COMPANY LAW

Tax & Compliance Due Dates – January 2025

RJA 31 Jan, 2025

Tax & Compliance Due Dates – January 2025 Description Due Date TDS/TCS Payments 07-Jan-2025 Monthly GSTR-7 & GSTR-8 10-Jan-2025 Monthly GSTR-1 11-Jan-2025 Quarterly GSTR-1IFF (QRMP) 13-Jan-2025 Monthly GSTR-6 & GSTR-5 13-Jan-2025 GSTR-2B Download (for Reconciliation with GSTR-3B) 14-Jan-2025 TCS Return (Q3: Oct - Dec 2024) 15-Jan-2025 Belated/Revised ...

COMPANY LAW

Complete Guide on ROC Filing of Form MSME- 1

RJA 12 May, 2024

Guide on ROC Form MSME -1 : Filling Objective, Timeline Date & Penalty ROC Filing of Form MSME-1 is a statutory requirement under the Companies Act, 2013, & the Specified Companies (Furnishing of Information about payment to Micro and Small Enterprise Suppliers) Order, 2019. MSME Form 1, as mandated by the Ministry of Corporate ...

COMPANY LAW

MCA : PAS Rules -Pvt Ltd Co. to issue shares etc in Demat form only

RJA 12 May, 2024

MCA has notified amendments to PAS Rules - Pvt Ltd Co. to issue shares etc in Demat form only, MCA bring significant changes to the regulatory framework for private companies in India, especially concerning the issuance and holding of securities in dematerialized form. Private companies, excluding small companies, are now ...

COMPANY LAW

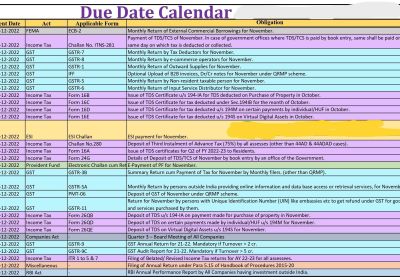

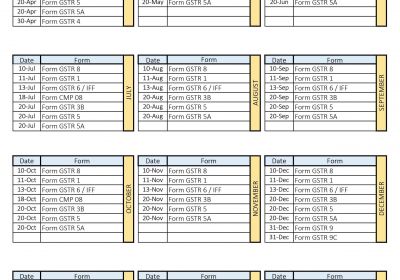

Statutory & Tax Compliance Calendar for December 2023

RJA 01 Dec, 2023

Statutory & Tax Compliance Calendar for December 2023 S. No. Statue Purpose Compliance Period Due Date Compliance Details 1. Goods and Services Tax GSTR-7- Tax Deducted at Source Return under Goods and Services Tax Nov-23 10-Dec-23 GSTR 7 is a return to be filed by the persons who is required to deduct ...

COMPANY LAW

Taxation & Statutory Compliance Calendar for Sept 2023

RJA 07 Sep, 2023

Taxation & Statutory Compliance Calendar for Sept 2023 Important dates in Sept 2023 for compliance under GST & Income tax & Other Law S. No. Statue Purpose Compliance Period Due Date Compliance Details 1 Income Tax Tax Deducted at Source / Tax Collected at Source Liability Deposit Aug-23 7-Sep-23 Timeline ...

COMPANY LAW

Taxation & Statutory Compliance Calendar for July 2023

RJA 01 Jul, 2023

Taxation & Statutory Compliance Calendar for July 2023 Important dates in July 2023 for compliance under GST & Income tax & Other Law S. No. Under Law Purpose of compliance Period of Compliance TimeLine Date Details of Compliance 1 Income Tax Tax Collected at Source or Tax deducted at Source ...

COMPANY LAW

Tax & Statutory Compliance Calendar for June 2023

RJA 01 Jun, 2023

Tax & Statutory Compliance Calendar for June 2023 S. No. Statue Purpose Compliance Details Compliance Period Due Date 1 Income Tax Tax deduction at source / Tax collected at source Liability Deposit TimeLine date of depositing Tax deduction at source / Tax collected at source liabilities for the previous month. May-2023 7-Jun-23 2 Income Tax ...

