IBC

Lok Sabha Unveils Game-Changing IBC Amendment Recommendation

RJA 18 Dec, 2025

Lok Sabha Select Committee Unveils Game-Changing IBC Amendment Recommendations The IBC (Amendment) Bill, 2025, introduced in Lok Sabha on August 12, 2025, seeks to overhaul the Insolvency and Bankruptcy Code, 2016, by addressing delays, judicial ambiguities, and creditor recovery issues through measures like mandatory admission on default proof and clarified security interests. The Lok ...

IBC

Key Highlights IBBI Notifies 4th Amendment to CIRP Regulations

RJA 04 Jun, 2025

Key Highlights IBBI Notifies 4th Amendment to CIRP Regulations The Insolvency and Bankruptcy Board of India (IBBI) has introduced key amendments to the Corporate Insolvency Resolution Process (CIRP) regulations to further strengthen the insolvency framework, enhance investor interest, and uphold creditor rights. IBBI Amends Corporate Insolvency Regulations to Enhance ...

IBC

Landmark Supreme Court judgments concerning homebuyers' rights are safeguarded

RJA 14 Jan, 2025

Landmark Supreme Court judgments concerning homebuyers' rights are safeguarded Chitra Sharma v. Union of India: discusses the inclusion of homebuyers as financial creditors under the Insolvency and Bankruptcy Code following the June 2018 Ordinance. Covers the challenges faced by homebuyers in stalled real estate projects, the initiation of corporate insolvency resolution ...

IBC

Encouraging Restructuring Over Liquidation in the IBC Framework

RJA 09 Jan, 2025

Encouraging Restructuring Over Liquidation in the IBC Framework The IBC was conceived as a mechanism to prioritize the revival of distressed companies over liquidation, ensuring a balance between creditors’ recoveries and the economic viability of corporate debtors. However, recent amendments to the Insolvency and Bankruptcy Board of India Regulations ...

IBC

Survey conducted after taking input from around 30 Insolvency Professionals

RJA 19 Sep, 2024

A Survey conducted after taking input from around 30 Insolvency Professionals The survey conducted by the Indian Institute of Insolvency Professionals of ICAI reveals that Insolvency Professionals face significant challenges when dealing with statutory authorities and enforcement agencies during the Corporate Insolvency Resolution Process. Insolvency Professionals face significant challenges during the ...

IBC

Definition & Meaning of a Small Company U/S 2(85) of the Companies Act, 2013

RJA 19 Sep, 2024

Definition & Meaning of a Small Company U/S 2(85) of the Companies Act, 2013 The definition of a small company under the Companies Act, 2013, was revised to reduce compliance burdens and encourage ease of doing business, especially for startups and smaller entities. Here’s a summary of the key changes ...

IBC

IBBI Guidelines for Insolvency Professionals & Committee of Creditors

RJA 08 Aug, 2024

IBBI Guidelines for Insolvency Professionals & Committee of Creditors IBBI outlined guidelines for IPs and Committee of Creditors are indeed comprehensive, emphasizing the importance of objectivity, integrity, independence, professional competence, cooperation, supervision, timeliness, confidentiality, and cost management. Understanding the Current Scenario governing IPs & CoC Your frustration with the current ...

IBC

IBC Code Section 29A disqualification applies in the present time.

RJA 24 Dec, 2023

Principles enshrined in relation to IBC Code Section 29A disqualification applies in the present time. National Company Law Appellate Tribunal give the judgments that Non-Executive Director who wasn’t involved in Mgt of company affairs couldn’t be disqualified u/s 29A, Managing Director of a Successful Resolution ...

IBC

Complete Explanation on IBC Section 29A Eligibility Check

RJA 23 Dec, 2023

Complete Explanation on IBC Section 29A Eligibility Check IBC Section-29A clearly states that “A person shall not be eligible to file a Vibal resolution plan, In case that person, or any other person acting jointly or in concert with a such person— As above expression ...

