Goods and Services Tax

GST on Interest Income applicability Business Owner Must Know

RJA 19 Feb, 2026

GST on Interest Income applicability Business Owner Must Know Understanding Goods and Services Tax implications on interest income are crucial for businesses, professionals, and tax consultants. While many assume interest is completely exempt, the reality depends on the nature of the transaction. Interest income under Goods and Services Tax is ...

Goods and Services Tax

GST Notice Trap: Section 160(2) and the Point of No Return

RJA 31 Jan, 2026

GST Notice Trap: Section 160(2) of the CGST Act and the Point of No Return Section 160(2) of the CGST Act creates a critical but silent trap for taxpayers who receive any GST notice with procedural defects. If a GST notice, order, or communication is made available on the GST portal, ...

Goods and Services Tax

Assessment on a Deceased Person Is Void: High Courts

RJA 26 Jan, 2026

Assessment on a Deceased Person Is Void: High Courts Reiterate Limits of GST Jurisdiction Case 1: Proceedings Against Deceased Proprietor – Assessment Quashed Facts of the Case Late B. Kameswara Rao was a registered person under GST, carrying on business as M/s Aravinda Enterprises. He passed away on 21.12.2021. The business ...

Goods and Services Tax

Simplified GST Registration Scheme – Rule 14A (CGST Rules, 2017)

RJA 22 Nov, 2025

Simplified GST Registration Scheme – Rule 14A (CGST Rules, 2017) GST Registration Scheme – Rule 14A (CGST Rules, 2017): GST Rule 14A under CGST Rules, 2017 has been inserted to provide a simplified, risk-based GST registration mechanism, reducing documentation and physical verification requirements. This rule allows certain applicants to obtain GST registration quickly, ...

Goods and Services Tax

Important GST Update for Restaurants (Effective from 1st April 2025):

RJA 05 Apr, 2025

GST Rates for Different Types of Restaurants (Effective 1st April 2025): GST Rates for Restaurants post the changes effective from 1st April 2025, including the latest Notification No. 05/2025–CTR: Key Update: Scrapping of Declared Tariff : From 1st April 2025, declared tariff will no longer be used to determine GST applicability. Instead, ...

Goods and Services Tax

New GST registration applicants with Biometric Aadhaar Authentication

RJA 05 Mar, 2025

New GST registration applicants with Biometric Aadhaar Authentication Biometric-Based Aadhaar Authentication & document verification for GST registration applicants GSTN has implemented Biometric-Based Aadhaar Authentication and document verification for GST registration applicants in Jharkhand and the Andaman & Nicobar Islands Effective February 15, 2025. This initiative aims to enhance security, transparency, and fraud ...

Goods and Services Tax

GST Advisory for Handling Invoices on IMS for FY 2023-24

RJA 24 Oct, 2024

GST Advisory for Handling Invoices on IMS for FY 2023-24 GST Dept. Recommendation: Avoid rejecting any invoices from FY 2023-24 on the Invoice Management System in October 2024, as this is the last month for ensuring credit eligibility for invoices auto-populated in GSTR-2B and GSTR-3B. Doing so satisfies the ...

Goods and Services Tax

SCN & Assessment orders validity when AO are not digitally signed: GSTN

RJA 28 Sep, 2024

SCN & Assessment orders validity when AO are not digitally signed: GSTN The GST Network clarified that show-cause notices and assessment orders issued by tax officers through the GST portal are valid despite not having digital signatures on the PDF version of the documents downloaded by taxpayers. The clarification comes ...

Goods and Services Tax

Goods and Service Tax Network has Issued FAQ on Invoice Management System

RJA 25 Sep, 2024

Goods and Service Tax Network has Issued FAQ on Invoice Management System With the Introduction of Invoice Management System (IMS), the taxpayers interaction with invoices and business processes will change. This innovative feature empowers taxpayers to seamlessly accept, reject, or keep invoices pending in the system to avail ...

Goods and Services Tax

Key Updates and Recommendations from the 53rd GST Council Meeting

RJA 24 Jun, 2024

Key Updates and Recommendations from the 53rd GST Council Meeting Under this article we are providing latest updates and significant recommendations from the 53rd GST Council Meeting. These updates include important changes aimed at easing compliance and enhancing the efficiency of the GST system. Key Updates and Recommendations: Monetary Limits ...

Goods and Services Tax

How to Handling negative IGST liability under the GST System in India

RJA 17 May, 2024

How to Handling negative IGST liability under the GST System in India the mechanism for handling negative IGST (Integrated Goods and Services Tax) liability under the GST (Goods and Services Tax) system in India. When the tax amount of credit notes (CGST+SGST/IGST) exceeds the tax amount of outward ...

Goods and Services Tax

More than 8 lakhs ITR (income tax returns) for AY 24–25 have been filed so far.

RJA 14 May, 2024

More than 8 lakhs ITR (income tax returns) for AY 24–25 have been filed so far. The fact that over 829,000 Income Tax Returns (ITRs) have already been filed for Assessment Year 2024-25 indicates a proactive approach among taxpayers to fulfill their obligations in a timely manner. This early filing trend could ...

Goods and Services Tax

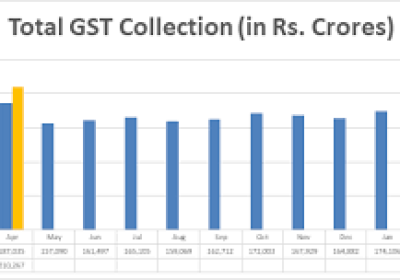

Goods and Services Tax Collection Hits Record High in April 2024

RJA 10 May, 2024

Goods and Services Tax Collection Hits Record High in April 2024 India's Goods and Services Tax (GST) collection for April 2024 has broken records, which is undoubtedly a positive indicator for the economy. Goods and Services Tax Collection Hits Record High in April 2024 Here's a summary of the key points: ...

Goods and Services Tax

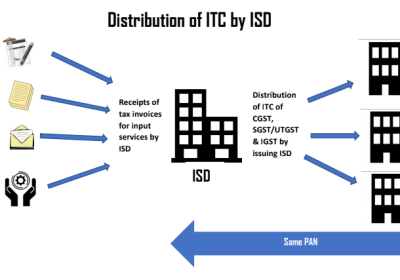

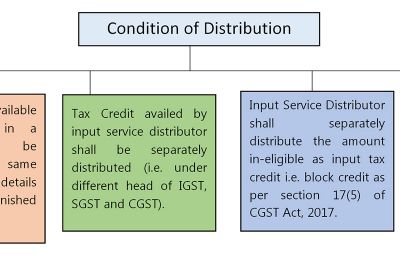

Changes in ISD Concept & Definition: Union budget 2024

RJA 05 Feb, 2024

Changes in Input Service Distributer (ISD) Concept & Definition: Union budget 2024 Registration as input service distributer (ISD) & Distribution of Input Tax Credit is proposed that to to necessary every person receives GST invoices for or on behalf of other branches having separate Goods and Services Tax Identification Number. It ...

