Table of Contents

Conditions of Condonation in filing of Income Tax Form 10-IC

1. Representations had been received by The Central Board of Direct Taxes stating that Income Tax Form No. 10-IC could not be submitted for A.Y. 2021-22 within the Timeline date or extended Timeline date, as the case may be. Taxpayers made request that delay in submitting of Income Tax Form No. 10-IC for A.Y. 2021-22 may be condoned.

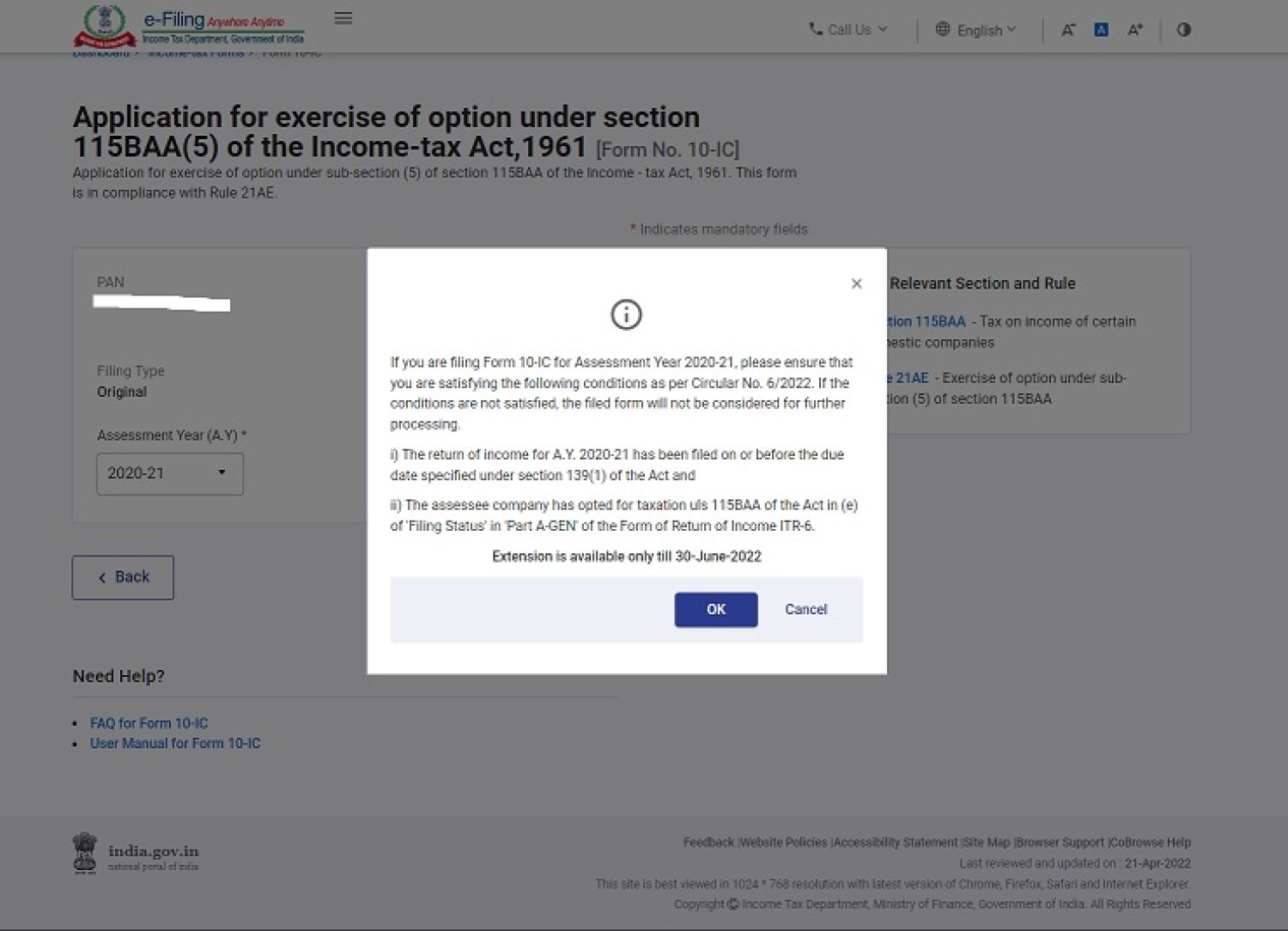

2. Income Tax Form 10-IC is needed to submit, if a Company classify as Domestic chooses the chose to pay Income Tax liability at concessional rate of 22 percentage U/s 115BAA of the Income Tax Act,1961.

3. On consideration of the above filling matter, with a view to avoid genuine hardship to the companies (domestic) in opting the option u/s 115BAA of the Income Tax Act,1961, The Central Board of Direct Taxes in exercise of the powers conferred via section 119(2)(b) of the Income Tax Act,1961, hereby directs that: -

4. Late in filing of Income Tax Form No. 10-IC as per Income Tax Rule 21AE of the Rules for previous year relevant to Assessment Year 2021-22 is condoned in cases where the below pre-requirement are fulfilled:

a. ITR for relevant AY has been submitted on or before the timeline date prescribed U/s 139(1) of the Income Tax Law.

b. Taxpayer company has opted for taxation Uls 115BAA of the Act in item (e) of "Filing Status" in "Part A-GEN" of the ITR form 6.

c. Income Tax Form No. 10-IC is submitting electronically on or before 31st Jan 20214 or Three months from end of the month in which this Central Board of Direct Taxes Circular is realised, whichever is later.

Conculsion of the post is Condonation of delay u/s 119(2)(b) via in filing of Form No. 10-IC for AY 2021-22 for details referece you may refer below circular : (The Central Board of Direct Taxes issued Circular 19/2023 download link - https://incometaxindia.gov.in/communications/circular/circular-no-19-2023.pdf )