COMPANY LAW

Tax and Statutory Compliance Calendar for May 2023

RJA 02 May, 2023

Tax and Statutory Compliance Calendar for May 2023 S. No. Under the law Objective Period of Compliance Timeline Date Details of Compliance 1 Goods and services Tax Act GSTR - 3B April 2023 20-May-23 1. Goods and services Tax Filing of returns by registered person with aggregate turnover exceeding Rs. 5 Cr. during Last ...

COMPANY LAW

Tax & Statutory Compliance Calendar for February 2023

RJA 03 Feb, 2023

Tax & Statutory Compliance Calendar for February 2023 S. No. Statue Objective of compliance Period of Compliance Timeline Particular of Compliance 1 Labour Law PF / Employees' State Insurance Scheme January 2023 15- February -2023 Timeline for payment of Provident fund and Employees' State Insurance Scheme contribution for the previous month. 2 Goods and Services ...

COMPANY LAW

Tax & Statutory Compliance Calendar for January 2023

RJA 29 Jan, 2023

Tax & Statutory Compliance Calendar for January 2023 S. No. Statue Purpose Compliance Period Timeline Date Compliance Details 1 Under Goods and Services Tax GSTR-1- Quarterly Returns with Monthly Payment October -December, 2022 13- January 2023 GSTR-1 of registered person with turnover less than INR 5 Crores during the preceding year and who has ...

COMPANY LAW

Tax and Statutory Compliance Calendar for December 2022

RJA 01 Dec, 2022

Tax and Statutory Compliance Calendar for December 2022 S. No. Statue Purpose Timeline & Compliance Period Due Date Compliance Details 1 Income Tax Tax deducted at sources / Tax collected at source Liability Deposit November -2022 7-December-2022 Timeline of depositing Tax deducted at sources / Tax collected at source liabilities under the ...

COMPANY LAW

Tax & Statutory Compliance Calendar for Nov 2022

RJA 01 Nov, 2022

Tax & Statutory Compliance Calendar for Nov 2022 S. No. Statue Purpose Compliance Period Deadline Compliance Details 1 Income Tax tax deducted at source Certificate October -22 14- November -22 Deadline for issue of tax deducted at source Certificate for tax deducted U/s 194-IB, 194-IA, & 194M in ...

COMPANY LAW

Tax & Statutory Compliance Calendar for Oct 2022

RJA 30 Sep, 2022

Tax & Statutory Compliance Calendar for Oct 2022 S. No. Statue Purpose Compliance Period Due Date Compliance Details 1 Goods and Services Tax GSTR -5 Sep-2022 20-Oct-22 GSTR-5 is to be filed by a Non-Resident Taxable Person for the previous month. 2 Goods and Services Tax GSTR-7- TDS ...

COMPANY LAW

What is Change in threshold limit of small company definition?

RJA 16 Sep, 2022

What is Change in threshold limit of small company definition? Small Company many advantages over mediam & large companies, a small business promotes entrepreneurship, employment, and jobs while also being simpler to manage. Change in definition of a Small Company via Increased paid-up share capital & turnover ...

COMPANY LAW

Tax & Statutory Compliance Calendar for Sept. 2022

RJA 01 Sep, 2022

Tax & Statutory Compliance Calendar for Sept. 2022 S. No. Statue Purpose Compliance Period Due Date Compliance Details 1. Goods and Services Tax. GST Form No GSTR -7 Tax Deducted At Source return under GST August-2022 10-Sep-22 GSTR-7 is a return to be filed by the persons who are required ...

COMPANY LAW

Physical Verification of the Registered Office of the Company By ROC

RJA 19 Aug, 2022

MCA Amends Incorporation Rules: ROC has to prepare a Physical Verification Report of the Registered Office of the company in the given format. {MCA notifies Companies (Incorporation) Third Amendment Rules,2022.} A Registrar of Companies (RoC) is allowed under Section 12 of the Act to physically inspect a company's registered office ...

