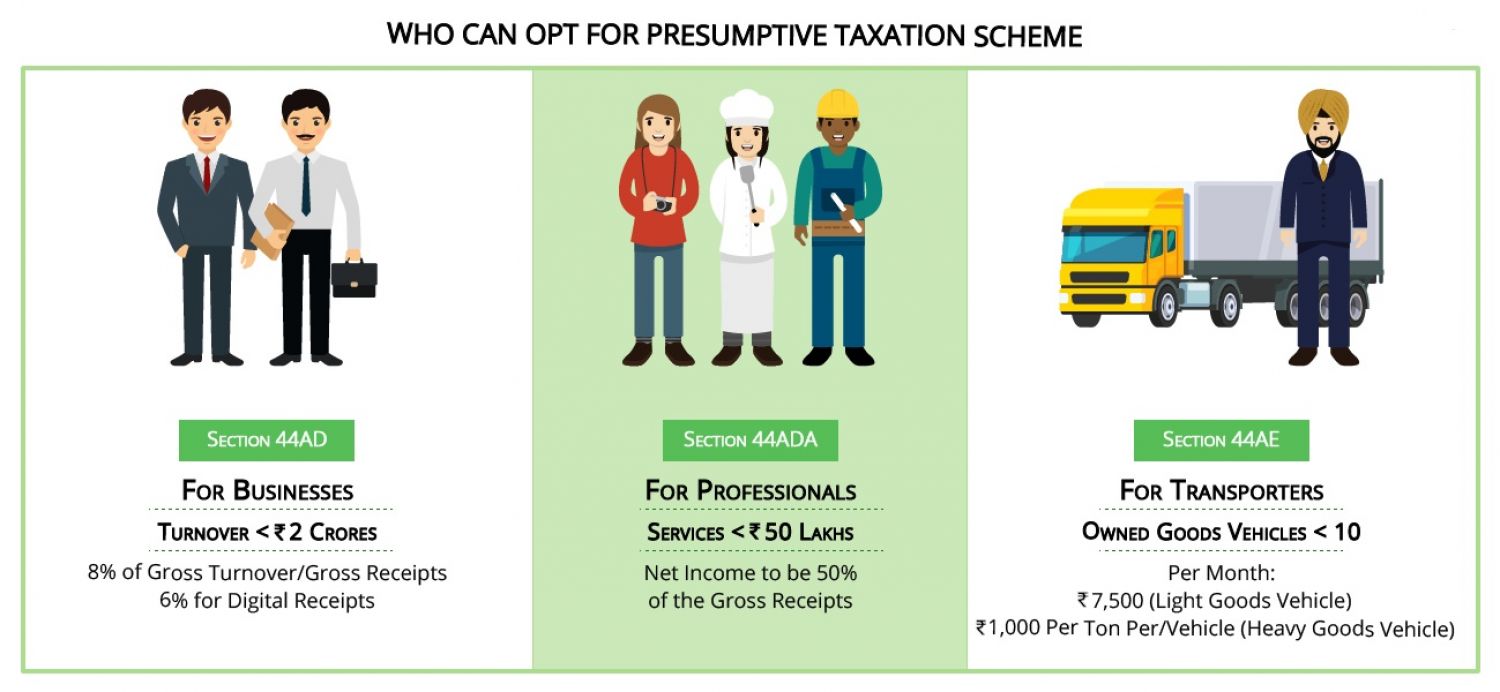

The small taxpayers can avail of the following presumptive taxation scheme under the Income-tax Act –

- Section 44AD: Applicable to taxpayers including the resident individual, resident Hindu undivided family or resident partnership firm engaged in a certain business.

- Section 44ADA: Applicable on the resident person engaged in professions specified under section 44AA (1).

- Section 44AE: Applicable on taxpayers including Individual, HUF, AOP, BOI, Firm, Company, Co-operative society or any other person resident in India or not, and are engaged in the business of plying, leasing or hiring goods carriages.

- Section 44B: Taxation on shipping profits derived by a non-resident in India.

- Section 44BB: Applicable on non-resident, earning income from activities connected with the exploration of mineral oils.

- Section 44BBA: Applicable on income in relation to foreign airlines.

- Section 44BBB: Applicable on profits and gains of foreign companies engaged in the business of civil construction.

Q.: Who all are eligible to avail the benefit of the presumptive taxation scheme under section 44AD?

