FCRA

FCRA Registration & Compliances for Foreign Contribution Regulations in India

RJA 07 Dec, 2021

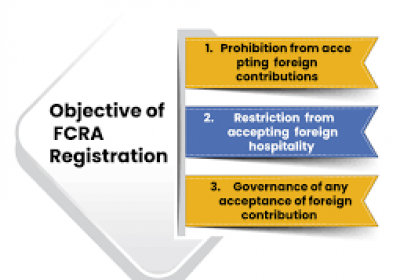

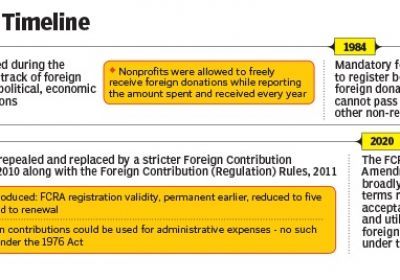

FCRA Registration & Compliances for Foreign Contribution Regulations in India The legislation was abolished in 2010 and replaced with the Foreign Contribution (Regulation) Act, 2010 and the Foreign Contribution (Regulation) Rules, 2011, which had two major aims: - To regulate the acceptance and use of foreign contributions or hospitality by specific persons, associations, ...

FCRA

About FCRA Registration renewal & Cancellation/Suspension

RJA 30 Nov, 2021

Overview about FCRA Registration renewal FCRA registration certificate's validity has been limited to 5 years under the updated FCRA 2010. It should be remembered that under previous legislation, FCRA registration was virtually permanent until it was revoked. The FCRA 2010 requires organizations to update their registration every five years. Organizations who want ...

FCRA

FAQs on obtain prior permission from FCRA authorities

RJA 28 Oct, 2021

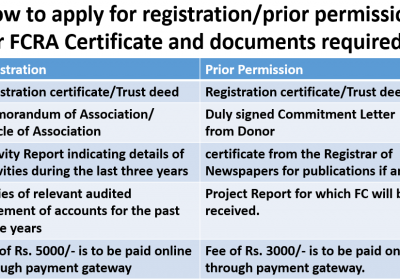

FAQs on obtain prior permission from FCRA authorities Q1 What is the different type of registrations provided under FCRA 2010? There are generally two types of pf FCRA registration granted in India, namely – Prior Permission and Proper Registration. Each of the above type requires some prerequisites such as – PRIOR ...

FCRA

Frequently Asked Questions (FAQs) on FCRA

RJA 28 Oct, 2021

Frequently Asked Questions (FAQs) on FCRA Q1: What are the various kind of FCRA registrations? The below are the two forms of FCRA registration: Proper FCRA registration Proper FCRA registration permission The eligibility requirements, as well as the duration of the registration, vary depending on the type of FCRA ...

FCRA

FCRA Returns Forms & Related Documents required under FCRA Act

RJA 21 Sep, 2021

Returns under FCRA 2010 S. No. Return Name Due Date Details to be Provided 1. FC - 1 Within 30 days of receipt (Part A&B) Within 45 days of being nominated (Part C) Intimation of receipt of foreign contribution by way of gift / as Articles / Securities / by candidate for Election 2. FC - 2 ...

FCRA

ONLINE FCRA REGISTRATION PROCESS, DOCUMENTATION & ELIGIBILITY

RJA 02 Jun, 2021

FCRA Registration The 1976 Foreign Contribution Act (FCRA) was implemented in 1975 with the major purpose of regulating the acknowledgement and use of the foreign contribution and of foreign hospitality, by individuals and associations working in the important domestic areas. This is important to ensure that such assistance ...

FCRA

Overview about FCRA Registration renewal

RJA 12 May, 2021

FCRA Registration Renewal The registration certificate's validity has been limited to 5 years under the updated FCRA 2010. It should be remembered that under previous legislation, FCRA registration was virtually permanent until it was revoked. The FCRA 2010 requires organizations to update their registration every five years. Organizations who want to extend ...

FCRA

MHA extends FCRA registration certificates validity of NGOs till 31.05.2021

RJA 03 Apr, 2021

Ministry of Home Affairs extends FCRA registration certificates validity of NGOs till 31.05.2021 The Ministry of Home Affairs said that Non-governmental organization’s whose registration in accordance with the 2010 Foreign Contributions Act expired between Sept 29, 2020 — when notifying fresh amendments to the Act were filed and May 31, 2021, will now receive ...

FCRA

Frequently Asked Question on Fcra Registration

RJA 01 Apr, 2021

Frequently Asked Question on Fcra Registration Q.: What is FCRA stand for? FCRA stands for Foreign Contribution Regulation Act. Q.: Is the Reserve Bank of India (RBI) is governed by the FCRA? The FCRA is an internal security law that is not governed by the RBI. It is ...

FCRA

Changes to the Annual Return under the FCRA

RJA 01 Jan, 2021

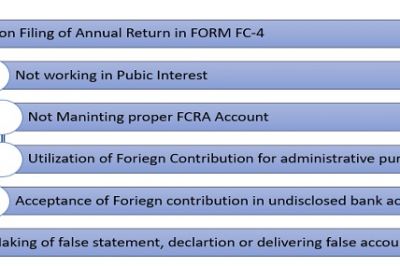

Changes to the Annual Return under the Foreign Contribution Regulations Act : The Foreign Contribution Regulation Act of 2010 (“FCRA”) and the Foreign Contribution Regulation Rules (“FCRR”) have recently undergone some modifications. The modifications are as follows: 1. Registration, Prior Approval, and Renewal of Registration Consolidated Form: Previously, Form ...