TDS

Time Limit for Revising TDS Returns is 31st March 2025

RJA 01 Mar, 2025

Effect of Amendment on Time Limit for revising TDS Returns The July Budget 2024 introduced a six-year time limit for revising TDS returns. Budget 2024 amendment introduced a six-year time limit for revising TDS returns, which was added under Section 200(3) of the Income Tax Act, Previously, no time limit existed for filing ...

TDS

CBDT clarifies Income Tax Clearance Certificate Not required for travel abroad

RJA 22 Aug, 2024

CBDT clarifies Income Tax Clearance Certificate Not required for travel abroad 1. Union Budget Proposal: The Union Budget initially raised concerns by proposing a mandatory Income Tax Clearance Certificate for all residents traveling abroad. However, it was later clarified that this requirement is limited to specific cases, particularly under the Black ...

TDS

Overview on TDS Deduction U/s 194T : Payment by Firm-to-Partner

RJA 26 Jul, 2024

Overview on TDS Deduction U/s 194T : Payment by Firm-to-Partner A significant reform for partnership firms is the Finance Bill, 2024, which proposes to add a new TDS section 194T to the Income Tax Act, 1961. The goal of the same action is to include all payments made to partners under TDS&...

TDS

Correcting TDS Errors through filling New Income Tax Form 71

RJA 28 May, 2024

Form 71 helps to claim TDS Credit in respect of income disclosed in Income tax return submitted in earlier years CBDT has issued Notification No. 73/2023, dated August 30, 2023: The Finance Act 2023 introduced Section 155(20) of the Income-tax Act, effective from October 1, 2023. This provision addresses situations where income has been reported in an earlier ...

TDS

CBDT Circular : TDS/TCS Relief Due to Inoperative PAN

RJA 22 May, 2024

CBDT Circular : TDS/TCS Relief Due to Inoperative PAN The Central Board of Direct Taxes (CBDT) issued a circular providing relief to taxpayers who received tax demand notices due to short deduction of Tax Deducted at Source / Tax Collected at Source. This was in response to numerous grievances from taxpayers ...

TDS

Payment made for official Sponsor/Promotion objective is not consider royalty

RJA 31 Dec, 2023

Payment made for official sponsor / promotion objective is not consider royalty: ITAT Assessee had been taken an appointed as the official sponsor of ICC Events, after that said assessee submit an application to remit professional sponsorship amounts to Global Cricket Corporation PTE Ltd. – Singapore (GCC) without deduction of TDS ...

TDS

New Tax deducted at Source & Tax Collected at Source Update

RJA 01 Jul, 2023

New Tax deducted at Source & Tax Collected at Source Update : CBDT CBDT extends due date certain TDS/TCS Statements Central Board of Direct Taxes extends the due date for submission of certain Tax Collected at Source or Tax deducted at Source TDS Statements. Due date ...

TDS

Important changes w.r.t LRS Scheme & Tax Collected at Source

RJA 01 Jul, 2023

Important changes w.r.t Liberalised Remittance Scheme and Tax Collected at Source The Finance Ministry, Gov of India has, via a press release dated 28th June, 2023, announced significant changes to the LRS & TCS, which shall be implemented from 1st October, 2023 as against earlier deadline of 1st July, 2023. One ...

TDS

India crypto TDS % on cryptocurrency trading

RJA 07 Feb, 2023

India crypto TDS % on cryptocurrency trading A significant crypto tax is expected to be implemented in India in 2023, which could strangle the cryptocurrency sector. Cryptocurrency transactions are subject to a sizable 30% tax, which is deductable from income and other revenue from any source. This taxation rule will apply to cryptocurrency ...

TDS

TDS applicability when Purchased Crypto Currency

RJA 26 Jan, 2023

TDS (Tax deducted at source) when you purchased Bitcoin or Crypto Currency 1% Tax deducted at source on the sales transaction will be applicable if a customer exchanges a Bitcoin or Crypto Currency or Virtual Digital Assets to purchase another Bitcoin or Crypto Currency or Virtual Digital Assets. For Example, if ...

TDS

Deadline of TDS Return filing for second QTR of FY 2022-23 Extended

RJA 27 Oct, 2022

Deadline of submitting TDS Return(Form 26Q) for second quarter of Financial Year 2022-23 extended till to 30th Nov 2022. CBDT has extended the Timeline of filing of TDS Return in Form 26Q for 2nd QTR of FY 2022-23 from 31st Oct 2022 to 30th Nov 2022. Central Board of Direct Taxes issue ...

TDS

Equalization Levy for Online Google Ads not attached, If it does not accrue in India

RJA 17 Oct, 2022

Equalization Levy for Google Ads Online Not attached Because, If it does not accrue in India: ITAT The Equalisation Levy version 1.0 will not be applicable on Google Ads Due to Foreign Audience if recipient of service is located outside India & advertisement income is not accruing in India ...