Goods and Services Tax

Excess RCM claimed: ITC Claimed Twice against the RCM paid

RJA 18 Jan, 2024

Interest on ITC Credit Claimed Twice against the RCM paid : Excess RCM claimed Relevant provisions under the GST Act. : Interest on ITC wrongly availed and utilized. As per substituted subsection 50 (3) of the act, interest is applicable only where ITC is wrongly availed and utilized. In order to attract interest ...

Goods and Services Tax

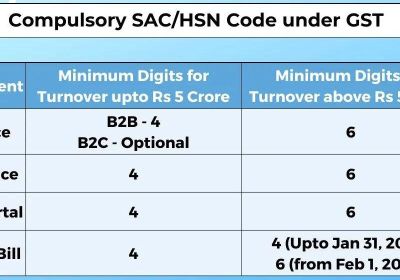

Compulsory e-Invoice Details & New HSN Code Requirements

RJA 17 Jan, 2024

Compulsory e-Invoice Details & New Harmonized System of Nomenclature (HSN) Code Requirements: Here are main basic points related to 2 update related to e-Way bills- New requirement of Changes in e-Waybill Generation/ issuing in GST HSN code is Compulsory in GSTR 1 for B2B exempt supply, depending on the AATO of ...

Goods and Services Tax

GST Taxpayers will be permitted to submit Revised GST Returns w.e.f April 2025

RJA 30 Dec, 2023

GST Taxpayers May be permitted to submit Revised GST Returns with effect from Apr 2025 At present, there is no provision for filing revised goods and Services Tax Returns under GST, barring minor corrections in GST Invoice details & information uploaded on goods and Services Tax portal. Indian Industry has been ...

Goods and Services Tax

New Changes in Goods and Services Tax Law which come to be effective from 01.10.2023

RJA 17 Oct, 2023

New Changes in Goods and Services Tax Law which come to be effective from 01.10.2023 ITC for Corporate social responsibility Expenses has been restricted. Time Limit to generate E-Invoice with effect from 01 Nov 2023. Govt may share the information of assessee by taking prior consent. New condition has been inserted for Supply ...

Goods and Services Tax

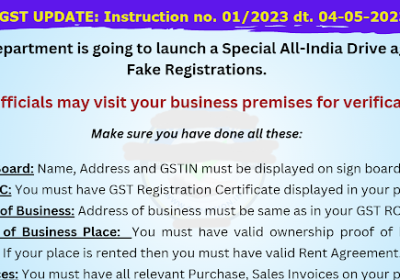

Out- Come of A Special All-India Drive on GST

RJA 19 Jul, 2023

Outcome of A Special All-India Drive on GST A Senior Tax Official of Goods and Services Tax stated that GST officials have so far cancelled over 4,900 bogus GST Registrations as part of a nationwide drive. Moreover, this GST special Drive has been discovered 17,000 GSTINs that do ...

Goods and Services Tax

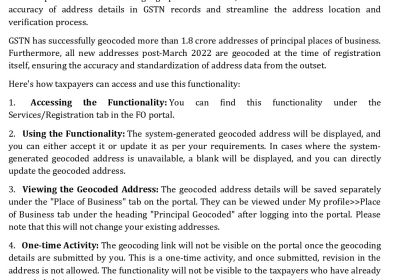

GSTN :Geocoding-Businesses can have to geocode their addresses

RJA 10 Jul, 2023

Geocoding can help in finding out exact location of the registered businesses entity & their addresses, to check bogus registrations. Geocoding makes it possible to pinpoint the location of registered firms and ensures that the address information in GSTN records are streamlined. For the purpose of to assure the accuracy ...

Goods and Services Tax

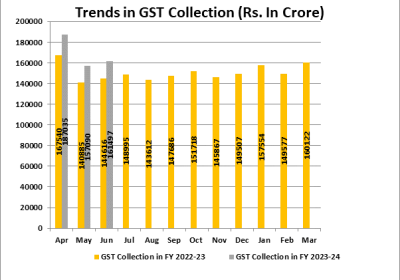

INR 1.61 Cr Gross Goods and Services Tax revenue collected for June 2023;

RJA 05 Jul, 2023

INR 1.61 Cr Gross Goods and Services Tax revenue collected for June 2023, Records 12% Growth Gross Goods and Services Tax Revenue collected in the month of June, 2023 is INR 1,61,497 crore of which Central Goods and Services Tax is INR 31,013 crore, state Goods and Services Tax is INR 38,292 crore, Integrated Goods ...

Goods and Services Tax

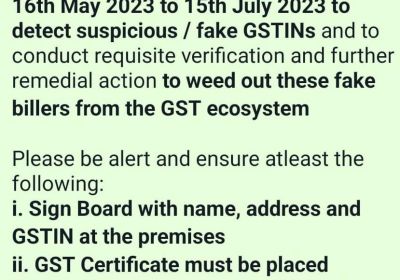

GST Inspector visit at Business Premises of dealers from 16th May to 15th July 2023

RJA 15 May, 2023

GST Inspector will visit at Business Premises of all dealers during special drive from 16th May to 15th July, 2023 The issue of unscrupulous participants utilising the identities of others to obtain fake/bogus GST registration was discussed during the National Co-ordination Meeting. Fake/non-genuine registrations are being utilised to ...

Goods and Services Tax

GSTN started option to utilize Cash Ledger from 1 GSTIN to another GSTIN

RJA 12 Mar, 2023

GSTN started option to utilize Cash Ledger amount from 1 GSTIN to another GSTIN having same PAN. GSTN has started option to utilize to use the amount in cash ledger of 1 GSTIN (entity with the same permanent account number) by another Goods and Services Tax Network via transfer through form ...

Goods and Services Tax

GST applicability on compensation, liquidated damages, & penalties for contract violations etc

RJA 15 Nov, 2022

GST applicability on compensation, liquidated damages, & penalties for contract violations, among other things. The taxability of liquidity damages, cancellation fees, late payment fees, etc. arising from contract breaches is a very frequent query under GST. The issue is raised by Central Goods and Service Tax Act, 2017, Schedule II, Paragraph ...

Goods and Services Tax

Haryana jurisdiction Govt 373 GST registrations cancelled of all non-filers of GSTR-3B

RJA 01 Nov, 2022

Haryana jurisdiction Govt 373 GST registrations cancelled of all non-filers of GSTR-3B upto March 2021 Gst Dept. Govt of Haryana had identified 373 active GST registered taxpayers of State jurisdiction who had not submitted FORM GSTR-3B up till March 2021. These GST taxpayers were liable to be cancelled under the provisions ...

Goods and Services Tax

GSTR-9 and GSTR-9C(i.e GST Annual Return) are Available for filing Now

RJA 08 Aug, 2022

GSTR-9 and GSTR-9C(i.e GST Annual Return) are Available for filing Now GSTR 9C is a statement that reconciles the information from the yearly returns filed under GSTR 9 for a given financial year with the data from the taxpayer's audited annual financial statements. A cost accountant or ...

