Table of Contents

SECTION 115BAA

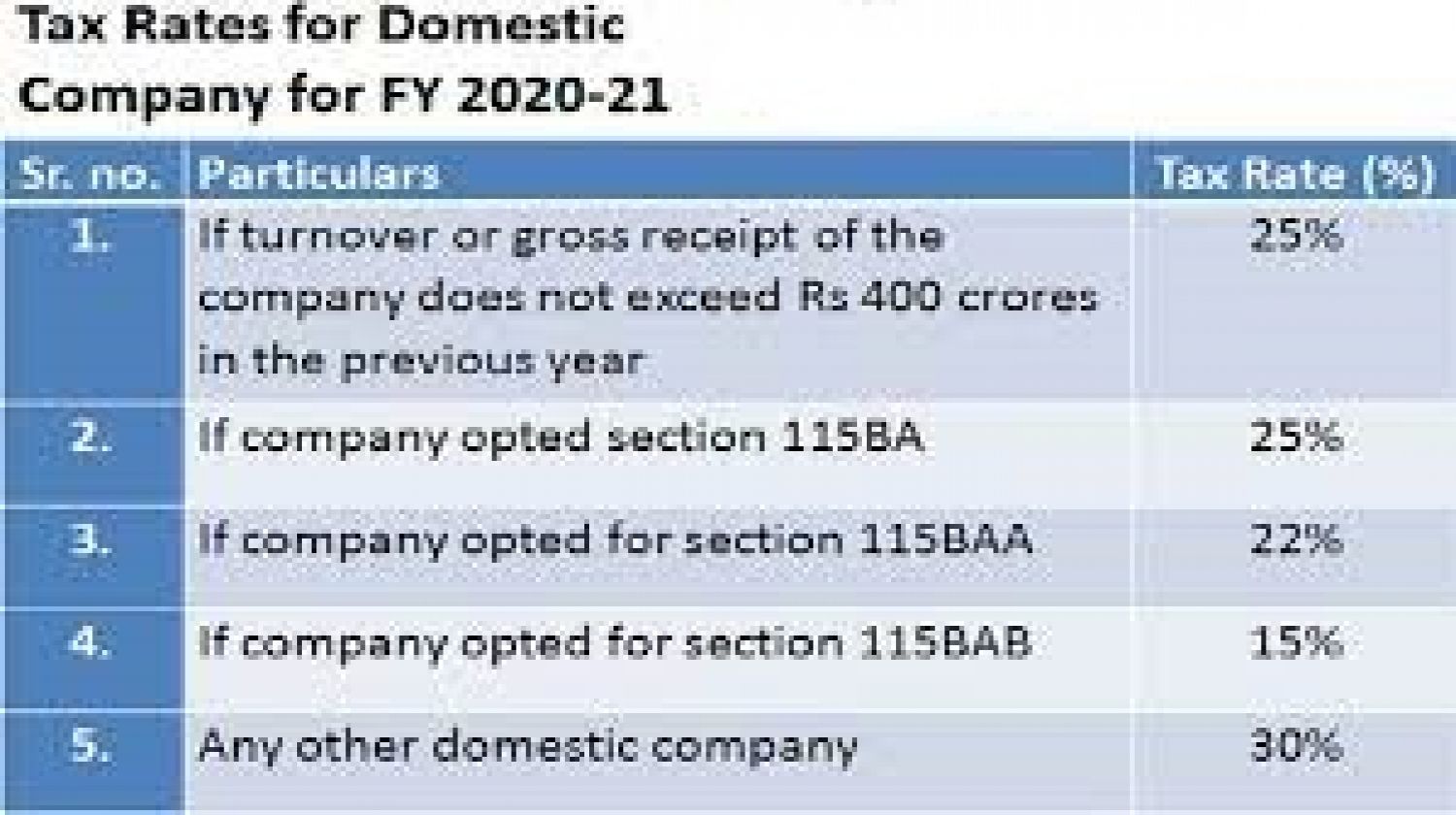

Under this section, newly set up manufacturing companies are provided with a concessional rate of tax. The tax rate is as follows –

- The annual income is subject to a tax @ 22%. In Addition to this, a surcharge of 10 % and cess of 4 % is also levied, thus making the effective tax rate @ 25.168%. This rate does not consider the amount of income earned. It is a flat rate.

- Also, the provisions of MAT are not applicable on such entities i.e., they would not compulsorily pay tax under MAT and then avail credit in further assessment years.

ELIGIBLE ENTITIES SECTION 115BAA

- Such a tax rate is applicable with effect from financial year 2019-20.

- The entities eligible to pay tax under this scheme are domestic companies and exclude foreign companies, LLP and partnership firms.

SECTION 115BAB

A domestic company incorporated on and after 1st October 2019 is eligible to claim a lower tax rate of 15% + 10% surcharge and 4% cess which effectively comes out to be 17.16%.

CONDITIONS OF SECTION 115BAB

- The company seeking such benefit shall be a domestic company and shall exclude any foreign company, LLP and partnership firms.

- The domestic company shall have been incorporated on or after 1st October 2019.

- The company must be in the business of manufacturing or production of an article or thing, and the same shall commence on or before 31st March 2023.

- The company must not be incorporated by means of splitting up or reconstruction of a business already in existence.

- They shall not use any type of second-hand machinery (except imported second-hand machinery) whose total value does not exceed 20% of the value of the total Plant & Machinery used by the company.

- The company shall not be in receipt of any building which was previously used as a Hotel or Convention Centre and for which a deduction under Section 80ID has been allowed.

