Table of Contents

FAQS ON INPUT SERVICE DISTRIBUTOR

Q.: Who is an Input service distributor (ISD) under GST?

Input Service Distributor is defined as follows –

- Input Service Distributor is an office of a business that receives tax invoices for input services and distributes available ITC to other branch offices of the identical business. ISD and also the branches may have different GSTIN’s, but they need to have the same PAN.

- ISD Mechanism is supposed just for distributing the credit on common invoices per INPUT SERVICES and not on goods (Input Goods or Capital Goods).

An Input Service Distributor (ISD) could be a taxpayer that receives invoices for services employed by its branches. - It distributes the tax paid referred to as the Input decrease (ITC), to such branches on a proportional basis by issuing ISD invoices. The branches can have different GSTINs but must have the identical PAN as that of ISD.

Q.: What is the purpose of registering as ISD under GST?

The concept of ISD may be a facility made available to business having an outsized share of common expenditure and where billing/payment is completed from a centralized location. The mechanism is supposed to simplify the input reduction taking process for the entities and therefore the facility is supposed to strengthen the seamless flow of credit under GST.

Q.: Will Input Service Distributors be required to be separately registered aside from the prevailing taxpayer registration?

Yes, the ISD registration is for one office of the taxpayer which is able to vary from the conventional registration.

Q.: Can credit be distributed to only revenue-generating units?

The revenue-generating units have GST liability, so rightly the ITC on those services employed by them must be allocated to them to use the step-down to line off against their liabilities.

Q.: Can a taxpayer have multiple ISDs?

Yes, a taxpayer can separate ISD registration, for different places of business.

Q.: Can a corporation have multiple ISDs?

Yes, different offices just like the marketing division, security division etc. may apply for separate ISD.

Q.: What are the implications of credit distributed in contravention of the provisions of the Act?

The credit distributed in contravention of provisions of Act can be recovered from the recipient to which it's distributed together with interest.

Q.: Do Input Service Distributors have to file a separate statement of outward and inward supplies with their return?

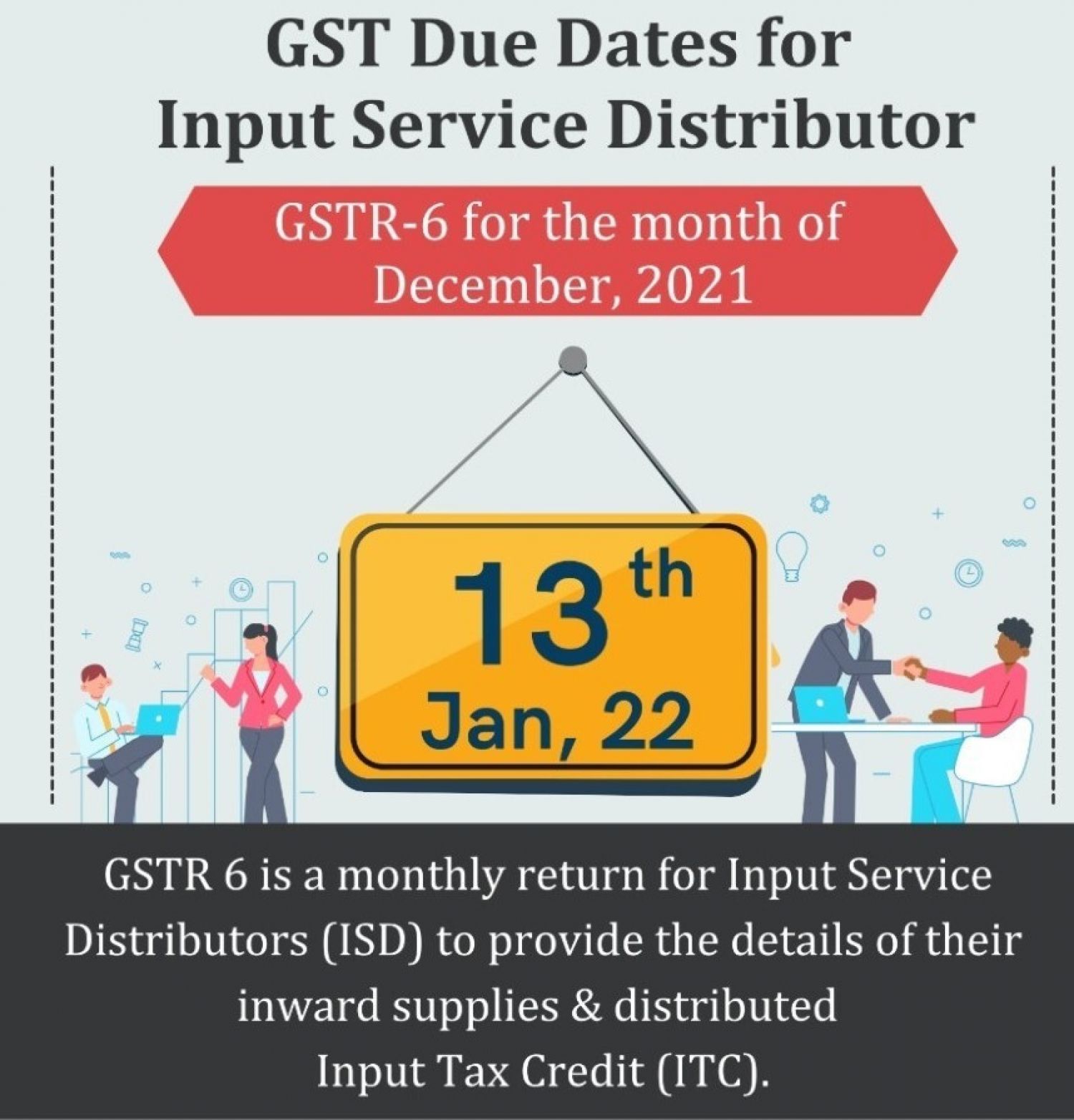

No, the ISDs have to file only a return in Form GSTR- 6 and also the return has the main points of credit received by them from the service distributor and also the credit distributed by them to the recipient units. Since their return itself covers these aspects, there's no requirement to file a separate statement of inward and outward supplies.

Q.: What is the implication of Issuing Debit notes or Credit notes by the supplier to ISD?

Issue of debit note –

If any debit note is issued to the ISD by the supplier of service, the extra credit of tax that he gets on such debit note should be distributed by him within the month within which he includes the Debit note in GSTR-6.

Issue of credit note –

Where a credit note is issued to the ISD by any supplier of service, the amount if ITC that gets reduced in such credit note should be apportioned by him to the recipients within the same proportion because the original credit that was distributed.

Such apportioned credit gets reduced from the credit of tax distributed in the month within which the credit note is included in GSTR-6.

However, if the quantity to be reduced exceeds the amount of diminution to be distributed, then such excess shall be added to the output liabilities of the Recipient. The same process shall be followed for all those cases where the credit distributed has to be reduced for any reason.

For example, credit distributed to the wrong person ISD is required to reconcile each credit available for distribution and credit distributed in relation to the original invoices and Debit/Credit note received from the supplier. Original Invoices, Amendment in Invoices, Debit/Credit note received from the supplier will be prohibited ordinary care and furnish in FORM GSTR-6.

Read more about: ITC on Marketing Expenses/Sales Promotion Scheme