Goods and Services Tax

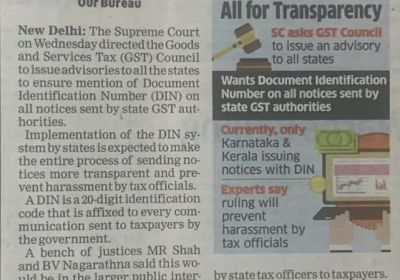

Advisory for SGST to Issue DIN While Issuing Notice

RJA 06 Aug, 2022

Advisory to Issue Document Identification Number (DIN) By SGST, While Issuing GST Notice What is Document Identification Number in GST? A DIN Number (DIN) is a unique 20-digit identification code attached to every correspondence issued by the Govt offices to GST taxpayers. With this Document Identification Number, the GST Taxpayer ...

Goods and Services Tax

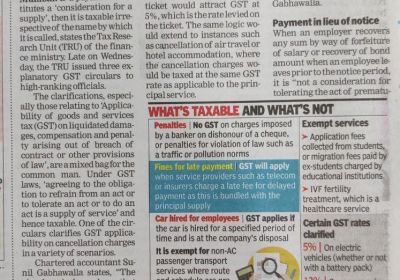

Pay GST on bookings of train or air tickets hotel cancellation charges

RJA 05 Aug, 2022

Pay GST on bookings of train or air tickets hotel cancellation charges Finance ministry Tax Research Unit (TRU) issued 3 circulars along with clarifications or explanations as far as the Goods and Services tax levy is concerned. In accordance with CBDT circular, GST levy in cases where payments arise from ...

Goods and Services Tax

Impact of GST on unsold stock of pre-packaged commodities

RJA 03 Aug, 2022

Complete overview GST impact on Pre-Packaged Unsold goods The Department of Consumer Affairs addressed the impact of GST on unsold stock of pre-packaged commodities under the Legal Metrology (Packaged Commodities) Rules 2022 in a letter dated 01.08.2022, in light of the recent decision to impose a % GST on pre-packaged commodities. In ...

Goods and Services Tax

CBIC : GST Compensation Cess term has been extended to March 31, 2026

RJA 25 Jun, 2022

GST Compensation Cess term has been extended to March 31, 2026 GST Compensation Cess has been extended by the Central Govt for an additional four years, till June 2026. The period for levying and collecting the cess under section 8(1) of the Goods and Services Tax (Compensation to States) Act, 2017, "shall ...

Goods and Services Tax

Input Tax credit can not be denied on Genuine transaction with suppliers

RJA 01 Jun, 2022

Input Tax credit can not be denied on Genunine transation with suppliers In the matter of Sanchita Kundu & Anr. Vs Assistant Commissioner of State Tax If the supplier is later discovered to be a fake, ITC cannot be denied to the buyer for a genuine transaction: The High ...

Goods and Services Tax

Modification/Change to GSTR 1 & GSTR Filling Process

RJA 30 Apr, 2022

Change to GSTR 1 and GSTR Filling Process GSTR 1 is a monthly return form for regular taxpayers who have a yearly turnover of more than 1.5 crores and must provide information of outward supply on the 11th of the next month. Taxpayers with income under 1.5 crores will be required to submit ...

Goods and Services Tax

NIC implemented 2-factor authentication to login into e-invoice system.& e-way bill

RJA 19 Apr, 2022

NIC implemented two-factor authentication. To accessing the e-way bill and e-invoice systems, NIC is deploying 2-Factor Authentication for logging in to the e-Way Bill/e-Invoice System to improve the security of the system. OTP will be used to authenticate login in addition to username and password. The OTP can be ...

Goods and Services Tax

GST e-Invoicing is compulsory for businesses limit decreased to INR 20 Cr.

RJA 28 Feb, 2022

The threshold limit for electronic invoicing was decreased in the applicability from INR 50 crore to INR 20 crore with effect from April 1, 2022, as announced by the Central Board of Excise and Customs in Notification No. 01/2022, dated 24 February 2022. A system known as a " electronic-Invoice" allows B2B invoices to be ...

Goods and Services Tax

How to deal with Goods and Services Tax summon?

RJA 01 Feb, 2022

What should you do if you receive a summons for the GST? Normally Our email inboxes are filled with GST reminders for GST taxpayers. Unfortunately, we constantly overlooked vital notices for other taxpayers. Is it, however, merely a notice that is extremely crucial? Do you think you're losing out ...

Goods and Services Tax

All about the GST on Reimbursement of expenses

RJA 30 Jan, 2022

All about the GST on Reimbursement of expenses The issue of whether reimbursement of expenses provided by service receiver are to be included in the value of taxable service for purposes of charging service tax was also the subject of much litigation under the service tax regime, wherein the Hon'...

Goods and Services Tax

Reversal of ITC if payment is not made to supplier within 180 days

RJA 28 Jan, 2022

Analysis of validity of section 16(2)(D): Reversal of Input tax credit if payment is not made to supplier within 180 days VALIDITY OF SECTION 16(2)(D) IN THE EVENT OF NON-PAYMENT OF CONSIDERATION WITHIN 180 DAYS WHEN SUPPLY IS FROM ONE GSTIN TO ANOTHER GSTIN OF THE SAME LEGAL ENTITY/PAN ...

Goods and Services Tax

Whether Liable to GST on Discount Received for early payments?

RJA 27 Jan, 2022

GST not applicable on incentive, schemes or cash discount offered by supplier, Rules AAR - M.P. This order is taxpayer favorable order in the matter of M/S RAJESH KUMAR GUPTA OF M/S MAHVEER PRASAD MOHANLAL, GANDHI GANJ, JABALPUR, 482002(MP) AUTHORITY FOR ADVANCE RULING-MADHYA PRADESH Because the cash ...

Goods and Services Tax

Supply of Restaurant Services via E-Commerce Operator liability to pay GST w.e.f. 01.01.2022

RJA 21 Jan, 2022

Supply of Restaurant Services via E-Commerce Operator liability to pay GST w.e.f. 01.01.2022 E-Commerce Operators will be responsible to pay Goods and Services Tax on any restaurant service supplied via them, including by an unregistered person. Because there is no exemption for the supply of restaurant services by unregistered ...

Goods and Services Tax

FAQS ON INPUT SERVICE DISTRIBUTOR

RJA 11 Jan, 2022

FAQS ON INPUT SERVICE DISTRIBUTOR Q.: Who is an Input service distributor (ISD) under GST? Input Service Distributor is defined as follows – Input Service Distributor is an office of a business that receives tax invoices for input services and distributes available ITC to other branch offices of the identical ...

Goods and Services Tax

Input Service Distributor Mandatory Registered Under GST ACT

RJA 11 Jan, 2022

Input Service Distributor Mandatory Registered Section 24(Viii) CGST ACT 2017 Input Service Distributor stands for Input Service Distributor and has been defined u/s 2(61) of the CGST/SGST Act. It is basically an office meant to receive tax invoices towards receipt of input services & further distribute the credit to ...

Goods and Services Tax

Input Transaction are genuine & supported by valid documents then ITC can Not be denied

RJA 08 Jan, 2022

Input Transaction are genuine & supported by valid documents then ITC can Not be denied Payment along with tax actually paid to supplier or not is to be verified before disallowing ITC (LGW Industries Ltd. v. Union of India - [2022]) Petitioner was served with letters by the GST Dept, ...

