GST Filling

GST Amendments with Implications under Finance Bill 2026

RJA 12 Feb, 2026

GST Amendments with Implications under Finance Bill 2026 The Finance Bill 2026 introduces several progressive changes to the GST framework, aimed at reducing litigation, simplifying compliance, and aligning GST law with commercial realities. Below is a structured and comprehensive explanation of each amendment along with its practical impact on businesses. Post‑Supply ...

GST Filling

Overview of TDS & TCS Under GST

RJA 29 Jan, 2026

QUICK CLARITY ON TAX DEDUCTED AT SOURCE & TAX COLLECTED AT SOURCE UNDER GST: Many GST mismatches don’t happen due to wrong tax rates; they happen because TDS and TCS are misunderstood. A clear understanding of tax deducted at source & TCS under GST helps avoid unnecessary mismatches ...

GST Filling

Conversion of Sundry creditors to unsecured Loan than ITC required to be Reversed

RJA 05 Aug, 2024

Is Conversion of Sundry creditors to unsecured Loan than ITC required to be Reversed? It is big question on Conversion of Sundry creditors to unsecured Loan than ITC required to be Reversed, Let's break down the key points regarding Input Tax Credit reversal under the Central Goods and Services ...

GST Filling

Overview on ITC Reversal for Unpaid Invoices, Intt and Reclaiming ITC

RJA 05 Aug, 2024

Overview on ITC Reversal for Unpaid Invoices, Intt and Reclaiming ITC, Here under Summary of highlights important aspects of Input Tax Credit reversal under Central Goods and Services Tax law. These provisions of ITC Reversal for Unpaid Invoices, Intt and Reclaiming ITC ensure proper compliance and timely adjustments of ...

GST Filling

ITC Reversal required in case of Financial Credit Note?

RJA 01 Jun, 2024

ITC reversal required in case of a financial credit note? The big question is whether ITC reversal is required on the financial credit note received from the supplier. (in which the supplier has not mentioned GST). It is an ambiguous issue since the implementation of GST. Our summary on ...

GST Filling

New Functionality of the interest calculator in GSTR-3B

RJA 16 Mar, 2024

New Functionality of the interest calculator in GSTR-3B on GST Portal: The New GST functionality of interest calculator in GSTR-3B is now live on the Goods and Services Tax Portal. This Goods and Services Tax functionality will facilitate and assist the taxpayers in doing self-assessment. This GST functionality ...

GST Filling

GST apply to corporate guarantees between Subsidiaries, Parent & parties

RJA 28 Oct, 2023

18% GST apply to corporate guarantees between Subsidiaries, Parent & Related parties GST on service supplied by State or Central Govt. to their undertakings or Public sector undertaking’s by way of guaranteeing loans taken by them -The Central Board of Indirect Taxes and Customs issue explanation that guaranteeing of ...

GST Filling

FAQS ON ONLINE RETURN COMPLIANCE IN FORM DRC-01B

RJA 01 Jul, 2023

FAQS ON ONLINE RETURN COMPLIANCE IN FORM DRC-01B : GSTN Advisory Goods and Services Tax Network has developed a functionality to enable the Goods and Services Tax taxpayer to explain the difference in GSTR-3B & GSTR-1 return online mode as directed by the Goods and Services Tax Council. ...

GST Filling

CBIC will soon have Advance Analytics in Indirect Taxation

RJA 16 May, 2023

CBIC will soon have Advance Analytics in Indirect Taxation Vivek Johri, Chairman of the Central Board of Indirect Taxes and Customs, announced in a newsletter that the Central Board of Indirect Taxes and Customs will soon have Advance Analytics in Indirect Taxation (ADVAIT). ADVAIT (Advanced Analytics in Indirect Taxation) has ...

GST Filling

Employee from branch office to head office, & vice versa to attract 18% GST

RJA 29 Apr, 2023

Employee services from a branch office to the headquarters will be subject to an 18% GST: Profisolutions Pvt Ltd (Applicant) Services provided by employees of a company's branch office to its head office and vice versa located in different states would be subject to 18% Goods and Services Tax, the Authority ...

GST Filling

Time Schedule for Filling of GST Refund Application

RJA 29 Jan, 2023

Time Schedule for Filling of GST Refund Application Punctual refund procedures are important for the best tax management since they open the door to trade by releasing restricted money. The claim for GST Refund process is now completely online and scheduled under the GST regime, throwing the previously time-consuming ...

