GST Consulting and Training

Expertise With A Potenial To Deliver Maximum Benefits

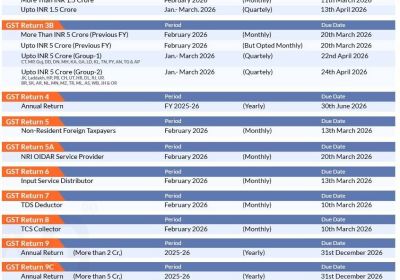

While the implementation of the GST is completed and the sailing is perfect. The GST law is evolving. There are many changes happening. A lot of notifications, circulars and press releases are happening all the time. There are many common conditions where the legislators are fine-tuning. Corporates require a lot of feedback and day-to-day guidance on GST assistance.

Importance of GST consulting

In the dynamic time when the law is shaping up, corporates and multinational companies shall need to be connected to an expert team for consulting, legal opinions and day to day consulting. The corporates may need certifications from Chartered Accountants for complex aspects like Anti Profiteering.

GST Consulting Services

APMH has been niche practitioner of Indirect tax in India with specialized team for VAT and Service Tax consulting. APMH has been studying the law since more than an year before GST came in force. The team has developed a specialization with respect to

1. Corporate GST instruction on legislative, administrative and enforcement issues

2. GST legal opinion on concerns such as "Location of supply," "Time of supply," "Registration provision," etc.

3. Classification and duties of the GST HSN

4. Requirements for a GST advance rule

5. Support desk with GST consultancy via personal meetings, phone calls and emails