IBC

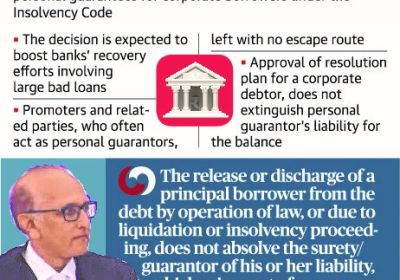

Supreme Court upholds validity of Personal Guarantors’ IP of IBC Code

RJA 07 Nov, 2023

Supreme Court upholds validity of main provisions of Personal Guarantors’ Insolvency Resolution of IBC Code, Supreme Court on Nov 2023 upheld few IBC Provisions of the IBC which were challenged on grounds of being violative of fundamental rights like the right to equality of those against whom insolvency proceedings are ...

IBC

Model time line for CIRP (Corporate Insolvency Resolution Process )

RJA 10 Sep, 2023

Model time line for CIRP (Corporate Insolvency Resolution Process) Under IBC law Section/ Regulation Description of Activity Norm Latest timeline Section 16(1) Commencement of CIRP and appointment of IRP T Regulation 6(1) Public announcement inviting claims within 3 Days of Appointment of IRP T+3 Section 15(1)(e)/Regulations 6(2)(e) and 12(1) Submission of ...

IBC

Filing of Forms under the Insolvency & Bankruptcy Code

RJA 10 Sep, 2023

Filing of Forms under the Insolvency & Bankruptcy Code (1) The insolvency professional, interim resolution professional or resolution professional, as the case may be, shall file the Forms, along with the enclosures thereto, on an electronic platform of the Board, as per the timelines stipulated against each Form, in ...

IBC

Summary of Important Rulings on Insolvency & Bankruptcy Code

RJA 09 Sep, 2023

Summary of Importants Rulings on Insolvency & Bankruptcy Code Court: Supreme Court S.no Name of Case Law Decision 1 Innoventive Industries Ltd Vs ICICI Bank and Anr. IBC has overriding effect of all Acts. Moratorium imposed in IBC will previal aginst all other Acts &...

IBC

Summary of Importants Penalties on Insolvency & Bankruptcy Code

RJA 09 Sep, 2023

Summary of Importants Penalties on Insolvency & Bankruptcy Code CIRP Section 68 to 77 - Penalties on Insolvency & Bankruptcy Code S.No Nature of Offence Punishment Imprisonment Fine 1 Concealment of Property 3-5 1-100 2 Misconduct during CIRP by CD/officer 3-5 1-100 3 Falsification of Books of ...

IBC

IBBI invites comments from Public on Regulations notified under IBC

RJA 07 May, 2023

IBBI invites comments from Public on Regulations notified under IBC Law The public is invited to comment on the rules announced under the 2016 Insolvency and Bankruptcy Code of the Insolvency and Bankruptcy Board of India. Public consultation allows for collaborative decision-making and hence plays an important part in the regulatory ...

IBC

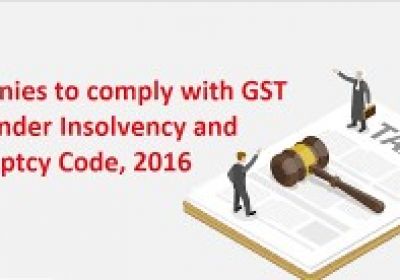

Circular to facilitate on GST tax due recovery from IBC Companies

RJA 07 May, 2023

The government will release a circular to facilitate the recovery of tax debts from insolvent enterprises, which may force new buyers to settle "agreed tax claims" while a resolution package is finished. Revenue Department will consult with the MCA, which administers the IBC, on any necessary changes. The ...

IBC

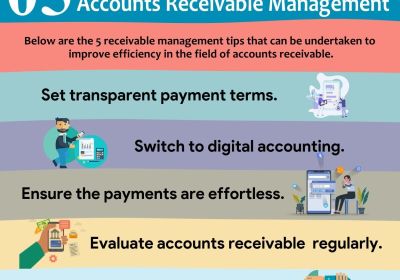

Overview on Effective Accounts Receivable Management Strategies

RJA 12 Mar, 2023

What is effective Accounts Receivable Management Strategies? · Accounts Receivable Mgt describes the procedures and guidelines used to handle unpaid invoices from customers who are past due. This process makes sure that clients always pay their bills, no matter what. · &...