COMPANY LAW

Tax & Statutory Compliance Calendar for the Month of August 2022

RJA 01 Aug, 2022

Tax & Statutory Compliance Calendar for the Month of August 2022 S. No. Statue Purpose Compliance Period Month Compliance particular Timeline 1 Goods and services Tax Compliance GSTR - 3B July-22 1. Goods and services Tax Filing of returns by a registered person with aggregate turnover exceeding Rs. 5 Crores during the preceding year. 2. ...

COMPANY LAW

Appointment Auditor or Resignation, Intimation & Related Formalities

RJA 18 Jun, 2022

Appointment Auditor or Resignation, Intimation & Related Formalities in Company Act 2013 All registered companies, whether they are a one-person corporation, or a limited company or a private limited company are required to keep a proper book of accounts and have them audited. As a result, following the incorporation of ...

COMPANY LAW

MHA Clearance required for Chinese nationals' appointment as directors

RJA 10 Jun, 2022

MHA's latest notification aims to restrict the backdoor entry of Chinese companies or investors into India The Govt of India has issued a notification requiring nationals of land border-sharing nations who are appointed as directors on boards of corporations to receive a security clearance in order to prevent Chinese ...

COMPANY LAW

GST Compliance Calendar for the Month of June 2022

RJA 01 Jun, 2022

Key Dates for GST compliance in the month of June 2022. A lot of responsibilities and duties come while we are running and operating a successful business. As a law-abiding citizen, we must observe the government's rules and regulations in India, there are a slew of regulations that a ...

COMPANY LAW

Tax Compliance & Statutory Calendar for May 2022

RJA 02 May, 2022

Statutory and Tax Compliance Calendar for May 2022 S. No. Statue Purpose Compliance Period Due Date Compliance Details 1 Labour Law PF/ ESI Apr-22 15-May-22 Timeline for payment of PF & ESI contribution for the previous month. 2 Goods and Services Tax GSTR -7 TDS return under GST Apr-22 11-May-22 GSTR 7 is a ...

COMPANY LAW

Strict Compliance - Documents Related to formation of Company or LLP

RJA 28 Apr, 2022

Strict Compliance - about the Verification/ Clarification of Documents Related to the Incorporation of a Company or an LLP by Practicing Professionals. - ICAI made and warn for Strict Compliance - about the Verification/ Clarification of Documents Related to the Incorporation of a Company or an LLP by Practicing Professionals ...

COMPANY LAW

Compulsory audit trail in company accounting postponed to FY on 01.04.2023.onwards

RJA 28 Apr, 2022

The requirement for a compulsory audit trail in company accounting software has been postponed to the financial year commencing April 1, 2023. The requirement for a mandatory audit trail in corporate accounting system has been postponed until the fiscal year that begins on or after April 1, 2023. MCA Notifications should be read. The ...

COMPANY LAW

4 more CA, CS & directors have been fraud charged under Co. Act

RJA 26 Apr, 2022

FOUR MORE CHARTERED ACCOUNTANTS, COMPANY SECRETARIES, AND DIRECTORS HAVE BEEN CHARGED WITH ALLEGED FRAUD UNDER THE COMPANIES ACT. MUMBAI: The Economic Offences Wing has filed four new FIRs for alleged fraud under the Companies Act against seven Chinese nationals, several chartered accountants, company secretaries, and directors of Indian companies. ...

COMPANY LAW

Statutory & Tax Compliance Calendar for April 2022

RJA 01 Apr, 2022

Taxation & Statutory Compliance for April 2022 S. No. Statue Purpose Compliance Period Timeline Compliance Details 1 Labour Law Compliance PF / ESI Return March-2022 15- April-2022 Timeline for payment of PF & ESI contribution for the Last month. 2 Goods and services Tax Compliance GSTR -7 TDS return under GST March-2022 10- ...

COMPANY LAW

Ministry of Corporate Affairs issue Companies (Accounts) Amendment Rules, 2022.

