Table of Contents

Tax Implications on Reclassification of Futures & Options

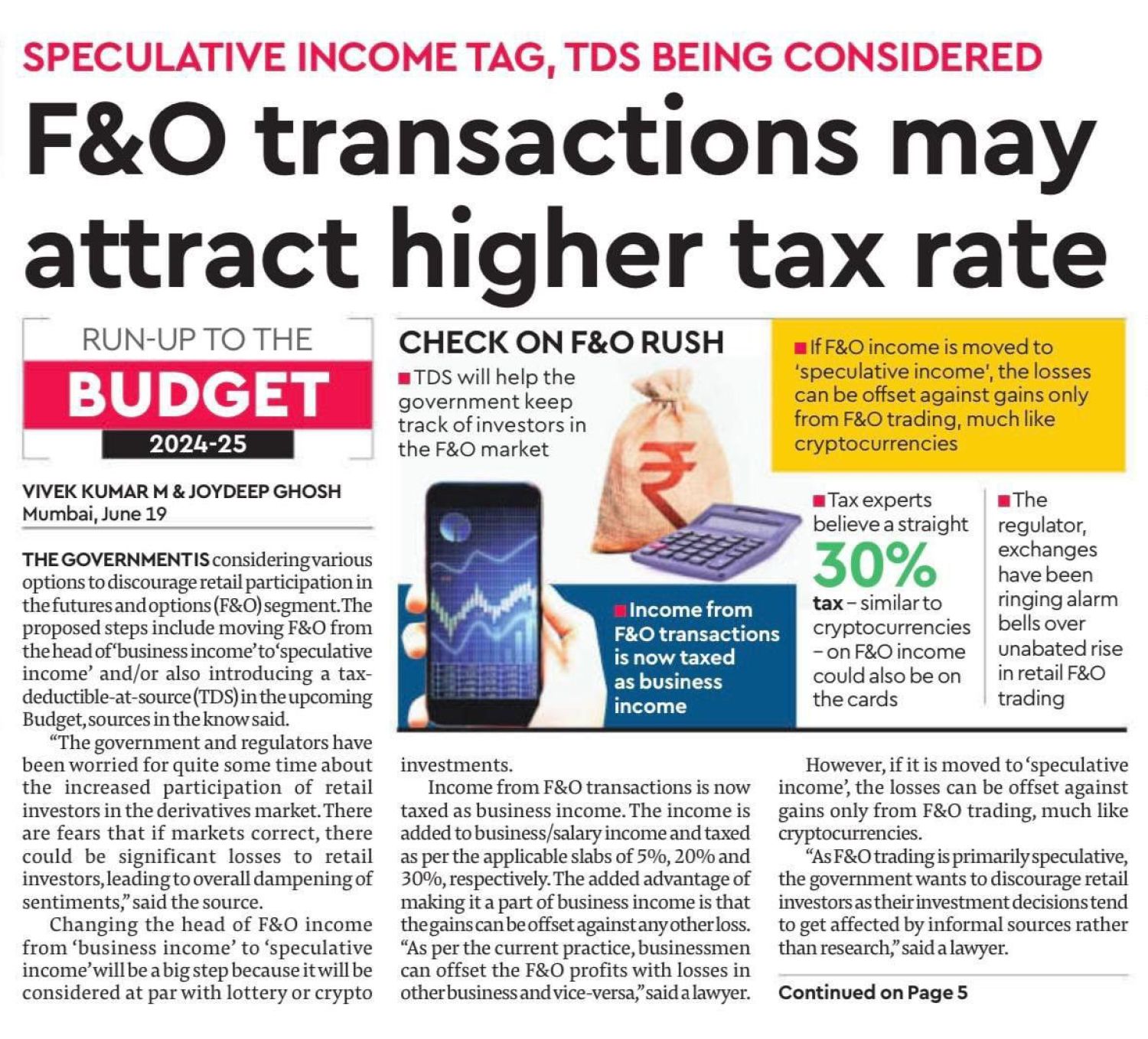

The reclassification of Futures & Options profits as speculative income would introduce a higher tax rate, restrict loss offset capabilities, and potentially deter retail participation in the Futures & Options segment. Traders and investors would need to adjust their strategies accordingly, and the overall market dynamics could shift as a result of these changes.

|

S. No |

Particular |

Current Treatment |

Proposed Change |

|

1 |

Loss Adjustment

|

Losses from Futures & Options trading can currently be set off against other business income, allowing for more flexibility in managing tax liabilities.

|

Speculative losses can only be set off against speculative gains, limiting the ability to offset losses against other income types and potentially leading to higher net taxable income.

|

|

2 |

Restrictions on Loss Offset |

Currently, losses from F&O trading can be offset against other business income, providing flexibility in managing tax liabilities and optimizing overall tax payments. |

In case the F&O income is treated as speculative, losses from F&O transactions can only be offset against profits from other speculative transactions. This restricts the ability to mitigate tax liability by using losses from F&O trading against other income.

|

|

3 |

Higher Tax Rate |

Currently, F&O income is treated as non-speculative business income, taxed under the head of 'PGBP'. This allows taxpayers to be taxed at their applicable income tax slabs, which can range from 5%, 20%, to 30%.. |

If F&O profits are classified as speculative income, they would attract a flat 30% tax rate, regardless of the taxpayer's income slab. An additional 4% cess would also apply, making the effective tax rate 31.2%.

|

|

4 |

Implementation of TDS |

At present, there is no TDS on F&O transactions. Traders report their net income or loss from Futures & Options trading at the end of the financial year and pay taxes accordingly. |

If Futures & Options transactions are classified as speculative income, TDS may be introduced. This would mean taxes are deducted at the source on profits earned from Futures & Options transactions before the net amount is credited to the trader's account. |

Taxation implication

- The introduction of TDS and higher taxes on Futures & Options income could boost government revenue in the short term. However, the overall impact would depend on how significantly trading volumes are affected.

