Table of Contents

- Audit Report Components

- Filing Tax Audit Report Filling Procedure

- Tax Audit Report Is To Be Filed Online By A Ca To The Tax Department.

- After Filing Of The Audit Report By The Member Of Ca At Www.incometaxindia.gov.in. income Tax Taxpayer Has To Approve Tax Audit Report From His Account On The Online Website Of tax Department

- Due Date Of Filing Tax Audit Report

- What Happened If The Tax Audit Exemption If Cash Transactions Are Not Exceeding 5%.

Objective if Tax Audit:-

- The objective of the tax audit is to report the requirements of Form Nos. 3CA/3CB and 3CD. Other than the reporting requirements of Form Nos. 3CA/3CB and 3CD a proper tax audit will ensure that the books of account and other records are properly maintained so that they truly show the income of the taxpayer and claims for deduction are correctly made by him.

- Such an audit would also help in checking fraudulent practices. It can also facilitate the administration of tax laws by a proper presentation of accounts before the tax authorities and considerably save the time of Assessing Officers in carrying out routine verification. The time of the Assessing Officers saved could be utilized for attending a more important investigation of any case.

As per section 44AB under income tax act, 1961:-

- very person who is doing business and his turnover exceeds one crore rupees.

- Every person who carries any profession and his gross receipt is exceeded twenty-five lakh rupees.

- If the person is carrying on business and claims a lower profit than the profits and gains earned in business under section 44AD.

W.e.f 1st April 2021, Provision is read as follows for the AY 2022-23 & Subsequent AYs –

When an assessee is conducting on business, the threshold limit is Rs.10 crores.

a: total of all payments made, including amount incurred for expenses, in cash, during the previous year does not exceed 5 % of said payment ; and

b: total of all amounts received, including amount received for turnover, sales or total receipts during PY, in cash, does not exceed 5% of such amount

The receipt or payment, as the case may be, by cheque drawn on a bank or by bank draught, other than account payee, will be considered to be the receipt or payment, as the case may be, in cash for the purposes of this section.

