Table of Contents

Avoid Mistakes While submitting ITR’s For AY24

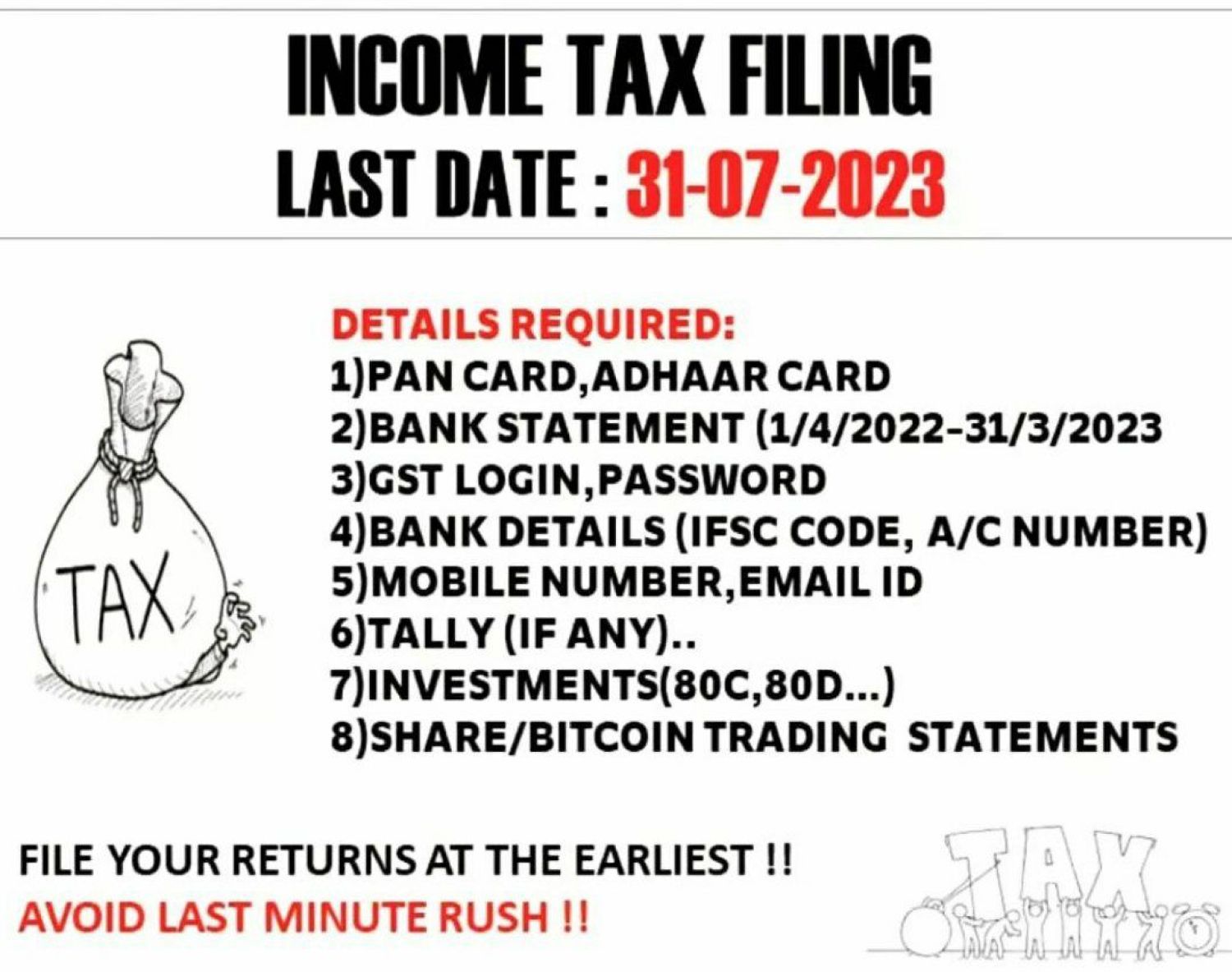

Despite the fact that ITR e-filing has been enabled, Income tax taxpayers are able to start filing their income tax returns for FY 2022-23 (or AY 2023-24). If you are doing the ITR on your own, there are a few pitfalls to avoid in order to file an appropriate income tax return. It Now 7,55,412 returns for AY 2023-24 have been filed. The deadline for filing income tax returns for fiscal year 2022-23 for those who do not need their accounts examined is July 31 2023.

Don’t Pick the Wrong Income Tax return Form

One of most common errors that filers make is selecting the incorrect Income Tax Form. It is critical to file details on the correct form, whether you file online or offline. Taxpayers employ seven different sorts of forms to file their returns. ITR-1 can be filed by an individual earning up to Rs 50 lakh and receiving income from salary, one house property, and income tax other sources including interest. ITR-4 can be filed by HUFs (Hindu Undivided Families), individuals, and firms earning up to INR 50,00,000/- and earning income from profession and business.

While ITR-2 is done by persons who earn more than Rs 50 lakh from residential property, ITR-3 is filed by professionals & business. Professionals file ITR-3. ITR-5 and ITR-6 are filed by LLPs, whereas ITR-7 is for taxpayers such as charitable or religious trusts, political parties, research associations, news agencies, or other organisations defined in the Act. Before picking up the form, verify your eligibility criteria.

Not Reporting All Income Sources

You must report all sources of income on your income tax return. If you do not record all of your income sources, the income tax department will most likely consider it a breach of the Income Tax Act and will send you a warning. Aside from salary, most individuals have other sources of income, such as interest collected on bank savings accounts. If you have changed jobs, you must declare money earned via both employers. If you have any investment income in your child's name, you must include it on your income tax filings.

Not Disclosing Your Assets

Individual taxpayers are required by law to include certain assets on their income tax returns. You must submit a description of the item, its address, and the cost of such property if you hold immovable assets such as land and buildings.

Mistakes in Claiming Deductions Under Section 80C

Many people believe that an employer's contribution to the Employee Provident Fund (EPF) must be considered when claiming Section 80C benefits. It is not correct. Similarly, only the principal repaid on a mortgage qualifies under Section 80C. Many other deductions are claimed under the incorrect headings, resulting in their rejection. Please verify your form before submitting it.

The discrepancy in TDS Details

No of insurance, fixed deposits (FDs) & other savings schemes like Public Provident Fund. You required to report all such income, even if it is income tax-free.

Many of us submit ITR returns without verifying the Form-26 AS credit of tax deducted at source held with the Income tax Dept. If your employer or anybody else who has deducted tax deducted at source fails to deposit it with the I-T department or fails to provide your permanent account number correctly on Form-26 AS, you will be in default. Check if the credit for tax deducted at source deducted is mentioned on Form-26 AS. If there is a mismatch, fix it as soon as possible.

Log in to your account on the e-filing website, https://www.incometax.gov.in/iec/foportal/, to download your Form-26AS.. Once logged in, go to the 'My Account' tab and select 'View 26AS (Tax Credit)'. The Income tax webpage will take you to the TRACES website where you may obtain the form.