Table of Contents

- Online Itr Filing Amendment – Fy 2022-23 (ay 2023-24)

- What Is The Income Tax?

- Online Itr Submitting Due Dates For Ay 2023-24

- Advance Taxes Payment Timeline For Fy 2022-23

- Timeline Of Itr For Assessment Year 2023-24 (non-audit Cases)

- Submitting Itr Timeline Date For Assessment Year 2023-24 (audit Cases)

- Timeline Dates For Tax Audit Report (3cb-3cd/3ca-3cd)

- What Is Last Due Date Of Itr For Ay 2023-24

- Belated & Revised Itr Timeline Dates For Assessment Year 2023-24

- Submitting Income Tax Returns For Ay 2023-24 before 31st March With Rs. 5k Penalty

- Do You Want To Save Your Taxes And Save Money?

Online ITR Filing Amendment – FY 2022-23 (AY 2023-24)

What is the Income Tax?

· There are two Kind of tax levy one is a an indirect tax & second is direct tax. Income tax is a kind of direct tax that is mainly directly attributable to the income of the assessee.

- Income which is issue from the different head of income like Business, House Property, .Salary, Capital Gain & Income from other sources. The tax Taxpayer has to pay Income tax if his total Income after allowing deduction under Chapter VI-A,.

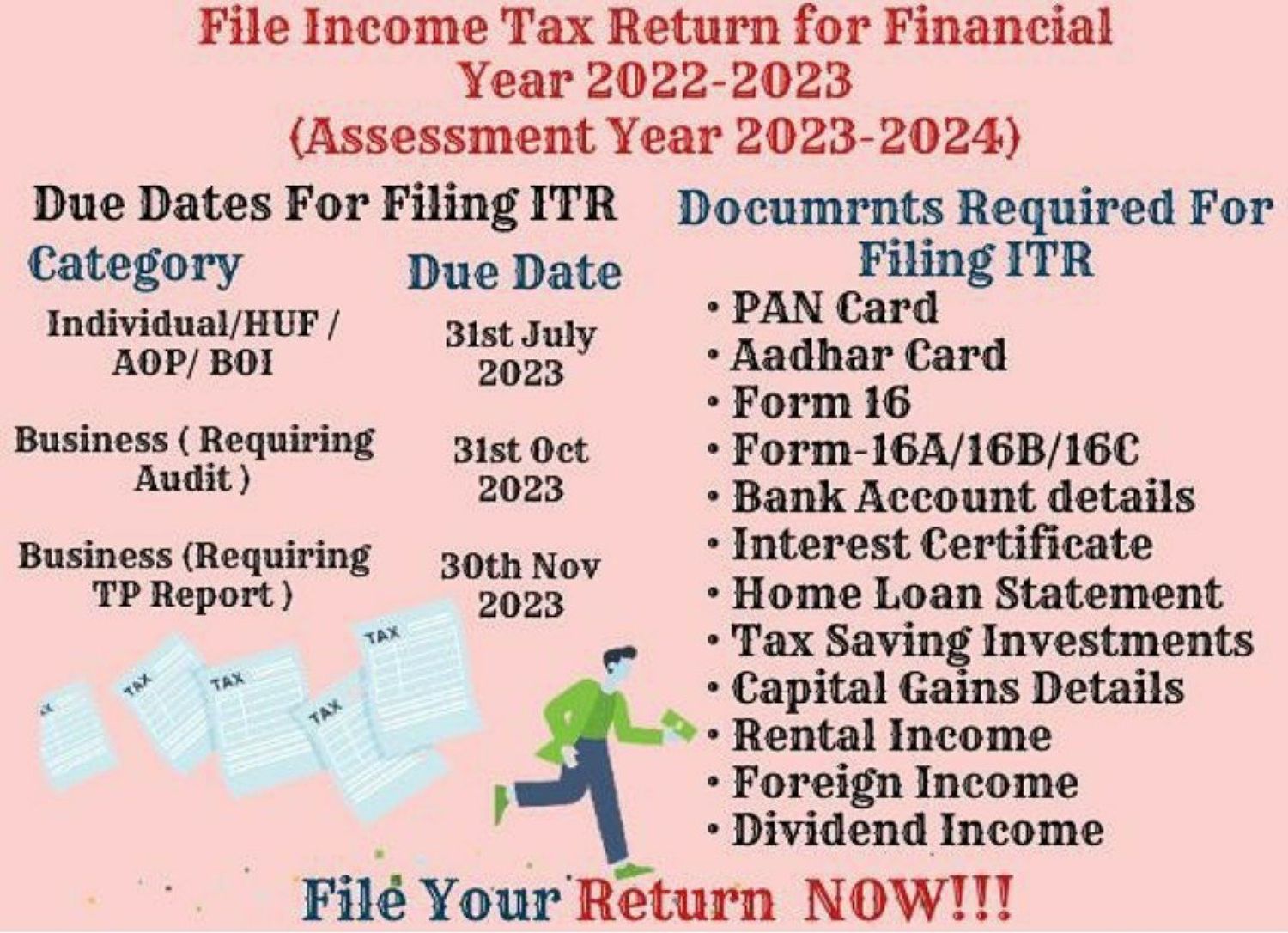

Online ITR submitting Due Dates for AY 2023-24

Advance Taxes Payment Timeline for FY 2022-23

· In case Income Tax liability is excess than INR 10k in a FY then Income Tax Advance tax required to be paid by the Income tax Taxpayer.

· 15th June (15% of Tax Liability) | 15th Sept. (45% of Tax Liability) | 15th Dec. (75% of Tax Liability ) | 15th March (100% of Tax Liability)

· The Income tax Taxpayer who is covered U/s 44ADA and 44AD (i.e. all are Presumptive Income tax Provisions) are also needed to pay Income tax advance tax on or before the 15th march of PY. But Any Income tax paid till 31st March will be treated as Advance Tax.

Timeline of ITR for Assessment Year 2023-24 (Non-Audit Cases)

- The Normally due date of submitting the ITR by Income tax Taxpayer whose Books of Account are not needed to be audited is 31st July 2023.

Submitting ITR Timeline Date for Assessment Year 2023-24 (Audit Cases)

- General Timeline date for filing the ITR for the audit cases is 31st October 2023

