New Income tax Rules for verification of Income tax return Filling

If ITR for Assessment year 2022-23 filed today or in months to come upto 31.12.2022 and not verified within 30 days

- Date of verification will be taken as date of filing. So interest and late fees will be levied accordingly

- Where these 30 days expire at any time in 2023 then ITR will be treated as never filed because post 31.12.2022 ITR cannot be filed.

But, for Income tax return Filling returns filed upto 31.7.2022 time limit of 120 days shall be available

New Income tax Rules for verification of Income tax return Filling Procedure :

- Electronic verification of tax returns Here is everything you need to know about the timeline.

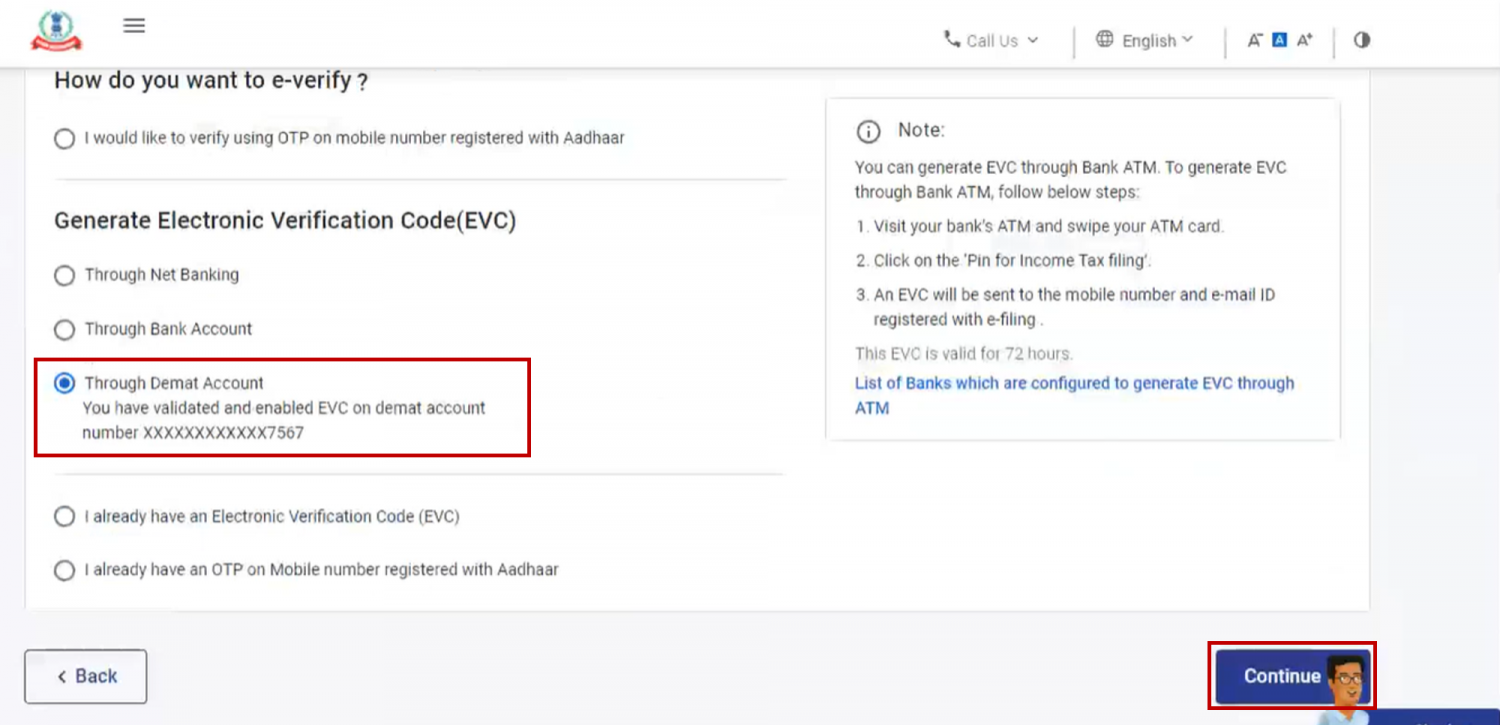

- The process of filing an income tax return is completed by e-verification.

- If an income tax return is not filed for electronic verification within the allotted time, it is treated as invalid.

- The income tax notification said that the time limit for e-verification or submission of ITR-V would now be 30 days from the date of uploading/ transmitting the return data electronically, "regarding any electronic transmission of return data on or after the date of this notification comes into effect."

- Till now, we had 120 days from the date of filling the Income tax return to electronic-verify the return or mail the ITR-V after from the date of the uploading of the ITR.,

- The Income tax notification made it clear that if the hard copy ITR-V or e-verification of the income tax return is sent via mail after the allotted 30 days, the Income tax return will be considered late or beyond the due date.

- Hard copies of the ITR-V can be sent to the Centralised Processing Centre, Income Tax Department, Bengaluru-560500, Karnataka, using the normal address and "speed post only."

- "The date of dispatch of speed post of duly verified ITR-V shall be considered for the purpose of determination of the 30 days period, from the date of transmitting the date of Income-tax return electronically," it said.

- It stated, "For the purpose of determining the 30 days period, from the date of submitting the Income-tax return electronic, the date of sending of speed post of duly verified ITR-V shall be considered."