Table of Contents

- India Should Implement A Wealth Tax & Inheritance Tax To Address Inequalities & fund Social Sector Investments

- Introduction

- Key Suggestions And Observations On Wealth Tax & Inheritance Tax

- Proposed Tax Rates:

- Moderate Variant Proposal:

- Ambitious Package Proposal:

- Impact On Population:

- Emphasis On Redistributive Policies

India should implement a wealth tax & inheritance tax to address inequalities & fund social sector investments

Introduction

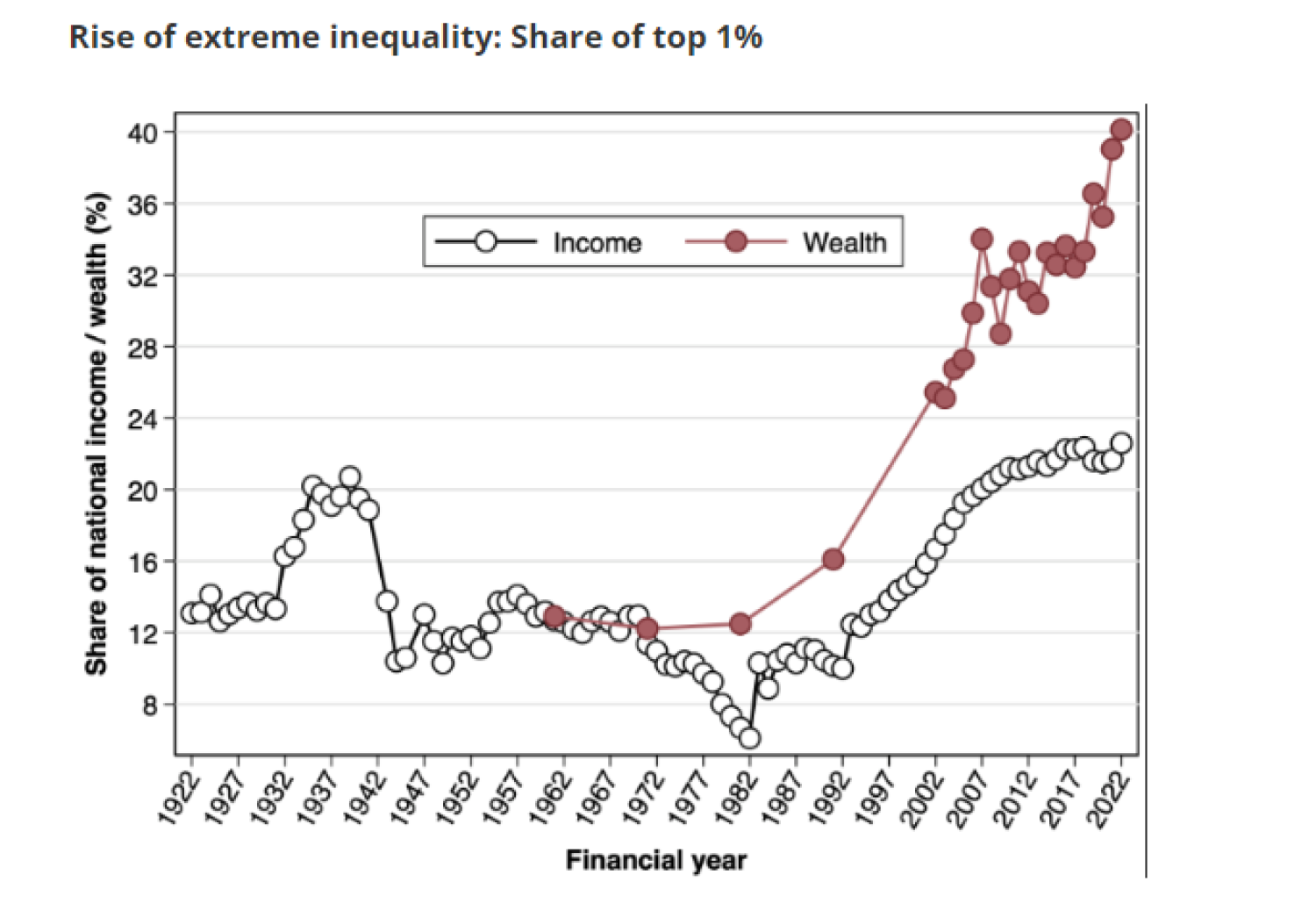

A recent paper by the World Inequality Lab, authored by economists Thomas Piketty, Nitin Kumar Bharti, Lucas Chancel, and Anmol Somanchi, suggests that India should implement a wealth tax and inheritance tax to address extreme inequalities and fund social sector investments. Recommendation: India implement a 2% tax on wealth and a 33% inheritance tax to address rising inequality. The study underscores the need for explicit redistributive policies to assist the poor, lower castes, and middle classes alongside the proposed taxation measures.

The proposed wealth and inheritance taxes, if implemented with redistributive policies, could play a significant role in addressing economic inequality in India. The study highlights that these measures would primarily impact the ultra-rich, thereby generating substantial revenue to fund social sector investments and support the economically disadvantaged populations.

As the 2024 Lok Sabha elections come to a close, the debate on wealth redistribution is expected to be reignited. It is crucial that this momentum translates into policy action, implementing progressive wealth taxation, effective redistribution, and broad-based social sector investments for an equitable and prosperous India. By addressing the stark economic disparities and promoting tax justice, India can pave the way for a more inclusive and just society, ensuring that the benefits of economic growth are shared more equitably among all its citizens

Key Suggestions and Observations on Wealth Tax & Inheritance Tax

The paper was released during the general elections in India. World Inequality Lab -A global research center focused on studying inequality and public policies that promote social, economic, and environmental justice.

