NGO

BIG BRANDS GAVE THOUSANDS OF CRORES. BUT TO WHOM?

RJA 30 May, 2025

BIG BRANDS GAVE THOUSANDS OF CRORES IN CSR. BUT TO WHOM? INR 17,967 crore was officially spent by companies last year on CSR. And ye A 14-year-old girl in Bihar dropped out because no one taught her about periods. A village in Odisha still has no toilets after 10 years ...

NGO

Form10BB/10B to be Submit by Charitable Trust/Institution Now Changes

RJA 05 Mar, 2023

Form10BB/10B to be Submit by Charitable Trust/Institution Now Changes The Central Board of Direct Taxes has notified the Income-tax (3rd Amendment) Rules, 2023, to amend IT Rules 16CC/17B & Forms 10B/10BB amended which shall be effective as of 01/04/2023, vide Income Tax Notification 7/2023 Amended in 2023, So ...

NGO

Documents to be maintenance by NGO or Trust as per New Rule 17AA

RJA 01 Nov, 2022

NGO’s Books of account & other documents to be kept and maintained- New IT Rule 17AA Central Board of Direct Taxes established new rule 17AA via income tax Notification No. 94/2022 dated August 10, 2022, which specifies the books of account and other documents that must be kept by each ...

NGO

NGOs Receipt of foreign grants & its Utilizations Provisions

RJA 20 Jan, 2022

NGO’s accepts foreign grants & its Utilisation Provisions under Income Tax & FCRA Act Legality of foreign donations/Grants and its Utilisation of the for charitable purpose Provisions under Income Tax & FCRA Act. We hereby giving some applicable provisions of Income Tax Act 1961 and FCR Act 2010,for ...

NGO

How to register under section 12A online

RJA 13 Jan, 2022

How to register under section 12A online Section 12A Registration As per section 12A of Income Tax Act, 1961, all the NGOs, being registered as a Trust, or Section 8 Company, or a Society, can obtain registration under this section, in order to avail exemption from payment of income tax. Thus, the ...

NGO

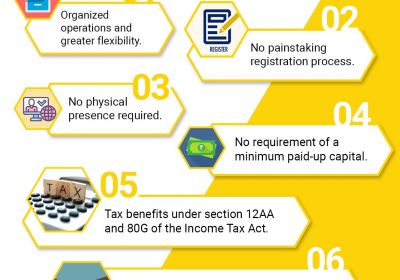

All about the Registration of a section 8 company in India

RJA 13 Jan, 2022

All about the Registration of a section 8 company in India Section 8 Company Registration: NGO can be registered via Section 8 company, which is incorporated under Companies Act, 2013. Such companies work towards charity, religion, trade etc. Benefits of Registration section 8 Company In india No minimum capital requirement in ...

NGO

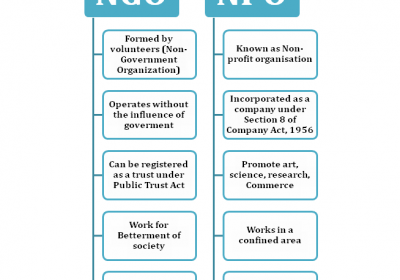

All About Non-Governmental Organization

RJA 13 Jan, 2022

All About Non-Governmental Organization Brief Introduction Non Governmental Organizations, commonly known as NGO’s, work for the benefit of society. These organizations fight for and against the evils of the society and strive to work for creation of a better world and hence help in protecting the rights of ...

NGO

All about the Trust Registration and Society Registration

RJA 13 Jan, 2022

All about the Trust Registration and Society Registration Trust Registration: Trust can be one of the form of Non-Governmental Organization that can be registered in India. These NGO’s work towards the eradication of poverty, and also provide help in the form of education and medical relief. Such ...

NGO

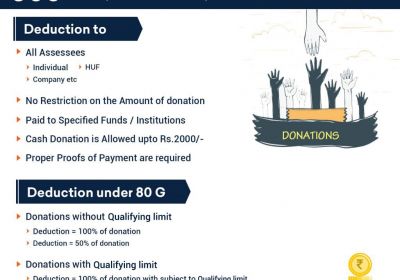

What does Section 80G for NGO?

RJA 18 Dec, 2021

What does Section 80G for NGO? The contributor of a non-profit organization can benefit from Section 80G of the Income Tax Act. The donor receives financial advantages that are included in his taxable income. Required conditions section 80G (5) Registration. The NGO should not have any non-exempt revenue, such as ...

NGO

FAQ's on NGO's Tax benefits & Tax Incentives

RJA 29 Sep, 2021

FAQ's on NGO's Tax benifits & Tax Incentives Q.: What is the difference between Section 12A and Section 12AA? Everything you need to know about Sections 12A and 12AA If certain circumstances are met, a trust, society, or section 8 company can apply for registration under Section 12A of ...

NGO

FAQs ON SECTION 12AB & 80G REGISTRATION

RJA 15 Jul, 2021

Q.: What is Section 12A & Section 12AA? Ans. All you would like to grasp about the Section 12A & Section 12AA Trust, Society and Section 8 Company can seek registration Under Section 12A of income tax Act to assert exemption under income ...

NGO

Non-Government organisation Management

RJA 25 Sep, 2020

NGO Management NGOs are a non-governmental organization which works independently of government or international organizations. The NGO structure varies considerably, with the improvement in communications, the grass-root organizations (locally based groups) and the community-based organizations have become increasingly active at the global network. NGO Management Services in Delhi NGOs play ...

NGO

DOCUMENTS REQUIRED FOR REGISTRATION U/S 12A; 80G; AND TRUST REGISTRATION

RJA 06 Sep, 2020

NGO REGISTRATION AND 80G/12AA REGISTRATION REQUIRED Rajput Jain & Associates are an organization providing consultancy services as well as u/s 12AA and 80G registration Compliance under Income tax. We confirm our willingness to undertake the below assignment. FOR TRUST REGISTRATION: BEFORE YOU REGISTER YOUR TRUST ...