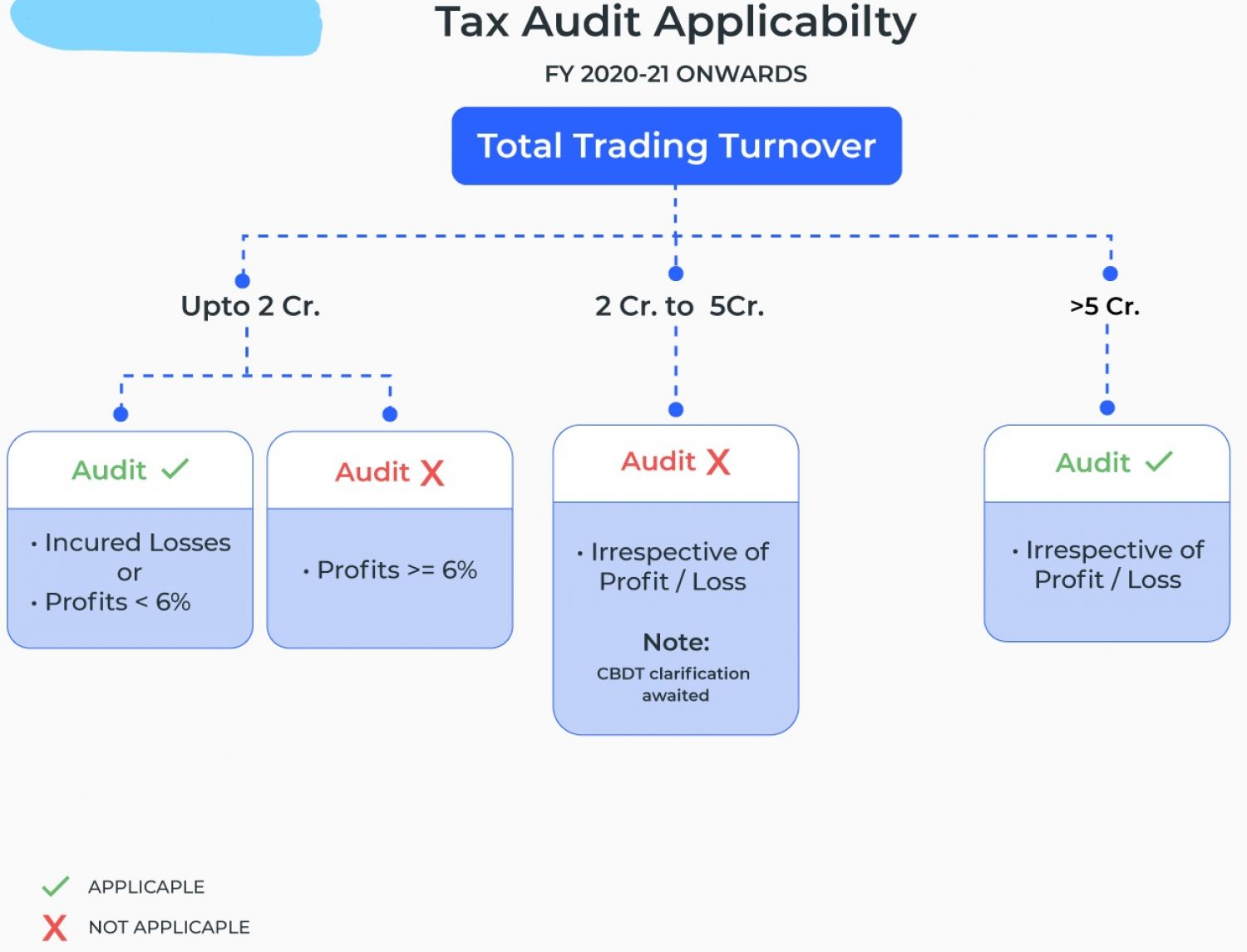

When the above-mentioned Rs.5 crore turnover limit was increased to Rs.10 crores in the Finance Act of 2021, misunderstanding over the turnover limitations for the use of Tax Audit grew even more.

As per Sub Section (5) of section 44AD under income tax, 1961:-

As per provisions of Section 44AD person who satisfy all of the following conditions is required to get his books of accounts audited under Section 44AB:-

-

The Following persons include:

- An individual

- Hindu undivided family

- A partnership firm, who is a Resident of India and not a limited liability partnership firm.

- The Following business includes:

- Any business except the business of plying, hiring or leasing goods carriages referred to in section 44AE.

- Whose total turnover or gross receipts in the previous year does not exceed an amount of one crore rupees.

- The profits of an assessee who is doing eligible business under the head ‘Profits and gains from business and profession’ are less than 8% of the total turnover of the assessee.

- The total income of a person is also more than the maximum amount which is not chargeable to tax.

Persons like companies or cooperative societies are required to get their accounts audited under their respective laws. Section 44AB provides that, if a person is required by or under any other law to get his accounts audited, then he need not again get his accounts audited to comply with the requirement of section 44AB.

FORM NO.3CA/3CB & 3CD:

The report of the tax audit conducted by the chartered accountant is to be furnished in the prescribed form. The form prescribed for audit report in respect of audit conducted under section 44AB Form No. 3CB and the prescribed particulars are to be reported in Form No. 3CD. Persons are required to get their accounts audited by or under any other law, the form prescribed for the audit report in Form No. 3CA/3CB and the prescribed particulars are to be reported in Form No. 3CD.

Audit Report Components

The tax auditor must provide his report in a regulated format, such as Form 3CA or Form 3CB, in which:

- Form No. 3CA is filed when an assessee who is engaged in a business or profession is already required by law to have his accounts Audited.

- Form No. 3CB is filed when an assessee who conducts a business or profession is not required by law to have his accounts audited.

- Tax auditor must additionally provide specified particulars in Form No. 3CD together with either of the above-mentioned Tax Audit reports.

Filing Tax Audit Report filling Procedure

-

Tax Audit report is to be filed online by a CA to the Tax Department.

