Due Diligence Audit

In business, a due diligence audit is basically a careful

investigation into the complete financial picture of a company. Generally, these audits come

before a purchase, merger or other major decision that could negatively influence the

finances of one or more businesses. These audits are generally used to ensure that no hidden

liabilities exist.

In business, a due diligence audit is basically a careful

investigation into the complete financial picture of a company. Generally, these audits come

before a purchase, merger or other major decision that could negatively influence the

finances of one or more businesses. These audits are generally used to ensure that no hidden

liabilities exist.

Due diligence can be compared to an employee background check on a corporate scale. Like

perspective employees, companies wishing to be purchased are often trying to make the most

positive impression possible. The strengths of the company are often highly stressed and the

weakness is downplayed. A due diligence audit is the equivalent of checking references

before hiring

In general, a due diligence audit focuses on information outside of what is freely presented.

While it is generally expected for a purchasing company to perform these investigations,

they are often done discreetly. The hire of private investigators is not uncommon, and

seldom are the companies that are being investigated aware of the specific focuses of

investigation.

Forensic accounting teams are often the backbone of a due diligence audit. These specialists

are trained to thoroughly review the financial records of an organization for any

discrepancies. Unlike traditional accountants, forensic accountants are specifically trained

to search for fraud and hidden assets and debts.

The due diligence procedure involves: Identifying legal and financial risks associated

with investing in a particular business

- Preparing a report on the legitimacy of a target business and its assets

- Advice on minimizing investment risks

The work which is performed within the due diligence procedure may be divided into three

interconnected parts:

- Financial Due Diligence: confirmation of net assets, both title and value, check of

accuracy of accounting, historic and prospective financial analysis, assessment of

financial risks;

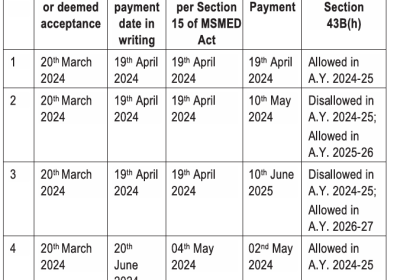

- Tax Due Diligence: check of accuracy of tax calculations, tax risks evaluation;

- Legal Due Diligence: check of corporate structure, titles to assets, intellectual

property rights, commercial liabilities and legal risks evaluation.

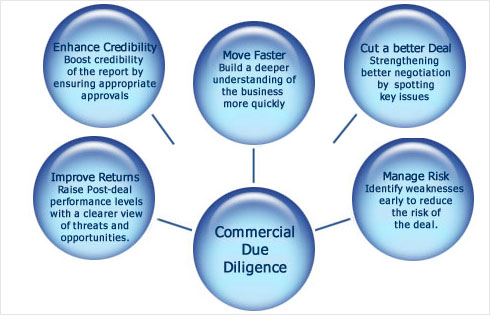

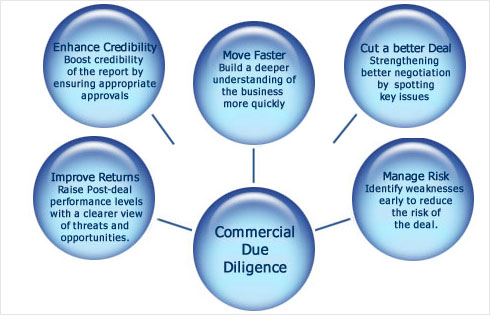

Effective Due Diligence depends on identifying and managing significant transaction issues,

anticipating and identifying potentially important risk and negotiation issues. The

objective is to improve future performance of the organization by forecasting of potential

risk outcomes and attempting to improve the efficiency and effectiveness of the existing

business processes.

What Rajput Jain & Associates Offers

Before starting any project we discuss with the Client the issues that are of main concern.

At the end the Client receives a due diligence report containing all findings. Our approach

is to save time, money and effort as well as to help in influencing the price at the outset

of the deal. We assist clients in conducting financial, legal and accounting reviews in case

of mergers, acquisitions and investments. A sound understanding of local laws, regulations

and accounting practices enables us to vet all critical issues in detail. Our Due Diligence

Solutions cover following areas:

Prime focus

- Independent analysis and evaluation of financial and commercial information prepared at

an early stage of a disposal or strategic divestment

- Gather, analyses and interpret financial, commercial and tax information in detail

- Compilation and review of financial information to be provided to bidders

- Audit of special purpose accounts

- Interfacing with purchaser and their accounting advisors on accounting matters and

challenging due diligence findings of the purchaser

- Identifying contract warranties.

Regulatory Compliance

- Review of policies and procedures and documentation requirements as they pertain to

specific regulatory and industry compliance needs

- Assessment of regulatory compliance concerns

Finance and Accounting

- Validation of balance sheet items and modified cash basis (off balance sheet items)

- Review and assessment of existing accounts receivable

- Analysis of trends in financial data and quality of earnings.

- Assessment of relevant accounting policies and procedures and adherence to

industry-accepted standards

Finance Process

- Review of financial close process and timing

- Assessment of internal audit function

- Assessment of current finance systems and integration with overall IT infrastructure

- Assessment of finance organization

- Assessment of synergies and redundancies

Operations

- Site visit and review of facilities

- Assessment of relevant intellectual property

- Review of real estate and related contracts

- Assessment of existing employees and contracts

- Assessment of synergies and redundancies

Information Technology

- Assessment of current systems and processes

- Data and network security

- Assessment of IT organization

- Review of software development lifecycle

- Assessment of synergies and redundancies

- Assessment of third-party service and software providers

Environmental, Health and Safety

- Identification of potential EH&S risks

- Assessment of EH&S risk management goals, objectives, and infrastructure

In business, a due diligence audit is basically a careful

investigation into the complete financial picture of a company. Generally, these audits come

before a purchase, merger or other major decision that could negatively influence the

finances of one or more businesses. These audits are generally used to ensure that no hidden

liabilities exist.

In business, a due diligence audit is basically a careful

investigation into the complete financial picture of a company. Generally, these audits come

before a purchase, merger or other major decision that could negatively influence the

finances of one or more businesses. These audits are generally used to ensure that no hidden

liabilities exist.