Table of Contents

Is Linking Aadhaar with PAN for NRI's?

- NRIs without Aadhaar: NRIs who do not possess an Aadhaar card are exempt from the requirement to link PAN with Aadhaar, provided they update their residential status as Non-Resident on the income tax portal. Exempt from linking PAN with Aadhaar, provided they update their residential status as Non-Resident.

Steps for NRIs without Aadhaar

- Log in to the Income Tax e-filing portal.

- Navigate to the profile section.

- Update your residential status to Non-Resident.

- NRIs with Aadhaar: If an NRI holds an Aadhaar card, they are required to link their PAN with Aadhaar. The exemption does not apply in this case. : Must link their PAN with Aadhaar.

Steps for NRIs with Aadhaar

- Access the Income Tax e-filing portal and log in with your credentials.

- Go to the 'Link Aadhaar' section.

- Enter your PAN and Aadhaar number.

- Verify the details and submit.

- NRI make Ensure that your details on both PAN and Aadhaar match to avoid any issues during the linking process. Stay updated on deadlines announced by the government for linking PAN with Aadhaar to avoid penalties or deactivation of your PAN. Remember, only NRIs without Aadhaar are exempted if they update their residential status on the income tax portal.

NRIs whose PAN has become inoperative due to non-linking with Aadhaar

NRIs whose PAN has become inoperative due to non-linking with Aadhaar should take immediate steps to rectify the situation. This involves contacting the Income Tax Department with proof of NRI status, updating NRI status through the Jurisdictional Assessing Officer, and linking Aadhaar if they hold one. By following these steps, NRIs can ensure their PAN becomes operative and avoid disruptions in their financial and tax-related activities.

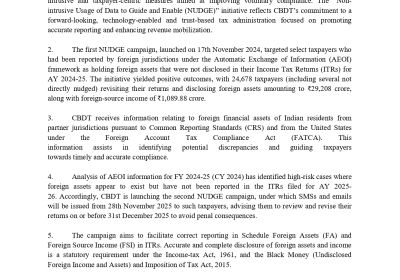

Tax Dept reply to NRI : Refund Under Income Tax Refund cannot be issued

- Social media question on NRI tax refund in case Pan not like with adhar Card : If your PAN is inoperative, refunds cannot be processed. Ensure your PAN is operative to receive tax refunds. After resolving the PAN issue, check the refund status again on the Income Tax e-filing portal.

- Replying to the taxpayer, the Income Tax Department said, “Please write to us with your/ taxpayer’s details, along with colour-scanned copy of PAN and copy of documents in support of non-resident status (passport showing period of residence outside India) via email at adg1.systems@incometax.gov.in & jd.systems1.1@incometax.gov.in Our team will look into it.”

Steps for NRIs to Address Inoperative PAN Due to Non-Linking with Aadhaar

If an NRI's PAN has become inoperative because it was not linked with Aadhaar, despite the exemption, the following steps should be taken to rectify the situation:

- Verify NRI Status with the Income Tax Department Colour-scanned copy of your PAN card. & Colour-scanned copy of your passport showing the period of residence outside India. Email to Income Tax Department: Send an email with the above documents to: adg1.systems@incometax.gov.in or jd.systems1.1@incometax.gov.in

- Personal details including full name, date of birth, and contact information.

- Explain your NRI status and the issue of your PAN becoming inoperative despite being exempt from linking with Aadhaar.

2. Contact Jurisdictional Assessing Officer (JAO) : Log in to the Income Tax e-filing portal.Find your Jurisdictional Assessing Officer (JAO) details. Submit a request online to update your NRI status.

3. If You Have Aadhaar and Need to Link PAN : Pay the requisite fee of Rs. 1,000 under section 234H to make the PAN operative again. Link Aadhaar and PAN: Use the Income Tax e-filing portal to link your Aadhaar with PAN. Follow the instructions to complete the linking process.

4. You can file your return even if your PAN is inoperative, but certain consequences and limitations may apply. Once the PAN is linked to Aadhaar or the NRI status is updated, it can be made operative within 30 days.