TDS

CBDT issue Circular on Section 194R of the Income-tax Act

RJA 21 Jun, 2022

Section 194R of the Income-tax Act of 1961 What is 194R TDS? In the Budget 2022 New section 194R, which was introduced by the central government would apply a 10% TDS (tax deducted at source) to benefits earned by professionals or businesspeople in the course of their profession or business beginning July 1. ...

TDS

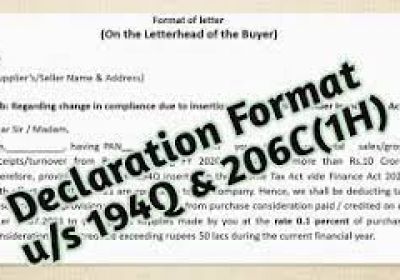

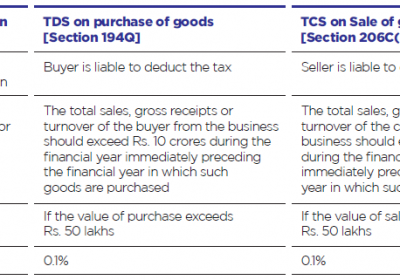

Declaration format in relation to Section 194Q, 206AB & 206CCA

RJA 19 Dec, 2021

Declaration format in relation to Section 194Q, 206AB & 206CCA of the Income Tax Act 1961. As you may be aware, the Finance Act of 2021 added section 194Q to the Income Tax Act of 1961, effective July 1, 2021, imposing 0.1 percent TDS on purchases of goods. Buyers with a total revenue of more than ...

TDS

After filing a regular TDS return, we may receive a TDS notice

RJA 11 Nov, 2021

After filing a regular TDS return, we may receive a TDS notice for: Late fee penalty (u/s 234E) Some interest pending amount (u/s 201(1A), 206C(7)) Interest u/s 220(2) Short deduction Or for a variety of other reasons that can be addressed simply by include challan in the ...

TDS

Frequently Asked Questions(FAQ’s) on TAN

RJA 03 Oct, 2021

Frequently Asked Questions(FAQ’s) on TAN Ques-1: How am I supposed to get my TAN number online? Ans. You can register for a TAN number of websites; you need to visit the local TIN-NSDL site by clicking on .https://carajput.com/services/tan-registration.Php Now, clicks New TAN ...

TDS

Income Tax and Tax Deducted at Source (TDS) Forms

RJA 07 Sep, 2021

Income Tax and Tax Deducted at Source (TDS) Forms Income Tax Forms Part- 1: Application for allotment of PAN and TAN Sr. No Form Number Description 1. FORM NO. 49A Application For Allotment of Permanent account number [In the case of Indian citizens/Indian Companies/Entities incorporated in India/unincorporated entities formed ...

TDS

Section-by-section analysis on TDS/ TCS perspective on the finance bill 2021

RJA 11 Jul, 2021

The Union Budget, which was presented in Parliament, proposed a number of significant modifications to the Income Tax Act. Certain adjustments to the TDS and TCS sections of the Act have been made in particular. The proposed modifications to the TDS/TCS provisions of the Income Tax Act will be ...

TDS

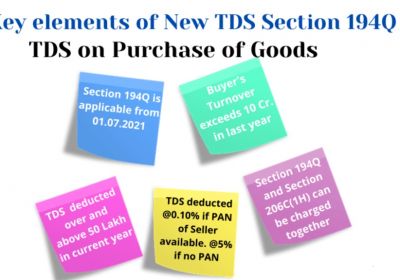

TDS U/s 194Q when purchasing the goods- Applicability

RJA 13 Jun, 2021

TDS on Purchase-Tax Deducted at Source (TDS) u/s 194Q when purchasing the goods-Applicability A new section 194Q was introduced in Budget 2021-22, which will come into force on July 1, 2021. In Budget 2021-22 a new section 194Q relating to the payment of a certain sum to purchase goods. As described ...

TDS

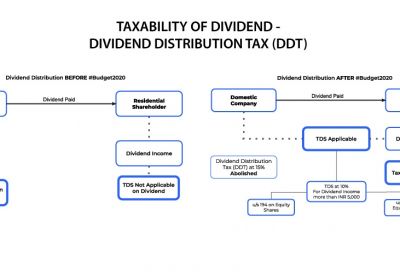

NRI and TDS on Dividend Income from Equity Shares(194

RJA 11 Jun, 2021

TDS on Dividend on Equity Shares Applicable: This section is effective beginning on April 1, 2020, for the financial year 2020-21. Update on Dividend Tax in Union Budgets 2020 and 2021 After the elimination of the Dividend Tax in Budget 2020, dividends that were previously exempt will now be taxed beginning in FY 2020-21. TDS ...