The following persons can apply for this scheme –

- Any resident individual in India

- Resident Hindu Undivided Families (HUFs) in India

- A partnership firm resident in India

The entities mentioned above must not have claimed deductions in income tax during the relevant assessment year under the following sections-

- 10A

- 10AA

- 10B

- 10BA

- 80HH

- 80RRB

The following persons shall not be eligible to apply for the presumptive taxation scheme under section 44AD -

- Any Limited Liability Partnership Firm (LLP) resident in India

- Any Non-Resident of India

- Any other person not included in the list of eligible persons.

Q.: Who all are not eligible for the presumptive taxation scheme under section 44AD?

The following businesses are not eligible to apply for the presumptive scheme under section 44AD –

- Business involved in renting, hiring and plying of goods carriages as specified under section 44AE

- Business working as an agency.

- Any Individual receiving commission or any income as a brokerage.

- An individual involved in any profession mentioned under section 44AA (1)

- Insurance agents receiving income in the form of commissions.

- Businesses having gross total income exceeding Rs 2 crores in a financial year.

Q.: What provisions are applicable for a person carrying profession under section 44AA (1)?

The benefit under section 44ADA shall be applicable to professions registered in India. Professionals having total gross receipts of up to Rs. 50 Lakhs in a financial year, shall be eligible to claim benefit under this Section with effect from Financial Year 2016-17. Under this scheme, the taxable income of the person shall be determined at a flat rate of 50% of the total receipts.

Q.: What does the taxable income be computed under the presumptive taxation scheme of section 44AD?

The person opting for presumptive taxation under section 44AD shall declare their income @ 8% for non-digital transactions or 6% for digital transactions on the gross receipts or turnover.

Q.: Can the person opting for the presumptive scheme under section 44AD, claim any deduction under Schedule VI of the Income Tax Act?

It is to be noted, that where a person opts for the presumptive taxation scheme under section 44AD, no amount of deduction can be claimed by such person, and the income will be computed at a flat rate of 8%/6% depending on the nature of transactions.?

Q.: What are the provisions related to the maintenance of books of accounts under section 44AD?

Where the business satisfies the eligibility criteria, they would be required to mandatorily maintain proper

- Their annual income exceeds Rs. 1,20,000.

- Their total sales, turnover or gross receipts exceeds Rs. 10,00,000.

- In any of the 3 financial years immediately preceding the current financial year.

However, in the case of individuals and HUF, the above provisions have been further relaxed and they would be required to maintain proper books of accounts where –

- Their annual income exceeds Rs 2.5 lakhs.

- Their total sales, turnover or gross receipts exceeds Rs 25 lakhs

In any of the three financial years immediately preceding the current financial year.

Q.: What are the provisions related to advance tax payment under section 44AD?

As discussed earlier, any person opting for the presumptive taxation scheme under section 44AD shall be required to pay the whole amount of advance tax by 31st March of the relevant financial year. Thus, whenever the liability to pay advance tax arises, they can pay the same, without calculating the income, and the whole of the amount be paid before March 31, instead of making payments quarterly.

Q.: What is the provisions related to opt-in and out in relation to the scheme under section 44AD?

It is provided that the person eligible to claim the benefit under Section 44AD, shall avail the same at any time during the relevant financial year. And also, such a person can opt-out of the scheme at any point in time.

However, where a person opts out from the scheme of Presumptive Taxation under Section 44AD, the same shall not be eligible to avail of the scheme for the next 5 financial years.

|

PARTICULARS |

PRESUMPTIVE TAXATION UNDER SECTION 44AD |

|

AY 2019-20 |

OPTS FOR PRESUMPTIVE TAXATION |

|

AY 2020-21 |

DOES NOT OPT FOR PRESUMPTIVE TAXATION |

|

AY 2021-22 - AY 2025-26 |

INELIGIBLE FOR PRESUMPTIVE TAXATION |

Q.: Who all persons are eligible to avail presumptive taxation scheme under section 44ADA?

The benefit under this scheme shall be applicable to professions registered in India. Professionals having total gross receipts of up to Rs. 50 Lakhs in a financial year, shall be eligible to claim benefit under this Section with effect from Financial Year 2016-17.

Under this scheme, the taxable income of the person shall be determined at a flat rate of 50% of the total receipts.

