Table of Contents

- Faq On The Filing Of An Income Tax Return

- Q.1: Would The Dept Of Income Tax Provide An E-filing Utility?

- Q.2: what's The Distinction Between E-payment And E-filing?

- Q.3: what Are The Various Forms Available Under The Income Tax Act?

- Q.4: will I Face Any Prosecution If The Tax Returns For My Taxable Income Are Not Submitted?

- Q.5: if I File The Income Tax Returns, Should I Attach Any Documents Along With Itr?

- Q.6: how To E-verify Tax Return?

- Q.7: can It Returns Be Filed Without Form 16?

- Q.8: can I Upload A Return On Income Tax After The Deadline?

- Q.10: how Do I Track The Progress Of The Itr?

- Q.11: how Can I Revise The Income Tax Return?

FAQ on the filing of an Income Tax return

Q.1: Would the Dept of Income Tax provide an e-filing utility?

- Yes, the e-filing service has been offered by the Tax Department. E-filed returns can be generated and provided by electronic means.

Q.2: What's the distinction between e-payment and e-filing?

- The process of electronically furnishing the returns is e-filing. E-payment is the payment of tax by using State Bank of India’s debit/credit card or by net banking.

Q.3: What are the various forms available under the Income Tax Act?

- The different forms available under the Income Tax Act are ITR-1, ITR-2, ITR-3, ITR-4, ITR-5, ITR-6, ITR-7, and ITR-V.

ITR Form |

Applicable to | Salary | House Property | Business Income | Capital Gains | Other Sources | Exempt Income | Lottery Income | Foreign Assets/Foreign Income | Carry Forward Loss |

| ITR 1 / Sahaj | Individual, HUF (Residents) | Yes | Yes(One House Property) | No | No | Yes | Yes (Agricultural Income less than Rs 5,000) | No | No | No |

| ITR 2 | Individual, HUF | Yes | Yes | No | Yes | Yes | Yes | Yes | Yes | Yes |

| ITR 3 | Individual or HUF, partner in a Firm | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| ITR 4 | Individual, HUF, Firm | Yes | Yes(One House Property) | Presumptive Business Income | No | Yes | Yes (Agricultural Income less than Rs 5,000) | No | No | No |

| ITR 5 | Partnership Firm/ LLP | No | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| ITR 6 | Company | No | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| ITR 7 | Trust | No | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Q.4: Will I face any prosecution if the tax returns for my taxable income are not submitted?

- Yes, if the tax is not paid, you may be subject to significant interest, penalties or prosecution. The prosecution will vary depending on the size of tax to be paid.

Q.5: If I file the income tax returns, should I attach any documents along with ITR?

- No, you do not need to submit any documents when filing income tax returns. However, the relevant documents must be retained and, if requested, must be provided to the tax authorities.

Q.6: How to E-Verify Tax Return?

- System and procedure for creating and validating tax filings through the Electronic Verification Code (EVC):

- OTP by Aadhaar Number

- Generation of EVCs

- Via Net Banking

- Email ID & Mobile No

- Pre-validation bank account No.

- Via -DE-mat Account Number

- E-verification of ITR through the EVC (If already having the same)

Q.7: Can IT Returns be filed without Form 16?

- Yes, you can file Income Tax Returns (ITR) without Form 16.

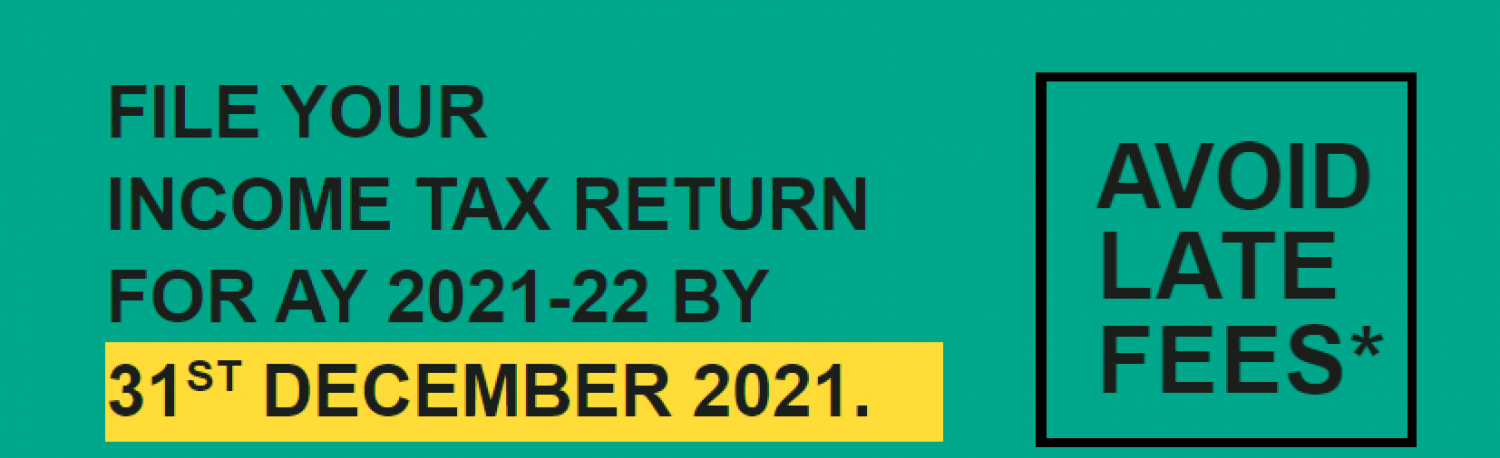

Q.8: Can I upload a return on income tax after the deadline?

- Yes, after the due date, you can file your income tax return. However, a penalty will be levied if the ITR is filed after the deadline.

Q.10: How do I track the progress of the ITR?

- The position of the ITR can be found on the official site of the Tax Department of India. The status can be checked with your PAN & Password.

Q.11: How can I revise the income tax return?

- U/s 139(5) may be revised before processing by the dept or before the end of the relevant assessment year, whichever is earlier.

- While uploading the original return, if the assessee has forgotten to disclose any income or claim any deduction or wants to change the ITR details, it can do a revision in its ITR by uploading the revised return.

- In the that case, the assessee must make changes to its original Income tax Return form and file an Income Tax return in response to notice 139(9) by inserting CPC Communication No. and Notice 139(9) (9)

- After the last assessee must log in to the ITD portal->E-File->Upload Return->In Response to Notice U/S 139(9) and upload the XML file.

Popular Blogs :

Needed to file Income Tax return of Bitcoin profit earned

Prevent popular errors while filing an income tax return

or query or help, contact: singh@carajput.com or call at 9555-555-480