GST Filling

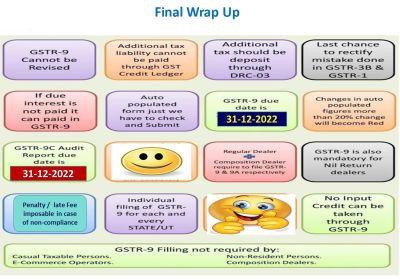

Clarification on HSN code Summary in annual GSTR 9 Return

RJA 26 Dec, 2022

Key Clarification on Harmonized System of Nomenclature Code Summary in annual GSTR 9 Return Annual GSTR 9 Return Disclosure of Harmonized System of Nomenclature Code Summary. Harmonized System of Nomenclature Code Summary should be after net of Credit Note & Debit Note/adjustment. Exempted & Taxable Supply Harmonized System of Nomenclature Code ...

GST Filling

Continuous Non-Filling of GSTR-3B can be ground for GST Registration Cancellation

RJA 30 Sep, 2022

Continuous Non-Filling of GSTR-3B a Ground for Cancellation of GST Registration: CBIC Notifies Amendment to GST Rules As a consequence of the Central Board of Indirect Taxes and Custom (CBIC) amending the CGST Rules, individuals who fail to file their GST (Goods & Services Tax) reports risk having their ...

GST Filling

CBIC published Instructions on Sanction, Post-Audit, & Review of Refund Claims

RJA 16 Jun, 2022

CBIC published Instructions on Sanction, Post-Audit, & Review of GST Refund Claims The CBIC published guidelines for sanction, post-audit, and refund claim review. While the field officers were pursuing varied processes involving discipline, review, and post-audit of refund requests, the Board issued these directions. The Central Board of Indirect Taxes ...

GST Filling

Latest New feature in GSTR 3B - under the GST Portal

RJA 22 Jan, 2022

New feature in GSTR 3B - GST Portal The GST Network, which functions as the technology backbone for the indirect tax system, will soon include interest calculator capabilities to the monthly tax payment form GSTR-3B, which will aid taxpayers in computing interest for late payments. In an advisory, GSTN ...

GST Filling

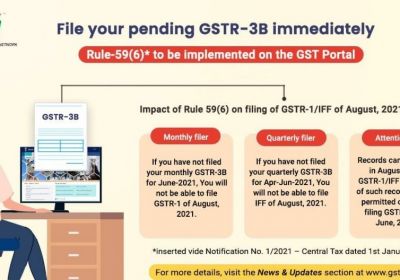

New Restrictive GST Rule Implementation of Rule-59(6) is a useful tool for taxpayers & tax officers

RJA 26 Sep, 2021

GSTN advises tax payers to register their pending GSTR 3B as early as possible after the implementation of Rule 59(6) on the GST Portal on 1st September. The Goods and Service Tax Network (GSTN) has issued an advise on the implementation of Rule 59(6) of the CGST Rules, 2017 on the ...

GST Filling

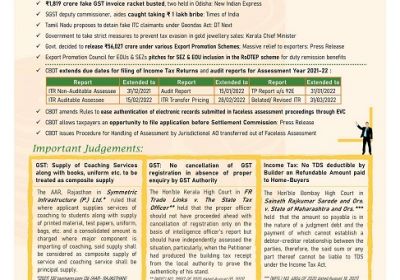

GST UPDATES FOR THE PERIOD OF Aug 2021

RJA 14 Sep, 2021

GST COMPLIANCE REQUIREMENTS FOR THE MONTH OF AUG 2021 GSTR –3B filing Taxpayers with an overall turnover of more than Rs. 5 Crore in the preceding fiscal year Tax period Due Date No interest payable till Particulars August, 2021 20th September, 2021 - Due date for filing GSTR - 3B return for ...

GST Filling

Priority Action Items for Financial Years 2020-21 Before Sept 2021 GST Returns

RJA 08 Sep, 2021

As September is the final & last chance to comply with different GST Regulations & rules there under the Goods and Services Tax Act in respect to FY 2020-21, vigilance or so caution should be exercised in relation to inward and outward supply before submitting GST Return for ...

GST Filling

Applicable Forms under Goods and Services Tax Rules, GST Acts

RJA 04 Sep, 2021

https://carajput.com/archives/gstn-issue-standard-operating-procedure-for-tds-under-gst.pdfGoods and Services Tax (GST) Rules & GST Acts Sr. No GST Rules GST Acts 1. CGST RULES, 2017 (UPDATED UPTO 01.06.2021) THE CONSTITUTION (101 AMENDMENT ACT) 2016 2. IGST RULES, 2017 CGST ACT UPDATED TILL 01.01.2021 3. EXTENSION TO JAMMU & KASHMIR CGST ACT, 2017 4. IGST ACT UPDATED TILL 01.10.2020 5. EXTENSION TO ...

