NRI

Income Tax Dept. is Closely Tracking These 10 Transactions

RJA 25 Dec, 2025

Income Tax Department is Closely Tracking These 10 Transactions Tax dept. has significantly strengthened its surveillance mechanisms to curb tax evasion and ensure transparency in financial dealings. If you engage in high-value transactions, it’s crucial to understand the reporting norms and thresholds that can trigger scrutiny. Staying informed helps ...

NRI

NRI Income Tax Filing Checklist for FY 2024-25 (AY 2025-26)

RJA 18 Jul, 2025

NRI Income Tax Filing Checklist for FY 2024-25 (AY 2025-26) Step 1: Essential Documents Checklist To begin your filing process, NRIs should gather the following documents: PAN Card and valid visa or proof of overseas residency Bank statements (NRE, NRO, savings) for April 2024 – March 2025 Interest certificates, capital gains reports, and ...

NRI

FAQS related to Filling of Form 67 & claiming Foreign Tax Credit

RJA 03 Oct, 2024

FAQS related to Filling of Form 67 & claiming Foreign Tax Credit How we claim the Foreign Tax Credit & Save More Tax? Ans: Effective tax planning goes beyond just avoiding double taxation. By understanding and utilizing the provisions of the Income Tax Act, such as Sections 90, 90A, and 91, and maintaining ...

NRI

Who Needs a Tax Residency Certificate?

RJA 27 Sep, 2024

Who Needs a Tax Residency Certificate? Filing Form 10F and obtaining a Tax Residency Certificate ensures NRIs and foreign nationals benefit from Double Taxation Avoidance Agreement provisions, avoiding double taxation. It enables access to lower TDS rates, smooth tax processing, and compliance with both Indian and foreign tax regulations. A ...

NRI

CBDT exempts NRIs from Online filing form 10F Upto 31 March 2023

RJA 26 Jan, 2023

Central Board of Direct Taxes exempts non-resident Indians (NRIs) from Online filing form 10F Upto 31 March 2023, The Central Board of Direct Taxes has exempted non-resident Indians (NRIs) without PANs from Online filing Form 10F up to March 2023. Central Board of Direct Taxes notification No. 03/2022, dated July 16, 2022, issued by the Directorate ...

NRI

Analysis of NRI Fixed Deposits Investing with Tax Implications

RJA 16 Nov, 2021

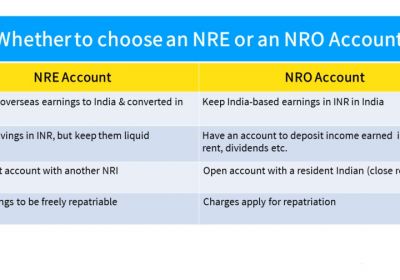

Analysis of NRI Fixed Deposits Investing with Tax Implications Are you considering about investing in India? Are you worried about the tax implications of being a non-resident alien? The investment prospects in India may be tailored to meet the needs of NRIs, and they can enjoy a hassle-free banking and ...

NRI

FAQ/Guidelines on Aadhaar-based PAN distribution

RJA 19 Oct, 2021

FAQ on Aadhaar-based PAN distribution What's the PAN? Answer: PAN, or Permanent Account Number, is a special 10-digit alphanumeric code. The Income Tax Department issues PAN in compliance with the Income Tax Act & Regulations. Financial institutions and agencies are also required to have PAN. What is Instant PAN ...

NRI

ALL ABOUT TAXATION OF NON-RESIDENT INDIANS

RJA 18 Sep, 2021

ALL ABOUT TAXATION OF NON-RESIDENT INDIANS BRIEF INTRODUCTION It is commonly seen that taxation system is an integral part of Indian economy. In India, several taxes have been levied on products and services, being available to the citizens of India. These taxes are used to finance ...

NRI

NRI RECOGNITION OF TAXABLE INCOME IN INDIA

RJA 18 Sep, 2021

RECOGNITION OF TAXABLE INCOME IN INDIA NRIs are required to tax on any sought of income, being earned in India. Thus, as an NRI, one must pay tax in respect of following income - • Income earned or received in India. • Salary received or is expected to be received ...

