GST Compliance

48th Meeting GST Council recommendations highlights

RJA 19 Dec, 2022

Brief highlights of 48th Meeting GST Council recommendations The GST Council has, among other things, recommended the following amendments to the GST tax rates, trade facilitation measures, and GST compliance streamlining measures: E-invoice Related : CBEC Circular will be issued for clarification on GST New e-invoices applicability with effect from 1...

GST Compliance

CBEC Clarification on 5% GST on the ticket cancellation fee,

RJA 18 Aug, 2022

CBEC Clarification on 5% GST on the ticket cancellation fee, 5 % GST is only applicable on the cancellation of the tickets of AC class which will be subject to penalty, affirmation made by south central railways official by a statement given. GST on cancelled train tickets is one of the wide spread ...

GST Compliance

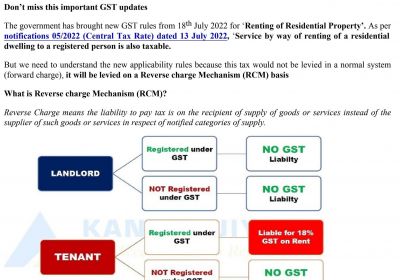

Key impact on GST on Rent of Residential Property

RJA 18 Jul, 2022

Key impact on GST on Rent of Residential Property The fundamentals of renting residential property under GST will change Starting on July 18, 2022. 47th GST Council Meeting decided to include the rental of residential properties in the tax net. Immovable property rental is regarded as a provision of services and is ...

GST Compliance

Taxpayer compulsory submit the correct HSN codes in GSTR-1: GSTN Advisory

RJA 09 Jul, 2022

GSTN Implements Compulsory mentioning of HSN codes in GSTR-1: GST System Update The GSTN has updated its system to implement mandatory Compulsory mentioning of Harmonized System of Nomenclature codes in GSTR-1 GSTN is Compulsory for the GST taxpayers to report minimum 4 digits or 6 digits of Harmonized System of Nomenclature (HSN) ...

GST Compliance

LATE FEE FOR DELAY IN GST FILING FORM GSTR-4 FOR FY 2021-22 WAIVED

RJA 28 May, 2022

New E-Advance Rulings Scheme 2022 - CBDT Notification No. 07/2022 The Ministry of Finance announced the E-Advance Rulings Scheme 2022 in a notification dated January 18, 2022. Taxpayers can now ask for advance rulings by e-mail under the new e-advance rulings scheme. Notably, the case's personal hearing will be held via video conference as ...

GST Compliance

Complete guide on E- commerce operator

RJA 14 Sep, 2021

COMPLETE UNDERSTANDING E COMMERCE OPERATOR MEANING Electronic Commerce Operator is basically a person, undertaking activities related to owning, operating or management of digital or electronic facility. And Electronic Commerce has been defined to mean the availability of products or services or both, including digital products over digital ...

GST Compliance

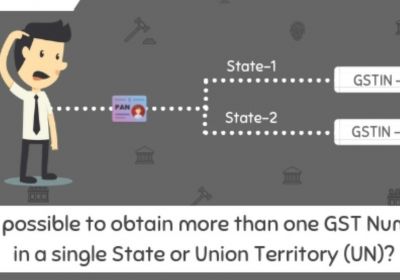

2 GSTIN IN ONE STATE/UT UNDER 1 PAN

RJA 05 Jun, 2021

BRIEF INTRODUCTION After the introduction of GST, any business entity having an aggregate turnover exceeding the prescribed limit of Rs 20 lakhs and Rs 10 lakhs, depending on the state or UT in which they are operating, are required to get registered under that state/UT. Once registration is granted, a GSTIN ...

GST Compliance

Option to upload e-KYC documents or authenticate your Aadhar card On the GST Portal

RJA 01 Mar, 2021

Now you have the option to upload e-KYC documents or authenticate your Aadhar card On the GST Portal, What is Aadhaar Authentication, and how does it work? Aadhaar authentication is the process of submitting the Aadhaar number, along with other biometric details, to the Central Identities Data Repository (CIDR) for ...

GST Compliance

Limitation on filing GSTR-1 along with no ITC claim for your Customers

RJA 04 Feb, 2021

100 percentage limitation to avail 'ITC', if No GSTR-1 is filed by the supplier Monthly GSTR-1 is due by 11th October With the deadline closing in, it’s time to file GSTR-1 for your clients and we can help you file them accurately while saving your time As per the ...

GST Compliance

GST Rate @ 12% applies on Mixed Supply of Works Contract & Job Work: WB AAR

RJA 08 Dec, 2020

GST Rate @ 12% applies on Mixed Supply of Works Contract & Job Work: WB AAR West Bengal - Authority of Advance Ruling directed that 12 per cent GST Rate be extended to a mixed supply of works and job work contracts. The applicant is the owner of M/s Vrinda Engineers Private ...

GST Compliance

E-invoices details are auto-populated in the Respective GSTR-1 tables.

RJA 01 Dec, 2020

E-Invoicing Applicability E-invoicing applies to businesses with a turnover of more than 20 crores in any of the previous financial years From 2022-23 onwards..The initial ceiling was 500 crores, which was later reduced to 100 crores, and now the restriction has been set at 20 crores. However, regardless of the turnover limit, there ...

GST Compliance

Delayed in payment of GST then Interest to be paid on net GST liability from Sep 1, 2020.

RJA 23 Nov, 2020

September 2020 as the date of the entry into force of the provisions of Section 10 of the Delhi Goods and Services Tax (Amendment) Act, 2019 (Delhi Act 06 of 2019)" The Government has admitted that interest on late payment of goods and services tax (GST) will be charged on net tax liability with ...

GST Compliance

Highlights of GST Council Meeting Held

RJA 26 Jul, 2018

HIGHLIGHTS OF GST COUNCIL MEETING HELD The GST Council in its 28th meeting held today at New Delhi has recommended certain amendments in the CGST Act, IGST Act, UTGST Act, and the GST (Compensation to States) Act. The major recommendations are as detailed below: The upper limit of turnover for ...

GST Compliance

Special GST Audit (Section 66) Under under GST ACT 2017

RJA 22 Feb, 2018

GST AUDIT UNDER GST ACT 2017 Under GST Audit would be done in Two Ways: Section 65 (compulsory audit by tax authorities) Section 66 (special audit by chartered accountant or cost accountant) What is an GST Audit? As per Section 2(13) of CGST Act, 2017’audit’ means the examination of records and other ...

GST Compliance

Key Takeaways for E-Way Bill under GST

RJA 31 Jan, 2018

Latest update: Registration, Requirement & Process of E-way Bill E -way Bill An E-way bill is an electronic waybill for the movement of goods that can be generated on the GSTN portal. The E-way bill contains the details of transported goods besides the name of the consignor and consignee ...

GST Compliance

Tax Invoice in goods and services tax (GST)

RJA 07 Jan, 2018

TAX INVOICE IN GOODS AND SERVICE TAX An invoice is a commercial instrument issued by a seller to a buyer. It identifies both the trading parties and lists, describes, and quantifies the items sold, shows the date of shipment and mode of transport, prices and discounts, if any, and delivery ...

GST Compliance

Goods and Services Tax Impact On E-Commerce Sector

RJA 15 Dec, 2016

GST Tax Impact On E-Commerce Sector The most important and painful point of the e-commerce industry is the provision relating to tax collection at the source. E-commerce in India is hindered by the host of taxes such as the VAT, CST, and service tax, TDS with one or more taxes ...