IBC

Credit of fee by IPs & IPEs in IBBI A/c - Fee Compliance under IBBI

RJA 05 Mar, 2023

IBBI specified fee structure to be payable by IPs & IPEs Credit of fee by IPs & IPEs in IBBI A/c - Fee Compliance under IBBI - Regulatory Fee Compliance under IBBI (Insolvency Resolution Process for Corporate Persons) Regulations, 2016 r/w IBBI (Insolvency Professionals) Regulations, 2016 ...

IBC

IBC case law - SC, NCLT & NCLAT Rulings on Resolution Plans

RJA 21 Nov, 2022

Supreme Court, NCLT & NCLAT Rulings/Findings relating to Resolution Plans under IBC Code Under article also cover the contains of numerous rulings & observation in relation to resolution plans, also included, duties of various stakeholders, how Resolution Plans is approved etc, as per the orders of the Adjudicating Authorities ...

IBC

What are the key factors to an effective Section 29A Due Diligence

RJA 20 Nov, 2022

IBC Section 29A - Due Diligence of Resolution Applicants IBC 2016 Section 29A has establishing as one of the key essential laws in determining the eligibility of Resolution Applicants in the CIRP. The IBC, in its initial form had not inserted any regulations to prevent defaulting promoters via repurchasing or buying-back ...

IBC

Role of Insolvency Professional under the IBC Regulations

RJA 30 Jul, 2022

Role of Insolvency Professional under the IBC Regulations In administering the resolution outcomes, the role of the IP encompasses a wide range of functions, which include adhering to procedure of the law, as well as accounting and finance related functions. The latter include the identification of the assets and liabilities ...

IBC

CBIC issues SOPs for recovering GST dues from liquidation- IBC companies

RJA 28 May, 2022

SOP of the CBIC issued for recovering GST dues from companies in liquidation under IBC. SOP of the CBIC for recovering GST dues from entities that are in the process of being liquidated under the Insolvency and Bankruptcy Code (IBC). GST and Customs authorities have been designated as operational creditors, ...

IBC

IBC - INSOLVENCY CODE ON MCA MENU

RJA 08 May, 2022

INSOLVENCY CODE ON MCA MENU Bid to confirm errant promoters don’t regain control, usher in simpler framework for individual insolvencies. The Ministry corporate affairsis proposing to undertake multiple changes under the IBC 2016, and the same is expected to include the ways of ensuring ...

IBC

Is IBC 2016 is a the right step ?

RJA 02 May, 2022

Is IBC 2016 is a the right step ? Before this IBC legislation, the debt recovery system in our country took an average of four years to resolve insolvency. That's far too long and inexcusable, especially given the Prime Minister's and our country's efforts to improve the ease ...

IBC

Overview on Major changes in Insolvency Law - IBC

RJA 01 Feb, 2022

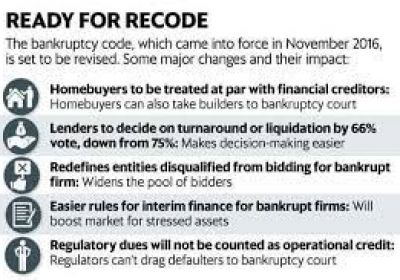

Major changes in Insolvency and Bankruptcy Board of India Eligibility of resolution applicant for submitting resolution plans (barring defaulting promoters to bid for the company) – Section 29A. Voting threshold for decision making by the committee of creditors (from 75% to 66%)- Section 21, 22, 27, 28. Categorization of Home Buyers as Financial Creditors ...