NRI

Non-Resident Indian (NRI) Repatriation Services

RJA 08 Sep, 2021

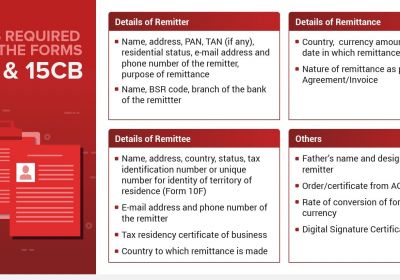

NRI REPATRIATION SERVICE An NRI, OCI and a Foreign Citizen, residing in India, are often into the transaction of remitting the money from Indian Bank accounts to foreign or NRI accounts. To undertake such type of transactions, the banks are authorized to ask for certain documents namely - Application form ...

NRI

RESIDENT FOREIGN CURRENCY ACCOUNT PROVISIONS

RJA 07 Sep, 2021

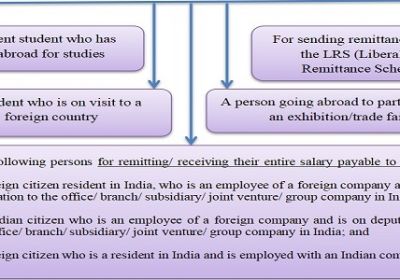

FOREIGN CURRENCY ACCOUNT PROVISIONS An Indian resident going abroad for studies or who is on a visit to a foreign country may open, hold and maintain a Foreign Currency Account with a bank outside India during his stay outside India, and on his return to India, the balance in the ...

