Table of Contents

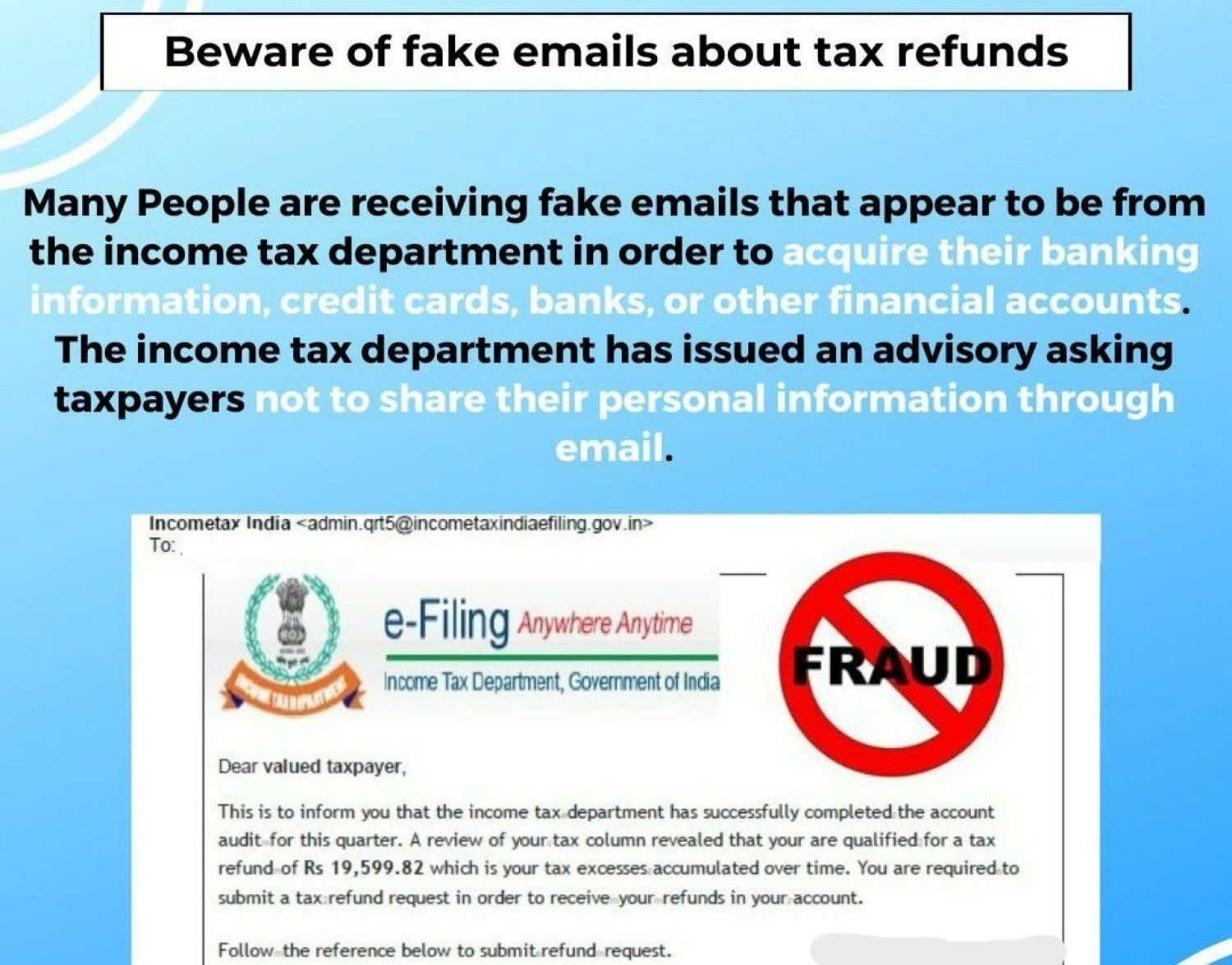

Beware about the Fake income tax refund email

Please refrain from clicking on any phone links that offer refunds. The Income Tax Department did not send these phishing emails, the I-T department stated in a tweet. For its part, the agency has begun contacting income tax taxpayers through email and requesting confirmation before processing reimbursements.

Tax Dept. does not request information personal details via e-mail. Tax Dept does not share e-mail application or requesting taxpayer PIN No, passwords or like that access details of for credit cards, other financial accounts or banks.

The income tax department has issued an alert issued an advisory asking taxpayers not to share their personal information via email or containing personal information.

According to the Income tax dept, IT staff members never email to the Income tax taxpayers asking for their PIN, passwords, or other similar login credentials for credit cards, banks, or other financial accounts.

The cyber police additionally cautioned consumers to disregard emails from anyone posing as representatives of the income tax department or referring them to websites for the department.

If we receive an e-mail from any one claiming to be Authorized by Tax Dept/Directing us to an Income Tax portal:

- Do not use anti spyware, anti-virus software, firewall & keep them updated. Few phishing e-mails have AI or other software that can harm our PC or track our Computer or online activities on the e mode like internet without our awareness or knowledge. Anti-spyware software, Anti-virus & firewall can protect our from inadvertently accepting such unwanted files

- Do not open any attachments. Attachments may contain malicious code that will infect your computer.

- Pls Do not cut & paste link from SMS or email into our browsers, Online phishers can make link look like actual or real one, But it mainly they shared us to different income tax or other related web side or Bank or credit card site websites.

- morover that, Do not click on any links. If we clicked on links in a phishing website or suspicious e-mail then do not enter confidential details like credit card or bank account details.

- Lastly Do not responses or reply.