Table of Contents

More than INR 102 Cr value of jewellery & cash seized in searches on contractors: the Income Tax Department has disclosed.

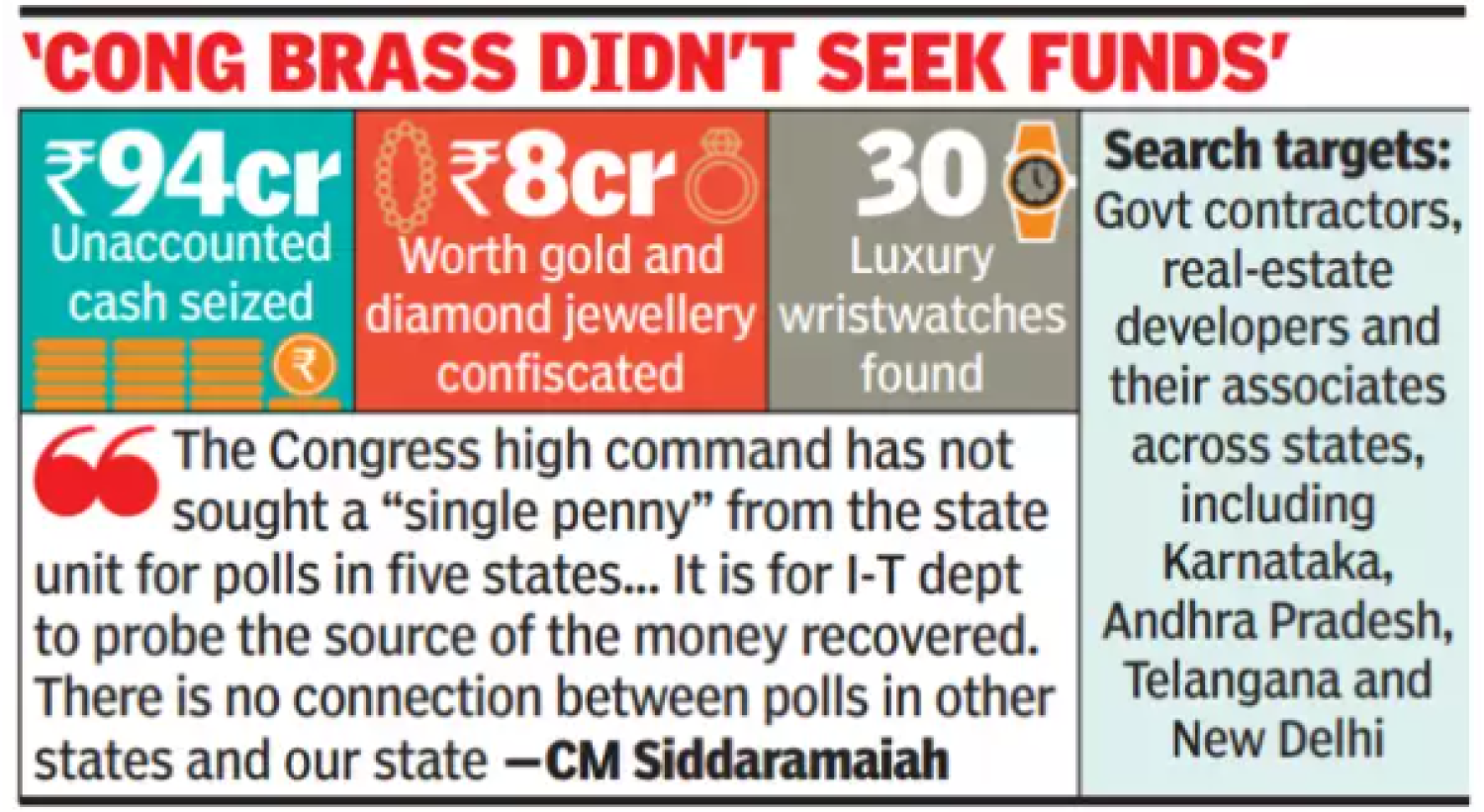

The Income Tax Department has revealed that searches conducted between October 12 and 15 at 55 locations in Karnataka, Telangana, Andhra Pradesh, and Delhi in connection with alleged illicit earnings generated by civil contractors and real estate players turned up a total of Rs 94 crore in cash and jewellery worth over Rs 8 crore.

Large amount of cash money—INR 42 Cr & INR 52 Cr —were seized from 2 Bengaluru locations. Additionally, a private salaried employee's home was the site of roughly 30 luxury wrist watches of foreign manufacture that were not being used for the wrist watch company.

According to Income Tax Dept., The technique or modus operandi of tax evasion detected that was discovered suggests that these contractors were engaged in booking fictitious transactions, making false claims of expenses with subcontractors, and claiming illegitimate charges. The use of contract receipts was found to be irregular, which led to the development of concealed assets and a significant amount of unaccounted cash.