RJA 12 Feb, 2022

Ministry of Corporate Affairs has issued Companies (Accounts) Amendment Rules, 2022 (1) New ROC e-Form CSR-2 has been introduced By MCA. (2) They shall come into force on the date of their publication in the Official Gazette. The Ministry of Corporate Affairs Notification dated 11 feb 2022 All the company covered under provisions section 135(1) ...

COMPANY LAW

Roc Compliance Calendar for LLP & Companies.

RJA 06 Feb, 2022

Roc Compliance Calendar for LLP & Companies. The Registrar of Companies is an office within the Ministry of Corporate Affairs whose primary responsibility is to ensure that companies and limited liability partnerships (LLPs) in India comply with the Companies Act and its related laws. Although incorporating a Company or Limited ...

COMPANY LAW

Tax & Statutory Compliance Calendar for January 2022

RJA 02 Jan, 2022

What are the Tax & Statutory Compliance Calendar for January 2022 S. No. Statue under Purpose Under the Compliance Period Due Date- Timeline Details of compliance 1 Goods and Services Tax GSTR-1 Dec-21 11-Jan-22 "1. GST Filing of returns by GST registered person with aggregate turnover exceeding Rs. 5 Crores during preceeding ...

COMPANY LAW

Impact of Disqualification by MCA on a Director�s Career

RJA 21 Dec, 2021

What is the impact of Disqualification by MCA on a Director’s Career If you are a company director, you should be aware of the provisions of the Companies Act 2013, which could result in your directorship being suspended for 5 Years. If a firm fails to file its financial statements ...

COMPANY LAW

Issues & suggestions in Consultation paper issued by the NFRA

RJA 24 Oct, 2021

Issues & suggestions in Consultation paper issued by the NFRA In Paragraph 1.2 of the Consultation paper dated 29.09.2021, it has been said that “As per view of significant role played by Corporates in India in Economic development & growth of the India, it is required that the regulatory environment of ...

COMPANY LAW

FAQ�s on Winding Up of Private Limited Company

RJA 25 Sep, 2021

FAQ’s on Winding Up of Private Limited Company Why is liquidation important? Liquidation is important for the subsequent reasons- After the completion of the liquidation process, the directors as well as the other company officials bear no liability against any stakeholder. If&...

COMPANY LAW

Compliance needs for the month of aug 2021 under Co Act 2013

RJA 14 Sep, 2021

COMPLIANCE REQUIREMENT UNDER THE COMPANIES ACT OF 2013 AND THE RELATED RULES Laws/Acts in force Deadlines Particulars of Compliance Filing mode / Forms Companies Act, 2013 within 30 days of gaining beneficial interest Filing of form BEN-2 in accordance with the Companies (Significant Beneficial Owners) Rules, 2018. (the ...

COMPANY LAW

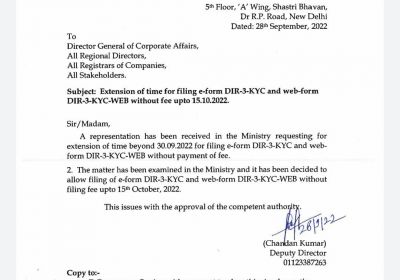

Frequently Asked Question on DIR-3 KYC

RJA 10 Jul, 2021

Frequently Asked Question on DIR-3 KYC Q.: Who is responsible for completing Form DIR-3 KYC? Individuals with a DIN on file in their names on March 31 and who did not file Form DIR-3 KYC the previous year are required to file Form DIR-3 KYC this year. In addition, ...

COMPANY LAW

FAQs on dematerialization of physical share certificates

RJA 06 Jul, 2021

FAQs ON DEMATERIALIZATION OF PHYSICAL SHARE CERTIFICATES Q.: What's the Governing Law? Section 29 read with Rule 9A of the businesses (Prospectus and Allotment of Securities) Rules, 2014. Q.: From when is Rule 9A effective? 02nd October 2018. Q.: What does Rule 9A state? Every unlisted public ...

COMPANY LAW

MCA enlarges the definition of a small business, as well as its turnover and borrowing limits.