IBC

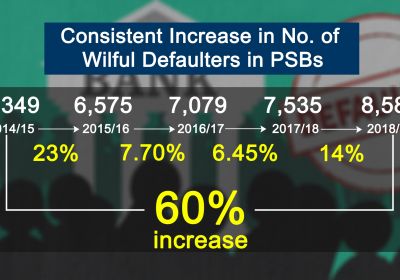

Wilful Defaulters under IBC 2016

RJA 24 Sep, 2021

WILLFUL DEFAULTERS UNDER IBC 2016 BRIEF INTRODUCTION It has been proposed that, as the promoters of defaulting companies have been vested with the right to bid for their own businesses, the same acts as a blockage in the insolvency proceedings. However, wilful defaulters or those borrowers who have diverted ...

IBC

GST & MCA on Insolvency Code Under IBC Code

RJA 24 Sep, 2021

GST & INSOLVENCY CODE It appears that the economy poised for certain substantial gains, arising from the structural reforms, being applied by the govt. Over the years, The ET Awards ceremony has provided the right platform for government and industry to come back ...

IBC

IBBI UPDATES : The MCA is working on a code of conduct for creditors under the IBC

RJA 14 Sep, 2021

IBBI UPDATES INSOLVENCY AND BANKRUPTCY BOARD OF INDIA The MCA is working on a code of conduct for creditors under the IBC: Verma According to MCA statistics, more over 17,800 cases totaling Rs 5 trillion were settled before admission under the IBC. Until July of this year, 4,570 cases were admitted for ...

IBC

SUMMARY PROCEDURE FOR WINDING UP OF COMPANIES

RJA 02 Aug, 2021

BRIEF INTRODUCTION Summary procedure for winding up has been introduced in respect of companies and the same has been provided under section 361 of the Companies Act, 2013. We all know that the liquidation process is carried out by an official Liquidator who is ...

IBC

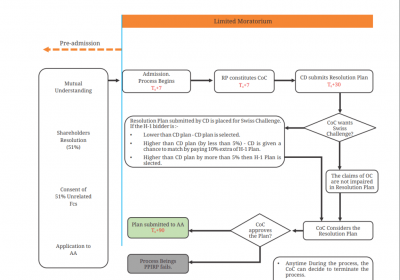

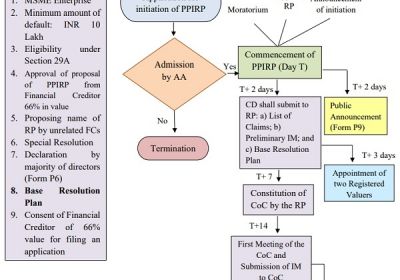

COMPLETE UNDERSTANDING OF PRE-PACK INSOLVENCY OF MSME

RJA 29 May, 2021

INTRODUCTION With the introduction of IBC 2016, there has been a transformative turnaround in the corporate distress resolution framework of India. The act provided a new lease of life to a Company whose future was earlier based on debt restructuring and sale. In India, most organizations are driven by their promoters. ...

IBC

SECTION 29A CERTIFICATION SERVICES UNDER IBC

RJA 28 May, 2021

SECTION 29A CERTIFICATION SERVICES UNDER IBC In the Corporate Insolvency Resolution Process (CIRP), Section 29A of the Insolvency and Bankruptcy Code, 2016 (“the Code”) has emerged as a fundamental statute in assessing Resolution Applicants' eligibility. The Code did not include any protections to prevent defaulting promoters from purchasing back ...

IBC

All about Moratorium U/s 14 of IBC, 2016 including judicial pronouncements

RJA 26 May, 2021

MORATORIUM UNDER IBC 2016 BRIEF INTRODUCTION While undertaking a Corporate Insolvency Resolution Process, the RP is under an obligation to apply for a moratorium as declared by the adjudicating authority and a public announcement be made regarding the last date for submission of claims and the details of the interim resolution ...

IBC

Retention of records by Insolvency Professionals relating to CIRP under IBC

RJA 08 Jan, 2021

Retention of records by Insolvency Professionals relating to CIRP under IBC Insolvency and Bankruptcy Board of India (IBBI) has issued a circular on “Retention of records relating to Corporate Insolvency Resolution Process (CIRP) by an Insolvency Professional” vide circular no. No.: IBBI/CIRP/38/2021 dated 06th January 2021 in the ...