NRI

GST Law Applicability on Non Resident Taxable Person

RJA 07 Sep, 2021

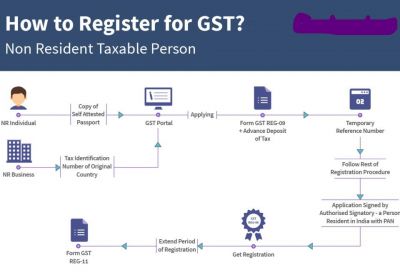

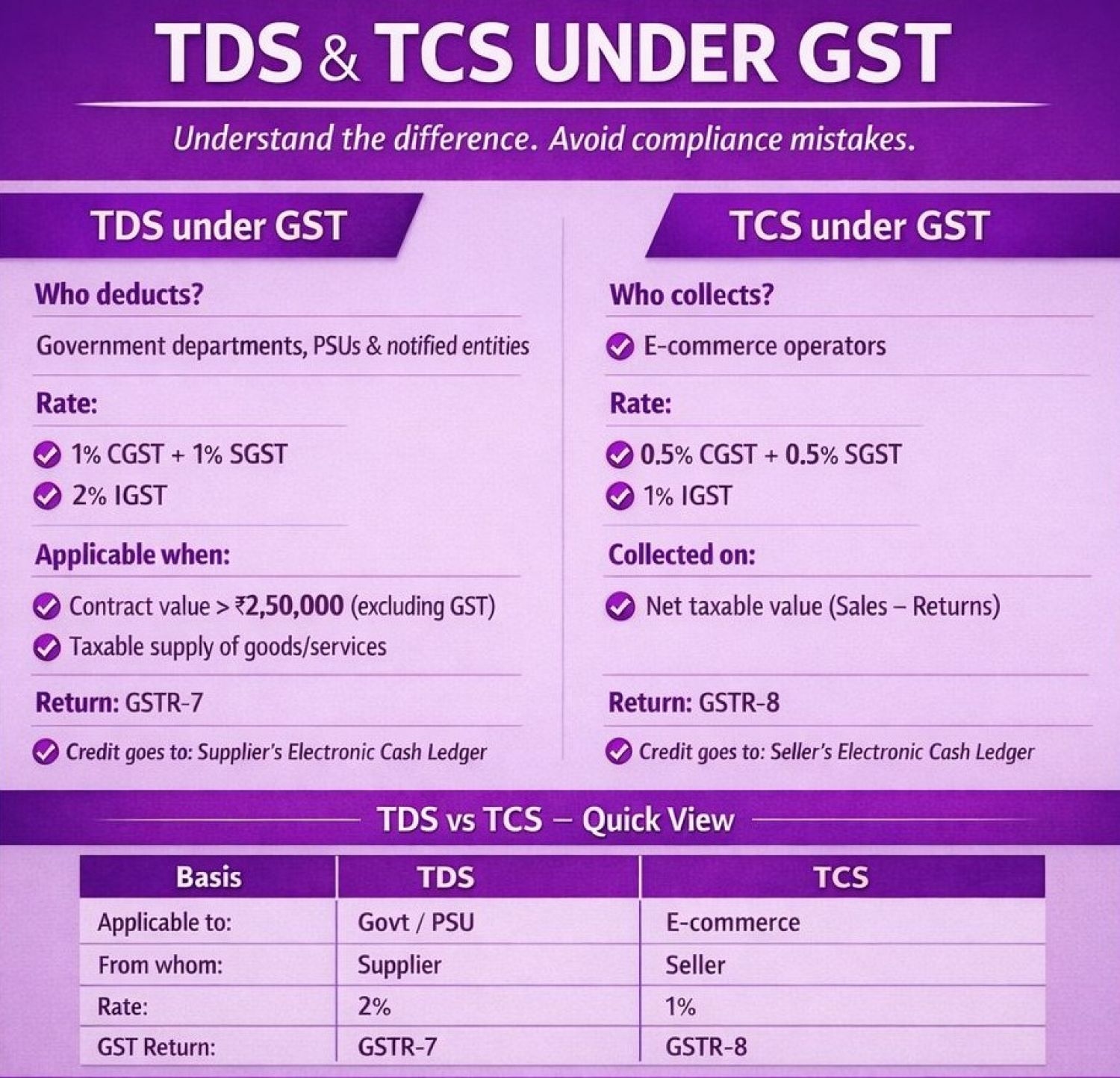

Complete Guidance on NRIs GST applicablity Goods and Services Tax Act was passed in 2017, which is an indirect tax. GST was passed to subsume many indirect taxes under one law i.e., GST Law. GST Law in India is comprehensive, multi-stage, destination tax. Non-Resident Taxable Person Under GST Under ...

NRI

Requirements for Lower deduction TDS Certificate For NRI's

RJA 07 Sep, 2021

PROVISIONS TO COMPLY WITH WHILE SALE OF PROPERTY The proceeds arising from the sale of such property be received in an NRO account in India. A properly executed and stamped copy of the sale deed must be obtained for tax compliances (ITR filing) and future tax/tax/another query. Keep ...

NRI

GUIDANCE TIPS FOR NRI RETURNING TO INDIA

RJA 06 Sep, 2021

TIPS FOR NRI RETURNING TO INDIA If you're an NRI returning to India permanently, this blog is for you. During this article, we would be explaining the fundamentals attached with the smoothly transition of an NRI to a Resident Indian and ...

NRI

PROBLEMS FACED IN INVESTING IN INDIA BY NRIS

RJA 06 Sep, 2021

PROBLEMS FACED IN INVESTING IN INDIA BY NRIS BRIEF INTRODUCTION With the rapid growth in the Indian market, NRIs have been eagerly looking for making investment in the Indian market. Several investment options are available in India, like mutual funds, equity stocks, IPOs, ETF, bonds, etc. However, ...

NRI

Tax Guidelines for Non Resident Indian (NRI)