RJA 24 Jun, 2021

The ministry of corporate affairs has broadened the definition of small and medium businesses (SMBs), allowing them to borrow more money and increase their turnover. According to a statement released on Wednesday, this would allow a broader range of enterprises to benefit from greater flexibility in accounting requirements. Small and ...

COMPANY LAW

COMPLETE OVERVIEW ON INTERIM AND FINAL DIVIDEND

RJA 18 Jun, 2021

COMPLETE OVERVIEW ON INTERIM AND FINAL DIVIDEND INTRODUCTION- INTERIM AND FINAL DIVIDEND Funds are the essence of the long term perspective of any business. Companies sought to rely on available for the management of their activities. One of the main sources of funds, available with a company are shareholders. ...

COMPANY LAW

Listing of Non Convertible Debentures by Private Companies

RJA 31 May, 2021

Listing of Non-Convertible Debentures by Private Companies BRIEF INTRODUCTION The most important step for a corporate entity to begin with its operations is funding. Funding is something that is required, not only for investment and expansion purposes but also for day-to-day operations. Companies, while looking for funding, consider various sources ...

COMPANY LAW

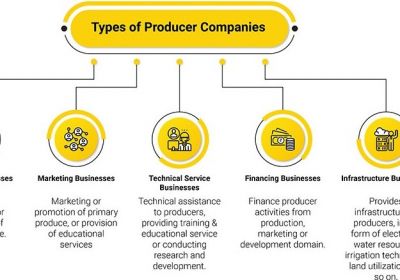

SHARE CAPITAL AND ACCOUNT, AUDIT & OTHER FEATURE OF A PRODUCER COMPANY

RJA 07 Mar, 2021

Normal characteristics of Producer Companies: Producer Company is always a Pvt Ltd company. The name of the Company shall end with “Producer Company Limited” which shall be stated in the MOA of Producer Company. There must be a minimum of Five directors & No need for Minimum Capital ...

COMPANY LAW

Annual Filing & Compliance of a Producer Company

RJA 07 Mar, 2021

Annual Filing & Compliance of a Producer Company A Producer Company is a business registered under the Company Act 2013 with the aim of producing, harvesting, promoting mutuality techniques, etc. Like other registered companies, a producer company also needs to file compliance on a fair and annual basis in order to ...

COMPANY LAW

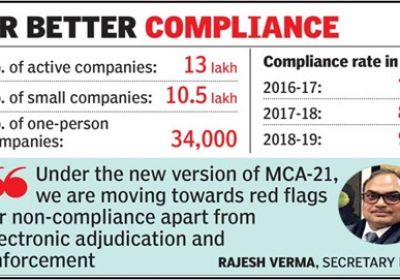

Govt introduces random e-scrutiny of corporate filings

RJA 06 Feb, 2021

MCA launch random e-scrutiny of corporate filings The Ministry of Corporate Affairs (MCA) is about to launch a random digital Scrutiny of company filings over the next year as it aims to use expert knowledge to enhance supervision and compliance, a senior official said. "The random sampling of ...

COMPANY LAW

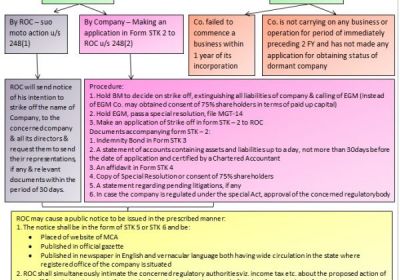

PROCESS OF STRIKING-OFF- A PRIVATE LIMITED COMPANY

RJA 26 Jan, 2021

PROCESS OF STRIKING-OFF- A PRIVATE LIMITED COMPANY – There really is a goal behind starting every company that will always run the company, although not all companies end up the same way. The company is founded to do a business, but sometimes the business venture does not succeed or the ...

COMPANY LAW

Avail Companies Fresh Start Scheme 2020

RJA 04 Nov, 2020

You may Avail Companies Fresh Start Scheme & File ROC Pending Compliances-Save Bulk ROC Penalty -Act Now If you are a struck-off company under Section 164 that has not been able to revive till now or if you are a disqualified director looking to activate your DIN then this is a&...

