Table of Contents

Last date approaching; How to file ITR For AY 2023-24

Income tax Taxpayers can e-verify his Income tax return immediately or within one hundred and twenty days of filing using the techniques outlined on the website. The ITR e-verification can be completed via pre-validated demat account, or Aadhaar OTP, pre-validated bank account or EVC generated through bank ATM

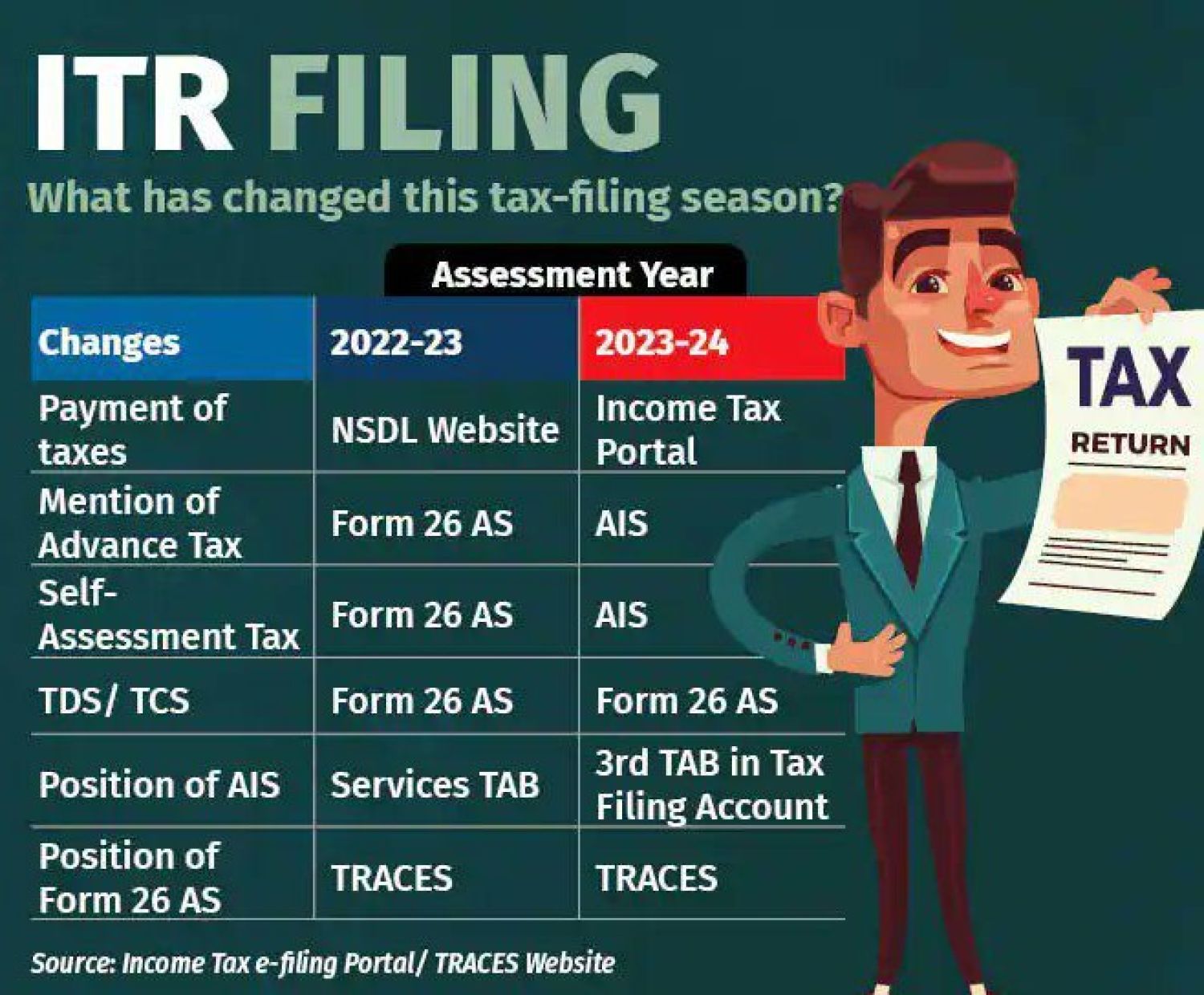

The CBDT has notified taxpayers that the option to file Income Tax Return for the current AY 2023-24 is available on the income tax department’s website portal. The due date to submit the Income Tax Return is 31 July.

Income tax Taxpayers can visit the income tax website i.e incometax.gov.in/iec/foportal to file their returns. “Income Tax Return filing for AY 2023-24 is available on online-filing income tax portal. Then you can check your income tax Annual Information Statement, Form 26AS, and other documents relevant before submission,” the Income Tax dept tweeted recently June 2023. View the tweet here.

https://twitter.com/IncomeTaxIndia/status/1539556670426099712

Check how to file your ITR before the deadline for ITR AY 2023-24.

Now We can discuss about the How To File Income Tax Return Online? Here Income tax Taxpayers may check the Step-by-step guide in ITR filling below mention:

- First of all, Taxpayers Visit the income tax website incometax.gov.in/iec/foportal.

- Then pick up the Login using Taxpayers Permanent account number card No.

- Next step is to Click on ‘e-file’ and Pick the option AY 2023-24 .

- Now Taxpayers Select ITR-4 or ITR -1 depending on Income tax Taxpayers annual income, status & other relevant information details.

- Select Income tax Taxpayers reason for filing the income tax return & validate Income tax Taxpayers pre-filled details and other relevant information.

- Update Income tax Taxpayers Income Tax Return details by uploading the relevant documents.

- Lastly Confirm Income tax Taxpayers details & click on verify & file/submit. This step is just taking a few minutes.

- Now lastly Taxpayers Select the proper verification option under 'Taxes Paid & Verification' tab.

Income tax Taxpayers can e-verify your Income Tax Return immediately or within 120 days of filing using the methods listed on the income tax website portal. A pre-validated bank account, an Aadhaar OTP, a pre-validated demat account, or an EVC produced by a bank ATM can all be used to complete the e-verification. A a step-by-step guidance to filing a tax return is also given on The income tax department's website portal by click here.

Here is Step-by-step guide on, How to download ITR verification form?

- First of All, Income tax Taxpayers Go to the Income Tax India portal & Log in it

- Choose ‘View Forms/ Returns’ option on the view of website page main page.

- Finally Income tax Taxpayers Income Tax Return verification will appear on his computer screen.

If the taxpayer unable to complete your filling, You must maintain the version of your form if you can't finish filling your income tax return in one session. The drafts will be kept on the Income Tax Return online portal for 30-days the date of saving or until the return is submitted.

You can reach the Income Tax Department by telephone at 1800 103 0025 or 1800 419 0025 if you have any questions.

How To File Income Tax Return Online, Ay 2023-24 Itr Last Date, E Filing Income Tax Return, Income Tax Return Filing

Update on ITR Discloser :

- Penalty under section 43 of Black Money Act (BMA) will not be levy on non-disclosure of foreign assets in Income tax Return, In acse Taxpayer source was explained and assessee’s conduct was bonafide.