Taxation on Crypto does not mean that it shall not be banned future in India

Indian finance minister N. Sitharaman, said on Friday that the government has the sovereign right to tax money earned from cryptocurrency transactions, but that the govt has yet to decide whether to legalise or ban crypto assets.

She also said the budget stood for continuity and tried to restore stability to the pandemic-hit economy, as well as certainty in taxation, in her contribution to the Rajya Sabha's discussion on Union Budget 2022-23.

"At this moment, I'm not going to legalise or ban crypto assets." "Banning or not banning will be determined when consultations give me feedback," she said.

It's a different thing whether cryptocurrency is valid or not, she said, but I'll tax (transaction profits) because I have the authority to do so.

Private cryptocurrencies posed a significant threat to the country's financial and macroeconomic stability, and would undermine the RBI's ability to address financial stability issues, Das said after the monetary policy statement on Thursday.

"I think it is my responsibility to inform people that while investing in cryptocurrencies, they should remember that they are doing it at their own risk." They must remember that these cryptocurrencies have no underlying (asset), not even a tulip," he explained.

The RBI is said to have backed a ban on certain assets.

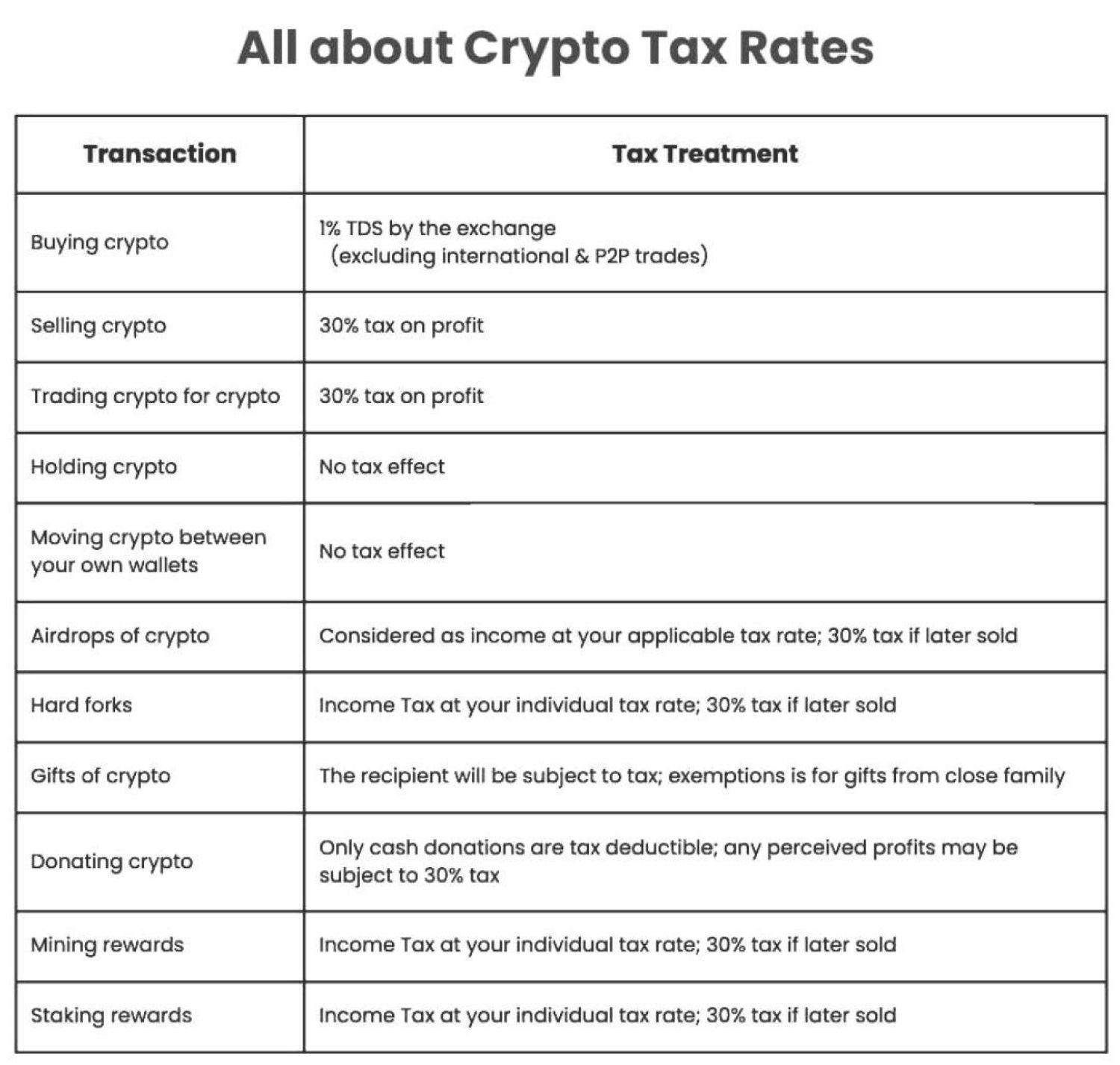

- From April 1, Sitharaman proposed a 30% tax on gains made from any private virtual digital assets in her budget. In addition, the budget proposes a 1% TDS on payments for virtual currencies exceeding Rs 10,000 per year, as well as taxes of such presents in the hands of the recipient, which industry players see as a step toward giving legitimacy to these items.

- Sitharaman defended the budget, saying it represented consistency and relied on capital spending to boost growth. She explained that because capital spending has a bigger multiplier effect than revenue expenditures, the government has expanded public capital spending to stimulate the economy.

- "The budget's goal is a solid and long-term economic recovery," she said, adding that the budget maintains the focus on growth that began last year.

- According to the finance minister, there is no risk of a slowdown or recession, citing an expected 9.2% GDP growth in the current fiscal year.

- She dismissed the opposition's criticism of high prices, claiming that the government has done a better job trying to manage inflation than the previous UPA administration, with only six instances of inflation exceeding the tolerance level of 6% since 2014, compared to 9.1 percent just after global financial crisis in 2008.

- "You could not really handle a lesser problem with very experienced finance ministers," she remarked, "and I was criticized, saying, would you know anything at all?"