COMPANY LAW

COMPANY ANNUAL RETURN UNDER SECTION-92

RJA 23 Oct, 2020

COMPANY ANNUAL RETURN SECTION-92 ANNUAL RETURN The annual return is required to be filed by every company in Form No. MGT.7 containing all the particulars as on the closure of the financial year of the company. An extract of all the annual returns in Form No. MGT.9 shall form parts ...

COMPANY LAW

Complete Concept of Rights issue of Shares Company Under Companies Act 2013

RJA 14 Oct, 2020

Rights issue of Shares Company. The right issue of shares is basically the way through which a company raises additional funds. The right issue is an invitation to existing shareholders to purchase additional new shares in the company. The company is giving the shareholder the chance to increase the shareholding ...

COMPANY LAW

Company Secretarial Retainership Service

RJA 01 Oct, 2020

Company Secretarial Retainership Service Company secretarial retainership services account for meeting standard statutory compliance requirements. It is the responsibility of the company secretary to maintain the integrity of the government framework, initiate strict measures for ensuring efficient administration in a company, ensure that the company aligns with all the statutory ...

COMPANY LAW

Company Registration Services in India

RJA 01 Oct, 2020

Company Registration Services A company that is formed by two or more individuals under Company Act 2013 is known as company registration or company incorporation. Entrepreneurs look forward to the establishment of a company undergoing proper law proceedings. Company registration services can take more than 7 days whether it is a public ...

COMPANY LAW

Amalgamation Services in India

RJA 01 Oct, 2020

Amalgamation Services Amalgamation is the combination of two or more companies into a single entity combining the assets and liabilities of both companies. This happens when two or more companies are engaged in the same profession and share similarities in business operations. The motive of amalgamation is expanding the business ...

COMPANY LAW

Corporate Law and Legal Compliance

RJA 19 Sep, 2020

Corporate Law Compliance 1.XBRL Data Conversion Services XBRL is an open digital business standard for digital business reporting managed by a global consortium. It defines the reporting terms in an authoritative way. It is used for determining accuracy in reports by avoiding the errors acknowledged at the source. For sharing, ...

COMPANY LAW

List of information document Requirements for New Company Registration/Incorporation

RJA 06 May, 2020

COMPANY FORMATION IN INDIA Company incorporation A company is generally formed through a process known as incorporation of company. When a company is incorporated legally, it becomes a separate entity from those who invest their capital and labour to run it. The legal process of forming a corporate entity ...

COMPANY LAW

Everything about MCA Company Fresh Start Scheme (CFSS) 2020

RJA 01 Apr, 2020

Everything about MCA Company Fresh Start Scheme (CFSS) 2020 The Ministry of Corporate Affairs released Company Fresh Start Scheme 2020 full Circular 12/2020 dt 30.3.2020 which applies to both public and private corporations incorporated under the CoAct 1956/2013. The key provisions are as follows:- (1) Permits to register all outstanding refunds, accounts, records over any ...

COMPANY LAW

Filing of Director KYC (DIR- Filing of Director KYC (DIR-3 KYC)

RJA 16 Jan, 2020

Filing of Director KYC (DIR- Filing of Director KYC) (DIR-3 KYC): Provision: Provision: In compliance with Rule 12A of the Rules of Procedure of the Companies (Nominations and Qualifications of Directors) 2014, any person holding a DIN as of 31 March of the financial year shall apply an EFORM DIR-3 KYC ...

COMPANY LAW

LAST DATE OF DIN KYC UPDATE HAS BEEN EXTENDED

RJA 25 Aug, 2018

LAST DATE OF DIN KYC UPDATE HAS BEEN EXTENDED For the purpose of KYC on ROC -Directors database on ROC, ROC has entered for updated all persons holding DIN to complete DIN KYC on or before 30/09/2022. To close DIN KYC, the Director will be required to complete a form file ...

