Table of Contents

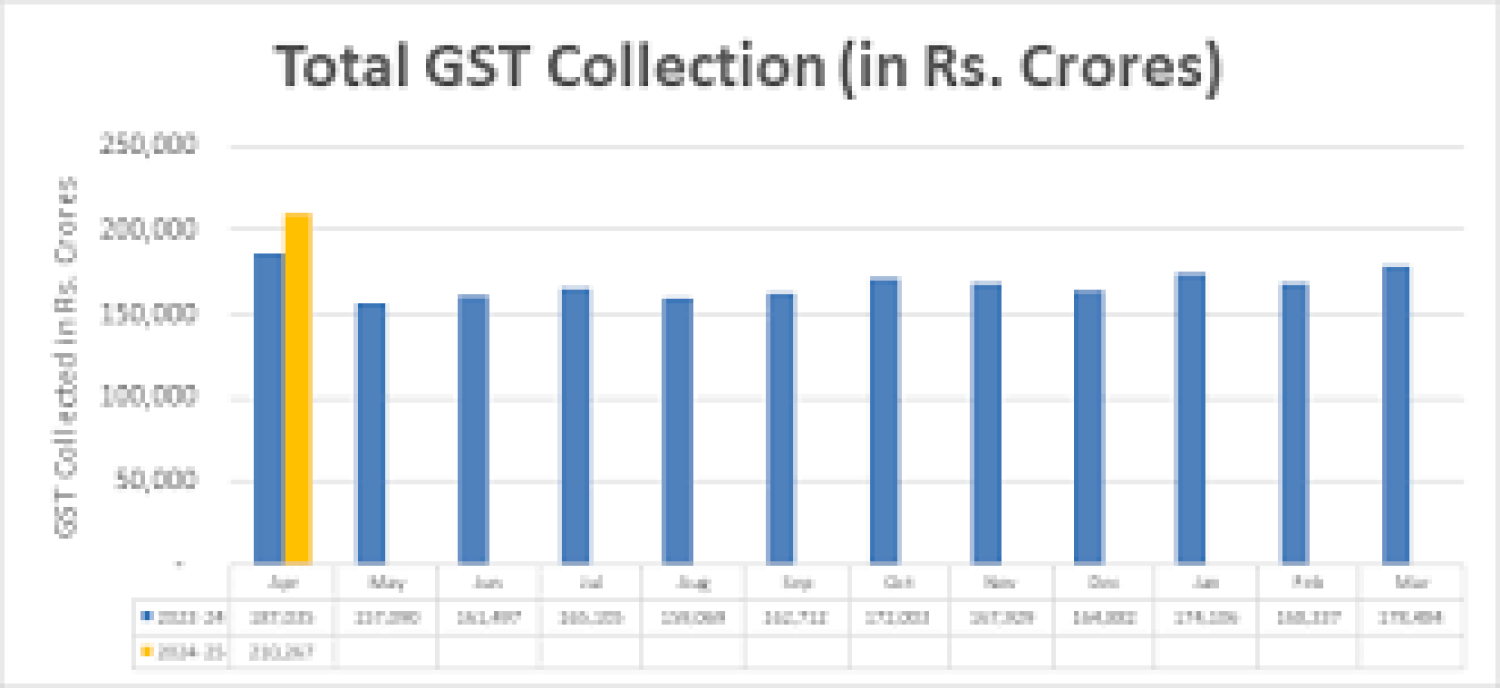

Goods and Services Tax Collection Hits Record High in April 2024

India's Goods and Services Tax (GST) collection for April 2024 has broken records, which is undoubtedly a positive indicator for the economy. Goods and Services Tax Collection Hits Record High in April 2024 Here's a summary of the key points:

- Total Collection: Rs. 2.10 lakh crore, marking a significant 12.4% year-on-year growth.

- Net GST Revenue: After refunds, it stands at Rs. 1.92 lakh crore, indicating a robust 17.1% increase.

- Component Breakdown:

- Central GST: Rs. 43,846 crore

- State GST: Rs. 53,538 crore

- Integrated GST: Rs. 99,623 crore (including Rs. 37,826 crore from imports)

- Cess: Rs. 13,260 crore (including Rs. 1,008 crore from imports).

- - Integrated Goods and Services Tax : Rs. 50,307 crore to Central GST and Rs. 41,600 crore to State GST from the IGST collected.

These figures suggest a healthy growth trajectory for GST collections, which could be attributed to various factors such as increased economic activity, better compliance, and effective tax administration. This bodes well for the government's revenue generation and indicates positive momentum in the economy

Indian Economy April 2024

- Highest Auto sales

- Highest Eway bills

- Economy growth at 8.4%

- Service PMI at 13 yr High

- Highest Power Consumption

- Highest GST @ ₹2,10,095cr

- Highest Monthly Home Sales

- Sensex at an all-time high

- Lowest Bank NPA in a decade

- Manufacturing PMI at 16 yr high

- Core inflation at Lowest in 12 yrs

- Highest UPI tranx at 18.4 Billion