Table of Contents

- Frequently Asked Questions (faq) On Udin Issued By The Income Tax Department

- What Would Be Regarded As The Date Of Submission Of The Form By The Taxpayer In The Event That Udin Is Revoked? :

- How Do I Fix An Error In A Form Where Udin Has Not Been Updated? :

- Timeline Of Updating Of Udins At E-filing Portal : Icai

Frequently asked questions (FAQ) on UDIN issued by the income tax department

- The Institute of Chartered Accountants of India has been pioneering in the construct of a unique idea called 'Unique Document Identification Number (UDIN)' after finding false certifications by Non - Chartered Accountants’ that have been misrepresented as Chartered Accountants, which have to mislead the authorities and stakeholders.

- Unique Document Identification Number (UDIN) is Eighteen —Digitsystem developed a unique number to be produced by Full-Time Practice Chartered Accountants for each documentation certified/certified by themselves.

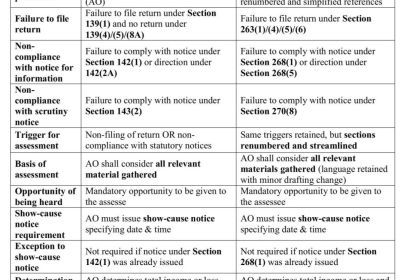

The Council of ICAI has agreed that UDIN should be made obligatory in a staggered manner as set out in the following schedule:

- In all Chartered Accountants Certificates w.e.f. 1st February 2019;

- In all other Chartered Accountants Audit, Assurance & Attestation functions w.e.f. 1st July 2019.

- In all GST and Tax Audit Reports w.e.f. 1st April 2019;

It's also been explained that UDIN is mandatory to submit the audit report and the CA certification forms to the e-filing platform.

Is it mandatory to submit the form without even a quote from UDIN? : Surely it is better if the UDIN for the form has not been created and the CA wants to upload it without UDIN. However, within fifteen calendar days of the submission, the UDIN created for the form should be modified to prevent the uploaded form from being regarded as null. It has also been explained that if a UDIN for the form has not been produced, it can still be referenced and if the CA wants to upload the same without UDIN. But in 15 calendar days of the upload, the UDIN generated for the form should be updated to prevent the uploaded form from being viewed as null and void.

What happens to the form submitted to UDIN by the CA and not approved by the taxpayer? : The form submitted will not be regarded as a legitimate submission by the taxpayer until it has been approved by the taxpayer.

What would be deemed to be the date of submission of the form by the taxpayer? : The date on which the form is submitted by the taxpayer will be the date on which the taxpayer approves the form submitted by the CA or the date on which the CA issued the UDIN, whatever happens later as the case may be.

- As well as another question about A form has been uploaded with a valid UDIN. But the status of UDIN indicates 'Update UDIN.' What does this mean to you? “. The response is that as long as the Taxpayer has not approved the submitted form, the Chartered Accountants will be able to change the UDIN.

- The Tax Department also answered a question about “On providing Unique Document Identification Number, the form submission page does not get opened. What to do?“. The response is one of the reasons that the Unique Document Identification Number validation process may take longer. You can delete the Unique Document Identification Number & proceed to the upload of the form and later update the UDIN form within fifteen days of its uploading.

- To check the UDIN in case the form is submitted without UDIN-the 'View/Update UDIN info' link will be available in the My Account tab. Users must click the link and be redirected to 'View/Update UDIN information' for any further action.

- It has also been explained that in the event of a mistake having been found after the form has been updated, please make sure that the taxpayer does not approve the form that has been uploaded. Upload the corrected form to the very same UDIN and confirm that the taxpayer recognises the corrected form.

What would be regarded as the date of submission of the form by the taxpayer in the event that UDIN is revoked? :

- In the event that UDIN is withdrawn after it has been approved by the taxpayer and that a new form with fresh UDIN is submitted, the date on which the taxpayer approves the revised uploaded form will be regarded as the date of submission. If an error or mistake in the form of attachment has been found after the taxpayer has approved a form linked to a valid UDIN, the procedure is only to amend the form with a fresh UDIN created by revoking the previously generated UDIN of the submitted form.

