Table of Contents

Income/Assets Transferred to Spouse Taxable In the Hands of Transferor Spouse

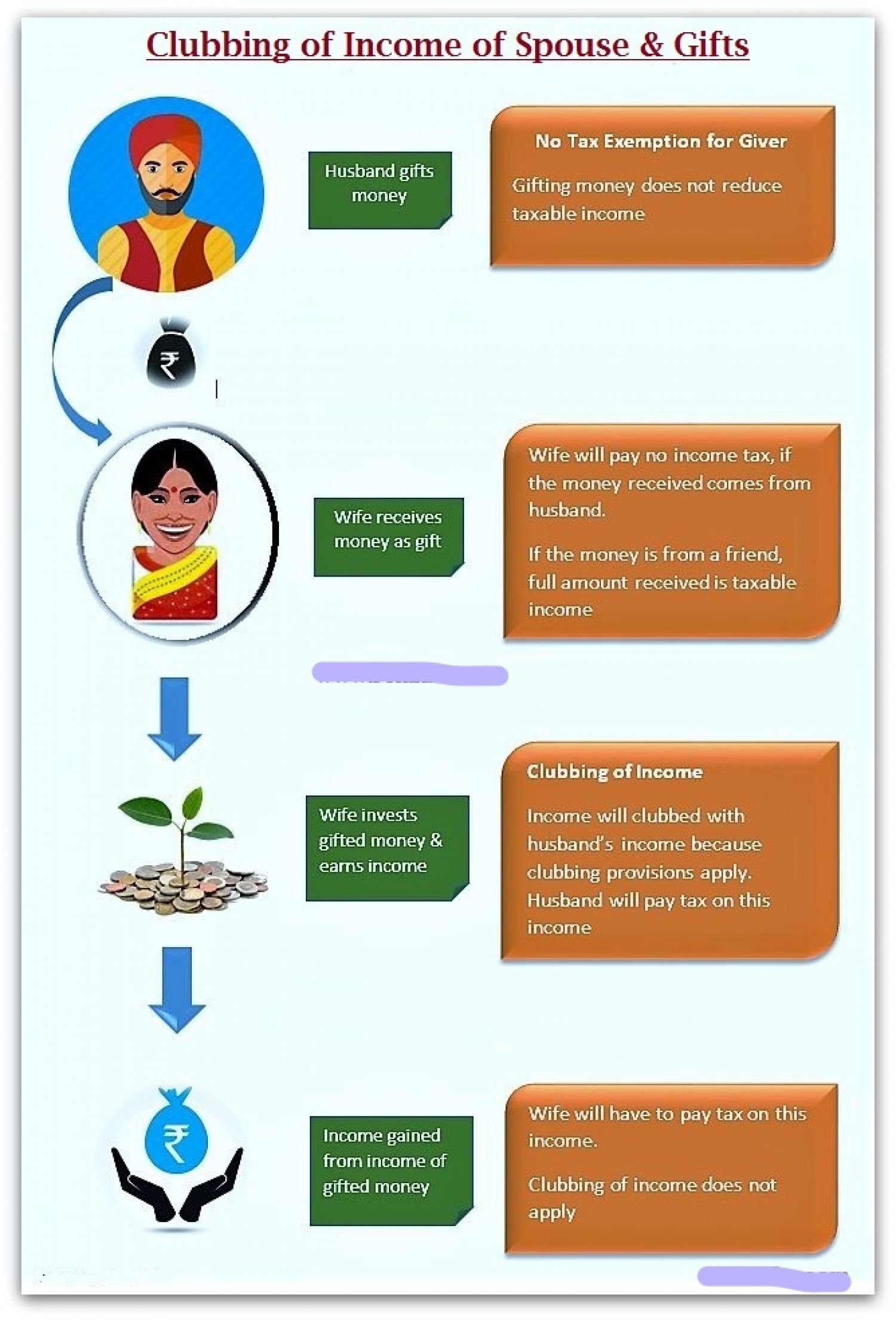

In India there is normal practice to buy/transfer properties under the name of a woman, for example, acquisition of real estate under the name of a wife, buying jewelry or stock under the name of a wife, etc. this is happening due to different reasons, for example in the case of women, the specified stump duty rate is lower. While other justified reasons for buying the properties in the name of the wife may be happening, another additional ulterior motive remains, i.e. Tax Avoidance.

To reduce those circumstances, which may lead to tax evasion/reduction (by the use of a woman's free hand salary exemption slab), rules for safeguarding income are included in the tax laws. Therefore the following provisions are very relevant to one know:

- As stated in the Income Tax Act, where a property or earnings are passed to the spouse without proper consideration, the income or earnings from that property are included in the possession of a transferor spouse for the purpose of income tax calculation. The exception to this provision is where assets in conjunction with a living apart relationship have been passed.

- Similarly, according to the Income Tax Act, whether a partner receives income from a business in which the other spouse has a 20% or greater interest. The only exception to this provision is where the partner earns their salary as a result of a scientific or vocational degree.

- According to the Wealth Tax Act, an estate that is passed to a partner without adequate regard is counted in the transferor spouse's net wealth when calculating wealth tax.