IBC

FRESH NORMAL For ONLINE HEARING AT NCLT & NCLAT

RJA 01 Dec, 2020

FRESH NORMAL AT NCLT & NCLAT– ONLINE HEARING The Year 2020 is an extraordinary year in a unique era. Technology helps us survive. The two Tribunals (online hearing process at NCLT and NCLAT) have only been hearing urgent matters until recently. Now the Tribunals court are moving to standard case ...

IBC

Overview on Personal Guarantor as per IBC Code

RJA 08 Nov, 2020

Overview on Personal Guarantor as per IBC Code The Govt Of India, through the MCA, issued a notification dated on15.11.2019, came into force Part III of the IBC Code (with the exception of the fresh start process) which deal with the insolvency and bankruptcy of partnership ...

IBC

Use of Disclaimers, Limitations & Caveats by Registered Valuers in his Report :IBBI Guidelines

RJA 01 Sep, 2020

Use of Disclaimers, Limitations, and Caveats by the Registered Valuers in his Report: IBBI Issue Guidelines The IBBI released guidance called India's Insolvency and Bankruptcy Board Guidelines (Use of Caveats, Limitations, and Disclaimers in Valuation Reports), 2020. The guidance is issued pursuant to Rule 14(i) of the Companies Rules (Registered ...

IBC

No Role of COC play as a claimant whose matters had to be determined by liquidator

RJA 11 Jul, 2020

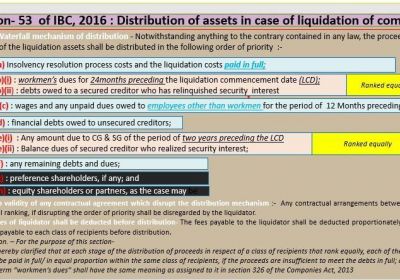

IBC : Realisation & Distribution of Assets by Liquidator Liquidation under the IBC 2016 with special focus upon priority of claims : Under section 53(1) of the Insolvency Code, 2016, the fees payable to the liquidator shall be deducted proportionately from the proceeds payable to each class of recipients, and the proceeds to the ...

IBC

BASIC FORENSIC AUDIT ASPECTS IN INSOLVENCY AND CODE BANKRUPTCY 2016

RJA 06 Jun, 2020

BASIC FORENSIC AUDIT ASPECTS IN INSOLVENCY AND CODE BANKRUPTCY 2016 PURPOSE OF FORENSIC AUDIT INSOLVENCY AND BANKRUPTCY CODE 1. Events describing, if any, Financial Statements with inconsistencies / Red Flags, The misuse/diversion of bank funds; Overvaluation of current/fixed assets and their non-existence; Documentation breach; To ...

IBC

Fresh IBC has been suspended for one year. As per the declaration of FM

RJA 17 May, 2020

Fresh IBC has been suspended for one year. As per the declaration of FM. Important notifications to reduce the burden of compliance under the Atmanirbhar Scheme 1. IBC related - debts related to COVID 19 are out of IBC default 2. No new IBC can be initiated up to 1 year 3. The minimum ...

IBC

Insolvency & Bankruptcy Code 2016 for Creditors

RJA 07 May, 2020

Insolvency & Bankruptcy Code 2016 – Panacea for Creditors but Business Course? It is vital that IBC is never presented as an anti-business law meant to penalize and liquidate industry or to make it a battle between rich and poor (class war). Instead, however, IBC rules can be seen as a ...

IBC

QUICK REVIEW ON INSOLVENCY AND BANKRUPTCY CODE

RJA 03 Mar, 2018

The meaning of Insolvency and Bankruptcy is not the same. “Insolvency” means the situation where an entity (the debtor) cannot raise enough cash to meet its obligations or to pay debts as they become due for payment Bankruptcy is the term for when an individual is declared bankrupt ...