Key highlights of PM Modi’s speech on Transparent Taxation: Seamless, painless, Faceless Assessment

On 13 August PM Modi will launch the platform 'Transparent Taxation – Honoring the Honest', The upcoming platform would help CBDT's reform agenda to make the tax filing process clearer and simpler, the Ministry of Finance said. The CBDT has taken a number of steps in recent years to boost transparency and introduced direct tax reforms: PMO. In the run-up to Independence Day, in a bid to honour honest taxpayers, Prime Minister Narendra Modi is preparing to launch the Transparent Taxation Honest Platform, a move that will enhance attempts to reform and streamline our taxation system. The system that will be launched today is expected to continue the journey of direct tax reforms that have been undertaken over the last six years.

Key highlights on Tax Reforms by PM Modi’s speech are as under:

- Faceless Income Tax Scrutiny – The income tax assessment is now entirely faceless. No local officer shall be engaged in the proceedings. Such a process shall be confidential to the taxpayer as well as to the tax officer.

- Now, a smooth, faceless, and tireless process.

- Faceless Income Tax Appeal

- No issue with the transfer of income tax officers

- Out of 130 Crores, only 1.5 Crores Indian pays income tax. Therefore, they should come forward to pay their taxes properly.

- In the last 6 years, about 1500 laws have been abolished by the Modi administration. In India, for ease of business.

- Incorporated the Taxpayer Charter, which set out the dedication of the Income Tax Department and the perceptions of the Taxpayers.

- The main purpose is to make every rule-of-law, policy-driven, and public-friendly. This is the use of the new governance model and the country is getting results.

- Taxpayers charter is also a major step forward on the nation's development journey.

- India is among the lowest corporate tax nations, says PM Modi.

- There is a very small percentage of the total population of taxpayers in the country. He said that.

- The goal is to make the tax system seamless, painless, and faceless.

- The statement posted on Wednesday stated that tax reforms would involve increasing accountability in official communications through the recently launched Document Identification Number (DIN) in which each departmental communication would carry a unique document identification number generated by a computer.