Goods and Services Tax

Deferred decision to raise GST Rates in textiles from 5% to 12% w.e.f. 01.01.22

RJA 01 Jan, 2022

GSTN Deferred decision to raise textile GST Rates in textiles from 5% to 12% w.e.f. 01.01.2022 The 46th GST Council meeting will be chaired by Hon'ble Finance Minister Smt. Nirmala Sitharaman today at 11 a.m. in Delhi, according to the Ministry of Finance. MOS Shri. Pankaj Chaudhary and Dr. Bhagwat ...

Goods and Services Tax

Aadhaar authentication is mandatary under GST w.e.f. 01.01.2022

RJA 27 Dec, 2021

Aadhaar authentication is mandatary under GST w.e.f. 01.01.2022 The GST Council approved recommendations at its 45th meeting, including making Aadhaar authentication of registration necessary for filing refund requests and applications for revocation or cancellation of registration under GST. As a consequence, the Central Board of Indirect Taxes and Customs ...

Goods and Services Tax

GST ITC available only when reflected in GSTR 2B/2A w.e.f. 01-01-2022

RJA 26 Dec, 2021

GST ITC available only when reflected in GSTR 2B/2A w.e.f. 01-01-2022 Central Board of Indirect Taxes and Customs through Notification No. 39/2021–Central Tax dated Dec 21, 2021 which specified following amendments made vide Section 109 of the Finance Act, 2021 w.e.f. January 01, 2022 Section -16(2) : Conditions and ...

Goods and Services Tax

GST leviable on services provided by Association or club to its members

RJA 26 Dec, 2021

GST on Transactions by a Club / Association or Activities with its members retrospectively w.e.f. July 01, 2017 (Under Section 7(1)(aa)) The definition of supply was expanded to cover services provided by members to club/AOP and vice versa. To overcome the Apex court's verdict in the Calcutta Club ...

Goods and Services Tax

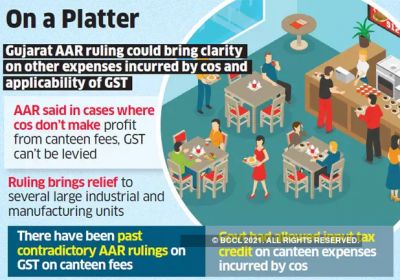

No Input Tax credit available on Canteen Services provided to Employees

RJA 26 Dec, 2021

No Input Tax credit available on Canteen Services provided to Employees M/s Tata Motors Ltd. (Applicant) has requested clarification on whether ITC will be applicable on GST levied by the service provider on canteen services given to factory personnel, and whether the ITC will be limited to the cost ...

Goods and Services Tax

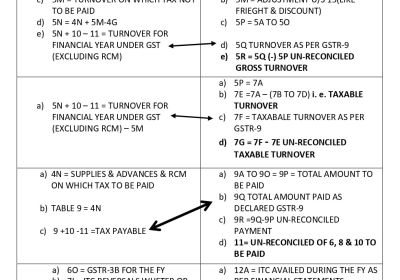

Check points of GST Annual Return & GST reconciliation statement

RJA 25 Dec, 2021

CHECK POINTS OF GST ANNUAL RETURN AND GST RECONCILIATION STATEMENT Annual Returns and Reconciliation Statements are required by GST Laws. These must be filed for each Financial Year (April – March) by December 31st of the Next Year. After the long ongoing effort to minimize the burden on small taxpayers. ...

Goods and Services Tax

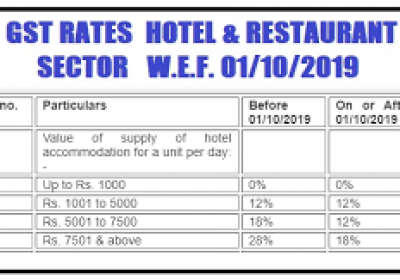

FAQ on GST in relating to Hotel Industry

RJA 25 Dec, 2021

FAQ on GST in relating to Hotel Industry Q1-Will GST be charged on actual tariff or declared tariff for accommodation services? A1-Declared or published tariff is relevant only for the determination of the tax rate slab. GST will be payable on the actual amount charged (transaction value). Q2...

Goods and Services Tax

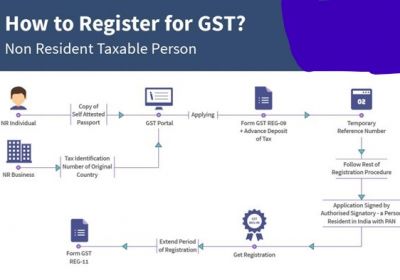

Provisions for GST Registration for foreigners in India

RJA 13 Dec, 2021

GST Registration For Non-Resident Taxable Individual (NRTP) GST Registration For Foreigners GST is an abbreviation for Goods and Services Tax. The Goods and Services Tax (GST) is an indirect tax that came into effect across India on July 1, 2017. GST has consolidated many indirect taxes into a single law, the ...

Goods and Services Tax

Latest Functionalities made available for GST Taxpayers on GST Portal

RJA 03 Dec, 2021

Latest Functionalities made available for GST Taxpayers on GST Portal GSTN has released module-by-module New functionality for taxpayers on the GST Portal. Numerous different functions for GST stakeholders are added on the GST Portal from time to time. These features apply to a variety of modules, including Registration, Returns, Advance ...

Goods and Services Tax

GST issues at the time of Inspection & Search

RJA 30 Nov, 2021

GST issues at the time of inspection: GST officers found various issues at the time of inspection: The GST Registration Certificate number was not displayed at a prominent place inside the office premises. There was a discrepancy between the stock register entry and the actual quantity of stock. The Aadhar ...

Goods and Services Tax

Key reasons for GST Notice from GST Dept.

RJA 29 Nov, 2021

Key reasons for GST Notice from GST Dept With greater GST tax evasion and lower GST revenue, the Indian government has tightened its scrutiny of GST compliance. Notices are frequently sent for a variety of reasons, including tax evasion, non-compliance with rates, late files, missing, incorrect invoices, eWay Bill mismatch, ...

Goods and Services Tax

Govt increases GST on footwear; apparel, effective from January 2022

RJA 23 Nov, 2021

Govt increases GST on footwear; apparel, effective from January 2022 New Delhi, India: The Goods and Services Tax (GST) on finished goods including clothes, textiles, and footwear has been raised by the government. GST rates would rise from 5% to 12% in January 2022, based on the state. the Central Board of Indirect Taxes ...

Goods and Services Tax

GSTN Issue GST Offline Tools for Download and Prepare GSTR Returns Offline

RJA 12 Nov, 2021

GSTN Issue GST Offline Tools for Download and Prepare GSTR Returns Offline Under GST regime various activities related to GST to be done online like GST registration, GST refunds, GST filing, GST application & lot of other. GST taxpayers must go to the GST site online and fill out the ...