- The higher tax and compliance burden may deter retail investors from participating in Futures & Options trading, leading to reduced trading volumes and liquidity in the derivatives market.

- Market dynamics could shift as institutional investors might dominate the Futures & Options segment, potentially increasing market stability but reducing retail investor engagement.

- To optimize tax liabilities, traders might diversify their portfolios away from Futures & Options and towards investments that are treated more favorably under the tax code, such as long-term equity investments, debt instruments, or other non-speculative financial products.

-

Tax Planning:

- Business owners who currently offset F&O losses against other business income would lose this advantage, impacting overall tax efficiency.

- Traders would need to reassess their tax planning strategies. The higher tax rate on speculative income could lead to a reevaluation of the cost-benefit analysis of engaging in F&O trading.

- Traders will need to maintain meticulous records of their Futures & Options transactions to accurately report profits and losses and manage TDS compliance.

- Given the higher tax burden and restricted loss offset, traders may need to reassess their trading strategies, potentially reducing their exposure to F&O markets or seeking alternative investment avenues with more favorable tax treatment.

- The move aligns with regulatory efforts to protect retail investors from high-risk speculative trading, potentially leading to a more stable and less volatile market environment.

The rapid increase in retail Futures and Options trading in India has prompted significant concern from both the government and financial regulators. Finance Minister Nirmala Sitharaman has highlighted the potential negative impact on investor sentiment and household finances due to the surge in retail participation in the Futures and Options segment. This concern is echoed by the Reserve Bank of India Governor Shaktikanta Das, who mentioned that both the Reserve Bank of India and the Securities and Exchange Board of India are closely monitoring the high volume of Futures and Options trading.

Tax Rate on Reclassification of Futures & Options

In response to these concerns, the government is exploring various measures to discourage retail investors from engaging heavily in F&O trading. One such measure under consideration, as reported by the Financial Express, involves reclassifying Futures and Options income as 'speculative income' rather than 'business income.' This reclassification would have significant tax implications:

- Loss Offset: Under the proposed change, gains from speculative income could only be offset against losses from the same type of income. This differs from business income, where losses can be offset against other business income, offering a broader scope for tax benefits.

- Tax Rates: Currently, business income is taxed according to the income slab rates of 5%, 20%, or 30%, depending on the individual's total income. In contrast, speculative income is taxed at a higher flat rate, similar to the taxation of lottery winnings or cryptocurrency trading.

Govt considering levying a higher STT on investors with F&O turnover exceeding INR 1,000 Crore

The government is considering levying a higher Securities Transaction Tax on investors with Futures and Options turnover exceeding Rs 1,000 crore. This move aims to mitigate the risks associated with excessive speculation in the derivatives market, particularly by retail traders, and to curb potential widespread losses in the event of a market crash.

An asset manager highlighted that the increased tax would likely dampen the activity of high-frequency trading firms, which could lead to a reduction in their profits. Since HFT firms often benefit at the expense of retail traders, the logic is that decreasing the profits of high-frequency trading firms might also reduce the losses incurred by retail traders.

India has witnessed a significant rise in retail participation in the derivatives market, causing concern among the government and regulators. They fear that a market downturn could lead to substantial losses for retail investors.

Implication on change in F&O Transation

In response to these concerns, industry representatives have proposed that the Finance Ministry impose a higher Securities Transaction Tax on high-frequency trading investors with substantial Futures and Options trading volumes. This measure could increase the operational costs for major firms like Jane Street and Millennium, which utilize sophisticated algorithmic strategies to trade derivatives in the Indian markets. By raising the Securities Transaction Tax, the government aims to create a safer trading environment for retail investors and reduce the speculative risks posed by large-scale, high-frequency trading activities.

These changes are intended to reduce the attractiveness of Futures and Options trading for retail investors by increasing the tax burden and limiting the flexibility to offset losses.

The government's concern stems from the phenomenal rise in the number of Futures and Options traders, which quintupled during FY19-FY22. According to the Futures Industry Association, India's NSE and BSE are now the world's largest stock exchanges by the number of derivatives contracts traded, contributing to 85% of the global volume. This explosion in trading activity poses a risk of widespread financial loss among retail traders if the market were to experience a downturn.

In an effort to safeguard retail investors, Securities and Exchange Board of India has already issued cautionary notes, mandating warnings that around 90% of retail investors lose money in Futures and Options trading. These initiatives reflect the authorities' proactive stance in attempting to curb speculative trading and protect retail investors from significant financial losses.