RJA 24 May, 2021

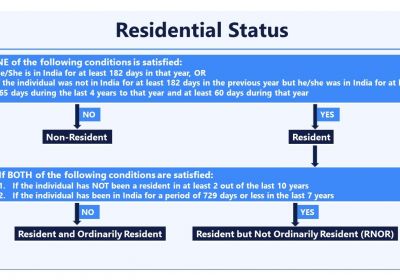

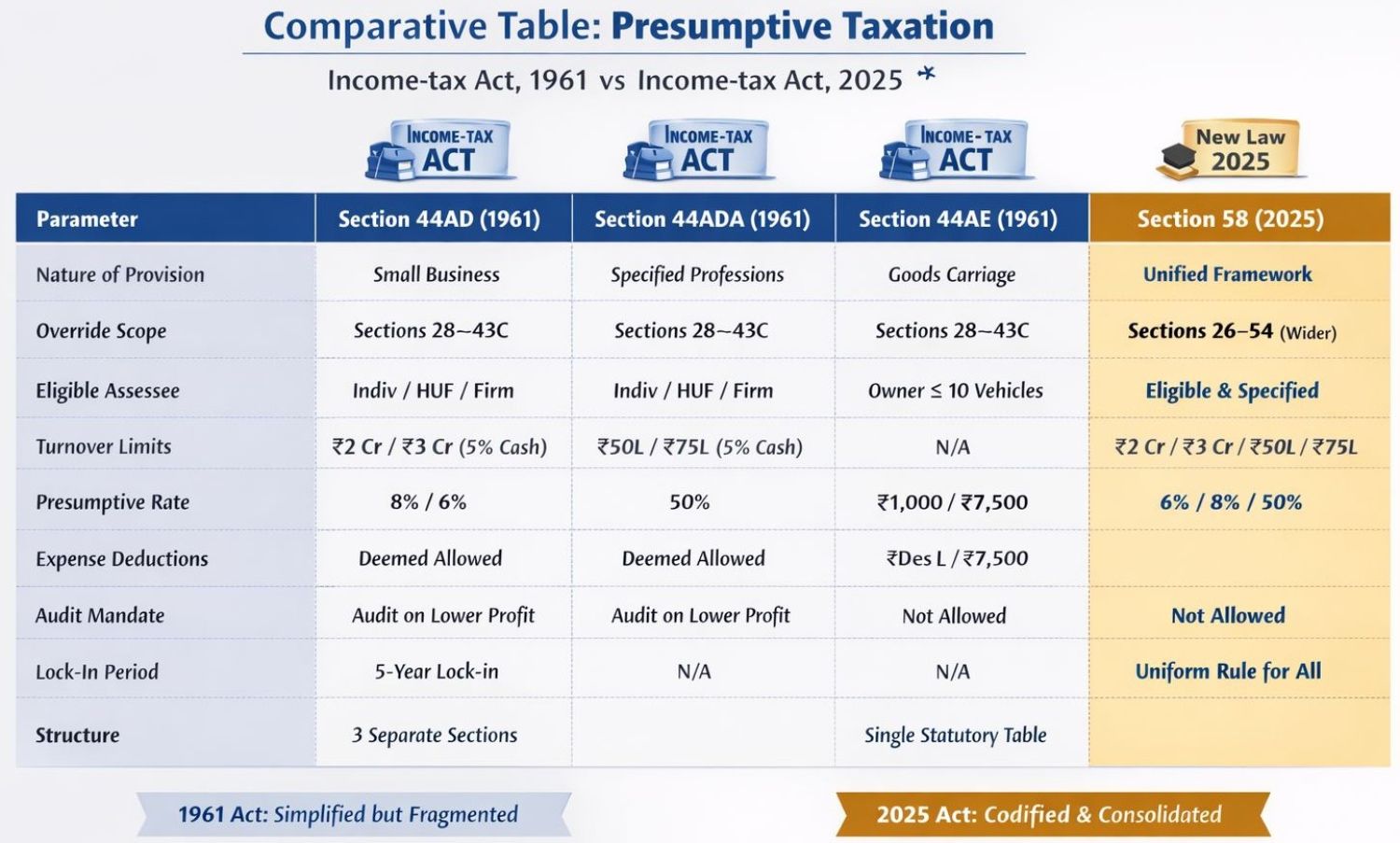

TAX GUIDELINES FOR NON-RESIDENT INDIAN (NRI) This article provides detailed information on various tax compliances, required by a Non-resident in India. Starting with the basic information and then going to some technical aspects are the key of this article. BASICS 1. RESIDENTIAL STATUS OF NRI An individual is said ...

NRI

Lower TDS Certificate for NRI Property Sales

RJA 21 May, 2021

LOWER TDS/NIL TDS/EXEMPTION CERTIFICATE U/S 197 ON PROPERTY SALE BY NRIs, OCIs CITIZENS Non-Residents' TDS on Property Sale Transactions (NRIs, OCIs) According to the Indian tax Act 1961- TDS provisions apply to various financial transactions in India. Tax deduction at sources is also applicable to property sale transactions ...

NRI

NRE A/c Salary Income Receipt - Not Taxable in the Hand of NRIs Working Abroad

RJA 19 May, 2021

Mumbai ITAT decided in a recent judgment that it was not possible to cause a tax incident that the only receipt of salary income by the employee of the NRE Bank accounts in India (which works in a ship on international routes run by Singapore's shipping company). Under ...

NRI

Capital Gains on the Sale of NRI Immovable Property

RJA 19 May, 2021

Capital Gains on the Sale of NRI Immovable Property Purchase Immovable Property in India by Non-Resident Indians. This purchase is made either through the Non-Resident Indians' own investment or through inheritance from their parents/grandparents, etc. Non-Resident Indians always want to sell their immovable property for two reasons. It is ...

NRI

Allow NRIs to buy gold from foreigners to claim GST refund by filling Return

RJA 31 Jan, 2021

Allow NRIs to buy gold from foreigners to claim GST reimbursement on their return (Expectation from Budget 2021) The gem and jewelry sector is hoping for a positive result from the budget 2021. The gem and jewelry sector is making a major contribution to the overall economy of the country. And ...