Form 15CA & 15CB Certificate

CA cannot be prosecuted for form 15cb based on client's submitted fake documents

RJA 05 Dec, 2022

ICAI member is not required to verify genuineness of supporting documents while issuing 15CB certificate High Court said on 23.11.2022 in a CA’s criminal case held that a CA in India while issuing Certificate 15CB is needed to only examine the remittance nature & Nothing more on that. CA ...

Form 15CA & 15CB Certificate

Form 15CA & 15CB Submission Process has been redesigned

RJA 07 Oct, 2021

Form 15CA & 15CB Submission Process has been redesigned The Income-tax Dept has introduced an entirely new re-engineered Form 15CA and Form 15CB submission process based on past year's feedback from numerous corporates and professionals across India. These alterations will optimise & simplify the Form's preparation, assignment, submission, ...

Form 15CA & 15CB Certificate

LIST OF PAYMENTS FOR WHICH E-FORMS 15CA AND 15CB ARE MANDATED

RJA 10 Jun, 2021

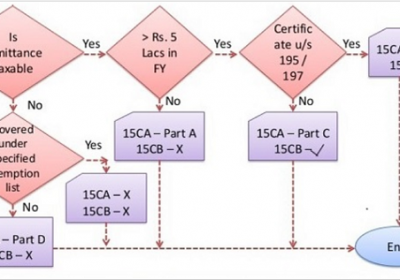

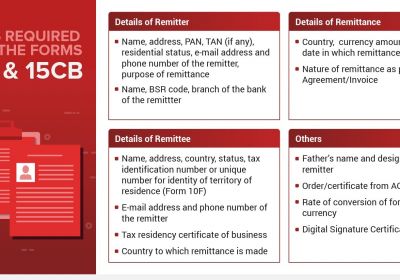

FORM 15CA & FORM 15CB FORM- 15 CA PROVISONS Amount can be remitted to any other non-resident or foreign company Such remittance be made by any resident /non-resident/ domestic company/foreign company from India. The income from which such remittance will be made, shall accrue/ arise/ received or deemed ...

Form 15CA & 15CB Certificate

An NRI’s Guidance on Forms 15CA and 15CB for International Remittances

RJA 01 Feb, 2021

An NRI’s Guidance on Forms 15CA and 15CB for International Remittances For foreign transfers or payments to non-residents, use Forms 15CA and 15CB. When a person is obligated to make a remittance to a non-resident, the remitter is legally required to withhold income tax from the payment. As ...

Form 15CA & 15CB Certificate

Applicability of Forms 15CA and 15CB for Goods Importation

RJA 01 Jan, 2021

Applicability of Forms 15CA and 15CB for Goods Importation As previously indicated, Form 15CA and Form 15CB are not necessary for payments on the exempted list; nonetheless, Form 15CA and Form 15CB were required for all types of payments. Importers who are compelled to make regular payments to non-residents may ...

Form 15CA & 15CB Certificate

Amended guidelines for submissions of Form 15CA & Form 15CB Certification

RJA 24 Jun, 2020

Amended guidelines for submissions of Form 15CA & Form 15CB Certification Paying outside India needs some adherence. This one enforcement is to apply Form 15CA and Form 15CB, if applicable. The different situations in which you need to apply these forms have been mentioned in this post. 1. Here are all ...