Therefore, in short, the argument should be made that even though assets are acquired in the spouse's name (e.g. wife) for the sake of stamping duties or for any legitimate reasons they should be included in the possession of a spouse whose funds were involved in purchasing the assets for tax calculation purposes. For instance, if a husband purchases an immovable property with his wife or merely on the basis of the name of his wife (in order to safeguard stamp duty), the same shall be included in the husband's hands to calculate the income tax or wealth tax. Even, if such deposits are made from husband's assets by a woman, the husband's tax calculation interest income from these deposits should be added.

The following table showing applicable Tax Provisions related to Clubbing of income

Under Section |

Transaction Nature |

Applicable Clubbed In The

|

Relevant Reference |

Exceptions/ Conditions

|

|

|

U/S 64(1)(ii) |

Salary, Commission, Fees or remuneration paid to spouse from a concern in which an individual has a substantial* interest. |

Spouse whose total income (excluding income to be clubbed) is greater. |

1. Income other than salary,

2. The relationship of husband and wife must subsist at the time of accrual of the income. [Philip John Plasket Thomas 49 ITR 97 (SC)]

|

Clubbing not applicable if: Spouse possesses technical or professional qualification and remuneration is solely attributable to the application of that knowledge/ qualification. |

|

|

U/S 61 |

Revocable transfer of Assets. |

Transferor who transfers the Assets. |

Transfer held as revocable 1. If there is provision to re-transfer directly or indirectly whole/part of income/asset to transferor; 2. If there is a right to reassume power, directly or indirectly, the transfer is held revocable and actual exercise is not necessary. 3. Where no absolute right is |

In the below case Clubbing not applicable if: 1. Transfer made prior to 1-4-1961 and not revocable for a period of 6 years. Provided the transferor derives no direct or indirect benefit from such income in either case. 2. Trust/ transfer irrevocable during the lifetime of beneficiaries/ transferee or

|

|

|

U/S 64(2) |

Income of HUF from property converted by the individual into HUF property. |

Income is included in the hands of individual & not in the hands of HUF. |

Fiction under this section must |

Clubbing applicable even if: |

|

|

U/S 64(1A) |

Income of a minor child [Child includes step child, adopted child and minor married daughter]. |

1. If the marriage does not subsist, in the hands of the person who maintains the minor child.

2. If the marriage subsists, in the hands of the parent whose total income is greater; or;

3. Income once included in the total income of either of parents, it shall continue to be included in the hands of some parent in the subsequent year unless AO is satisfied that it is necessary to do so (after giving that parent opportunity of being heard) |

1. The parent in whose hands 2. Income out of property transferred for no consideration to a minor

|

In the below case Clubbing not applicable for:— . 1. Income on account of any activity involving application of skills, talent or specialized knowledge and experience. 2.Income on account of manual work done by the minor child.

3. Income of a minor child suffering any disability specified u/s. 80U |

|

|

U/S 64(1)(iv) |

Income from assets transferred directly or indirectly to the spouse without adequate consideration. |

Individual transferring the asset. |

1. Income earned out of Income arising from transferred assets not liable for clubbed. 2. Transaction must be real. 3. Cash gifted to spouse and 4. Capital gain on sale of

|

Clubbing not applicable if, The assets are transferred; 1. With an agreement to live apart. 2. Before marriage. 3. Income earned when relation does not exist. 4. By Karta of HUF gifting co-parcenary property to his wife. 5. Property acquired out of pin money. [R.B.N.J. Naidu vs. CIT 29 ITR 194 (Nag.)] |

|

|

U/S 64(1)(vi) |

Income from the assets transferred to son’s wife. |

Individual transferring the Asset. |

Cross transfers are also covered |

Condition: |

|

|

U/S 60 |

Transfer of Income without transfer of Assets. |

Transferor who transfers the income. |

1. Section 60 does not apply 2. Income for the purpose of Section 64 includes losses. [P. Doriswamy Chetty 183 ITR 559 (SC)] [also see Expl. (2) to Section 64]

|

Irrespective of: 2. Whether such transfer is revocable or not. |

|

|

|

|

|

|

|

|

|

U/S 64(1)(vii),(viii) |

Transfer of assets by an individual to a person or AOP for the immediate or deferred benefit of his: |

Individual transferring the Asset. |

1. Transferor need not necessarily have taxable |

Condition: 1. The transfer should be without adequate consideration. |

|

* An individual shall be deemed to have a substantial interest in a concern for the purpose of Section 64(1)(ii)

|

IF THE CONCERN IS OTHER THAN A COMPANY |

IF COMPANY IN CONCERN |

|

A person either himself or jointly with his relatives is entitled in aggregate to not less than 20% of the profits of such concern, at any time during the previous year. |

A person’s beneficial shareholding should not be less than 20% of voting power either individually or jointly with relatives at any time during the Previous Year. (Shares with a fixed rate of dividend shall not be considered) |

Note: Here another significant argument is that the saving made by a woman from pin money (i.e. StriDhan) does not form part of the husband's profits. Similarly, non-working women can have their parents/relatives' receipts, etc. In light of this, it is extremely necessary for women to construct their receipts/income annually by keeping a record of receipts/income, submitting ITR annually, maintaining their funds on the bank accounts, etc. According to the Income-tax Provision, the clubbed income retains the same income head under which it is earned.