Goods and Services Tax

Key Analysis of Rate Notifications issued by CBIC

RJA 06 Nov, 2021

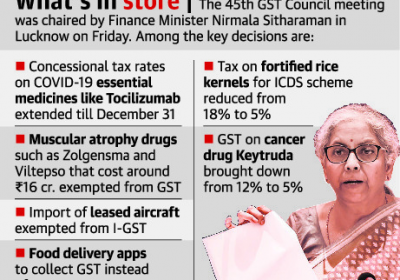

Key Analysis of Rate Notifications issued by CBIC 45th GST Council, chaired by the Honorable Union Finance & Corporate Affairs Minister Smt. Nirmala Sitharaman, will be held in Lucknow on September 17th, 2021. The council's recommendations included some reliefs in view of the COVID pandemic, compensation cess utilisation, GST law ...

Goods and Services Tax

Whether Self-Certification of GSTR-9C really a Good Step?

RJA 06 Nov, 2021

Whether GSTR-9C Self-Certification Really a Good Step? The Finance Act of 2021 implemented amendments to the CGST Act, eliminating the need to provide a CA-certified Reconciliation Statement in GSTR 9C. GST Taxpayers with a revenue / sale receipt of more than INR 5 CR in the last FY are needed to ...

Goods and Services Tax

Export considered as a service offered by a sister concern located in India to a foreign Co. Abroad

RJA 06 Nov, 2021

Export is considered as a service offered by a sister concern, subsidiary or group concern located in India to a foreign company located outside India. There are major benefits to "exporting" goods or services. To constitute a transaction as "Export," however, a set of conditions must ...

Goods and Services Tax

FAQs on GST cancellation, valuation and Classification

RJA 02 Nov, 2021

FAQs on GST canceelation, valuation and Clasification Query1: Whether a person suo moto can apply for revocation of cancellation of registration whose registration has been cancelled by the proper officer and what is the time limit for submitting such application? Answer: Yes, a person ...

Goods and Services Tax

Taxability Position on IRP Under GST

RJA 02 Nov, 2021

GST rate on permanent transfers of IPR in respect of goods has been increased by the CBIC the government must issue clear instructions to avoid future controversies, tax avoidance, and subsequent litigation, as well as proper compliance to promote ease of doing business with regard to applicability of GST on ...

Goods and Services Tax

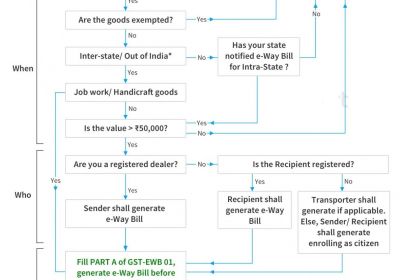

How to generate E- Way Bill Under the GST ?

RJA 01 Nov, 2021

How do I create an eWay Bill? On the e-Way Bill Portal, you can generate an E-Way Bill. All you need is a Portal username and password. Check out our article – Guide to generate e-Way Bill online – for a comprehensive step-by-step guide on e-Way Bill generation. When unregistered ...

Goods and Services Tax

SC disallowed Bharti from taking INR 923 Cr GST refund by changing GSTR Return

RJA 30 Oct, 2021

Supreme Court Bench Disallows Bharti Airtel from seeking Rs. 923 crore GST Refund by Rectifying Return Facts- The Respondent was having issues filling GSTR Form 3B due to several glitches in the Online GST Portal, according the brief facts of the case. Despite these issues, the Respondent filed its GST ...

Goods and Services Tax

DGGI Unit arrests 3 Persons for running multiple fake firm & Evading GST of more than INR 48 Crore

RJA 30 Oct, 2021

DGGI Unit (Gurugram) arrests 3 Persons for running multiple fake firm & Evading GST of more than INR 48 Crore Directorate General of GST Intelligence (DGGI) of Gurugram Zonal Unit (GZU) has arrested 3 persons on charges of running multiple fake firms on the strength of fake documents in two different cases under ...

Goods and Services Tax

FAQs ON GST ON HOTELS & RESTAURANT INDUSTRY

RJA 28 Oct, 2021

FAQs ON GST ON HOTELS & RESTAURANT INDUSTRY Q.: A hotel is registered on the Fab hotels site. Fab hotels give their listing on Goibibo. During this case, Gobibo was not having any information in respect of such hotel. In this case who is susceptible to collect TCS? As ...

Goods and Services Tax

Pre deposit for GST appeal should be paid via cash ledger only

RJA 15 Oct, 2021

Orissa Honorable High court: Pre deposit for filing appeal under GST to be paid Via cash ledger only & adjustment not allowed from credit ledger Fact In case of Jyoti Construction v. Deputy Commissioner of CT & GST, Jajpur (Orissa) petitioner was a partnership firm doing the business of ...

Goods and Services Tax

WRITING OFF OF UNREALIZED EXPORT BILLS

RJA 23 Sep, 2021

WRITING OFF OF UNREALIZED EXPORT BILLS BRIEF INTRODUCTION Exports are available with various incentives in India like refund of taxes paid with regard to export, various duty-free scripts, Duty Drawbacks etc. However, these incentives would be available, provided the realization of consideration in respect of export&...

Goods and Services Tax

Key highlights of 45th GST Council Meeting : GSTN

RJA 17 Sep, 2021

Key highlights of 45th GST Council Meeting : GSTN the GST Council had its 45th meeting On the 17th of September 2021. This meeting, which took place in Lucknow, was keenly anticipated by the taxation community. It's interesting to note that this was the first time the two of them ...

Goods and Services Tax

FAQs ON GOODS AND SERVICES TAX REFUND

RJA 26 Jun, 2021

FAQs ON GST REFUND Q.1 What are the situations which can produce to refund under GST? Ans. Any sought of claim for refund arising in relation to - Export of products or services on payment of tax Supply of products or services to ...

Goods and Services Tax

GST Council 44th & 43th Meeting 2021 Conclusion: Press Briefing

RJA 12 Jun, 2021

Today, Finance Minister Nirmala Sitharaman will preside over the 44th meeting of the GST Council, which is likely to make a decision on relief for COVID-19-related individual items based on the Group of Ministers' report. GST Council 44th Meeting 2021 Conclusion: GST Council agrees to a 5% GST rate for ...

Goods and Services Tax

ONLINE INFORMATION DATABASE ACCESS OR RETRIEVAL

RJA 27 May, 2021

BRIEF INTRODUCTION In today’s world, with so much technological developments, businesses are nowhere restricted by geographical borders. The Internet is the most easy and affordable means for providing services abroad. To facilitate such services, there are several mechanisms, which are used in conjunction with business activities, to deliver ...

Goods and Services Tax

SUMMARY OF PENALTY ON DEFAULTS UNDER THE GST LAW

RJA 01 May, 2021

Summary of Penalty on Defaults under the GST Law The GST law specifies the types of violations that can be committed and the penalties that will be imposed in each case. This is critical information for all business owners, accountants, and tax professionals, as even a minor error can ...

Goods and Services Tax

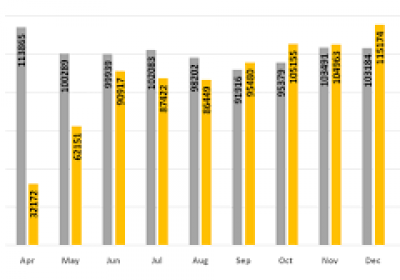

GST revenue has hit a record high of INR 1.20 lakh crore in January 2021. Budget Effect

RJA 03 Feb, 2021

In January, GST revenues hit a record of Rs 1.20 Lakh Crore: Great news on Budget Eve: Goods & Services Tax collections for January reached an all high of around Rs 1.20 lakh crore, the Finance Ministry said. According to the Finance Ministry, in line with the recovery trend in Goods & ...