How do I fix an error in a form where UDIN has not been updated? :

- In the event that a mistake has been found after the form has been submitted, ensure that the taxpayer does not approve the form that has been uploaded. Re-upload the corrected form with the same UDIN and confirm that the taxpayer accepts the corrected form. In the circumstance that the UDIN of the form is revoked after it has been approved by the taxpayer, the form submitted with that UDIN will be considered null on the date on which the UDIN is revoked with appropriate consequences of the legislation.

- The Tax Department also addressed the query about either the status 'Consumed' and 'Unconsumed' under ' Unique Document Identification Number (UDIN) status.'

- The response is Consumed status implies that the form submitted by the Chartered Accountants with the UDIN has been approved by the taxpayer and that the Unique Document Identification Number (UDIN) linked to the form cannot be used to upload another form or to amend or correct the form already uploaded without its revocation. And the Unconsumed status means that the form uploaded by the Chartered Accountants with the Unique Document Identification Number (UDIN) has been declined by the taxpayer and that the form can be re-uploaded to use the same Unique Document Identification Number (UDIN).

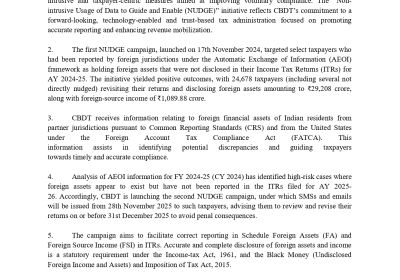

Compulsory validation of UDIN in all Tax filings

- Please keep in mind that The Central Board of Direct Tax will validate the UDIN created from the Institute of Chartered Accountants of India website portal while uploading the Tax Audit and other Tax Form/Reports under the income tax act as per their press release.

Tax audit reports/forms submitted to and from 27 November 2020 on the e-filing site.

- Tax reports/forms will only be accurate if their Unique Document Identification Numbers have been checked by the Central Board of Direct Tax E-filing portal. In order to do so, Chartered accountants would have a grace time of Fifteen days to upgrade their UDIN on the e-filing portal in addition to offering the same instantly.

Unique Document Identification Number is verified by the online e-filing portal with the Unique Document Identification Number Institute of Chartered Accountants of India portal for three parameters:

- Unique Document Identification Number

- Tax Form Number

- ICAI Membership No

Thus the form numbered picked on the Unique Document Identification Number web portal while creating Unique Document Identification Number, the very same form number must also be selected on the e-filing portal while updating Unique Document Identification Number at the time of submission of reports or within fifteen days thereafter. ICAI Members are therefore requested to ensure that the correct Form Number is selected from the Unique Document Identification Number web Portal drop-down column. For necessary action, the list of online IT forms available at Drop Down on the Unique Document Identification Number web Portal underneath the GST and Tax Audit categories can be displayed below.

Tax audit reports/forms were submitted to the e-filing portal around April 27, 2020, and November 26, 2020.

- The Central Board of Direct Tax has come out with this feature of listing UDIN in IT Forms on the e-filing portal since April 27, 2020. It is noted that some members may have created UDIN for IT Forms well in time, but somehow they missed updating the same with the e-filing portal.

- On the advice of ICAI, The Central Board of Direct Tax granted a one-time relaxation by enabling them to update UDINs for forms no later than 31 December 2020 in order to treat these forms as legitimate. In view of the same, certain members are requested to update the UDINs on the e-filing portal at the earliest but not later than 31 December 2020 for all such IT forms that have been submitted from 27 April 2020 to 26 November 2020.

- In light of the fact that the IT Form will now be considered as Legitimate by e-filing only if the Unique Document Identification Number is validated and the taxpayer has accepted the form, it is suggested that ICAI Members prepare to request tax audit reports without waiting for the last date in order to prevent any last-minute difficulties.

- ICAI Members should again be kind enough to remember that the Form/Tax Audit Report for which no valid UDIN has been revised within the time period of 15 days will now be considered invalid. For details, FAQ refer

Timeline of updating of UDINs at e-filing Portal : ICAI

- UDIN Directorate : CBDT has extended the Timeline for updating Unique Document Identification Number (UDIN) for Practicing Chartered Accountants for all the Income tax forms at the e-filing portal to 30.04.2022.