Table of Contents

Ten transactions that may trigger tax authorities' income tax scrutiny

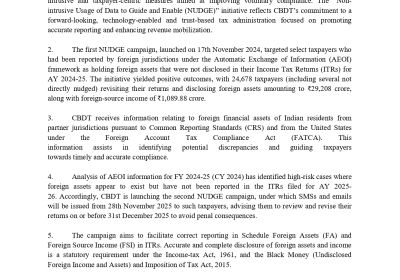

In today’s world, taxpayers should ensure that the money they declare accurately reflects their actual financial activity. Transparency regarding finances is important. The Income Tax Department is employing increasingly sophisticated techniques to investigate potential discrepancies between taxpayers' reported income and their actual spending patterns.

Various transactions can draw the attention of tax authorities due to their complexity, potential for abuse, or likelihood of tax evasion. Certainly, here are various transactions that can attract the attention of tax authorities: Here are such transactions Like Large Cash Transactions; Cryptocurrency Transactions; Offshore Accounts and Investments; High-Value Transactions; Transfer Pricing Arrangements: Unusually High Deductions or Losses: Frequent Buying and Selling of Securities; Complex Business Structures, Barter Transactions; Failure to Report Foreign Assets or Income; Large Cash Deposits or Withdrawals; Unreported Income; Underreporting of Income; Offshore Bank Accounts and Investments; Complex Business Structures; Unusual Deductions or Losses; Barter Transactions; Suspicious Transactions Reported by Financial Institutions; Failure to File Tax Returns; Inconsistent Information;

The Income Tax Authority closely monitors many cash transactions to prevent individuals from dodging taxes and transferring money unlawfully. Any cash transactions exceeding a specific threshold must be reported to the tax authorities by banks, investment firms, stockbrokers, and property registrars. This article will discuss ten significant transactions that may prompt the tax department to look at them more closely. It's essential for individuals and businesses to maintain proper documentation and transparency in their financial transactions to avoid attracting undue attention from tax authorities and to comply with tax laws effectively.

Following are List of Transactions That may trigger tax authorities' income tax scrutiny.

- Cash Withdrawal or Deposit from a Current Bank A/c of an amount of INR 50,00,000/- or more in a year.

- Purchase or Sale of Immovable property of INR 30,00,000/-or more.

- Purchasing RBI Instruments or Demand Draft of value of INR 10,00,000/- or more in Cash.

- Purchase or Sale of foreign currency of INR 10,00,000/- or more in a year.

- Payment of Credit card bill of INR 1,00,000/-or more in Cash in a year or payment of INR 10,00,000/- or more via channels other than cash.

- Cash deposit in Recurring Deposit or Fixed Deposit of INR 10,00,000/-or more.

- Made Expenditure in foreign currency through credit card, traveller’s cheque, debit card or by any mean for an amount of INR 10,00,000/-or more in a year.

- Cash Deposit of INR 2,00,000/- in a single transaction or Cash deposit INR 10,00,000/-in a year in a Savings Bank A/c.

- Investments in Debentures and Bonds or Shares, Mutual Funds in Cash for a value of INR 10,00,000/- or more in a year.

- HIGH risk if claiming in return & not submitted before to your employer. You may invite scrutiny from income tax dept.

- Any person liable for Income Tax audit u/s 44AB must report transactions in which Cash received against sale of services or goods is INR 2,00,000/- or more. The amount of INR 2,00,000/- is to be considered for a single transaction from a person & not to aggregated.

Fostering a culture of financial accountability and compliance is crucial for maintaining the integrity of the tax system and ensuring fairness for all taxpayers. Understanding the high-value transactions that may attract the attention of tax authorities underscores the importance of adhering to reporting requirements and maintaining accurate financial records.

By staying informed about these transactions and their potential implications, taxpayers can navigate the tax system more effectively and reduce the risk of triggering unwanted scrutiny from tax authorities. This not only helps taxpayers avoid penalties and legal consequences but also contributes to a more transparent and equitable tax system overall.

Responding to an Income Tax Department (ITD) Notice

When responding to an Income Tax Department (ITD) notice regarding high-value cash transactions, providing sufficient documentation to substantiate the source of funds is crucial. Here are some key documents that can help support your assertion like Bank Statements; Investment Records; Inheritance Papers; Loan Agreements; Business Records; Gift Deeds; Tax Returns; Legal Documents.

By gathering and presenting these documents effectively, you can demonstrate to the tax authorities that the high-value cash transactions were conducted using legitimate funds and in compliance with tax laws. It's essential to respond to ITD notices promptly and provide accurate and comprehensive documentation to resolve any inquiries regarding cash transactions satisfactorily.

Furthermore, when both taxpayers and tax authorities prioritize compliance and transparency, it fosters mutual trust and cooperation, leading to a smoother and more efficient tax administration process. Ultimately, a fair and transparent tax system benefits society as a whole by ensuring that everyone contributes their fair share towards public services and infrastructure.Top of Form Taxpayers should ensure compliance with tax laws, maintain accurate records, and seek professional advice when engaging in complex financial transactions to avoid attracting unwanted attention from tax authorities. It's essential for taxpayers to maintain accurate records, report all income, and comply with tax laws to avoid scrutiny and potential penalties from tax authorities.