Table of Contents

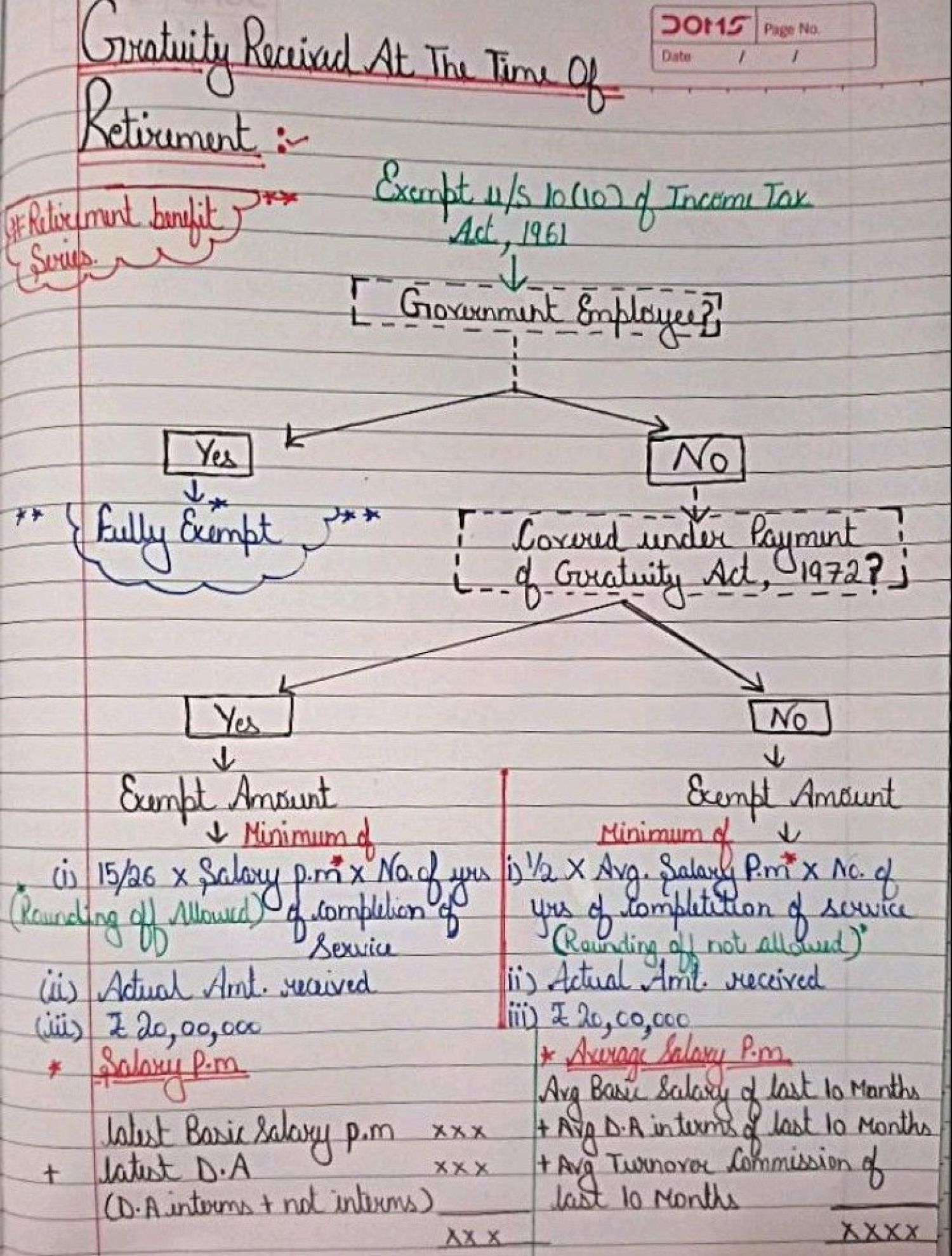

How to calculation of the gratuity amount exempted from income tax ?

When a monetary reward provided by the employer but not included in the employee's regular monthly salary is known as a gratuity.

The Payment of Gratuity Act, 1972 regulates the gratuity provisions, and it is paid upon the occurrence of any of the following circumstances.

1) On death or disablement due to accident or disease (the time limit of Five years shall not apply in the case of death or disablement of the employee).

2) On superannuation (means an employee who attains the age of retirement is said to be in superannuation).

3) On retirement or resignation.

The Gratuity is compulsory for the employee to have completed a minimum of 5 years in service to be able to eligible to receive gratuity. Gratuity is not available for interns or temporary employees.

How to calculation of the gratuity amount exempted from income tax ?

Employees Covered Under the Payment of Gratuity Act

least of the below is exempt from income tax:

- Gratuity Actually received

- INR 20,00,000/- (which has been hiked from INR 10,00,000/- as per the amendment);

- Last salary (basic + DA)* number of years of employment* 15/26;

Employees Not Covered Under the Payment of Gratuity Act

- Despite the fact that company is not covered by the Payment of Gratuity Act, there is no legal prohibition on an employer giving a gratuity to their employees.

- A half-wage month's for each year that has been completed might be used to determine how much gratuity is due to the employee.

Following Calculation of gratuity amount of exempted from income tax

Least of the below is exempt from income tax:

- Gratuity actually received

- Last 10 month’s average salary (basic + DA)* number of years of employment* 1/2;

- INR 10,00,000/- (the hike to INR 10,00,000/- is not applicable for employees not covered under the Payment of Gratuity Act)

Effects of the Amendment

The example makes the impact of the amendment clearly. The maximum exemption ceiling limit being increased lowers the amount of taxable gratuities. In the short to medium term, this amendment will be beneficial to individuals with higher salaries. The majority of employees will, however, benefit from this adjustment if you have a long time before retirement.

If any questions on the above topic you may have ask in the comments section,

If you have any query, then do ask in comments, we will be pleased to resolve it.