Goods and Services Tax

Key Analysis on Indirect Tax Proposals - Budget 2021

RJA 01 Feb, 2021

Key Analysis of Proposed Amendments in GST in Budget 2021 No Requirement of GST Audit Clause 101 of Finance Bill, 2021 has omitted the following Section 35(5) of CGST Act, 2017 which is made effective from the date to be notified: This is a prospective amendment that needs to be notified. It will be applicable ...

Goods and Services Tax

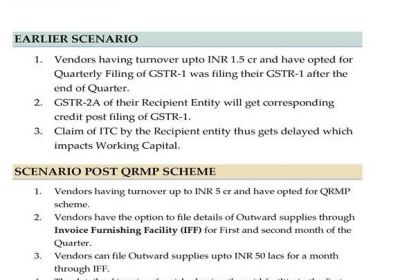

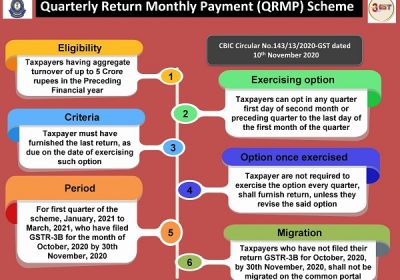

Choose the QRMP Scheme only after you identify its drawbacks.

RJA 31 Jan, 2021

Limitations/ drawbacks you should know before Choosing the QRMP Scheme. In order to benefit small taxpayers whose revenue is less than Rs.5 Cr, the Central Board of Indirect Taxes & Customs (CBIC) launched the Quarterly Return Filing and Monthly Payment of Taxes (QRMP) scheme as under Goods and Services Tax (...

Goods and Services Tax

GST Rule 86B : 1% payment of tax liability in cash in GST

RJA 06 Jan, 2021

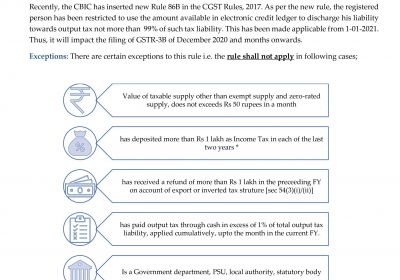

What is the restriction imposed pursuant to Rule 86B on ITC? Recently, the CBIC has inserted new Rule 86B in the CGST Rules, 2017. As per the new rule, the registered person has been restricted to use the amount available in the electronic credit ledger to discharge his liability ...

Goods and Services Tax

GSTN: Features of Quarterly Return Filing & Monthly Payment of Taxes (QRMP) Scheme

RJA 09 Dec, 2020

GSTN: Features of Quarterly Return Filing & Monthly Payment of Taxes (QRMP) Scheme 1. Who could choose for the scheme: With effect from 1st Jan 2021, Below Registered Persons can opt to submit Qtrly GSTR Returns & Pay tax on a monthly basis: A Registered person’s required to file Form ...

Goods and Services Tax

GSTN has notified supply of identified 49 items contains a 8 digits of HSN in Tax Invoice

RJA 02 Dec, 2020

The GSTN has issued Notified through 90/2020- dated 01.12.2020 whereby the supply of specified 49 products requires mention of 8 digit HSN in Tax Invoice. Currently, companies mention up to a 4-digit tariff code when issuing invoices. The registered person shall indicate in a tax invoice given by him 8 digits of the Harmonized ...

Goods and Services Tax

GST: Upcoming Major Changes under GST Regime may take place in 2021

RJA 29 Nov, 2020

GST: Upcoming Major Changes under GST Regime may take place in 2021 GST Changes w.e.f. 01st January 2021 1. Pre-filled GST returns to become the norm from 1st January 2020: GSTR - 3B: Sales Crossing Rs. Five Crore in Last Financial Year needs to file GSTR-3B on a regular monthly basis ...

Goods and Services Tax

Complete Overview about GST on OIDAR

RJA 05 Nov, 2020

ONLINE INFORMATION DATABASE ACCESS OR RETRIEVAL (OIDAR) Businesses are not restricted by geographical borders in today's Scenario. One of the means of delivering services from abroad in India is through the use of the internet. There are several mechanisms in which service users are delivered these services. For instance, ...

Goods and Services Tax

Frequently Asked Questions (FAQs) on Basic concepts of GST

RJA 31 Oct, 2020

Frequently Asked Questions (FAQs) on Basic concepts of GST Q.: How will imports be taxed under GST? Answer: The Additional Excise Duty or CVD, which are now known as the Special Additional Duty or SAD, being levied on imports are subsumed under GST. As per explanation to ...

Goods and Services Tax

Custom Law Services as per Custom Tariff Act 1975

RJA 22 Sep, 2020

Customs duty is the tax that is imposed on the export and import of goods by the state in or outside the country. Customs duty is levied on an individual in accordance with the scheduled provisions under the Customs Tariff Act 1975. In case of failure in payment of the customs ...

Goods and Services Tax

Big Relief for SMEs Business in India:- annual revenue of up to Rs 40 lakhs is now exempt from GST

RJA 25 Aug, 2020

On 24 August 2020, the Union Ministry of Finance announced that companies with an annual turnover of up to Rs 40 lakh will now be excluded from GST. The Ministry added that those with up to Rs 1.5 crore turnover will apply for the Composition Scheme and pay just 1 percent tax. Now firms with ...

Goods and Services Tax

GST compliance deadlines and Compliance Due date

RJA 01 Aug, 2020

GST compliance deadlines end 31st August 2020 Due to COVID 19 Situation and after Hon'ble FM Ms. Nirmala Sitharaman Ji "Corona is an act of God" and business loss now is the time to avoid late Fee, Interest, and Penalties. Deadlines are as under: ·Refund Application FY 2017-18: ...

Goods and Services Tax

Basic Impact after implication of GST on the Personal Loan

RJA 28 Jul, 2020

Basic Impact after the implication of GST on the Personal Loan The impact of GST on personal loans has been remarkable reforms in the new tax regime under the One Nation, One Tax, One Market concept under GST. Basically, the aim of tax structure impacted every sector of the ...

Goods and Services Tax

NAA disputes DGAP 's view that Barbeque Nation Hospitality Ltd alleges corruption.

RJA 06 Jun, 2020

NAA disputes DGAP 's view that Barbeque Nation Hospitality Ltd alleges corruption. After a complaint filed against them by Mrs. Chitra Kumar for profit-making under the GST, the Barbeque Nation refused to provide invoice details in the official inquiry. NAA directed DGAP to guide Barbeque Nation to supply its invoice ...

Goods and Services Tax

Government may not understand calls to lower GST

RJA 20 May, 2020

The exemption would block input-tax credit that would have a negative effect on companies and would not have a direct impact on customers, two finance ministry officials said on Tuesday. The Cabinet does not approve proposals from industry to substantially reduce the Goods and Services Tax (GST) for a period ...