The following professions are eligible to avail the benefit of presumptive taxation under section 44ADA –

- Legal services

- Medical services

- Engineering services

- Architectural services

- Profession related to Accountancy

- Technical Consultancy Services

- Interior Decoration services

The scheme includes only resident Individual, HUF and Partnership firms only and excludes Limited Liability Partnership firm. The person opting under this scheme shall be allowed to claim deductions under Section 30 to 38. However, no other deduction related to expenses shall be allowed.

Q.: What all deductions can be claimed by the person opting for presumptive taxation under section 44ADA?

The person opting for presumptive taxation under section 44ADA, shall not be allowed to claim any deduction. Since a flat rate of 50% is charged on the gross receipts, it is concluded that the 50% be deemed to be the number of expenses. However, the assessee shall be eligible to claim certain deductions under chapter VI-A

Q.: What are the provisions related to the maintenance of books of account under section 44ADA?

- PROFESSIONALS CARRYING SPECIFIED PROFESSIONS

Professionals carrying the above-mentioned professions would be required to maintain books of accounts in accordance with Rule 6F, provided they are having annual gross receipts of more than Rs. 1.5lakhs in any of the 3 financial years immediately preceding the current financial year.

NECESSARY ACCOUNTS UNDER RULE 6F

- Cash Book – Book containing all the records of cash receipts and payments.

- Journal – It is an account maintained as a log of day-to-day transactions.

- Ledger – Book where all your entries from the journal, are transferred to separate accounts containing the details of all the accounts.

- Proper maintenance of photocopies of the bills or receipts of value exceeding Rs. 25

- Proper maintenance of original bills or receipts of value exceeding Rs. 50

- Daily case registers to provide details of patients, fees received, services provided and date of receipt in case of medical services.

- Book stating the stock details of the medicines and other consumable items.

B.PROFESSIONALS CARRYING NON-SPECIFIED PROFESSIONS

Where the person carries the profession other than those discussed above, the same would be required to maintain proper books of accounts, provided the total annual income exceeds Rs. 2.5 lakhs or annual gross receipts exceeds Rs. 25 lakhs in any one of the immediately preceding 3 financial years.

Q.: What is the provisions related to opt-in and out in relation to the scheme under section 44ADA?

There is no restriction on undertaking opt-in and out from the scheme under section 44ADA. ????????

Q.: What businesses are covered under section 44AE?

Such a scheme can be availed by any person engaged in the business of plying, hiring or leasing of goods carriages and the said business shall not involve vehicles exceeding 10 goods vehicles at any point of time during the financial year.

Q.: How is the income under section 44AE determined?

In order to compute tax under this section 44AE, the following provisions are followed -

- Where the vehicle involves a heavy goods vehicle (having a gross weight exceeding 12000kg), income in respect of such truck shall be Rs. 1,000 per ton of gross weight of the vehicle, for every month or part of the month of usage.

- Where the vehicle is a lightweight goods vehicle, the income in respect of such truck shall be Rs 7,500 for every month or part of a month of usage.

Income computed using the above provisions, shall not be subject to any reduction due to the claim of any deduction. However, in case the taxpayer is a partnership firm, they can avail the deduction on account of remuneration and interest paid to partners.?

Q.: Will the provisions of section 44AA regarding maintenance of books of accounts, be applied to persons opting for the scheme under section 44AE?

It is to be noted that? Section 44AA ?provides for maintenance of books of account by a person engaged in business/profession. However, where a person opts for the presumptive taxation scheme under section 44AE, the provisions of Section 44AA will not apply.

Q.: What are the provisions in respect of advance tax payment to be made by a person opting for the presumptive taxation scheme under section 44AE?

It is provided that no concession has been granted in respect of advance tax payment by a person opting for the presumptive taxation scheme under s? section 44AE.

Q.: What is the due date for filing an annual return by an individual carrying any business or profession?

An individual carrying on a business or profession shall file their ITR on or before 31st July of the relevant assessment year. However, where the company is subject to a tax audit, the due date of ITR filing would be on or before 30th September of the relevant assessment year.

Q.: When does the liability to undertake tax audit arises?

A person carrying on a businessman would be required to undertake a tax audit, where their total turnover exceeds Rs 1 crore. However, in the case of a person carrying a profession, the said limit is reduced to Rs 25 lakhs.

Q.: Can a person opt-out from a presumptive taxation scheme?

It is provided that a person can opt-in and out from the presumptive taxation scheme at any point of time, however, in case the said scheme is availed under section 44AD, the person opting out, shall not be eligible to opt-in for the said scheme within the next 5 financial years.