COMPANY LAW

ARE YOU A DIRECTOR?-THEN YOU HAVE TO FILE E-KYC DIR-3 FORM

RJA 17 Jul, 2018

As part of updating its registry, MCA would be conducting KYC of all Directors of companies annually through a new e-form viz. DIR-3 KYC as per new The Companies (Appointment and Qualification of Directors) Rules, 2014. Today, E-form DIR-3 KYC now is on the Portal of the ...

COMPANY LAW

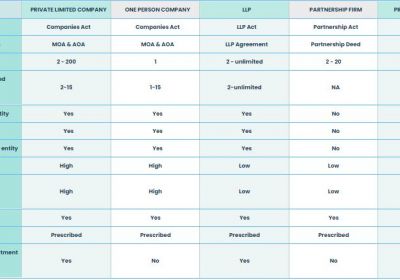

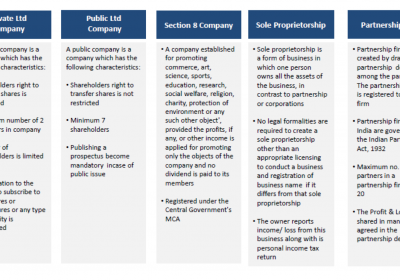

HOW TO INCORPORATE THE COMPANY

RJA 05 Jul, 2018

COMPANY REGISTRATION – START-UP REGISTRATION The first step in start-up registration is choosing the correct and suitable form of business. Such a choice will directly impact their business name, the extent of liability towards business, liabilities towards tax filing & statutory dues. The main factors for the operational and ...

COMPANY LAW

A FORIGN COMPANY OPEN A BRANCH OFFICE IN INDIA

RJA 15 Jun, 2018

Pre Compliances REQUIRED CONDITIONS OF A FOREIGN COMPANY OPEN A BRANCH OFFICE IN INDIA, The name of the Indian Branch office shall be the same as the parent company. The Branch office does not have any ownership, it is just an extension of the existing company in a foreign country. ...

COMPANY LAW

Start-Ups Companies & The Mistakes They Do Which Cause Them A Big Trouble to expand Their Business

RJA 09 May, 2018

START-UP’S COMPANIES & THE MISTAKES THEY DO WHICH CAUSE THEM A BIG TROUBLE TO EXPAND THEIR BUSINESS Details about start-ups and the mistakes they do which cause them big trouble to expand their business and yes sometimes more serious than that, they have negative remarks on their goodwill. ...

COMPANY LAW

Merger and Amalgamation under Companies Act, 2013 by National Company Law Tribunal (NCLT).

RJA 19 Mar, 2018

Merger and Amalgamation is a restructuring tool available to Indian conglomerates aiming to expand and diversify their businesses for various reasons whether it is to gain competitive advantage, reduce costs, or availing of tax benefits. A merger means an arrangement whereby one or more existing companies merge their identity into ...

COMPANY LAW

Elements of Financial Statements

RJA 07 Mar, 2018

The financial elements of a financial statement are broadly classified into five categories. These are grouped according to the monetary characteristics they possess. Let’s have a brief understanding of all five. Assets An asset is a resource (either tangible or intangible) that is in control of the enterprise ...

COMPANY LAW

KEY HIGHLIGHTS OF THE COMPANIES (AMENDMENT) BILL, 2017

RJA 30 Jan, 2018

KEY HIGHLIGHTS OF THE COMPANIES (AMENDMENT) BILL, 2017 Name reservation in case of new company Incorporation shall be valid for 20 days from the date of approval instead of 60 days from the date of application. In case of Change of Name of existing Company, Name Reserved by the ROC shall be valid ...

COMPANY LAW

MCA HAS LAUNCHED NEW E-FORM RUN(RESERVE UNIQUE NAME)

RJA 29 Jan, 2018

MCA HAS LAUNCHED A NEW E-FORM RUN(RESERVE UNIQUE NAME) The government has launched a web service RUN (Reserve Unique Name) for reserving the name of a proposed company under the Government Process Re-engineering on this Republic Day to improve the ease of doing business in the country. We can ...