Goods and Services Tax

Input tax credit of Goods and Services Tax

RJA 01 Sep, 2018

INPUT TAX CREDIT GST is the indirect tax that is imposed on the services and goods on the basis of the primary value addition. Hence, the imposing of the tax is totally based on the value addition at the single stage of the chain of supply until the finished product ...

Goods and Services Tax

HSN & SAC Codes along with GST Rate

RJA 03 Aug, 2018

What is HSN codes? HSN stands for Harmonized System of nomenclature. This coding system is developed by World Customs Organization (WCO). This is a Global standard of Nomenclature of trading goods in international trade. The HSN is the codification of all tradable commodities into 20 broad sections with each chapter containing ...

Goods and Services Tax

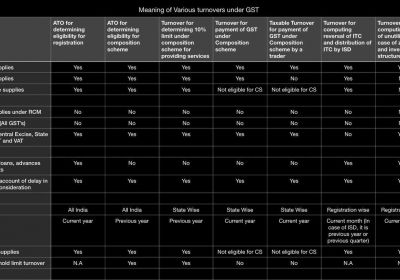

Different Meaning of Turnover In Income Tax Act ,Companies Act & Gst

RJA 30 Jul, 2018

DIFFERENT MEANINGS OF TURNOVER IN INCOME-TAX ACT, COMPANIES ACT & GST As per companies act,2013: - "turnover" means the gross amount of revenue recognized in the profit and loss account from the sale, supply, or distribution of goods or on account of services rendered, or both, by a ...

Goods and Services Tax

All About TDS under GST Applicability, Rate, penalties Provisions

RJA 25 Jul, 2018

Complete Guidance on TDS applicable on Goods and services GST TDS is the system through which a certain percentage of tax is collected at the source of the income. Certain Government departments, Local Authorities, Agencies, and Public Sector Undertaking are required to deduct GST TDS. GST TDS is a ...

Goods and Services Tax

OVERVIEW OF GOODS AND SERVICES REGISTRATION

RJA 24 Jul, 2018

GST REGISTRATION FOR SERVICE PROVIDERS: - like any other category of business, service providers would be required to obtain GST registration, if the entity has an aggregate annual turnover of more than Rs.20 lakhs per annum in most states and Rs.10 lakhs in the Special Category States(The GST Council ...

Goods and Services Tax

OVERVIEW OF ASSESSMENT UNDER GST

RJA 19 Jul, 2018

ASSESSMENT UNDER GST GST Assessment means the determination of tax liability under GST law. It includes self-assessment, re-assessment, provisional assessment, summary assessment, and best judgment assessment. Normally, persons having GST registration file GST returns and pay GST every month based on self-assessment of GST liability. However, the Government at all ...

Goods and Services Tax

How to file return under UAE VAT

RJA 05 Mar, 2018

As per the official site of the Ministry of Finance, UAE, the majority of the business entities will be required to file the VAT returns on a quarterly basis, within one month/28 days from the end of the respective quarter. USE OF ACCOUNTING SOFTWARE The business in UAE ...

Goods and Services Tax

DETAILS OF VALUE ADDED TAX (VAT) OF UAE

RJA 22 Jan, 2018

VALUE-ADDED TAX IN UAE REGISTRATION All the businesses who have a place of residence in the state of UAE and whose value of supplies in the member states in the previous 12 months has exceeded AED 375,000 should mandatorily register under UAE VAT. Also, if the businesses anticipate that the total value ...

Goods and Services Tax

Resident Welfare Association/ Housing Society under GST

RJA 19 Jan, 2018

Registration requirement If the aggregate turnover of such RWA is up to Rs.20 Lakh in a financial year, then such supplies would be exempted from GST even if charges per member are more than Rs. 7500 Exemption Limit RWA shall be required to pay GST on monthly subscription/contribution charged from ...

Goods and Services Tax

QUICK REVIEW ON UAE VALUE ADDED TAX

RJA 13 Jan, 2018

UAE VAT Registration Threshold If the Annual Turnover of the company is more than AED 375,000/, it is mandatory for the company to register under UAE VAT If the Annual Turnover is between AED 187,500 & AED 375,000/, it is optional for the company to be registered under UAE VAT law. Further, ...

Goods and Services Tax

Everything You Need to Know About Continuous Supply of Goods Under GST

RJA 11 Jan, 2018

When certain goods are being supplied on a recurrent basis, it comes under a continuous supply of goods scheme which can be under a contract of three months or more. Certain types of supplies can be mentioned by the Government to be continuous. The GST invoices therefore for such services ...

Goods and Services Tax

DON'T GET CONFUSE WITH UAE VAT TRANSITIONAL ISSUES

RJA 07 Jan, 2018

Value Added Tax (VAT) is an indirect tax. It is a type of general consumption tax that is collected incrementally, based on the value-added, at each stage of production or distribution/sales. It is usually implemented as a destination-based tax. UAE is among the first GCC member states ...

Goods and Services Tax

Goods and Services Tax Registration Made Easier

RJA 06 Jan, 2018

GST or General Sales Tax takes care of all intermediate taxes like service tax, sales tax, excise duty and so on into a composite whole tax so that paying taxes at each level can be avoided. GST registration is mandatory for all whose annual sales are more ...

Goods and Services Tax

E-COMMERCE PLATFORMS UNDER GST

RJA 06 Jan, 2018

E-commerce (electronic commerce) is the buying and selling of goods and services, or the transmitting of funds or data, over an electronic network, internet or online social networks. MEANING OF E-COMMERCE IN GST The Chapter defines an ‘electronic commerce operator’ to mean a person who owns, operates or ...

Goods and Services Tax

Applicability of GST on Hotels Industry - GST Rate, ITC & GST Return

RJA 04 Jan, 2018

Applicability of GST on Hotels Industry - GST Rate, ITC & GST Return Goods and Service Tax (GST) is a destination-based consumption tax which is a levy of tax on all goods and services with the objective of expanding the tax base through a wide coverage of economic activities, ...

Goods and Services Tax

Quick review on GST E-Way Bill

RJA 03 Jan, 2018

QUICK REVIEW ON GST E-WAY BILL What is the E -waybill system? The E-way bill is an electronic waybill for the movement of goods that can be generated on the GSTN portal. The E-way bill contains the details of transported goods besides the name of the consignor and ...

Goods and Services Tax

NOW UAE IS THE PART OF VAT IMPLEMENTED GROUP OF COUNTRIES

RJA 01 Jan, 2018

Compliance requirements under UAE VAT VAT (Value Added Tax) is an indirect tax, which is imposed on most supplies of goods and services that are bought and sold. UAE is one of the Member States of the GCC. All GCC countries have agreed to implement the VAT latest w.e....

Goods and Services Tax

SAC CODES FOR LEGAL AND ACCOUNTING SERVICES

RJA 27 Jul, 2017

Heading no. 9982 Legal and accounting services Group 99821 Legal services 998212 Legal advisory and representation services concerning other fields of law. 998213 Legal documentation and certification services concerning patents, copyrights and other intellectual property rights. 998214 Legal documentation and certification services concerning other documents. 998215 ...

