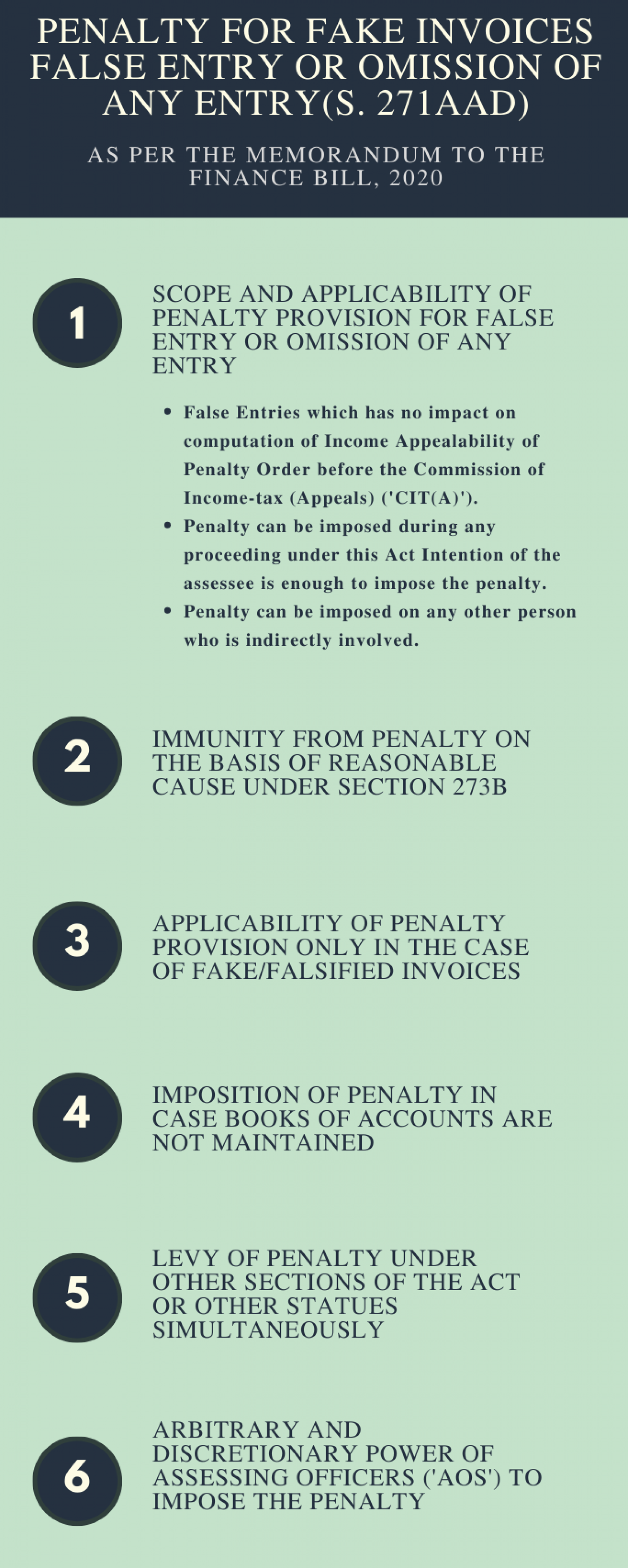

Penalty for false entry or fake invoices -New Section 271AAD

The Finance Bill 2020 added New section 271AAD under Penalties Imposable - Chapter XXI With effect from 1-04-2020. Section 271AAD

"During any proceeding under income tax Act, Without prejudice to any other provisions of income tax Act. If it is found that in the books of account of any person maintained by any person there is—

- an omission of any entry which is relevant for computation of total income of such person, to evade tax liability, or

- a false entry.

AO may direct that these person must pay by way of penalty a amount equal to the total amount of such omitted entry or false entry "

- The scope of this clause is really quite extensive, providing the Ld. Assessing Officer a lot of power. "Without prejudice to any other provisions of this Act," it states.

- It means that for fraudulent entries, penalties under sections 270A and 271AAD can be implemented simultaneously, or penalties under sections 271AAC and 271AAD can be applied for fake purchases.

- Furthermore, "if any person's books of accounts include any erroneous entries," it is stated. What happens if the assessee does not keep any books of accounts? In addition, the phrase "false entry" is defined as follows:

The False entry includes intention to use or use in the following cases:

- When Invoice in respect of supply or receipt of goods or services or both to or from a person who does not exist.

- In case invoice in respect of supply or receipt of goods or services or both without actual supply or receipt of such goods or services or both, but the person from whom the transaction has been done, does exist.

- Furthermore, falsification documents or Forged such as bogus invoices; or,

This is not an exhaustive list; there may be other circumstances that qualify as a false entry. This feature appears to be limited to capturing transactions that are entered in the books of accounts based on fictitious invoices. As a result of the foregoing, the following situation may arise:

1. What happens if the assessee does not produce the invoice? Sec 270A(9)(c) applies to situations in which the assessee asserts an expense but fails to substantiate it with evidence presented throughout the proceeding. Misreporting is the term for this situation, and the penalty under this section is two hundred percent of the tax due. The penalty cannot exceed 44 rupees if the transaction value is 100 rupees and the corporation is taxable at a rate of 22%; however, if the assessee provides such bill and fails to substantiate that such invoices are not fake, the penalty will be 100 rupees.

2. Can it be stated that the purchase was fraudulent if the assessee performed the bona fide transaction and produced the invoice and other related papers throughout the assessment process but neglected to supply the additional documents, such as confirmation from the supplier?

3. This portion is triggered by a fake entry or, in this case, a bogus invoice. Unless proven otherwise, the Ld. AO may assume that every invoice is a fake invoice.

4. What if the transaction is shown to be fraudulent, and the addition is made under section 69C? If the addition is made under section 69C, the tax is calculated under section 115BBE, and a penalty is imposed under section 271AAC.

5. When the term "used or intention to use" is used, what does intention to use entail, and when can the Ld. AO say that there was intention to use?

6. The application of this section is mechanical, and if it is discovered during the assessment process that the assessee used or intended to use a fake invoice, There would be a penalty levied. Whether or not the assessee will be given an opportunity to defend his position.

7. In this section, the term "omitted entry" is not defined. The dictionary definition of "omit" is to leave something out, either intentionally or because you forgot about it. If the assessee missed any entry that is important to the computation of total income, whether the penalty under Section 270A (9) will apply because it is misreporting under Section 270(9)(e) or whether the penalty under Section 271AAD will applicable.