GST Consultancy

GST on Commercial Rent from Unregistered Landlord – RCM Position

RJA 13 Feb, 2026

GST on Commercial Rent from Unregistered Landlord—RCM Position When Does RCM Apply? GST under the Reverse Charge Mechanism (RCM) applies when the property is commercial, the tenant is a registered person, and the landlord is unregistered. Renting of immovable property (other than residential dwelling for personal use)&...

GST Consultancy

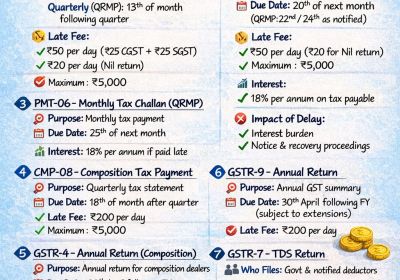

Guide on Mandatory GST Forms – Due Dates, Late Fees & Penalties

RJA 11 Feb, 2026

Guide on Mandatory GST Forms – Due Dates, Late Fees & Penalties Goods and Services Tax compliance is non-negotiable. Missing deadlines can lead to late fees, interest, ITC blockage, notices, and even cancellation of Goods and Services Tax registration. Goods and Services Tax Taxpayer Always reconcile GSTR-2B before ...

GST Consultancy

Summary of the key decisions in 54th GST Council Meeting

RJA 13 Sep, 2024

Summary of the key Recommendations in 54th GST Council Meeting The 54th GST Council met under the Chairpersonship of Union Minister for Finance &Corporate Affairs Smt. Nirmala Sitharaman in New Delhi. The 54th GST Council Meeting made key recommendations regarding cover a wide range of items and services, including ...

GST Consultancy

Physical Submission of GST Appeal Documents: Is It Necessary?

RJA 01 Jun, 2024

Physical Submission of GST Appeal Documents: Is It Necessary? In the context of filing an appeal under GST, there is often confusion about whether a physical submission of the appeal documents is required after the online submission on the GST portal. Compliance with GST appeal procedures can be efficiently managed ...

GST Consultancy

For Changing or Amendment in the Goods and Services Tax registration

RJA 15 Apr, 2024

For Changing or Amendment in the Goods and Services Tax registration Nature of your Business -New Partners’ Details - For Changing Nature of Business: You would need to provide a detailed description of the new nature of your business. you'll typically need to provide various documents to ensure ...

GST Consultancy

50th GST council meeting Important Decisions taken

RJA 11 Jul, 2023

50th GST council meeting Important decisions taken- Details are here under System-based intimation to the taxpayers in respect of the excess availment of input tax credit in FORM GSTR-3B vis a vis that made available in FORM GSTR-2B 28% Goods and Services Tax on the full value of the ...

GST Consultancy

Highest GST Revenue collection in HP ever in the month of April 2023

RJA 10 May, 2023

Highest GST Revenue collection in Himachal Pradesh ever in the month of April 2023 Commissioner of State Taxes and Excise Yunuspur Himachal Pradesh said in a report that, the GST collection in the month of April is 19% more than the last year’s GST collected in the state of Himachal ...

GST Consultancy

Why GST Registered firms are getting Notices from the GST Dept.?

RJA 26 Apr, 2023

Why Goods and Services tax Registered firms are getting Notices from the GST Dept. GST Notices for tax evasion, rate non-compliance, late filing, absent or incorrect invoices, eWay Bill inconsistency, and non-payment are frequently issued. Understanding the various notices that a company or professional could get, as well as their ...

GST Consultancy

GSTN added a new Federal Bank, total No of banks accepting GST payments to 20

RJA 01 Nov, 2022

20 Banks now Accept GST payments because to the addition of a new Federal Bank to the GSTN. A dealer who has registered for GST can generate a GST Challan on the GST Portal to pay tax, fees, penalties, interest, and other amounts. The payment methods include OTC, NEFT, RTGS, and ...

GST Consultancy

AO not to imposed penalty without giving him the opportunity of being heard

RJA 13 Oct, 2022

A person cannot be imposed penalty under GST without giving him the opportunity of being heard What is issue: Whether or not the Petitioner is GST liable to pay GST tax along with penalty equal to 100% of tax? An e-way bill was created with a validity date of September 28, 2020. By ...

GST Consultancy

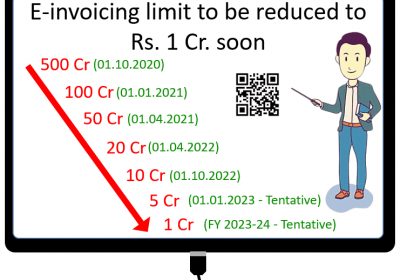

GST E-invoicing threshold limit to be decrease to INR. 1 Crore very soon

RJA 10 Oct, 2022

GST E-invoicing threshold limit to be decrease to INR. 1 Crore Very soon. Companies/Firm business with yearly Sales or annual turnover of over INR Five Cr. will have to move to e-invoicing under Goods and services tax from 1 January 2023. The Goods and Services Tax Network has asked its technology ...

GST Consultancy

GSTN Guidelines issued for prosecution in GST

RJA 07 Sep, 2022

GSTN Guidelines issued for prosecution in GST- Key Points The Central Board of Indirect Taxes & Customs has issued instructions for the Goods and Services Tax investigation officers which are to be followed while launching any prosecution proceedings exhibiting criminal charges against any person. Central Board of Indirect ...