Goods and Services Tax

GOODS AND SERVICES TAX IMPACT ON REAL ESTATE

RJA 07 Jul, 2017

GST IMPACT ON REAL ESTATE The new Goods and Services Tax regime charges under-construction properties at 12% with reducing logistic costs. It also provides for a simplified tax structure for buyers and input tax credits that allow builders to increase profit margins as well as transfer benefits of the same to ...

Goods and Services Tax

SALIENT FEATURES OF NEW GST SYSTEM IN INDIA

RJA 22 May, 2017

SALIENT FEATURES OF NEW PROPOSED GST SYSTEM IN INDIA : In keeping with the federal structure of India, it is proposed that the GST will be levied concurrently by the central government (CGST) and the state government (SGST). It is expected that the base and other essential design features would be ...

Goods and Services Tax

Latest news from the GST council - final GST rates structure in India

RJA 22 May, 2017

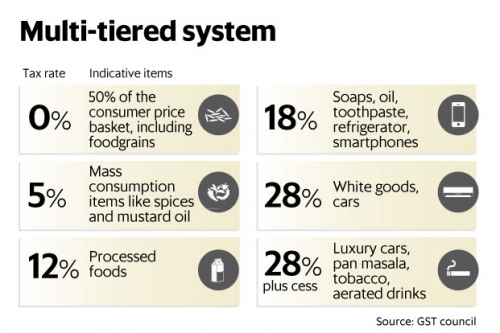

LATEST NEWS FROM THE GST COUNCIL – FINAL GST RATES STRUCTURE IN INDIA We already know that the GST slabs are pegged at 5%, 12%, 18% & 28%. According to the latest news from the GST council, the tax structure for common-use goods is as under. GST Rates Structure Tax Rates Products 5% Edible ...

Goods and Services Tax

GST : Value of supply under GST Act

RJA 09 Apr, 2017

VALUATION OF SUPPLY UNDER G.S.T Calculation of Value of Supply under GST Supply value is an important concept in the sense of GST as it specifies the GST payable in a transaction. Pursuant to the GST Act, the value of the supply of products or services is the ...

Goods and Services Tax

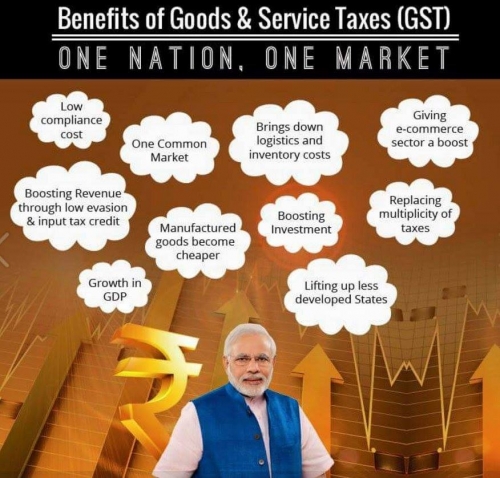

Overall Impacts of GOods and Service Tax

RJA 28 Dec, 2016

One of the most emerging taxes of the future that is added on consumption goods and value-added basis is the Goods and Services Tax (GST). From now one cannot distinguish between the ‘Dual GST’ that is going to be imposed on goods and services. The tax will be ...

Goods and Services Tax

GOODS AND SERVICES TAX Impact on Tea industry

RJA 27 Dec, 2016

The two tea associations i.e. the Indian Tea Association (ITA) and the United Planters’ Association of Southern India (UPASI) are worried about the GST rates. They believe that if the GST rates, which will be announced soon, are higher than the present VAT rates which are between 5-6 ...

Goods and Services Tax

Impact of Goods and service Tax on Pharmaceutical Sector

RJA 26 Dec, 2016

The current tax structure of our country contains many complications because of the multiplicity of taxes, tax surging, and a large number of necessary responsibilities. In order to create a more uncomplicated tax structure, various Indirect taxes have been incorporated in the GST. In the GST act, there has been ...

Goods and Services Tax

Impact of GST on Textile Industry

RJA 24 Dec, 2016

Impact of GST on Textile Industry The textile industry and especially the cotton value chain are going to be affected negatively by the changing GST rates. Although the GST rates are not announced yet it is likely to bring a great change. Dr. Arvind Subramanian Committee has recommended putting down ...

Goods and Services Tax

Impact of GST on telecommunication industry

RJA 23 Dec, 2016

With the model draft of GST law, the industry has been transformed in a great way. This has changed the new industry due to ease of registration, smooth credit flows and a single tax approach. The business and the State government must be directly involved. This is a basic requirement ...

Goods and Services Tax

Effect of GST on the Real Estate Sector

RJA 22 Dec, 2016

Effect of GST on the Real Estate Sector The indirect taxes which are received from the Real Estate Sector are to be soon combined together under the GST regime. There are several reasons as to why the Real estate Sector is to be made a part of the tax base ...

Goods and Services Tax

GST Impact On Traveling Business

RJA 21 Dec, 2016

The effect of GST will certainly initially affect the hospitality sector, which is a significant part of the tourism industry. Nevertheless, it can prove to be of long-term value to the industry. Within the GST system, the incentives are required to be pursued, R&D cessation would be reduced ...

Goods and Services Tax

Impact of Goods and Service Tax on the Power Sector

RJA 20 Dec, 2016

India staged a decision to implement GST (unified Good and Services Tax), which was proposed almost 30 years ago, after obtaining nod from both the upper and lower houses. The uniform tax is helpful for the tax payers across the nation. The new tax law considering including Countervailing duty, VAT, ...

Goods and Services Tax

Goods and service Tax effect on manufacturing sector

RJA 19 Dec, 2016

Countries that are emerging are largely supported economically by the country's manufacturing sector. But when all other emerging economies are seeing an increase in manufacturing sector growth, India is a way behind. The topographical and the demographical position of India are promising but the country has not been ...

Goods and Services Tax

GST effect on Logistics Industry

RJA 18 Dec, 2016

As soon as the parliament gave a green light to the Goods and Services Tax bill, the Indian companies had a moment of ecstasy. The implementation of the GST was intended to ensure that a uniform tax structure existed in the country by removing the multi-layer taxation system in both ...

Goods and Services Tax

Goods and Service Tax Impact On Automobile Sector

RJA 17 Dec, 2016

Due to the multiplicity of taxes, elaborate compliance obligations, and cascading of taxes, there is a complex system of taxes existing in our country. A number of complex systems occur in the automotive industry. It may be the longer investment period, vendor/part maker growth, significantly outsourced processes, specific business ...

Goods and Services Tax

Effects of Goods and Services Tax on the Energy Sector

RJA 16 Dec, 2016

If the economy continues to expand then the energy market is one of its key engines, but it is currently plagued by political instability and regulatory hurdles. The biggest problem of indirect taxes cutting into this sector's income has also, unfortunately, persisted into the Goods and Services Tax (GST). ...

Goods and Services Tax

GST Impact on Importers and Exporters

RJA 12 Dec, 2016

GST Impact on Importers and Exporters The implementation of the General Sales tax bill has been delayed by our Finance Minister. Due to this, there is a constant amount of anxiety that is prevailing among the people running the export-import business in India. With the help of this article we ...