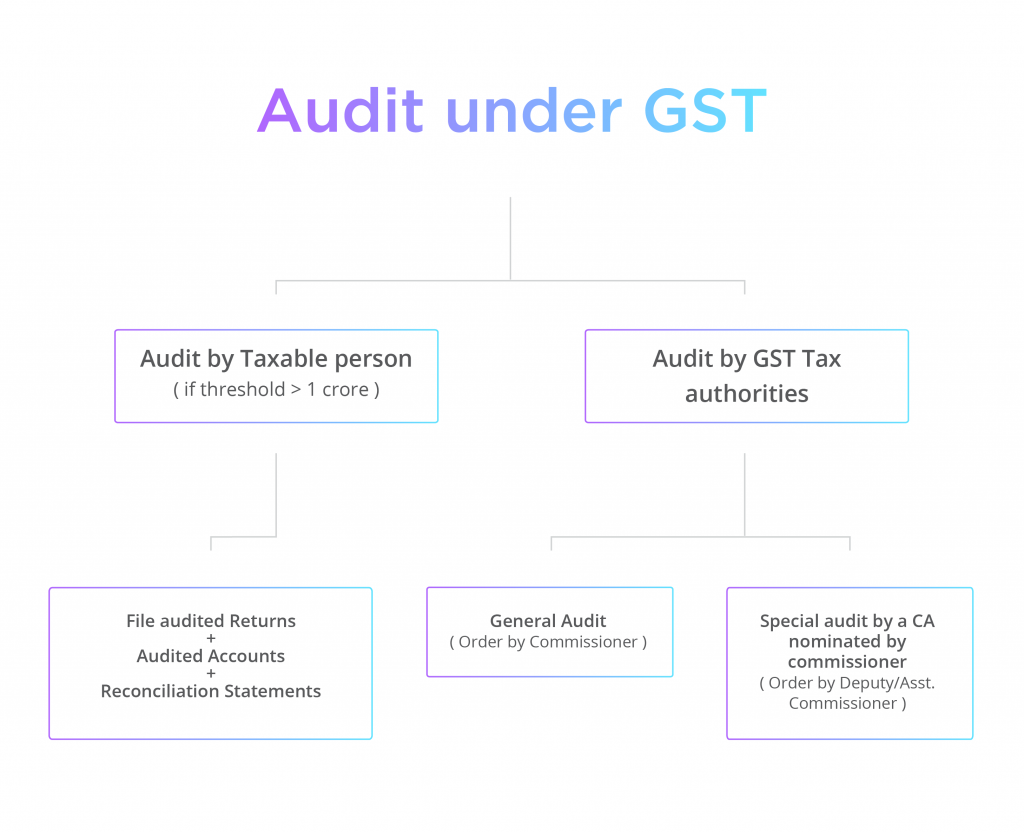

Audit Under GST

GST audit is the method of checking the accounts, receipts and other documentation held by a taxable individual. The goal is to test the accuracy of the turnover reported, the taxes charged, the rebate received and the input tax credit used, and to determine conformity with the requirements of the GST

GST audit is the method of checking the accounts, receipts and other documentation held by a taxable individual. The goal is to test the accuracy of the turnover reported, the taxes charged, the rebate received and the input tax credit used, and to determine conformity with the requirements of the GST

Threshold for Audit

Any recorded taxable individual whose turnover during the financial year exceeds the specified limit [in compliance with the current GST regulations, the turnover limit is greater than Rs 1 crore shall have his financial statements audited by a CA or by a CMA. He shall electronically file:

- annual return using the form GSTR 9B, the reconciliation document by 31 December of the next financial year

- the audited copy of the consolidated reports

- the reconciliation notice, the comparison of the amount of the supplies recorded in the return with the audited annual financial document

- and other information as specified.

Rectifications after the return Based on the results of the audit under GST

If a taxable individual notices any omission / inaccurate information (from the results of the audit) once the return has been made, he or she can amend the same subject to payment of interest. Though, no adjustment shall be permitted after the deadline for the filing of the return for the period of September or the 2nd quarter (as the case may be) one the financial year is ended or after the exact date of filing of the return, which would be even earlier.

For example, X found during audit that he has made a mistake in Oct 2017 return. X submitted annual return for FY 2017-18 on 31st August 2018 along with audited accounts. He can rectify the Oct 2017 mistake within-

20th Oct 2018 (last date for filing Sep return)

or

31st August 2018 ( the actual date of filing of relevant annual return)

-earlier, ie., his last date for rectifying is 31st August 2018.

Audit by Tax Authorities

- The CGST / SGST Commissioner (or any officer appointed by him) can audit the taxpayer. The pace and method of the examination would be recommended at a later date.

- Notice must be submitted to the auditee at least 15 days in advance.

- The report must be done within 3 months of the initiation of the report.

- The Commissioner can extend the audit period for a further six months with reasons recorded in writing.

Responsibilities of the auditor

The taxable individual shall:

- have the requisite facilities to validate the books of accounts / other records as needed and provide evidence and support for the timely conclusion of the audit

- have to give information and assistance for timely completion of the audit.

Findings of Audit

auditOn completion of the examination, the officer shall, within 30 days, notify the taxable individual of the observations, the explanations for the observations and the privileges and responsibilities of the taxable individual

Unless the examination resulted in the discovery of unpaid / short-paid tax or inaccurate reimbursement or inaccurate input tax credit being utilized, the appeal and restitution procedure shall be undertaken.

Special Audit

When can a special audit be initiated?

The Assistant Commissioner may initiate special audit, considering the nature and complexity of the case and interest of revenue. If he is of the opinion during any stage of scrutiny/enquiry/investigation that the value has not been correctly declared or the wrong credit has been availed then special audit can be initiated.

Special audit can be conducted even if the tax payers books have already been audited before.

Who will order and conduct special audit?

The Assistant Commissioner (with the prior approval of the Commissioner) can order for special audit (in writing). The special audit will be carried out by a chartered accountant or a cost accountant nominated by the Commissioner.

Time limit for special audit

The auditor would be expected to deliver the report within 90 days. It can be expanded by the tax officer for another term of 90 days following the request submitted by the taxed individual or the auditor.

Price

The costs of the investigation and report, plus the remuneration of the inspector, shall be calculated and charged by the Commissioner.

Findings of special audit

The taxable person will be given an opportunity of being heard in findings of the special audit.

If the audit results in detection of unpaid/shortpaid tax or wrong refund or input tax credit wrongly availed then demand and recovery actions will be initiated.

Thus, GST is a completely new tax regime already taking India by storm. Businesses will face challenges in transition and application of GST. To know more about GST, feel free to read more of our articles on our blog.