GST Filling

FAQ’s on E-Invoicing under GST

RJA 06 Jul, 2021

FAQ’s on E-Invoicing under GST Q.: What exactly is E-Invoicing under GST? E-Invoicing under GST is the process of verifying B2B invoices, exporting them online through a unified portal, and assigning a unique IRN and QR code to each authenticated invoice. Q.: When does the system of ...

GST Filling

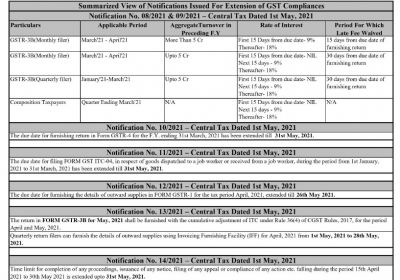

Extension of the due dates for different GST returns in April-2021

RJA 22 Apr, 2021

Extension of the due dates for different GST returns in April-2021 All India Traders' Confederation has demanded the enhancement in April-2021 of due dates in respect of the income tax and GST compliance. All the following compliance measures may lead to interest and late fees if not complied in time. ...

GST Filling

No GST Audit needed in Budget 2021 : latest Update

RJA 07 Feb, 2021

No GST Audit Required in New Budget 2021 On 1 February 2021, Finance Minister Nirmala Sitharaman delivered the 2021 paperless budget. FM also announced several improvements to the tax system on goods and services to target helping small and medium businesses to overcome pandemic disruptions. Relevant GST changes carried out in the ...

GST Filling

Input Tax Credit in GSTR-3B not to be exceed 105% of GSTR-2A

RJA 04 Feb, 2021

Claiming more than 105% of the ITC as shown in GSTR 2A may offer notice of revocation or cancellation of registration. If you assert the ITC in the GSTR 3B return for a sum that exceeds the specified limit as set out in Rule 36(4), we will inform you of the ...

GST Filling

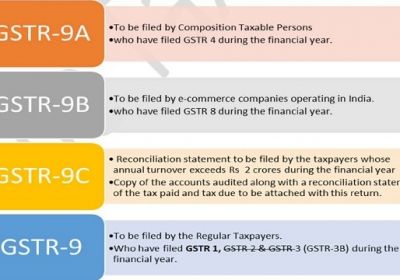

Not required to file GSTR-9C for Financial Year 2019-20 if Total Sale less than INR 5 Cr

RJA 10 Dec, 2020

GST Registered Person having total up to Rs 5 Cr, no needed to file GSTR-9C for Financial Year 2019-20 As per the Central Board of Indirect Taxes and Customs though this notification No. 79/2020-dated 15, Oct 2020 replaced, Subject to Rule 80(3) of the Central Goods and Services Tax Rules 2017 (CGST Rules), the ...

GST Filling

Prevent common errors when filing with GSTR-1

RJA 02 Dec, 2020

Avoid Common Errors/Mistakes when making GSTR-1 Filing After the introduction of Rule 59(6) of the CGST Rules 2017, you will have the idea that simply filing GSTR-1 is not sufficient for your business. As per the new regulations, not filing GSTR 3B on a continuous basis will result in a limitation ...

GST Filling

GST Latest Notifications: Review of CBIC, GST Extension Notifications

RJA 24 Jun, 2020

GST Latest Notifications: Review of CBIC, GST Extension Notifications CBIC released various notifications for enforcing the recommendations of the 40th meeting of the GST Council as follows: CBIC notifications signed on 24.06.2020 concerning interest waiver and late fees. The CBIC issued several GST notices on 24 June 2020. There is a ...

GST Filling

Key considered for GST PMT 09 under the GST Regime

RJA 07 May, 2020

Relevant points to be considered for GST PMT 09 under the GST Regime Form PMT-09 can be found on the GST page. The taxpayer will also move the cash balance available under one heading to another head of tax, i.e. from CGST to SGST or interest or fine, or ...

GST Filling

THRESHOLDS AND ELIGIBILITY CRITERIA OF MONTHLY GST RETURN IS TURNOVER EXCEEDED 1.5 CR

RJA 12 Dec, 2017

GST RETURN FILLING: GST Return filling means return prescribed or required to furnished by or under GST Acts or by the rules made thereunder. A GST return is a completed document that has details of sale/revenue which a taxpayer is required to file with the GSTN authorities. This is ...