GST Consultancy

Reopening of TRAN 1 & TRAN 2 Forms is a One-Time Opportunity

RJA 01 Sep, 2022

CBIC Guidelines on Reopening of TRAN 1 & TRAN 2 Forms is a One-Time Opportunity Central Board of Indirect Taxes and Customs has issued the guidelines in terms of the order passed by the Supreme Court in the case of UOI vs. Filco Trade Centre Pvt. Ltd. has provided the following ...

GST Consultancy

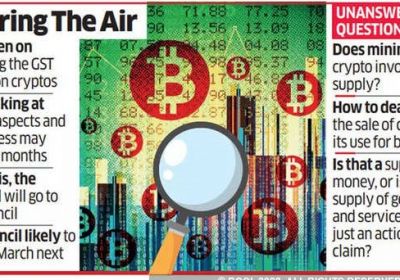

CBIC examine crypto ecosystem to bring more activities on GST framework

RJA 10 Aug, 2022

CBIC examine crypto ecosystem to bring more activities on GST framework The CBIC's GST policy department is carefully analysing how to extend the reach of taxation to the cryptocurrency ecosystem. It intends to grow its activities by providing platforms for mining cryptocurrency assets and the usage of virtual digital ...

GST Consultancy

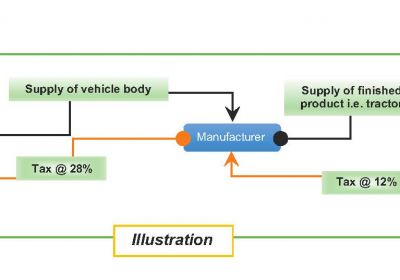

Formula Improved for claiming ITC refund in case of inverted duty structures

RJA 21 Jul, 2022

GSTN : Formula Improved for claiming ITC refund in case of inverted duty structures Following the 47th GST Council, the GOI improved the formula of inverted duty structure by issuing Central Tax Notification No. 14/2022, which was published in the Gazette and stated that in the event of a refund due to ...

GST Consultancy

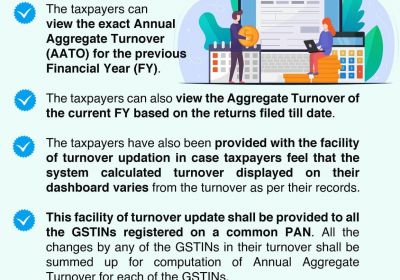

How to compute AATO (annual Aggregate Turnover) computation for FY 2021-22.

RJA 01 May, 2022

GSTN Enables Functionality Of AATO (annual Aggregate Turnover) For The FY 2021-22 On GST Taxpayers' Dashboards Functionality of Annual Aggregate Turnover for the Financial Year 2021-22 has now been made live on GST Taxpayers’ GST Dashboards with the below characteristic mentioned here under: The GST taxpayers can view the ...

GST Consultancy

ITC now only for amounts reflected in GSTR 2B:

RJA 25 Jan, 2022

ITC now only for amounts reflected in GSTR 2B We are aware of the change in Input Tax Credit Availment Rules of the entitlement eligibility from GSTR 2B w.e.f. January 1, 2022, Almost each business is concerned about having to implement a new system of Input Tax Credit reconciliation as ...

GST Consultancy

What to be do when issue of summons to a person under GST

RJA 01 Nov, 2020

Power to summon persons to give evidence and produce documents in GST Provision of the CGST Act, 2017 under Section 70 mentioned hereunder: Power to summon persons to give evidence and produce documents. The proper officer under this Act shall have the power to summon any person whose ...

GST Consultancy

Late fee Exemption for GST Return filing those are not been able to file GST Return.

RJA 19 Jun, 2020

Late fee Exemption for GST Return filing those are not been able to file GST Return. Great effect on tax revenues due to lock-out of coronavirus A relief of late interest and fees will be given to small taxpayers with a minimum turnover of up to 5 crores if they ...

GST Consultancy

NAA Allowed by Court to visit offices for collection of documents & Information

RJA 27 May, 2020

The National Anti-profiteering Authority (NAA) has obtained clearance from the High Court of Bombay for a visit to the offices of Saphire Foods Pvt. Ltd. to gather documents and information during the locking process. In this writ petition, it was brought to the court's notice that the &...

GST Consultancy

Levy of IGST on ocean freight under RCM is unconstitutional

RJA 23 Apr, 2020

Levy of Integrated Goods and Services Tax on Ocean Freight under RCM is Unconstitutional The GST levy on ocean freight levied on services rendered by a person located in non-taxable territory by means of transport of goods by a vessel from a place outside India to a customs clearance ...

GST Consultancy

No GST on Interest on Loan by DEL-Credere Agent

RJA 03 Sep, 2018

NO GST ON INTEREST ON LOAN BY DEL-CREDERE AGENT Act as a guarantor of credit extended to the buyer. A Del credere agent can act as a combination of a salesperson and an insurance firm. A Del credere agent becomes liable to pay the principal if the buyer made ...

GST Consultancy

Analysis of Changes in Service Tax & GST via Finance Bill, 2018

RJA 05 Feb, 2018

Analysis of Changes in Service Tax and GST through Finance Bill, 2018 and GST Council 25th Meeting Finance Bill 2018 has been presented by the honourable Finance Minister on 1st February 2018 which has put forward some changes in the indirect taxation regime. Also, in recent days, several modifications have been made ...