- The company be in the business of any of the following activities –

- Manufacturing or production of any article.

- Research and development in relation to such manufacturing or production activity.

- Business of providing means for distribution of such articles or things manufactured or produced by it.

RESTRICTIONS ON SECTION 115BAB

The company requiring payment of tax under section 115BAB, are restricted from claiming certain deductions/ exemptions under the Income Tax Act, 1961. These are as follows –

- The company shall not claim the tax holiday for units in Special Economic Zones (Section 10AA)

- Shall not claim additional depreciation on newly purchased assets u/s 32(iia).

- No deduction is claimed for investments u/s 32AD.

- No benefit be claimed u/s 33AB or 33ABA.

- No deduction be made in respect of R&D allowance u/s 35(1), (2AA) (ii)(iii)

- Disallowance for deductions u/s 35AD, 35CCC or 35CCD

- Disallowance for deductions under Chapter VIA section 80JJAA of the Income Tax Act,1961.

NEW AMENDMENT TO SECTION 115JB

The government made some amendments to section 115JB and reduced the tax rate levied under section 115BAB. Therefore, from AY 2020-2021, the rate of tax u/s 115JB will be 15% instead of 18.5%. Additionally, surcharge @10% and cess @4% will also be charged on such a tax rate. Thus, the effective rate comes out to be 17.16%.

However, the domestic companies shall be ineligible to pay tax under section 115JB, if –

- The company is in receipt of any income accruing or arising to a company from life insurance business u/s 115B

- The company has exercised the option referred u/s 115BAA or 115BAB.

PROVISIONS UNDER FINANCE BILL 2020

- Concession tax rate provided under section 115BAB shall be effective from 1st October 2019.

- As per the notification of CBDT, dated 12.02.2020, Form no. 10-ID needs to be submitted by the company requiring to pay tax under section 115BAB and shall authorize the same, electronically under digital signature or electronic verification code. The form needs to be signed and filled by a proper officer of a company on behalf of the company.

- A company shall be ineligible to subsequently withdraw their consent, to pay tax at a concessional tax rate under section 115BAA of the Income Tax Act,1961,

- In case the company violates any of the conditions prescribed for paying tax at a concessional rate, they shall be excluded from such benefit and would result in permanent opting out i.e., they would never ever again be able to reap the benefit under section 115BAA.

SUMMARIZED SCHEME OF CONCESSIONAL TAXATION U/S 115BAA & 115BAB

PARTICULARS |

SECTION 115BA |

SECTION 115BAA |

SECTION 115BAB |

OTHERS |

|

EFFECTIVE DATE |

A.Y. 2017-18 |

A.Y. 2020-21 |

A.Y. 2020-21 |

– |

|

ELIGIBLE ENTITIES |

ALL DOMESTIC COMPANIES ENGAGED IN THE MANUFACTURING AND PRODUCTION OF ARTICLES. |

ALL DOMESTIC COMPANIES |

ALL DOMESTIC COMPANIES ENGAGED IN THE MANUFACTURING AND PRODUCTION OF ARTICLES. |

ALL DOMESTIC COMPANIES |

|

DATE OF INCORPORATION |

INCORPORATED AND COMMENCED ON AND AFTER 1ST MARCH 2016 |

NO SPECIFIC REQUIREMENT |

INCORPORATED ON AND AFTER 1ST OCTOBER 2019 AND COMMENCED ON AND BEFORE 31ST MARCH 2023 |

NO SPECIFIC REQUIREMENT |

|

ALLOWANCE FOR SPECIFIED DEDUCTIONS |

NOT ALLOWED |

NOT ALLOWED |

NOT ALLOWED |

ALLOWED |

|

BASIC RATE OF TAX |

25% |

22% |

15% |

25% IF TURNOVER UP TO RS 400 CRORES, OTHERWISE 30% |

|

SURCHARGE |

7% IF INCOME ABOVE RS 1 CRORE, UP TO RS 10 CRORES. 12% FOR INCOME ABOVE RS 10 CRORES |

10% |

10% |

7% IF INCOME ABOVE RS 1 CRORE, UP TO RS 10 CRORES. 12% FOR INCOME ABOVE RS 10 CRORES |

|

CESS |

4% |

4% |

4% |

4% |

|

MAT APPLICABILITY |

APPLICABLE @ 15% |

NOT APPLICABLE |

NOT APPLICABLE |

APPLICABLE @ 15% |

|

PROVISION FOR SPECIFIED DOMESTIC TRANSACTIONS |

NOT APPLICABLE |

NOT APPLICABLE |

APPLICABLE |

APPLICABLE |

|

RESTRICTION USE OF SECOND-HAND PLANT & MACHINERY/BUILDING USED AS A HOTEL OR CONVENTION CENTRE |

NO SUCH RESTRICTION |

NO SUCH RESTRICTION |

RESTRICTION IS APPLICABLE |

NO SUCH RESTRICTION |

Accordingly, the tax audit report (Form 3CD), transfer pricing report (Form 3CEB), and income tax return Form ITR-6 (applicable to companies) needs to be amended as well. Thus, these reports are required to include, where any company applies for paying tax under section 115BA, 115BAA, or 115BAB. These include:

- FORMS 3CD AND ITR-6 – as per the amendment made, these forms need to include information relating to adjustments made to WDV, brought forward losses, and unabsorbed depreciation under section 115BAA.

- FORM 3CEB – under this form, the amendment provides for including the particulars in respect of specified domestic transactions in the nature of any business transacted between persons referred to in section 115BAB (6).