-

After filing of the audit report by the member of CA at www.incometaxindia.gov.in. Income tax taxpayer has to approve Tax audit report from his account on the Online website of Tax Department

Due Date of Filing Tax Audit Report

- The due date of filing the tax audit report under section 44AB is 30th September of each assessment year.

- To avoid being penalised by the Income Tax Department, an assessee covered by section 44AB must have his accounts audited and an audit report submitted on or by the 30th September of the relevant previous year. For example, the Tax Audit Report for Fiscal Year 2020-21 shall be obtained by September 30, 2021, at the earliest.

- However, due to difficulties reported by taxpayers and other stakeholders in filing Income Tax Returns and Audit Reports, CBDT has extended the due date for submitting the Tax Audit report for Assessment Year 2021-22 from 30 September 2021 to 15 January 2022.

PENALTY FOR NON- COMPLIANCE WITH 44AB:

As per section 271B if any person who is required to comply with section 44AB fails to get his accounts audited as required under section 44AB may be liable for lower of the following penalty:

(a) 0.5% of the total sales or gross receipts, as the case may be, in business, or in the profession, in such year or years.

(b) Rs. 1,50,000

If reasonable cause is shown then no penalty is imposed according to section 273B. But, According to section 271B, No penalty will be imposed if reasonable cause for such kind of failure is proved. Till date, If reasonable causes that are admitted by Courts/ Tribunals are mention below

- Physical inability or death of the partner in charge of accounts

- Labour issues such as strikes, lock-outs for an extended period

- Resignation of the Tax Auditor & consequent delay

- Loss of accounts due to situations beyond control of Assessees

- Natural disasters

As you know, the extension due date by which the Tax Return will have to be filed is 31 December 2020 (Non-Audit Cases) and 31 January 2021 (Audit Cases) as well as U/S 234F fees after the due date. And do not wait until the last day to file your customers' returns.

For Assessment Year 2020-21, the due date for the submission of the audit report is one month before the due date for the return of income referred to in subsection (1) of section 139. As the due date of filing of the ITR for all audit cases is 31 January 2021, the due date for filing the audit forms is 31 December 2020.

Important Noted on filing of Tax Audit reports:

- In order to escape penalties under the Income Tax Act, 1961, the audit report in the respective form must be submitted within the specified time limit.

- Such deductions/allowances are permitted only if the audit reports are submitted within the due date.

- Earnings deductions under Chapter VI-A of Part C are permitted only where the respective audit forms are available.

- The audit report will be considered as filed only if "Relevant UDIN has effectively been updated" and the report is approved by the assessee.

- Make sure that your clients are reminded to approve the audit report submitted well before the deadline of 31 December 2020 to maintain accordance with the act.

Request that you send an audit report before the due date in order to prevent any disruption caused by the last-minute rush. Ask you to file early to prevent the very last traffic rush.

Also, read about : Limit Applicable for tax Audit U/S 44 AB under Income Tax

What happened if the Tax audit exemption If cash transactions Are not exceeding 5%.

- Businesses are required to have CA's audited account books when the previous year exceeds Rs. 1 Crore for total sales, turnover, or gross receipt respectively.

- If the cash receipt & payment made during the year does not exceed 5 percent of the total receipt& payment, the turnover threshold was increased to Rs. 5 Crore.

- The Tax Audit Limit exemption from AY 2021-22 was doubled to Rs. 5 Crore to Rs. 10 Crore turnover limit, provided that the cash receipt & payment does not exceed 5% of the total receipt and payment. A payment is considered to be a cash payment or a cash receipt payable via a non-account payee or non-account-payee bank draft.

In Conculsion

The Income Tax Audit is a mechanism by which the Income Tax Department assures that people are up to date on all tax regulations and that they are followed. It also helps the department in identifying fraudsters and those attempting to escape taxes. To be responsible citizens and avoid any long-term consequences, we must follow all of the Act's requirements and timely submit the Audit Report (if applicable) and Income Tax Return.

If you are searching tax audit firm in Delhi or tax audit consultant in Delhi for the objective of Income Tax Audit in Delhi, RJA can complied expectations. You contract us at singh@carajput.com

Popular Article :