-

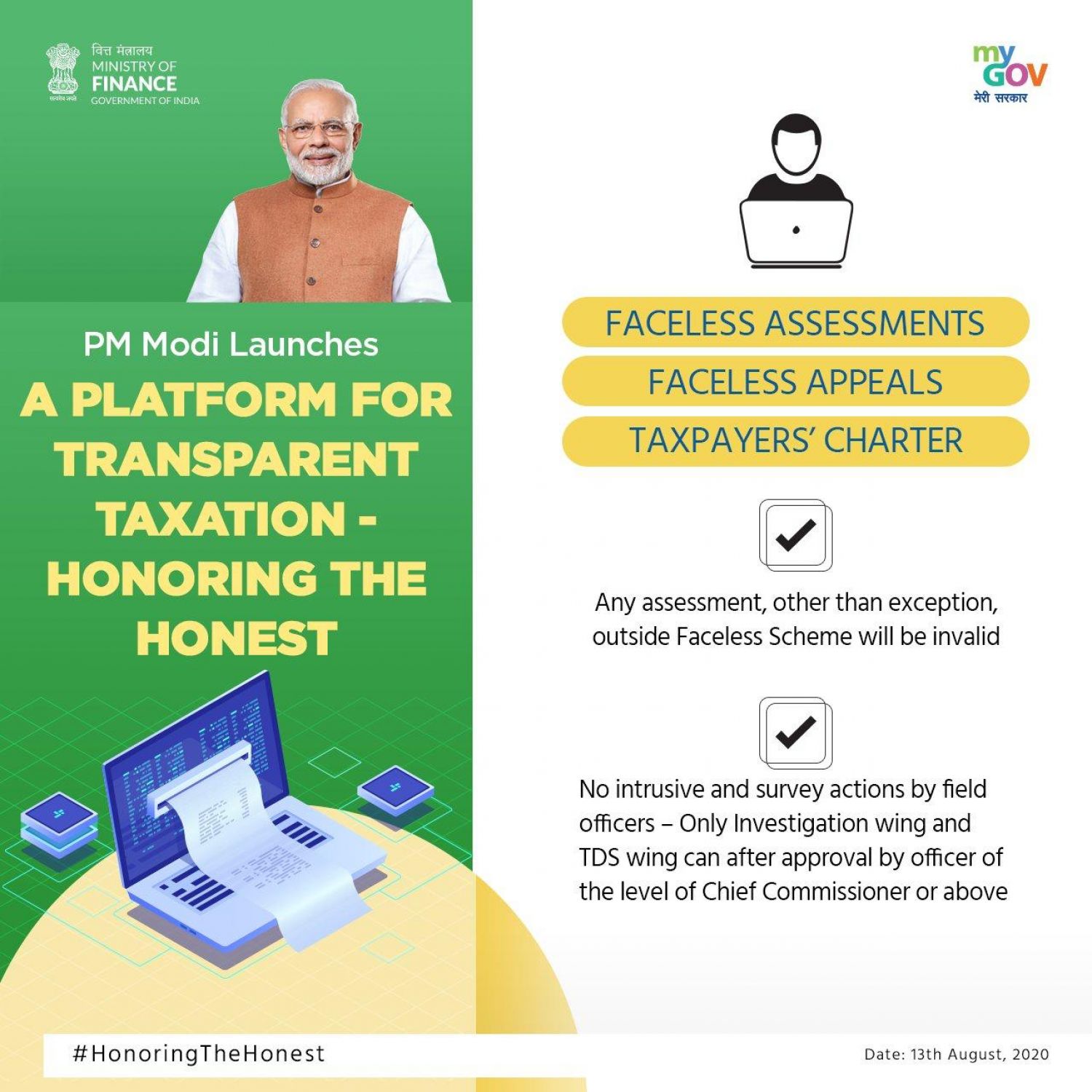

This is Regarding Exceptions to the Faceless Assessment under the Income-tax act. Exceptions to the Faceless Assessment

· Serious Fraud

· Major Tax Evasions

· Sensitive Matter

· Search Matter

· International Tax Cases

· Black Money Related Cases

· Benami Property Related Cases

The IT Department also outlined the Direct Tax "Vivid se Vishwas Act, 2020," under which declarations for settlement of disputes are currently being filed, in order to provide for the resolution of pending tax disputes. The monetary requirements for filing departmental appeals in multiple appellate courts have been increased to efficiently raising taxpayer lawsuits and litigation. Several measures were taken to promote digital transactions as well as electronic payment methods. The IT dept is determined to take measures forward and has also made efforts to ease adherence for taxpayers during the COVID period by trying to extend statutory timeliness for filing returns as well as releasing refunds promptly to increase liquidity in the hands of taxpayers.

Tax Payer Charter under the Faceless Assessment Scheme: "taxpayer charter" is a document, which outlines the rights and responsibilities of both tax officers (Department) and taxpayers.

Right of the Tax Payer (Obligation of Tax Officer)

- Treated with fairness and impartiality

- Right to be treated as honest and tax-compliant

- Right for certainty

- Right for assistance and information from the Tax Departments

- Right to pay the correct amount of tax

- Right not to be subject to retrospective taxation

- Right to minimize compliance costs

- Right to be advised and represented by any person on taxation matters

- Right to appeal

- Right to privacy and confidentiality of information

- Right to know what information Department hold

- Right to request a payment plan against due tax

- Right to complain about our service/officer

The obligation of Tax Payers (Right of Tax Officer)

- Obligation to be honest

- Co-operate while dealing with the Tax Departments

- Obligation to keep proper records in accordance with the law

- Obligation to file proper and complete tax documents and effect payments by the statutory due dates

- Obligation to Inform the Tax Departments about changes in circumstances

- Obligation to know your tax responsibilities and the consequences for non-compliance

In view of the Faceless Assessment Scheme 2020 adopted by the Department and the difficulties faced in the light of the COVID- 19 disease outbreak, the criteria for the compulsory collection of return for the Detailed Scrutiny during the financial year 2020- 21 and the performance of the assessment procedures in such cases are specified.

The Prime Minister's forthcoming announcement of the "Transparent Taxation-Honoring the Honest" initiative would begin the path of direct tax reforms

we hope, this will improve the quality of assessments, even if there would be more litigation at ITAT/HC/ SC level due to the difference of opinion of Tax Payers and the Income Tax Department.

CBDT: Income Tax Department hopes to finalize all faceless e-Assessments by mid-September.

Faceless Assessment: Step by step Procedure & Reasons for the implementation in India