Limited Liability Partnership

How to strike off a Limited Liability Partnership?

RJA 03 Feb, 2022

What is Limited Liability Partnership (LLP)? A limited liability partnership (LLP) is a mixture of a corporation and a partnership. It's a newer corporate structure that allows for partnership flexibility while also limiting the company's liability and lowering compliance costs. Benefits/Features of Limited Liability Partnership Simple to ...

Limited Liability Partnership

Limited limited Partnership Strike Off (Closure)

RJA 13 Nov, 2021

LLP Strike Off (Closure) E- Form 24 is needed to be filed for striking off the LLP Name under of Rule 37(1)(b) of LLP Rules 2008. Morover, ROC also has power to strike off any defunct Limited limited Partnership after fullfil the requirments himself of the need to strike off &...

Limited Liability Partnership

Conversion of firm to Limited liability Partnership

RJA 02 Oct, 2021

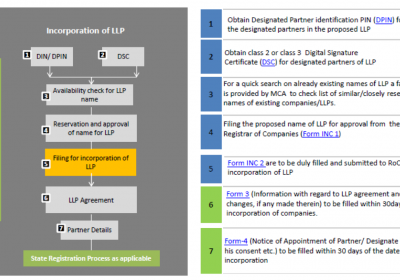

SUMMARY OF CONVERSION OF FIRM TO LLP At first, the applicant is required to have a Digital Signature Certificate, to authorize all the documents online. It is mandatory for all the partners to hold a digital signature. After obtaining DSC, the designated partners are required to apply for a DPIN (...

Limited Liability Partnership

The distinction between a private company and an LLP

RJA 30 Jun, 2021

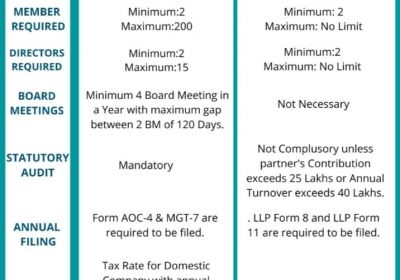

The distinction between a private company and an LLP: Entrepreneurs, businesses, investors have many choices to select a kind of company, such as private companies, public companies, LLPs, partnerships, and so on, in which they want to invest hard money. When deciding between a Private Company and an LLP, many ...

Limited Liability Partnership

Complete Overview of LLP registration and compliances

RJA 01 Oct, 2020

Limited Liability Partnerships (LLP) Registration LLP has become the most preferable form of organization among entrepreneurs as it leverages the benefits of both partnership and the company in a single organization. The cost of forming an LLP is low with limited formalities and documentation processes without any requirement of limited ...

Limited Liability Partnership

LLP requirements at the time of Incorporation

RJA 06 Jul, 2018

LIMITED LIABILITY PARTNERSHIPS (LLP) CONSULTING SERVICES The concept of limited liability partnership was introduced in order to adopt a corporate form that combines the organizational flexibility of a partnership firm with the benefit of limited liability for its partners. Some or all of the partners in a limited liability partnership ...

Limited Liability Partnership

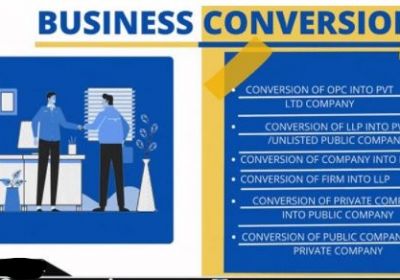

CONVERSION OF LLP INTO COMPANY LIMITED BY SHARES.

RJA 07 May, 2018

LLP Act, 2008 does not cover the conversion of LLP into Company but in Companies Act, 2013 conversion of LLP into Company is covered in section 366. Please note that recently MCA has notified Companies (Authorized to Register) Amendment Rules, 2018 which shall come into force on 16.02.2018 in which form URC–1 has ...

Limited Liability Partnership

ANNUAL FILINGS OF LIMITED LIABILITY PARTNERSHIPS (LLPS)

RJA 05 May, 2018

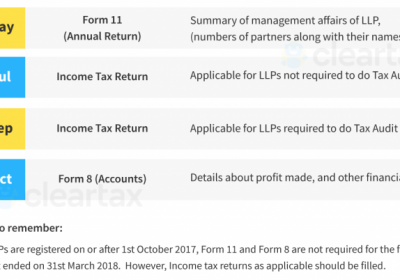

ANNUAL FILINGS OF LIMITED LIABILITY PARTNERSHIPS (LLPS) Is the next important task marked in the compliance list? Every Limited Liability Partnerships (LLPs) which are registered with the Ministry of Corporate Affairs (MCA) have to file the Annual Returns and Statement of Accounts for the FY 2018. here are three main ...

Limited Liability Partnership

Conversion of the Partnership Firm into LLP

RJA 17 Mar, 2017

Conversion of the Partnership Firm into LLP The Limited Liability Partnership in India was introduced by the Limited Liability Partnership Act of 2008. It was organized for a number of reasons which include creating a flexible environment for small enterprises and uplifting the service sector so that the business synergies can ...

Limited Liability Partnership

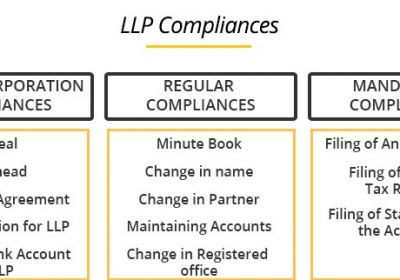

All About Compliance Post LLP Incorporation

RJA 03 Feb, 2017

All about Compliance Post LLP Formation For the perfect and efficient functioning of the Limited Liability Partnership, there are compliances and legal matters that need to be settled. To file an LLP Agreement: This agreement looks over the powers and entitlements of the partners and the organization itself. This ...