TDS

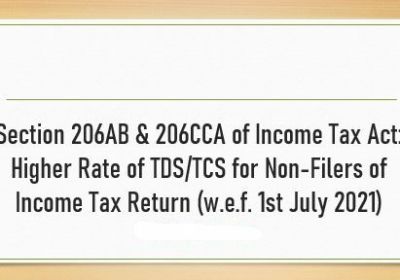

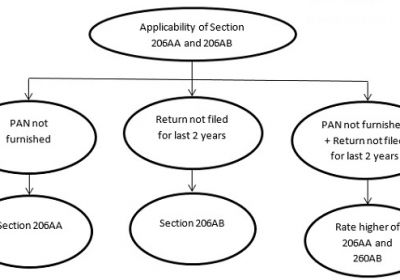

TDS/TCS | Non-Filers of Income Tax Return: Analysis of Sections 206AB and 206CCA

RJA 01 Jun, 2021

Analysis of Sections 206AB and 206CCA- Non-Filers of Income Tax Return: The Finance Bill 2021 proposed new section 206AB and section 206CCA, according to the 1961 Income Tax Act, that would provide the higher rate of TDS and of TCS for the deductors who do not file their income tax ...

TDS

FAQs ON TDS ON PURCHASE OF GOODS

RJA 01 May, 2021

FAQs ON TDS ON PURCHASE OF GOODS Q.: Who will be liable to deduct TDS under Section 194Q? The provisions of section 194Q apply to a buyer, who makes a total sales, gross receipts, or turnover from any business undertaken by them, exceeds Rs 10 Crores during the financial year immediately ...

TDS

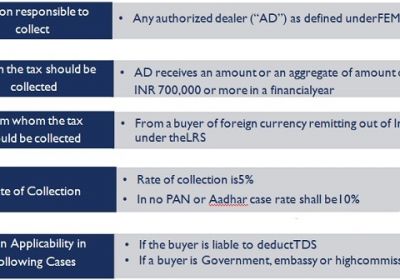

TCS on Tax Foreign Remittance Transactions under LRS

RJA 01 Mar, 2021

TCS on Tax Foreign Remittance Transactions under LRS Forex Facility for Residents – $250,000 per FY Under Liberalised Remittance Scheme (LRS) Scheme of LRS The Foreign Exchange Management Act, 1999 (FEMA) limits forex transactions to the limit permitted by its regulations. RBI Regulations apply to the LRS. Indian residents are permitted ...

TDS

Higher Rates TDS/TCS on non filed the ITR on time.

RJA 07 Feb, 2021

Income Tax Return filing: Applicable of at higher rates TDS/TCS on non filed the ITR on time (New Section 206AB and Section 206CCA) A higher rate of TDS for Non-Filer of Income Tax Return has been implemented in Budget 2021. The Proposed Section: 1. Section 206AB was proposed in ...

TDS

COMPLIANCES OF TAX DEDUCTED AT SOURCES(TDS)

RJA 12 Nov, 2020

Compliances of TDS/TCS One of the main concepts of the Income Tax Act 1961 is tax Deducted at Source (TDS) and Tax collected at Source (TCS). All registered assessee who&...

TDS

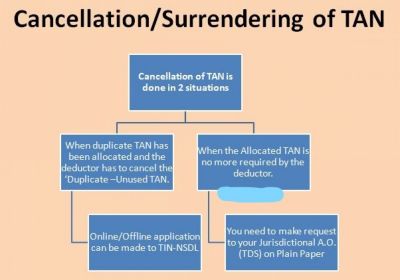

Process of Cancellation / Surrendering of multiple TANs Allotted

RJA 08 Nov, 2020

What is the Process of Cancellation / Surrendering of multiple TANs Allotted? Although we know, many times the assessee acquires Tax Deduction and Collection Account Number only to make some Tax Deduction at Sources payments, and there is no need for that Tax Deduction and Collection Account Number (TAN) in the ...

TDS

New TDS deduction No cash transactions exceeding 1 Crore -Section 194N

RJA 07 Jun, 2020

New TDS deduction No cash transactions exceeding 1 Crore -Section 194N Present TDS exclusion No currency purchases above 1 Crore -Chapter 194N To discourage cash transactions and to continue heading towards a cash-free economic structure, a new Section 194N has been enacted under the Income Tax Act with effect from 1 September 2019 to ...

TDS

NSDL: Extension of QTR TDS/TCS statement filing dates for Quarter

RJA 20 Apr, 2020

NSDL: Update on Extension of Quarterly TDS/TCS statement filing dates for Quarters. Extension of quarterly TDS / TCS statement submission of By the NSDL circular dates for Extension of due date for TDS returns for four Quarters of the Financial year. Due date of TDS/ TCS Return filling ...