Timeline Dates for Tax Audit Report (3CB-3CD/3CA-3CD)

- Timeline date for filing of Income Tax Audit Report (3CB-3CD/3CA-3CD) for all Kind of Income tax Taxpayer, whose Books of accounts are needed to be audited is date 1 month prior to due date for filling of Tax return U/s 139(1)

What is last due date of ITR for AY 2023-24

(Income tax Taxpayer who are needed to file TP Report U/s 92E)

- The Timeline date of submitting the ITR by Income tax Taxpayer who are needed to file a TP Report U/s 92E is 30th Nov 2022.

- Timeline date of Filing a Transfer Pricing return/Report from an Chartered Accountants by persons entering into an specified domestic transaction or international transaction as per section 92E for the PY 2020-21, is at least 1 Month before the Timeline date of filing of Income Tax return under Section 139(1)

Belated & Revised ITR Timeline Dates for Assessment Year 2023-24

- Timeline date for submitting belated & a revised ITR for Assessment Year 2023-2024 is before 3 months prior to the end] of the relevant AY or before the completion of the assessment, whichever is earlier i.e. 31st Dec 2023

Submitting Income Tax Returns for AY 2023-24 before 31st March with Rs. 5k Penalty

CBDT Notified the Income tax taxpayers of the late filing of income tax returns for Assessment Year 2023-24, along with a penalty of Rs 5k, But if the Income taxpayer’s Gross total income does not More Than INR 5,00,000/-, then maximum Income tax penalty levied for delay will not More than INR 1k.

Do You Want to Save Your Taxes and Save Money?

- If you pay premiums for unit-linked insurance plans, you can receive tax benefits under Section 80C. (ULIPs). Long-term investments in ULIPs have significant returns that can reach 8%. Moreover, it is advisable to save more in order to buy more.

Conclusion

- This article's conclusion is now in reach. You may easily file tax returns with this guide. This process can be made simpler and more convenient by having a complete awareness of all tax-related dates.

- Similar to this, being aware of various ITR that nullify your penalties. To accomplish this, enter your information and get in touch with a trustworthy financial advisor RIGHT AWAY!