- To combat extreme inequalities and create fiscal space for enhanced social sector investments, India should introduce an annual wealth tax and inheritance tax.

- These taxes should apply only above an exemption threshold of Rs 10 crore worth of net wealth.

Proposed Tax Rates:

- Annual Wealth Tax: A 2% tax on net wealth exceeding Rs 10 crore.

- Inheritance Tax: A 33% tax on estates valued over Rs 10 crore.

- The authors estimate that these taxes would generate approximately 2.7% of India’s GDP in revenue.

Moderate Variant Proposal:

- Increase the marginal wealth tax rate to 4% for net wealth exceeding Rs 100 crore.

- Implement a 33% inheritance tax on estates between Rs 10 crore and Rs 100 crore, and a 45% tax on estates exceeding Rs 100 crore.

- This variant could yield 4.6% of GDP in annual tax revenues.

Ambitious Package Proposal:

- Maintain the same thresholds but increase tax rates to 3%-5% for the wealth tax and 45%-55% for the inheritance tax.

- The revenue generated could be as large as 6.1% of GDP.

Impact on Population:

- The proposed taxes would affect only 0.04% of adults, meaning 99.96% of the population would remain unaffected.

- The top 0.04%, approximately those with net wealth exceeding Rs 10 crore, hold over a quarter of the total wealth in the country.

- Their total wealth amounts to 125% of India’s GDP.

Emphasis on Redistributive Policies

- The paper stresses that the taxation measures should be accompanied by explicit redistributive policies aimed at: Ensuring that the poorest segments of the population benefit from the revenue generated. Implementing policies to uplift historically marginalized groups. Providing support to maintain and enhance the economic stability of the middle class.

Source: Report from the World Inequality Lab, available on the WID World website.

The conclusion of the 2024 Lok Sabha elections presents an opportunity to reignite the debate on wealth redistribution and translate this momentum into concrete policy actions. By implementing progressive wealth taxation, effective redistribution policies, and making broad-based social sector investments, India can address economic disparities and promote a fairer, more inclusive society. This will not only enhance the quality of life for all citizens but also lay the foundation for sustainable and equitable economic growth.